Tesla, the renowned electric vehicle manufacturer, has been making waves not only in the automotive industry but also in the realm of sustainable business practices. One key metric that has been gaining prominence in recent years is the Tesla ESG score. In this article, we will delve into the significance of ESG in the business world, understand how our Tesla ESG score is calculated, and explore the impact it has on the electric vehicle market and beyond.

Understanding ESG and its Significance in the Business World

ESG has emerged as a crucial framework for evaluating the sustainability and ethical practices of companies. Environmental factors encompass the impact of a company’s operations on the planet, such as carbon emissions, waste management, and resource consumption. Social factors involve a company’s treatment of employees, customers, and communities, including diversity and inclusion, labour practices, and human rights. Governance factors assess the effectiveness of a company’s leadership, board structure, and transparency.

ESG scores are used by investors, stakeholders, and consumers to assess a company’s long-term viability and sustainability. Companies with high ESG scores are seen as more responsible and are increasingly sought after by investors looking to align their portfolios with ethical and sustainable practices. Tesla’s ESG score has become a significant benchmark in the electric vehicle market, where sustainability is at the forefront of innovation.

What is Tesla’s ESG Score and How is it Calculated?

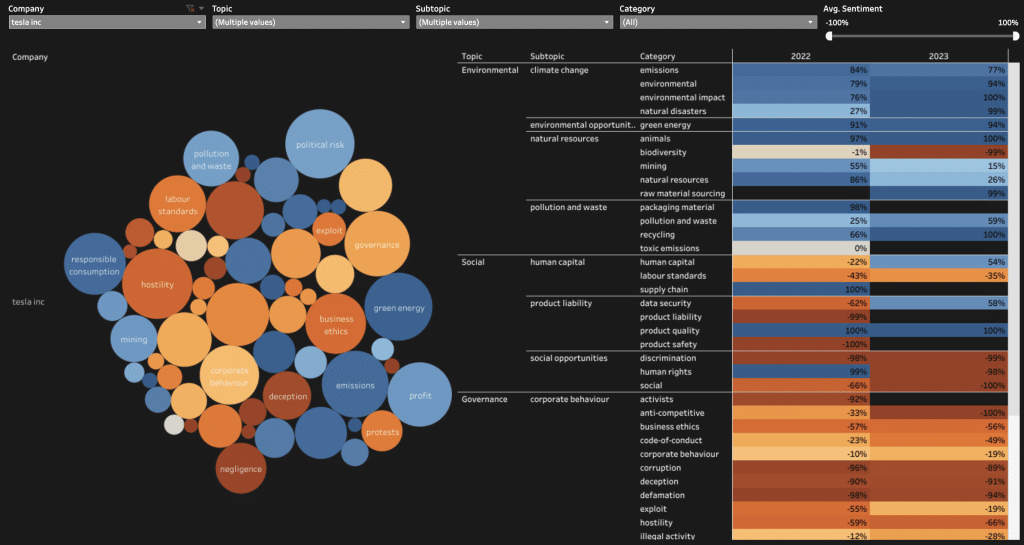

Our Tesla ESG score is a rating that quantifies the company’s performance in environmental, social, and governance aspects. It is calculated based on various metrics using cutting-edge sentiment analysis across key indicators, including carbon emissions, energy efficiency, labour practices, employee diversity, board structure, executive compensation, and transparency.

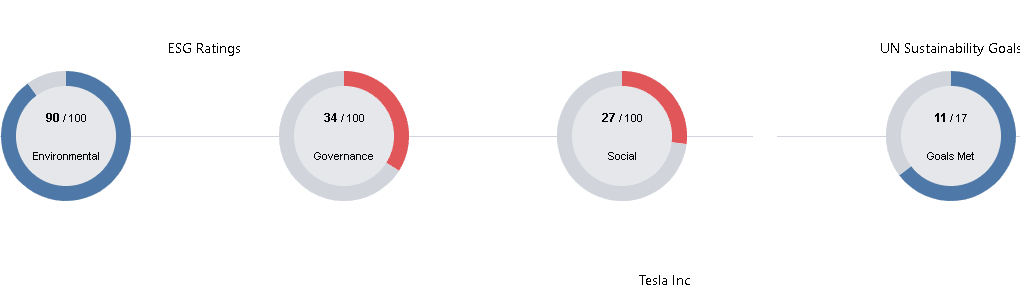

The calculation of our Tesla ESG score involves a comprehensive evaluation of the company’s operations, policies, and disclosures based on NLP news sentiment analysis. This score provides a snapshot of how well the company is managing its environmental impact, engaging with its stakeholders, and maintaining good governance practices. According to our latest data at time of writing, the breakdown of Tesla’s ESG score is as follows: Environmental – 90, Social – 27, Governance – 34.

Tesla ESG Score: Impact on the Electric Vehicle Market

Tesla’s ESG score has had a significant impact on the electric vehicle market. As sustainability concerns continue to rise, consumers are increasingly focused on supporting companies that prioritize environmental responsibility. Tesla’s high ESG score has positioned the company as a leader in the industry, attracting environmentally conscious customers who are willing to invest in electric vehicles that align with their values.

Moreover, Tesla‘s strong ESG score has put pressure on other electric vehicle manufacturers to improve their sustainability practices. Competitors in the market are now striving to match Tesla’s performance and meet the growing demand for eco-friendly vehicles. This heightened competition has accelerated the adoption of sustainable technologies and practices across the industry, leading to a positive environmental impact on a larger scale.

Tesla ESG Score: A Competitive Advantage

Tesla’s ESG score not only influences consumer preferences but also provides the company with a competitive advantage. As sustainability becomes an increasingly important differentiating factor, Tesla’s strong ESG performance sets it apart from its competitors. The company’s commitment to reducing carbon emissions, promoting renewable energy, and advancing sustainable transportation has resonated with customers and investors alike.

Tesla’s focus on environmental responsibility has allowed it to build a loyal customer base and attract investors who prioritize ESG factors. This strong reputation for sustainability has translated into increased market share and higher valuations for the company. By leveraging its ESG score as a competitive advantage, Tesla has solidified its position as a leader in the electric vehicle market.

Tesla ESG Score: How it Influences Investor Decisions

ESG scores, including Tesla’s, have become critical considerations for investors making decisions about where to allocate their capital. As sustainability concerns gain prominence, investors are becoming increasingly aware of the potential risks associated with companies that fail to address ESG factors adequately. Tesla’s high ESG score has garnered attention from institutional investors and asset managers who prioritize sustainable investments.

Investors are recognizing that sustainable companies like Tesla are better equipped to navigate long-term challenges, such as climate change regulations and shifting consumer preferences. By incorporating ESG considerations into their investment strategies, investors aim to align their portfolios with their values while seeking financial returns. Tesla’s strong ESG score has positioned the company as an attractive investment opportunity for those seeking both sustainability and profitability.

Tesla’s Environmental Score

Tesla’s high environmental score in ESG ratings stems from its contributions to reducing greenhouse gas emissions and promoting sustainable energy solutions.

Zero-Emission Vehicles: Tesla’s primary focus on electric vehicles (EVs) has significantly reduced the company’s environmental impact compared to traditional gasoline-powered vehicles. EVs produce zero tailpipe emissions, which helps to improve air quality and reduce greenhouse gas emissions.

Sustainable Energy Initiatives: Tesla’s investments in renewable energy projects, such as solar panels and battery storage systems, further contribute to the company’s environmental sustainability efforts. These initiatives help to reduce reliance on fossil fuels and promote cleaner energy sources.

Circular Economy Practices: Tesla has implemented measures to promote a circular economy, such as recycling battery materials and recovering components from scrapped vehicles. These practices reduce the environmental impact of Tesla’s products throughout their lifecycle.

Supply Chain Management: Tesla has made efforts to improve the sustainability of its supply chain by sourcing materials from responsible suppliers and working to reduce the environmental impact of transportation and logistics.

Overall, Tesla’s commitment to zero-emission vehicles, sustainable energy initiatives, and circular economy practices has earned the company a high environmental score in ESG ratings. However, it is important to note that Tesla continues to face environmental challenges, such as the ethical sourcing of raw materials and the potential environmental impact of battery manufacturing.

Tesla’s Social Score

Tesla’s low social score in their ESG rating stems from several factors related to corporate governance, labour rights, and environmental concerns.

Corporate Governance: Tesla has faced criticism for its lack of transparency and accountability, particularly regarding CEO Elon Musk’s behaviour. Musk’s tweets and public statements have been deemed irresponsible and have led to regulatory scrutiny. Additionally, Tesla’s board of directors has been criticized for lacking independence and diversity.

Labour Rights: Allegations of racial discrimination and poor working conditions at Tesla’s Fremont, California, factory have raised concerns about the company’s labour practices. Workers have reported facing harassment, discrimination, and unsafe working conditions. Tesla has also been criticized for its use of temporary workers and its efforts to unionize its workforce.

Environmental Concerns: Tesla’s manufacturing processes have been criticized for their environmental impact, particularly the use of cobalt, a mineral sourced from mines with questionable labour practices. Additionally, Tesla’s self-driving technology has been involved in several accidents, raising concerns about its safety and the company’s handling of these incidents.

These factors have contributed to Tesla’s low social score in ESG ratings, highlighting the need for the company to address these issues to improve its overall ESG performance.

Tesla’s Governance Score

Tesla’s low governance score in ESG ratings stems from several factors related to corporate structure, executive compensation, and board oversight.

Corporate Structure: Tesla’s dual-class share structure, which grants CEO Elon Musk significant control over shareholder voting, raises concerns about the company’s accountability to its shareholders. This structure allows Musk to make major decisions without having to seek approval from other shareholders.

Executive Compensation: Musk’s compensation package, which is tied to the company’s financial performance and certain operational goals, has been criticized for its lack of alignment with long-term sustainability and stakeholder interests. The emphasis on short-term financial performance could lead to decisions that prioritize profits over long-term environmental and social considerations.

Board Oversight: Tesla’s board of directors has been criticized for lacking independence and diversity. The majority of board members have ties to Musk or the company’s early investors, raising concerns about their ability to objectively evaluate Musk’s actions and make decisions in the best interests of all stakeholders.

Transparency and Disclosure: Tesla has been criticized for its lack of transparency and disclosure, particularly regarding its handling of environmental and social issues. The company has been reluctant to share detailed information about its supply chain, manufacturing processes, and labor practices, making it difficult for investors and stakeholders to assess the company’s ESG risks.

Risk Management: Tesla’s approach to risk management has been questioned, particularly its handling of worker complaints and potential safety hazards related to its self-driving technology. The company’s reactive approach to these issues suggests a lack of proactive risk management practices.

These factors have contributed to Tesla’s low governance score in ESG ratings, highlighting the need for the company to strengthen its corporate governance practices to improve its overall ESG performance.

Head over to our ESG Company Gallery to access the full version of our ESG company reports.

Comparing Tesla’s ESG Score with Other Electric Vehicle Manufacturers

When comparing Tesla’s ESG score with other electric vehicle manufacturers, it becomes evident that Tesla is leading the pack. While several companies have made strides in sustainability, Tesla’s comprehensive approach to ESG sets it apart. The company consistently outperforms its competitors in areas such as carbon emissions reduction, energy efficiency, and transparency.

Tesla’s commitment to sustainability and its ability to integrate ESG considerations into its business strategy has allowed it to maintain a significant advantage over other electric vehicle manufacturers. As the market continues to evolve, it will be crucial for competitors to improve their ESG performance to remain competitive in the industry. Why not explore Tesla’s peer ESG scores below:

The Future of Tesla’s ESG Score and its Implications for the Industry

As sustainability becomes an increasingly important aspect of business, Tesla’s ESG score is likely to play a significant role in shaping the future of the electric vehicle market and beyond. The company’s strong ESG performance has set a high standard for the industry, pushing competitors to improve their sustainability practices and driving the adoption of electric vehicles on a global scale.

Tesla’s influence extends beyond the automotive sector, as other industries look to the company as a model for sustainable business practices. The success of Tesla’s ESG initiatives has demonstrated that profitability and sustainability can go hand in hand, inspiring companies across various sectors to prioritize environmental responsibility, social impact, and good governance.

The Role of ESG Scores in Shaping the Future of Sustainable Businesses

Tesla’s ESG score has emerged as a game-changer in the electric vehicle market and beyond. It has not only positioned the company as a leader in sustainability but has also influenced consumer preferences, investor decisions, and industry standards. Tesla’s strong ESG performance serves as a testament to the importance of environmental responsibility, social impact, and good governance in driving long-term success.

As the world continues to grapple with pressing sustainability challenges, ESG scores will play a crucial role in shaping the future of sustainable businesses. Companies that prioritize ESG factors and demonstrate a commitment to sustainability are likely to thrive in this changing landscape, while those that fail to adapt may face significant risks and challenges. Tesla’s ESG score serves as a beacon of inspiration for businesses across industries, reminding us that sustainable practices are key to building a better future for our planet and its inhabitants.

Find Out More

Looking for more nuanced ESG data on Tesla? Fill out the form below to request more granular data.