*This analysis examines how gold and oil markets have responded differently to recent geopolitical tensions, offering valuable insights for commodity traders, hedge fund managers, and institutional investors seeking to understand shifting market correlations and optimise their trading strategies in volatile conditions.

The diverging paths of precious metals and energy markets

The past week has offered a fascinating window into the gold vs oil correlation that has long intrigued financial analysts and traders alike. As specialists in LLM-powered market intelligence, we’ve seen a very obvious divergence in market sentiment between these two critical commodities that we’ll take a closer look at in this article.

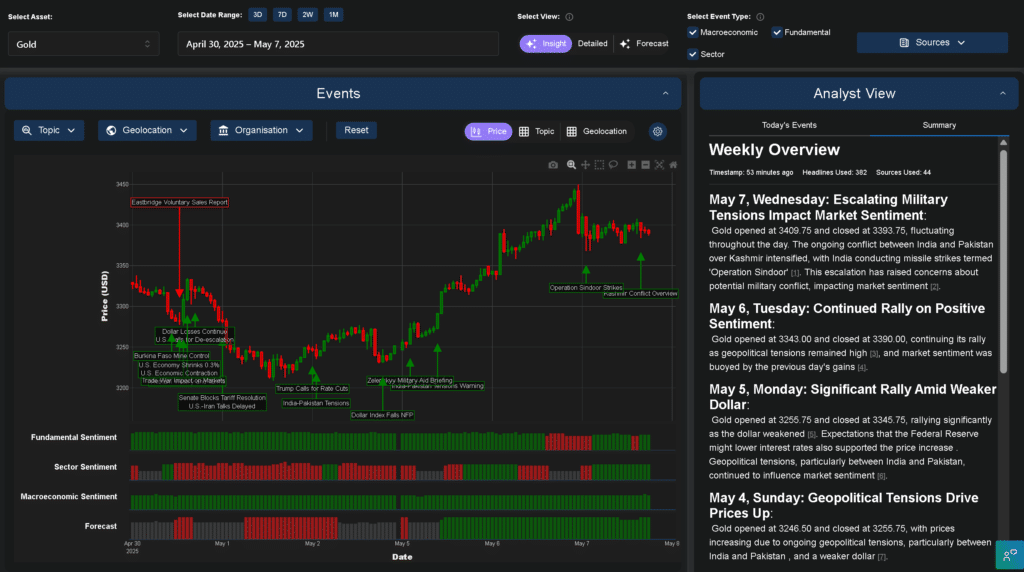

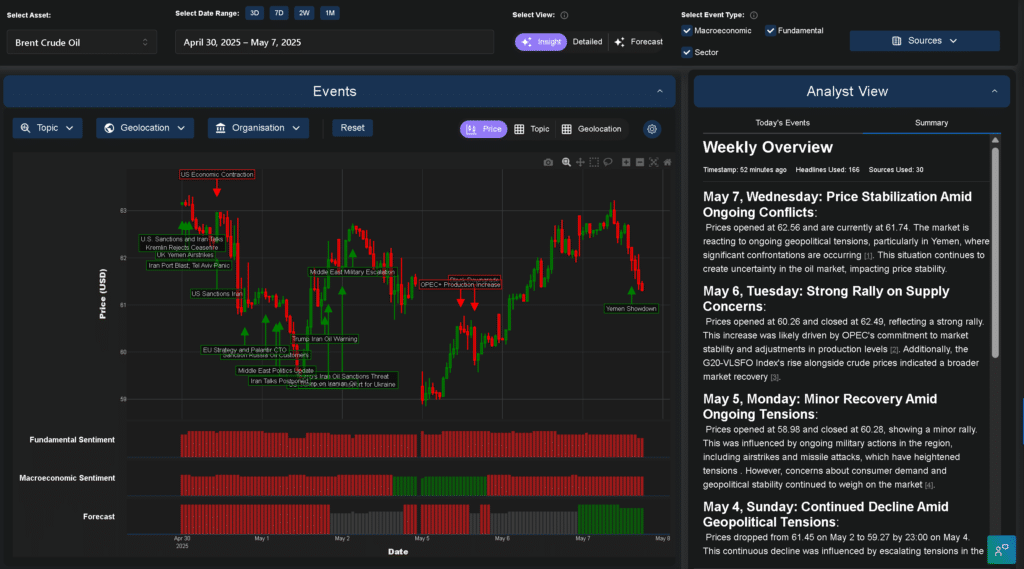

Starting with gold, which has has demonstrated exceptional strength, opening last Wednesday at $3,409.75 and maintaining levels above $3,390 despite minor fluctuations. In stark contrast, oil markets have shown considerably more volatility, with WTI crude hovering around the $59 mark and Brent managing slightly better at approximately $62. This disparity challenges traditional market assumptions and offers valuable insights for forward-thinking investors.

Geopolitical tensions: The common denominator

What’s particularly noteworthy about the current gold vs oil correlation is how differently these commodities have responded to the same geopolitical catalyst. The escalating military tensions between India and Pakistan over Kashmir, culminating in India’s “Operation Sindoor” missile strikes on May 7th, have sent ripples through global markets. Yet while both commodities have historically served as barometers for geopolitical risk, their responses have diverged significantly.

Gold has embraced its traditional safe-haven role, with prices remaining elevated despite daily fluctuations. The precious metal saw a remarkable rally earlier in the week, moving from $3,255.75 on Sunday to $3,345.75 by Monday’s close. As uncertainty persists in the Kashmir region, gold continues to attract investors seeking shelter from potential market turbulence.

Oil’s response, however, tells a different story. Rather than rising on supply disruption fears – as conventional wisdom might suggest – Brent crude has stabilised around $62, while WTI has struggled to maintain momentum above $59. This suggests that the gold vs oil correlation has fundamentally shifted, with broader economic concerns and supply dynamics outweighing geopolitical risk factors for energy markets.

Figure 1: Permutable’s Trading Co-Pilot analysis of gold price movements (April 30-May 7, 2025) showing the market’s response to geopolitical tensions. Note the significant rally as India-Pakistan conflicts escalated and the dollar weakened, demonstrating gold’s continued strength as a safe-haven asset during periods of uncertainty.

Economic undercurrents reshaping the gold vs oil correlation

The divergent performance extends beyond immediate geopolitical responses. Looking at the underlying economic factors, we can identify several critical drivers reshaping the gold vs oil correlation.

For gold, the combination of a weakening dollar and lingering expectations about Federal Reserve rate cuts has provided substantial support. Last Monday’s significant rally coincided with dollar weakness, demonstrating how currency movements continue to influence precious metals pricing. Despite mixed signals from recent economic data, gold remains well-positioned in an environment where monetary policy uncertainty persists.

Meanwhile, oil markets are grappling with a more complex set of challenges. OPEC+’s announcement of production increases has raised oversupply concerns, while signs of weakening global demand – particularly related to ongoing trade tensions – have dampened enthusiasm. Unlike gold, which benefits from economic uncertainty, oil remains fundamentally tethered to growth prospects and industrial activity.

This evolving relationship underscores why the gold vs oil correlation deserves careful attention from investors navigating today’s complex market landscape.

A week of contrasting market signals

Examining the day-by-day movements reveals nuances in the gold vs oil correlation worth exploring further:

On Wednesday, May 7th, gold opened at $3,409.75 and closed slightly lower at $3,393.75, maintaining strength despite the heightened military tensions between India and Pakistan. Concurrently, Brent crude opened at $62.56 and declined to $61.74, while WTI opened at $59.58 and stayed relatively stable around $59.46. This contrasting response to the same geopolitical development highlights the shifting nature of commodity interrelationships.

The previous day, Tuesday, May 6th, saw both commodities rally, though for different reasons. Gold climbed from $3,343.00 to $3,390.00, building on momentum from Monday and continuing to benefit from the geopolitical risk premium. Oil markets staged an even more dramatic comeback, with Brent climbing from $60.26 to $62.49 and WTI jumping from $57.16 to $59.49. Yet these parallel movements stemmed from different catalysts – gold responding to risk aversion, while oil reacted to OPEC+ statements about market stability.

Monday, May 5th, provided the clearest evidence of the evolving gold vs oil correlation, with gold surging nearly $90 from $3,255.75 to $3,345.75, while oil markets made more modest gains. Brent moved from $58.98 to $60.28, and WTI from $55.94 to $57.18. The substantial outperformance of gold during this session demonstrates how investor preference for safe-haven assets is currently outweighing traditional commodity market dynamics.

Figure 2: Brent crude oil price action (April 30-May 7, 2025) as analysed by our Trading Co-Pilot. Despite similar geopolitical tensions affecting gold markets, oil prices showed greater sensitivity to supply concerns and OPEC+ production decisions than to safe-haven demand, illustrating the evolving gold vs oil correlation in today’s market environment.

Market intelligence implications for financial decision-makers

For financial institutions and traders navigating this complex landscape, understanding the evolving gold vs oil correlation offers several strategic advantages.

Firstly, the traditional assumption that these commodities move in tandem during geopolitical crises needs reconsideration. As the events of the past week demonstrate, gold has retained and even strengthened its safe-haven characteristics, while oil has become increasingly dominated by supply-demand fundamentals and broader economic concerns.

Secondly, the gold vs oil correlation may provide valuable signals about market sentiment regarding economic growth prospects. Gold’s outperformance suggests persistent concerns about global economic stability, despite relatively resilient equity markets. This divergence merits careful monitoring as a potential early warning indicator.

Finally, diversification strategies that have historically relied on certain assumptions about the gold vs oil correlation may require reassessment. The changing relationship between these key commodities could impact portfolio construction, particularly for asset managers with significant commodity exposure.

Looking beyond traditional correlations

As we progress through 2025, the gold vs oil correlation continues to evolve in response to structural market changes. The precious metal has demonstrated remarkable resilience, reaching record highs above $3,400 despite adjustments in monetary policy expectations. Meanwhile, oil markets remain caught between OPEC+ supply management and concerns about global demand growth.

For forward-thinking market participants, this evolving relationship and cross-asset correlation offers both challenges and opportunities. Rather than relying on historical correlations, successful strategies will incorporate real-time analysis of the factors driving each commodity independently, while monitoring how their interrelationship adapts to changing economic and geopolitical conditions.

The past week has provided a valuable case study in how the gold vs oil correlation responds to acute market stresses. As geopolitical tensions persist and economic uncertainties linger, we anticipate further evolution in this critical market relationship – evolution that sophisticated analysis can transform into actionable market intelligence.

In a world where traditional asset correlations are increasingly unreliable, depth of analysis makes all the difference. Understanding the nuanced dynamics between gold and oil markets isn’t merely academic – it’s essential intelligence for navigating today’s complex financial landscape.

Transform your commodity trading strategy

Ready to leverage our advanced market intelligence in your commodity trading decisions? Our Trading Co-Pilot provides the analytical edge needed to identify opportunities where others see only volatility. Experience how our specialist LLM tools can help you:

- Anticipate market shifts before they appear in conventional indicators

- Identify divergences in traditional correlations that signal trading opportunities

- Access real-time analysis of how geopolitical events impact specific commodity relationships

Discover how leading commodity traders are already using these insights to outperform major indices consistently. Request a personalised demonstration today by emailing enquiries@permutable.ai or simply get in touch via the form below and see how our approach can enhance your trading performance through periods of market uncertainty.

Permutable AI – Specialist LLM tools delivering instant market intelligence with zero integration headaches.