This article examines the unique dynamics propelling GBP/USD to a three-and-a-half-year high. It explores the interplay of fundamental macroeconomic indicators and market perceptions of institutional credibility, unveiling systemic truths behind sterling’s 2025 rally and the unexpected deterioration of US economic exceptionalism.

Table of Contents

ToggleAdvanced AI market intelligence

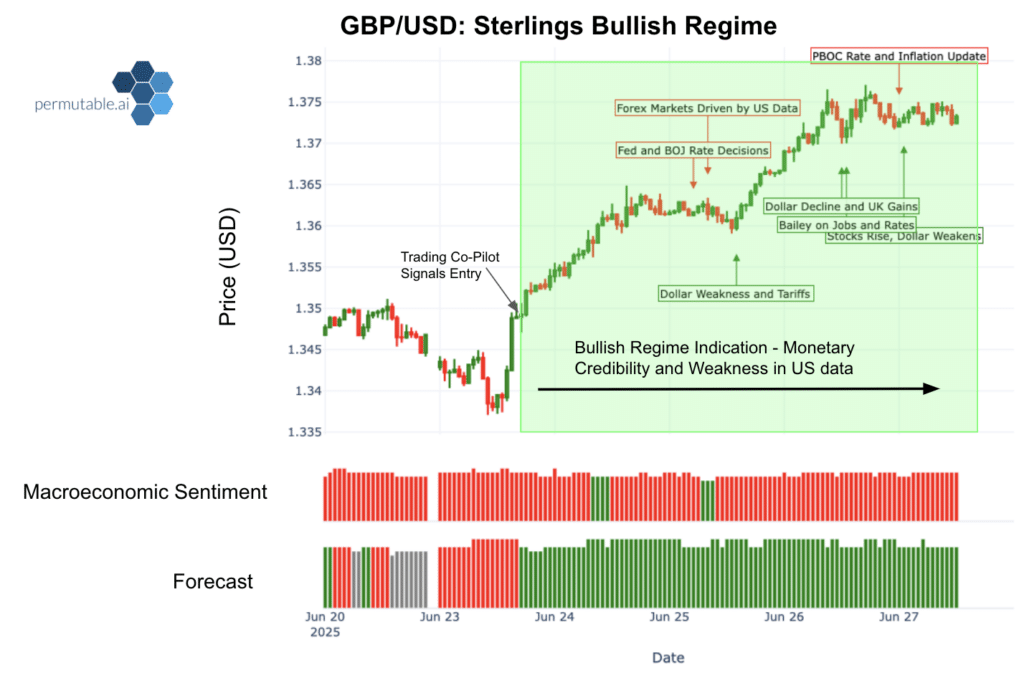

This week, our AI-driven Trading Co-Pilot detected early bullish signals in GBP/USD, picking up on subtle shifts in market sentiment, macroeconomic data flow, and central bank rhetoric well before the broader market reacted. Our Trading Co-Pilot issued a “Buy” signal on 23rd June, as its forecast quickly turned bullish in response to changing market dynamics, specifically the easing tensions in the Middle East and evolving US monetary policy rhetoric. The accompanying chart clearly shows a significant bullish regime for GBP/USD, highlighting its swift ascent. These machine learning-driven analytical insights are increasingly vital in fast-moving FX markets, where gaining an edge by positioning ahead of key inflection points directly informs successful strategies.

The world of FX rarely encounters such reversals of fortune as seen in the GBP/USD over the course of the last 3 years. Yet sterling’s meteoric rise to 1.3740 against the greenback represents a narrative that goes beyond cyclical momentum, but one of fundamental pivot away from prior norms. As geopolitical tensions simmer down, the focus of FX markets has migrated away from safe haven flows and leans towards growth, political stability and monetary credibility.

The dollar’s demise: When political pressure meets monetary policy

Fed’s new reality

For decades, the Federal Reserve’s independence was the bedrock of global monetary policy. Currently, that foundation appears to be cracking under political pressure. Public criticism from Trump and his appointed governors targeting Chair Powell’s hawkish ‘wait and see’ stance has created broader market concern over political interference. This perceived erosion of the wall between politics and monetary policy is now being priced in by investors as an inherent risk premium.

Key indicators reflect this shift:

- Markets are still pricing in 60-70 basis points cut from the Fed till 2025-end.

- Treasury yields, with the 10-year yield falling to 4.27%, reflect fading institutional credibility.

- The Dollar Index (DXY) hovers around 97.0-97.50, reaching multi-year lows despite recent safe-haven demand buoying the greenback.

This policy uncertainty and weakening of perceived Fed independence directly challenge the dollar’s dominance.

Economic fundamentals underpinned by political risk

The US economy’s Q1 contraction of -0.5% (y-o-y) points to deeper structural issues. While headline GDP weakness can be fleeting, the convergence of political and economic fractures casts a shadow over the dollar’s resilience. The greenback’s deterioration reflects a market revaluation of US institutional risk premium, beyond mere cyclical weakening.

Key pressure points include:

- Private consumption growth significantly slowed, rising merely 0.5% (q-o-q) in Q1, marking its weakest post-pandemic reading amidst a cooling labour market.

- Initial jobless claims show an upward trend, reflecting a softening labour market.

- The recent widening of trade deficits is amplified by aggressive tariff policies and pre-tariff import surges.

- The recent downgrade of US sovereign debt across the board, including Moody’s Ratings to Aa1 from Aaa on 16th May, starkly reflects mounting fiscal deterioration and ratings agencies’ lack of faith in policy makers ability to control ballooning debt.

Sterling’s rise

Monetary integrity

As markets grapple with monetary interference elsewhere, the Bank of England (BoE) has emerged as a beacon of institutional stability. Governor Bailey’s unwavering integrity, combined with the BoE’s ability to manage tempering services inflation (5.4%) and broader growth concerns, exemplifies astute policy discipline. Such inherent credibility has fostered a yield advantage for investors in sterling, particularly as Fed policy uncertainty persists, proving supportive for the currency.

UK’s comparative outperformance

Britain’s Q1 2025 GDP expansion of 0.7% (q-o-q) indicates genuine economic momentum despite April’s lackluster m-o-m data. While Brexit fears and past economic policy challenges owing Truss’s mismanagement of economic guidance dominated headlines in prior years, the economy has slowly adapted and found new momentum. The current rally reflects the maturing of this prolonged adjustment period, backed by shifting underlying growth drivers.

Key growth drivers include:

- Increased business investment as market confidence returns.

- Resilient consumer demand despite global headwinds.

- Industrial strategy investments in key sectors like AI, life sciences, and clean energy are beginning to yield dividends.

FX markets at work

The multiplier effect

GBP/USD’s breakthrough above the 1.37 resistance level has triggered strategic UK-bound flows. However, the pound’s selective strength, underperforming against the euro (EUR/GBP at 0.853) while gaining against the dollar. This highlights the rally’s true nature, sterling’s strength coming at a point of dollar demise. FX markets are now diversifying away from dollar-heavy portfolios, favouring alternatives with credible policy frameworks. Sterling benefits favourably from this pivot, owing to the UK’s liquid markets and robust fundamentals.

European resilience

The Eurozone’s own revival, with 0.6% Q1 growth and continued ECB hawkishness, complicates sterling’s narrative. Germany’s planned fiscal stimulus and the Euro Area’s current account surplus provide structural support the UK lacks. While sterling benefits from dollar weakness, it must also justify its gains against a resurgent euro, backed by robust macro-fundamentals and robust external balances.

The current account conundrum

Britain’s deep-seated current account deficit remains its strategic vulnerability. While recent trade data has shown some volatility, this underlying structural imbalance has the potential to reverse sterling’s gains in risk-off environments. The currency’s strength thus depends heavily on continued global risk appetite and stable capital flows.

The bigger picture in FX: diversification of capital flows

The GBP/USD forecast outlook

For investors, this signifies accelerating diversification away from the dollar, favouring currencies like sterling as a hedge against US institutional uncertainty. FX Strategy increasingly hinges on governance quality, not only traditional macro metrics. If current trends persist, GBP/USD could approach 1.40, though prevailing risks and technical barriers linger, from the UK’s persistent current account deficit, enduring services inflation, and external shocks like a Fed policy reversal or stronger eurozone growth.

The appreciation of GBP/USD shows a broader pivot in FX markets. As the dollar’s perceived exceptionalism fades, currencies rooted in credible, independent central banks and measured policy frameworks are attracting capital flows. Institutional integrity is now as paramount as traditional economic might in currency valuations. Political interference in central banking is increasingly being priced in as a risk premium. For sterling, the challenge is proving this strength can endure beyond the current cycle of dollar depreciation.

The GBP/USD narrative highlights the advantage of AI-driven market insights

The GBP/USD narrative highlights the critical role of sophisticated, AI-driven market insights. Our Trading Co-Pilot’s ability to detect shifts in sentiment, macro divergences, and policy rhetoric early enables positioning ahead of broader market consensus. This provides instant analytical value in today’s fragmented and politically sensitive FX landscape.

As traditional correlations weaken and political risk premiums reshape FX valuations, the power of Large Language Model (LLM) derived sentiment pattern recognition becomes indispensable. Such systems are crucial for identifying key inflection points within currency pairs before they become apparent through conventional analysis. In today’s FX markets – where central bank credibility plays an outsized role in driving currency movements – gaining an informational edge is everything. Our Trading Co-Pilot delivers real-time institutional and policy-driven insight, making it an essential tool for traders looking to stay ahead in an increasingly fast-paced and macro-sensitive environment.

Discover how our integrated intelligence can transform your FX trading performance. Contact enquiries@permutable.ai to unlock these market-moving insights in real-time.

Jack Watson is Permutable AI’s in-house analyst, leveraging our AI-driven insights to decode market trends, uncover global data signals, and explore how intelligent analytics are reshaping trading and investment strategies.