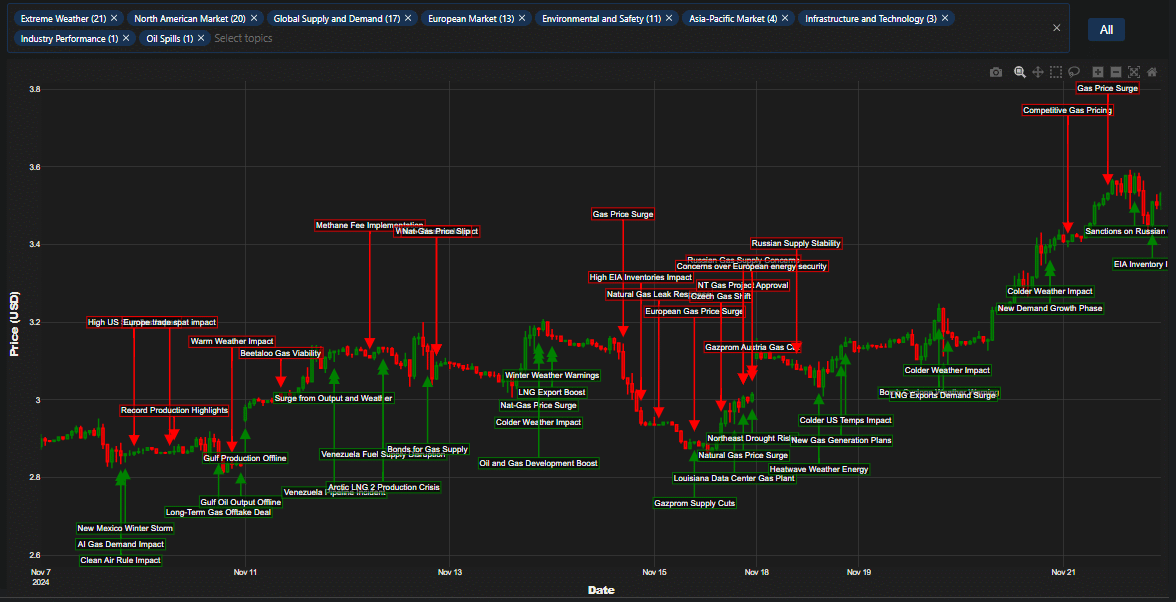

In these uncertain times, Henry Hub natural gas prices have demonstrated remarkable volatility throughout November 2024. This particular situation feeds on geopolitical instability and shifting fundamental factors that continue to reshape the market landscape. In this article, we’ll take a closer look at the seven key factors that have been impacting Henry Hub Natural Gas prices over the last month.

Table of Contents

Toggle7 factors impacting Henry Hub Natural Gas price – a look at key price drivers of U.S. Natural Gas

1. Weather: The perpetual market mover

Indeed, there are of course parallels with previous seasonal patterns, as weather remains a dominant force in U.S. Natural Gas prices. Which is why the market responded so obviously to early winter weather warnings and subsequent temperature forecasts. The snag is that weather impacts have become increasingly unpredictable, with both warm and cold weather events triggering significant price movements.

2. Supply dynamics and production challenges

If you believe the old adage that supply drives the market, recent events certainly support this view. Ahead of the winter season, we’ve observed several critical supply-side developments. Gulf production offline events and Venezuela fuel supply concerns have created upward pressure on Henry Hub Natural Gas prices.

3. Infrastructure and technical factors

It is the pinning of all its hopes on new infrastructure developments that characterises the market’s longer-term outlook. Rather than merely reacting to short-term supply disruptions, traders will be closely monitoring developments across the sector.

The expansion of LNG export facilities has emerged as a crucial factor, while Natural Gas leak incidents have introduced unexpected volatility. Meanwhile, oil and gas development boosts have provided some stability, while the impact of new facilities like the Louisiana Meta data centre gas plant applications has also been one to watch.

4. Geopolitical influences

Given that it is still working its way through various international tensions, the U.S. Natural Gas market remains highly sensitive to global events. At which point when sanctions and supply stability concerns enter the equation, we typically see increased volatility in U.S. Natural Gas prices.

The recent news events surrounding Russian supply stability and European energy security have created ripple effects across global gas markets, with Henry Hub prices increasingly responding to international supply disruptions. Insiders say this interconnectivity is only set to deepen as LNG export capacity expands and cross-continental gas flows become more fluid.

5. Demand patterns and market evolution

For the avoidance of any doubt, we’re witnessing a significant shift in consumption patterns. Thereby, new demand growth phases and LNG export demand increases have become crucial price drivers.

Meanwhile, the emergence of new data centres and their substantial energy requirements has added another layer of complexity to demand forecasting while the transition of power generation from coal to Natural Gas continues to reshape baseline demand expectations, creating a more nuanced and sophisticated market environment.

_*]:min-w-0″ style=”box-sizing: border-box; border-image: initial; –tw-border-spacing-x: 0; –tw-border-spacing-y: 0; –tw-translate-x: 0; –tw-translate-y: 0; –tw-rotate: 0; –tw-skew-x: 0; –tw-skew-y: 0; –tw-scale-x: 1; –tw-scale-y: 1; –tw-scroll-snap-strictness: proximity; –tw-ring-offset-width: 0px; –tw-ring-offset-color: #fff; –tw-ring-color: hsl(var(–accent-secondary-100)/1); –tw-ring-offset-shadow: 0 0 #0000; –tw-ring-shadow: 0 0 #0000; –tw-shadow: 0 0 #0000; –tw-shadow-colored: 0 0 #0000; outline-color: hsl(var(–accent-main-100)); display: grid; grid-template-columns: repeat(1, minmax(0px, 1fr)); gap: 0.625rem; border: 0px solid hsl(var(–border-100));”>

6. Environmental and regulatory impact

Insiders say that environmental regulations continue to shape market dynamics. But we need to understand that initiatives like the Clean Air Rule impact and methane fee implementation are likely to have longer-term implications for Henry Hub Natural Gas prices.

The push towards stricter emissions standards is accelerating infrastructure upgrades across the industry, adding new cost considerations to production economics. Additionally, the growing emphasis on certified low-emission gas could create a two-tier market, potentially affecting price discovery mechanisms and trading patterns.

7. Forward-looking market indicators

So let us finish this analysis with two thoughts about the market’s direction. First, the combination of weather sensitivity and supply constraints suggests continued volatility in U.S. Natural Gas prices ahead. Second, the growing influence of global factors on Henry Hub natural gas prices indicates an increasingly interconnected market. The development of new pricing mechanisms and risk management tools will become increasingly crucial as market participants adapt to this evolving landscape. Furthermore, the integration of real-time data analytics and artificial intelligence in trading decisions is likely to transform how market participants interpret and react to price signals.

In short, while individual factors can drive short-term price movements, it’s important to remember that it is the interaction between these various elements that shapes the broader market trajectory. As we progress through the winter season, monitoring these key drivers will be crucial for understanding price dynamics in the natural gas market.#

Stay ahead of Henry Hub Price Movements

In today’s volatile Natural Gas markets, capturing real-time intelligence is nothing short of essential. Our Trading Co-Pilot and GenAI Commodities API are transforming how traders navigate Henry Hub price movements, processing thousands of market events instantly to deliver actionable insights and directional signals.

We’re currently offering select traders and institutions early access to our platform and GenAI Commodities API, which is already being used by leading early-adopter energy trading houses to detect price-moving events the moment they happen. Beyond merely aggregating news, our AI-powered system generates instant buy/sell signals by analysing complex market events and their potential impact on Natural Gas prices.

Whether you’re looking to enhance your existing trading infrastructure or seeking a comprehensive market intelligence solution, we’d be delighted to show you how our platform can integrate seamlessly into your workflow. Request a personalised demo to see firsthand how we track real-time events affecting Henry Hub, or start with a free trial of our Trading Co-Pilot to experience the competitive edge of AI-powered market intelligence.

Why not get in touch with our team today – we’d love to hear from you and show you our tech’s capabilities. Simply drop us a line to enquiries@permutable.ai or fill in the form below to get in touch. Early access spots are limited – ensure you’re equipped with the next generation of trading intelligence.