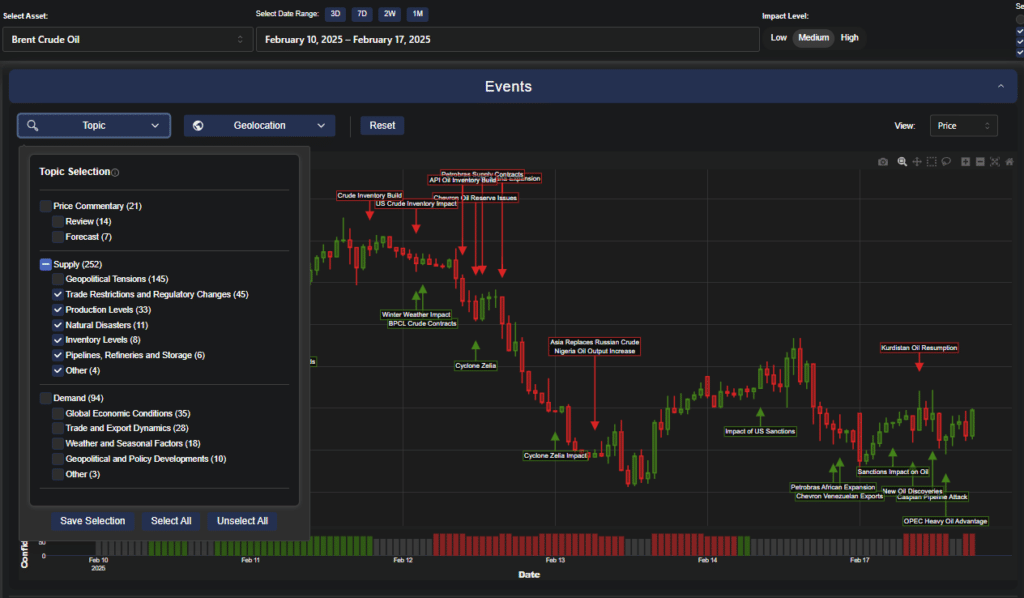

In terms of commodity price forecasting, in the current challenge to world diplomatic order, the emergence of AI agents in commodity forecasting represents a fundamental shift in market analysis. More importantly, these autonomous systems are redefining how traders approach price prediction, as evidenced by our Trading Co-Pilot’s recent analysis of Brent Crude Oil movements. During February 2025, our system demonstrated its sophisticated capability by tracking complex supply constraints, including Crude inventory builds, US reserve issues, and geopolitical tensions simultaneously. This multi-dimensional analysis provides traders with unprecedented insight into market movements that would be impossible to achieve through traditional methods.

Above: Our Trading Co-Pilot tracking multiple market influences on Brent Crude Oil prices, including inventory builds and supply contracts with clear impact indicators and price correlation markers.

The evolution of AI agents in trading

The implications here are far-reaching. At least in the short term, AI agents can process vast amounts of data in real-time, as demonstrated by our Trading Co-Pilot’s comprehensive tracking system. In one example, the platform simultaneously monitored the impact of Cyclone Zella, US crude inventory fluctuations, and Kurdish oil resumption – delivering an x-factor through comprehensive market intelligence that human analysts simply cannot match. Our system’s ability to correlate these events with price movements and provide impact-level assessments transforms raw data into actionable trading insights.

Autonomous decision-making and commodity price forecasting

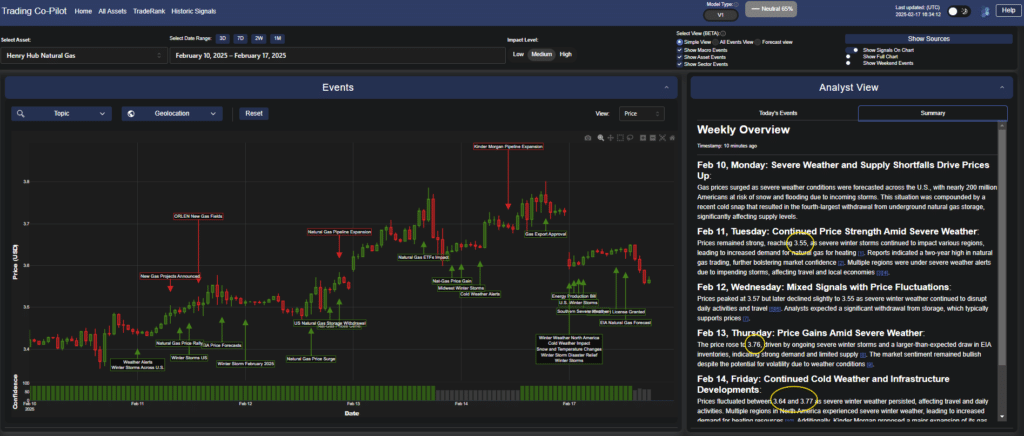

The hard truth is that commodity markets have always posed significant challenges for human traders. Rather than rely on conventional analysis, AI agents like those which we use to power our Trading Co-Pilot combine multiple streams of market intelligence with remarkable precision. In analysing natural gas markets, our system demonstrated this capability by correlating severe weather alerts with specific market impacts, tracking winter storms across North America alongside pipeline expansions and storage withdrawals. What makes this analysis particularly powerful is the system’s ability to quantify these impacts – as seen when it identified the fourth-largest withdrawal from underground natural gas storage and its immediate effect on supply levels.

Above: Real-time natural gas price movement analysis showing the impact of severe weather conditions, pipeline expansions, and storage withdrawals, with integrated analyst commentary tracking price fluctuations.

Real-time adaptation and learning

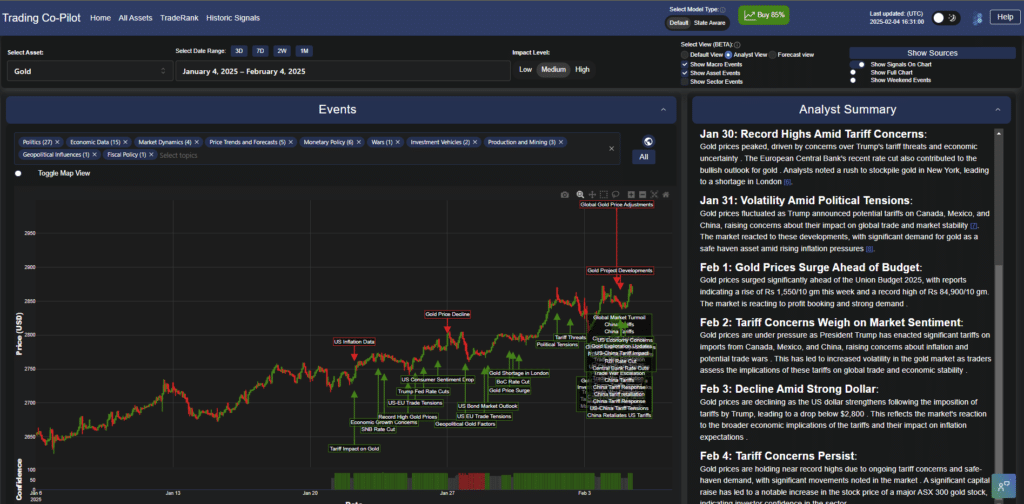

From where we stand, there are already clear signs that these AI agents are revolutionising market analysis. While America turns inward and global trade patterns shift, our Trading Co-Pilot’s gold price analysis showcases remarkable clarity. Between January and February 2025, the system tracked complex market dynamics including Trump’s tariff threats, ECB rate cuts, and global market turmoil. Alongside this, it identified a critical shortage of gold in London while simultaneously monitoring global price adjustments and bond market outlooks. Here, traditional approaches would simply be unmatched in terms of capability in this kind of multi-factor analysis.

Multi-agent systems in market analysis

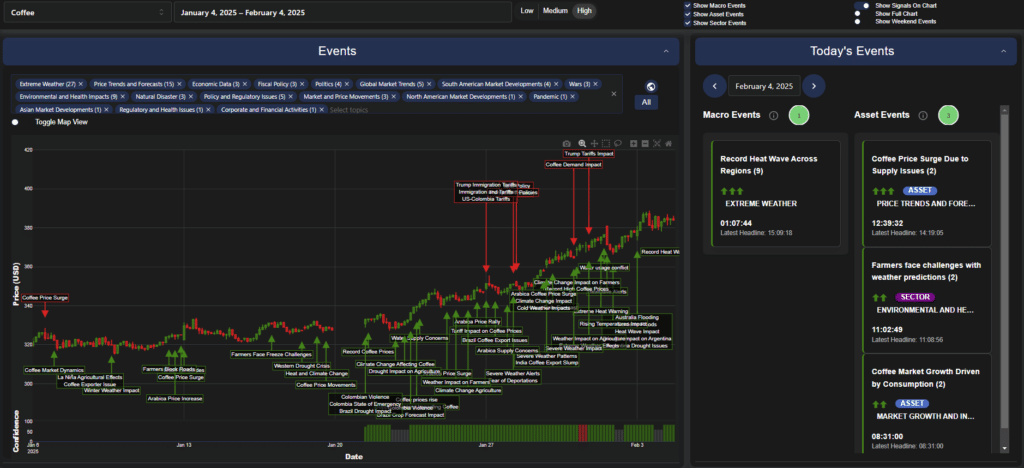

Perhaps we shouldn’t have been surprised by the rapid advancement of AI agents in commodity trading. This is partly because these autonomous systems offer unprecedented capabilities in coordinating multiple strategies simultaneously. Our Trading Co-Pilot’s analysis of coffee markets provides a perfect example, tracking 15 distinct categories of market influences including extreme weather (27 events), price trends and forecasts (19 events), and economic data (3 events). By the way, this multi-agent approach creates what we might call the ‘x-factor advantage’ in modern trading, as demonstrated by its ability to correlate events like “Record Heat Wave Across Regions” with specific price impacts and supply issues.

Above: Multi-dimensional analysis of coffee price movements incorporating extreme weather events, supply chain disruptions, and market developments, with real-time tracking of price surges and environmental impacts across growing regions

Beyond human limitations: Autonomous trading

The lasting significance of AI agents in commodity forecasting extends beyond basic automation. In this squalid era of politics and market volatility, their ability to maintain objectivity and respond instantaneously to changing conditions has become crucial. Take, for instance, our Trading Co-Pilot’s analysis of natural gas prices during severe weather events in February 2025. It was, of course, unfathomable just a few years ago that systems could track price movements from $3.4 to $3.77 while simultaneously monitoring weather impacts, pipeline expansions, and export approvals – all with precise timestamp accuracy.

A new era of trading intelligence and commodity price forecasting

Yes, many of the economies worldwide are still adapting to autonomous trading systems. However, at the very least, the integration of AI agents represents a significant leap forward, as evidenced by our Trading Co-Pilot’s sophisticated market sentiment views. Let’s take a moment to reflect on the fact that during the analysis of Brent Crude Oil above, the system maintained three distinct perspectives – Simple View, All Events View, and Forecast View – while providing detailed weekly overviews with timestamp precision down to the minute. So imagine how much more sophisticated these systems will become as they continue to evolve (spoiler: we’re already working on this in the lab).

Navigating market complexity through artificial intelligence

In the current AI narrative, we believe that the big danger for the global economy lies not in the adoption of these technologies, but in failing to embrace them. Trump’s second coming and China’s rising nationalism make the need for objective, autonomous decision-making more crucial than ever. Our Trading Co-Pilot demonstrates this through its analysis of gold markets, where it tracked global political tensions, tariff implications, and safe-haven demand simultaneously. The implication is that trading desks must now argue loudly for continued investment in AI capabilities that can process such complex, interrelated factors.

Above: Our comprehensive gold price tracking system demonstrating the interplay between political tensions, tariff impacts, and market sentiment, with detailed analyst summaries of daily price movements and contributing factors.

Embracing the future of autonomous analysis

All of which shows that the future of commodity trading clearly lies in the successful deployment of sophisticated multi-AI agents. Suffice to say that any commodity trading operation that fails to recognise and adapt to this autonomous reality will be firmly on the back foot. Our Trading Co-Pilot’s comprehensive analysis across multiple commodities shows the way forward: from tracking extreme weather impacts on coffee prices to monitoring geopolitical tensions in oil markets and analysing monetary policy effects on gold prices. We firmly believe that those who embrace these intelligent systems while maintaining appropriate oversight and risk management will be best positioned to succeed in tomorrow’s markets.

However, this transformation in commodity trading isn’t just about automation – it’s about augmenting human intelligence with AI capabilities that can process and analyse vast amounts of data in real-time, providing traders with unprecedented insight and advantage in increasingly complex global markets.

Transforming your trading future

The x-factor that AI agents bring to commodity trading isn’t just transformative – it’s becoming essential for survival in increasingly complex global markets. Our Trading Co-Pilot demonstrates that the future of intelligent trading is already here, offering unprecedented market insights across multiple commodities and time horizons.

Ready to experience the x-factor advantage in your trading operations? Book a personalised demonstration of our Trading Co-Pilot platform to see real-time market analysis in action. Contact us at enquiries@permutable.ai to schedule your personal consultation with our team and request a 14-day enterprise trial for qualified institutional trading professionals, or simply fill in the form below.