In this new world order of financial markets, we have been seeing first hand both through our own activities and those of our clients how powerful market sentiment indicators can be for navigating market volatility. The hard truth found in the blur of the last few weeks in global markets is that traditional indicators often lag behind the rapid shifts in investor psychology that drive price action. In this new reality, there is no shying away from the fact that emotion, rather than pure fundamentals, is steering market movements with unprecedented force.

1. Emotion is driving short-term price action with market volatility

When you consider how markets are reacting faster to narratives than fundamentals, the importance of tracking sentiment becomes crystal clear. For instance, U.S. equities and oil surged immediately after de-escalation comments around Middle East tensions – long before any material changes happened on the ground. This reactivity demonstrates that market sentiment now often precedes price movements.

In recent weeks, retail and algorithmic flows have become heavily headline-driven. A single tweet or soundbite from a central bank, government leader, or media outlet can now spike or sink markets within minutes. The exponential speed at which information travels and influences trading decisions means market sentiment indicators provide vital early warnings.

2. Global political sentiment has become front and centre

Anyone will know that the most glaring prospect facing markets today is geopolitical uncertainty. What has been unfolding before our eyes are multiple flashpoints – from the Red Sea to the Taiwan Strait to Ukraine and the Trump Tariff rollercoaster – that are constantly evolving. These events often drive fear-based moves long before they’re reflected in traditional economic indicators or yields.

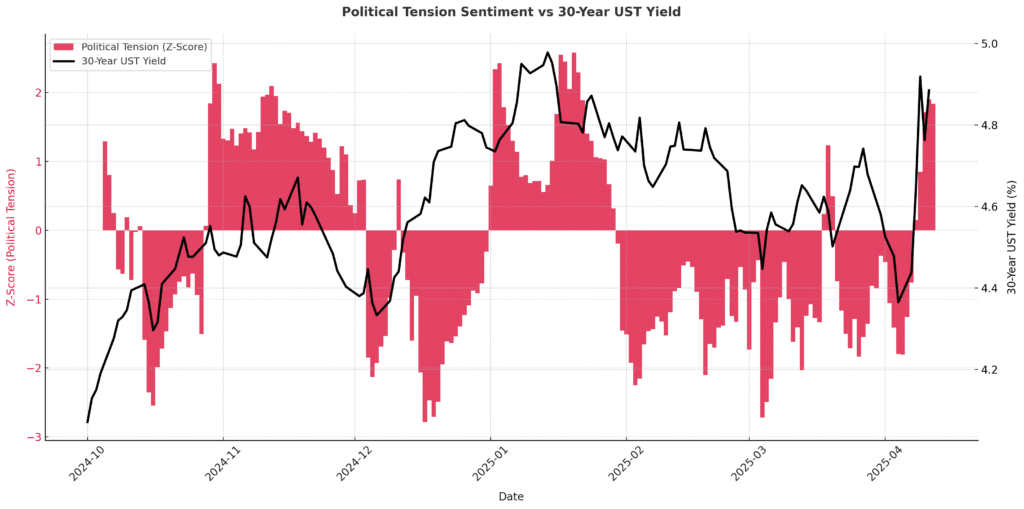

Here, our market sentiment engine aggregates and quantifies tension levels across leading international news sources in near real time—offering early signals before markets fully price in risk. As we stand in front of the revolving doors of time, this type of intelligence provides powerful foresight.

3. Traditional yield signals exhibit significant lag behind the narrative

Let us not forget that bond yields and traditional macro indicators often react too slowly in fast-moving geopolitical crises. During the recent oil price dip, sentiment indicators flagged softening rhetoric in the Middle East days before futures markets began correcting.

This exact type of sentiment signal becomes a better risk proxy than long-duration data that lags behind current global dynamics. The future is in the balance, and it’s hard to say how this current period of volatility will play out. But those relying solely on traditional indicators may find themselves consistently behind the curve.

Above: Our Alternative Political Risk Indicator: Permutable Geopolitical Indicator (PGI): We are introducing a proprietary alternative to the traditional 30-year U.S. Treasury yield as a gauge for political risk.

4. Risk appetite is being extremely influenced by escalation anxiety

The danger of this shift is that markets today swing heavily on perceived “risk-on vs. risk-off” moves based on geopolitical fear or relief. It’s hard to keep up with the firehose of information, but tracking market sentiment indicators provides a dynamic view of global risk appetite, capturing emotional tone shifts that influence investor behaviour.

Experts say this draws a clear line between reactive and proactive investment strategies, and by focusing on market sentiment indicators, this allows investors to anticipate shifts between flight to safety and high-beta risk-taking before they become widely apparent.

5. Sentiment reflects real-time, crowd-driven narratives

Our conversations here at Permutable often return to the cracks appearing in traditional market analysis, with crypto, commodities, and equities all showing increased correlation with news sentiment and social media tone. For example, our sentiment engine detected surging bullish sentiment before certain assets rallied on speculative headlines – purely sentiment-driven trading that traditional metrics missed entirely.

And this is why the question of incorporating sentiment analysis has become so powerful. Quite simply, the extremely rapid diffusion of information means market narratives are forming and shifting more quickly than ever before.

6. Trump 2.0 and policy uncertainty create sentiment volatility

As we write this, it should now be obvious that within the era of Trump 2.0, policy uncertainty has reached unprecedented levels. This rightly causes worries about market stability, as presidential rhetoric and policy shifts can trigger immediate market reactions.

Reaching even deeper into sentiment analysis allows investors to gauge market reactions to policy announcements before they’re fully implemented. The Trumpian backlash against certain sectors and the boost to others can be anticipated through careful monitoring of sentiment indicators, providing an powerful layer of insight.

7. The exponential value of sentiment during regime shifts

As we navigate today’s challenges, one thing is for certain – the new regime in markets requires new tools. As Trump continues to flex and confuse with America turning away from international order in various ways, this is creating unique market conditions where sentiment often trumps fundamentals as. We can clearly see that global trust will continue to be challenged as the world strives to recalibrate, and we can expect the hosepipe of information to continue to flow at an overwhelming rate.

While traditional indicators may have served us well in the past in this new era fed by tariff tantrums, characterised by rapidly evolving markets, market sentiment indicators offer a powerful advantage to relying solely on lagging indicator.

And so, in light of the above, in a world where market movements are increasingly driven by emotion rather than fundamentals, can you afford to navigate today’s volatile investment landscape without the insights provided by robust market sentiment indicators?

Stay ahead of market shifts, not behind them

Discover how Permutable AI’s market sentiment indicators can transform your investment approach in this new era of volatility. Book a demonstration today to see how our sentiment analysis technology can give you the edge in anticipating market movements before they occur. Simply email enquiries@permutable.ai to learn more about implementing our market sentiment indicators into your strategy or fill in the form below.