Palantir has been getting a lot of attention since going public in 2020. As we look ahead to 2030 many investors are wondering where Palantir’s stock will be. With their technology and growing presence in government and commercial markets Palantir’s upside is big. But predicting stock prices that far out requires considering many factors. This article will go into those factors and break down the Palantir stock price prediction 2030.

Palantir today and the Palantir stock price prediction 2030 trajectory

Palantir business model

Before we get to the predictions it’s important to understand Palantir’s business model. Palantir offers advanced data analytics through two platforms: Palantir Gotham and Palantir Foundry. Gotham is for government clients, particularly in defense and intelligence, and Foundry is for commercial clients across industries. Their technology allows organizations to integrate, manage and analyze large datasets and get valuable insights to inform decision making.

Palantir’s government contracts, particularly with the US government, are a big part of their revenue. But they have been slowly building out their commercial client base and that will be a big factor in Palantir stock 2030.

Palantir stock price prediction 2030 and growth

Palantir’s growth is tied to the growing demand for big data analytics and artificial intelligence. As more industries realize the value of data driven decision making Palantir is well positioned to benefit from that trend. The global big data market is expected to grow significantly over the next 10 years which would be a big boost to Palantir’s revenue and by extension their stock.

Another factor in Palantir stock 2030 is the company’s focus on innovation. Palantir is investing heavily in research and development to keep their platforms at the forefront of technology. That ongoing innovation will attract more clients and expand their market share and drive growth.

Government contracts

Palantir’s relationships with government agencies, particularly in the US, provide a steady revenue stream. Those contracts are long term and involve national security projects so are less impacted by economic downturns. That’s a good sign when thinking about Palantir stock 2030.

Additionally Palantir’s government contracts will grow as governments around the world prioritize data security and intelligence capabilities. The increasing complexity of global threats, cyber warfare and geopolitical tensions will drive more investment in defense technology and benefit Palantir.

Palantir stock price prediction and commercial expansion

While government contracts are important Palantir’s future growth will be driven by their expansion into commercial. Palantir Foundry, their platform for commercial clients, has already seen big adoption in industries like healthcare, finance and manufacturing.

The continued adoption of Palantir’s technology by big corporations will be a big factor in Palantir stock 2030. As more companies look to leverage data analytics to get more efficient and competitive Palantir’s commercial revenue will grow. And their ability to land big, multi year contracts with commercial clients will be key to sustaining their growth.

Competition and market

Palantir is a leader in their space but they have stiff competition from other tech giants and emerging startups. Companies like Google, Amazon and Microsoft are also heavily invested in AI and big data analytics and offer similar solutions. That competition will impact Palantir’s market share and by extension their stock by 2030.

But Palantir’s unique value proposition – combining deep expertise in data integration and analytics with a strong focus on security and privacy – sets them apart from the competition. That will help them maintain a competitive advantage even as the market gets more crowded.

Financials and valuation

To make a reliable Palantir stock 2030 prediction you need to look at their financials. As of recent reports Palantir has been showing steady revenue growth from both government and commercial contracts. But they haven’t yet achieved consistent profitability which is a concern for some investors.

By 2030 Palantir’s financials could be much stronger if they can scale efficiently and achieve sustained profitability. Their focus on long term contracts and recurring revenue streams provides a solid foundation for growth. If Palantir can improve their margins and control costs their stock could see big appreciation by 2030.

Palantir stock price prediction: Navigating risks

While the Palantir stock price 2030 looks good there are some risks to consider. Firstly Palantir’s reliance on government contracts, particularly in the US, exposes them to regulatory and political risk. Changes in government policy or budget will impact their revenue.

Secondly the competitive landscape is a risk. As mentioned above Palantir has competition from some of the biggest tech companies in the world. If those competitors can offer better or cheaper solutions Palantir will lose market share.

And finally the broader economic environment will also impact Palantir’s stock by 2030. Economic downturns, changes in interest rates and shifts in investor sentiment towards tech stocks will all impact their valuation.

Palantir stock price prediction 2030: What analysts say

Analysts are divided on the Palantir stock price prediction 2030. Some are very bullish, citing their growth potential and expanding into both government and commercial. They think Palantir’s stock will see big gains over the next 10 years and reach new highs.

On the other hand more conservative analysts point to the challenges they face, competition and achieving profitability. They think Palantir’s stock will appreciate by 2030 but the growth will be more modest than some expect.

If a relatively moderate growth trajectory is followed, with Palantir’s stock reaching approximately $8.38 billion in revenue by 2030 and an EPS (Earnings Per Share) of $1.17., this would imply a potential stock price increase to around $45-$50 per share, depending on market conditions (24/7 Wall St.).

For those expecting a more optimistic forecast, Palantir’s stock could soar to as high as $245.73 by 2030. This bullish scenario assumes significant growth in both the company’s AI platforms and its dominance in government contracts, which could drive a much higher valuation (CoinCodex).

These varying Palantir stock price prediction 2030 highlight the uncertainty and potential variability in Palantir’s future stock performance, influenced by how successfully the company can capitalize on emerging opportunities in AI and government sectors.

Palantir stock price prediction 2030: Summary

Palantir stock price prediction 2030 is a hot topic for investors. With their position in big data and AI they can deliver big returns over the next 10 years. Their continued innovation, expansion into commercial and stable government contracts all point to a good outlook for their stock.

But investors should also be aware of the risks, competition, political and economic factors that will impact Palantir’s performance. As always research and risk management is key when considering long term investments in tech stocks like Palantir.

In the end while the future looks good for Palantir only time will tell how they navigate the challenges and what their stock will be by 2030. Investors looking at the Palantir stock price prediction 2030 should keep an eye on the company’s developments, market trends and broader economic conditions.

What about Palantir stock price forecast 2025?

While our main focus has been on the Palantir stock price prediction 2030, it’s crucial to consider the shorter-term outlook, particularly the PLTR stock forecast for 2025. This mid-term projection can provide valuable insights for investors considering their positions in the coming years. Several key factors will likely influence the Palantir stock price forecast 2025 including:

- Commercial sector growth: The rate at which Palantir expands its commercial client base will be crucial. A significant increase in Foundry platform adoption could drive the share price higher.

- Government contract renewals: As existing government contracts come up for renewal, PLTR stock performance will be sensitive to these outcomes. New major government partnerships could also boost the short-term outlook.

- Profitability trajectory: Investors will be closely watching Palantir’s progress towards consistent profitability. Positive trends in this area could significantly impact the share price by 2025.

- Technological advancements: Any major breakthroughs or new product launches in AI and data analytics could positively influence the PLTR stock forecast.

- Macroeconomic factors: Interest rates, inflation, and overall economic growth will play a role in shaping investor sentiment towards tech stocks like Palantir.

Analysts’ opinions on the PLTR stock outlook are positive. Many analysts predict that if Palantir continues its current growth trajectory and successfully expands its commercial sector, the share price could potentially reach the high 40s($) by 2025. This is of course assuming that Palantir Technologies shares continue to grow at the average yearly rate as they have done over the last decade, representing a 40.12% increase in Palantir stock price. It’s important to note that these projections are speculative and subject to change based on company performance and market conditions.

PALANTIR STOCK PRICE FORECAST FAQ

What factors will most influence Palantir's stock price by 2030?

The key factors likely to influence Palantir’s stock price by 2030 include:

- Expansion of their commercial client base

- Continued growth in government contracts

- Advancements in AI and data analytics technology

- Achievement of consistent profitability

- Competition from other tech giants

- Global economic conditions and geopolitical factors

How does Palantir's reliance on government contracts affect its stock outlook?

Palantir’s government contracts provide a stable revenue stream, which can be positive for long-term growth. However, this reliance also exposes the company to political and budgetary risks. Diversification into commercial markets could help mitigate these risks and potentially boost stock performance.

What are the main risks to Palantir's stock price growth?

The main risks include:

- Intense competition from tech giants and startups

- Potential changes in government spending or policies

- Challenges in achieving consistent profitability

- Technological disruptions in the AI and data analytics field

- Economic downturns affecting client spending

How accurate are long-term stock price predictions?

Long-term stock price predictions, especially those extending to 2030, should be viewed as speculative. They’re based on current information and trends, which can change significantly over time. These predictions are best used as one tool among many when considering investment decisions.

How does Palantir's commercial growth affect its stock potential?

Palantir’s expansion into commercial markets is crucial for its long-term growth and stock potential. Success in this area could lead to more diverse revenue streams, reduced dependence on government contracts, and potentially higher profit margins, all of which could positively impact the stock price.

What should investors watch for in Palantir's quarterly reports?

Key metrics to watch in Palantir’s quarterly reports include:

- Revenue growth, especially in the commercial sector

- Customer acquisition and retention rates

- Progress towards consistent profitability

- Operating margins

- Cash flow and debt levels

- Updates on new products or technological advancements

How might global events impact Palantir's stock by 2030?

Global events such as geopolitical tensions, technological breakthroughs, or shifts in data privacy regulations could significantly impact Palantir’s stock. Increased global instability might boost demand for Palantir’s government services, while advancements in AI could open new markets or bring new competitors.

How does Palantir's AI capabilities compare to other tech giants, and how might this affect its stock by 2030?

Palantir’s AI capabilities are a significant factor in its potential stock performance by 2030. Here are key points to consider:

- Specialized Focus: Unlike broader tech giants, Palantir specializes in data analytics and AI for complex, mission-critical applications, particularly in government and large enterprise settings.

- Proprietary Technology: Palantir’s Gotham and Foundry platforms incorporate advanced AI and machine learning, giving them a unique edge in handling and analyzing massive, disparate datasets.

- Competition: While tech giants like Google, Amazon, and Microsoft have substantial AI capabilities, Palantir’s niche focus and deep expertise in specific sectors (e.g., defense, healthcare) could be a competitive advantage.

- Innovation Pace: Palantir’s continued investment in R&D and AI advancements will be crucial. Their ability to innovate and stay ahead in AI technology will significantly impact their market position and stock performance.

- AI Market Growth: As the global AI market expands, Palantir’s specialized AI solutions could see increased demand, potentially driving stock growth.

- Ethical AI: Palantir’s approach to ethical AI and data privacy could become a differentiator, especially in sensitive sectors, potentially affecting investor sentiment and stock value.

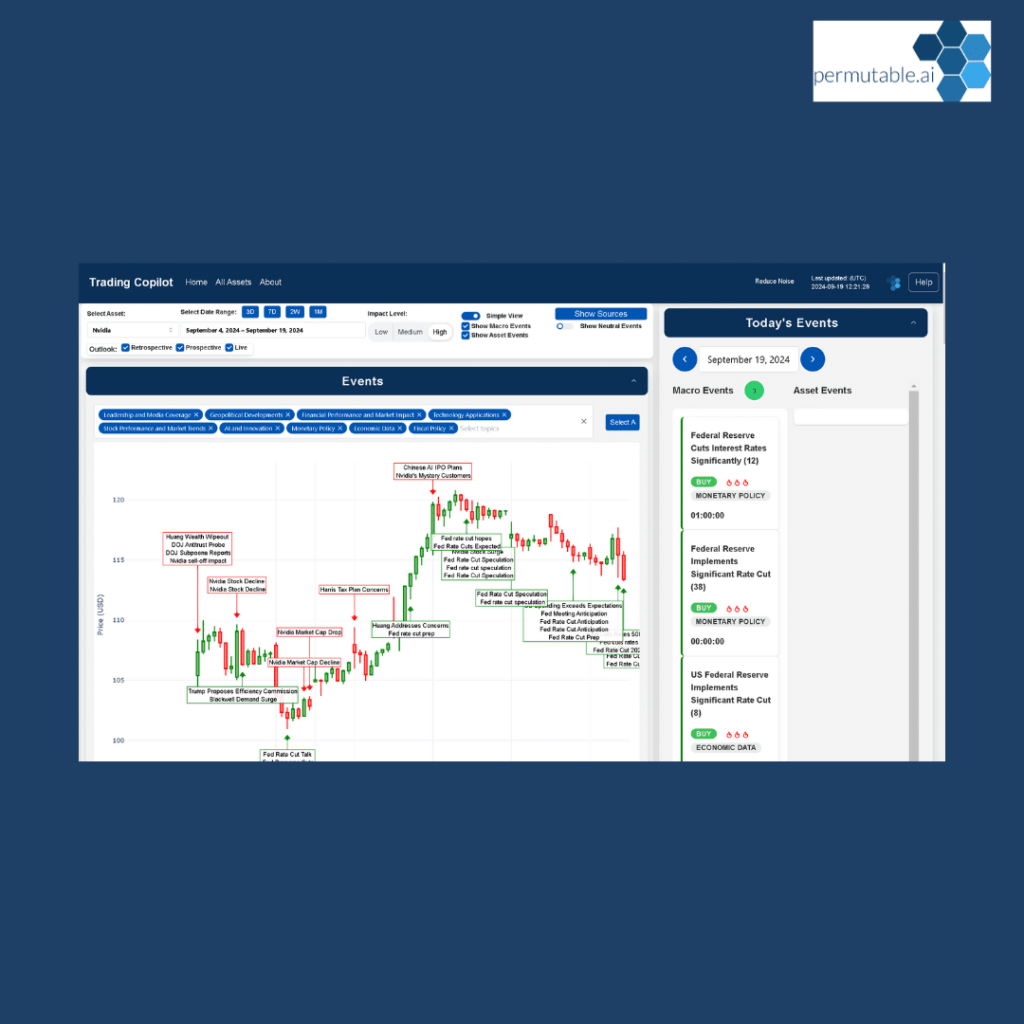

Trading Co-Pilot exclusive access

Are you ready to be part of the future of trading? At Permutable AI, we’re extending an exclusive opportunity to a select group of corporate partners to gain early access to our advanced Trading Co-Pilot, powered by cutting-edge machine learning for contextual understanding.

This is a rare chance to stay ahead of the competition by leveraging AI that not only processes data but also grasps the global context—analysing real-time sentiment and market-shaping events to deliver more precise and risk-aware trading strategies.

If your firm is ready to lead the way in AI-driven trading innovation, get in touch today to explore this limited opportunity and discover how our Trading Co-Pilot can transform your approach to the market by contacting us at enquiries@permutable.ai or fill in the form below.

Disclaimer: The information provided by Permutable AI is for informational purposes only and does not constitute financial advice, investment advice, or a recommendation to buy, sell, or hold any securities. While we strive to provide accurate and up-to-date information, we do not guarantee the completeness, accuracy, or reliability of the data. All investments involve risks, including the loss of principal. Past performance is not indicative of future results. Users are advised to conduct their own independent research and consult with a licensed financial advisor before making any investment decisions. Permutable AI, its affiliates, or its employees shall not be held liable for any losses or damages resulting from reliance on the information provided.

Your trading is about to take off

Schedule a free enterprise demo to see how our Trading Co-Pilot can help you make smarter trading decisions, faster.

Further reading

Looking for more stock price predictions? See below for:

Intel stock price prediction 2025

Nio stock price prediction 2025

Microsoft stock price prediction 2025