This article provides an in-depth analysis of the recent platinum price surge above $1,268 demonstrating how our proprietary AI-powered Trading Co-Pilot system delivered critical early sentiment signals ahead of major price movements. The piece combines real-time trading intelligence with macro analysis from our in-house analyst, examining supply constraints, geopolitical risks, and fundamental drivers behind platinum’s sustained rally and is aimed at professional commodity traders, precious metals investors, systematic trading funds, and institutional clients seeking advanced trading intelligence and real-time sentiment analysis for precious metals markets. Particularly valuable for traders managing multi-asset portfolios who require early-warning systems for commodity market inflection points.

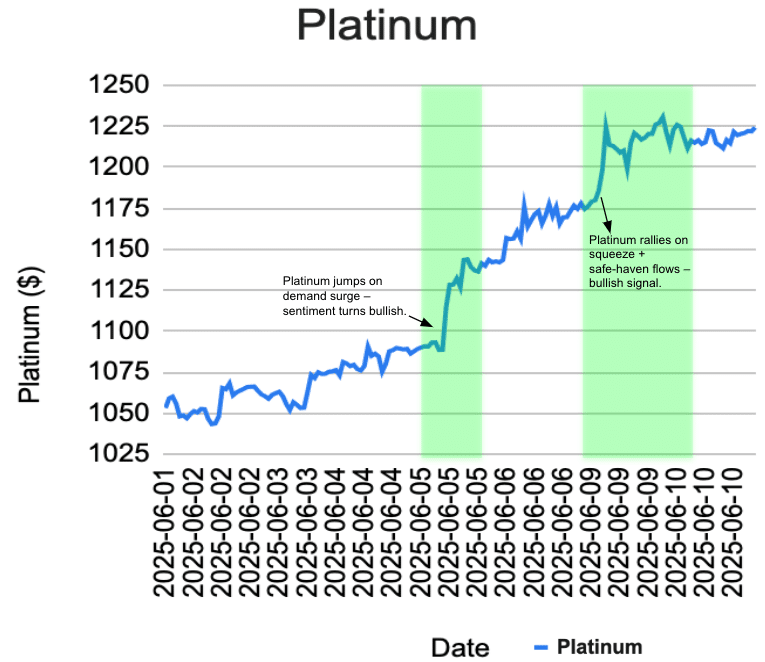

Platinum has taken the spotlight this month, roaring back into focus after breaking above $1,268.90, its highest level since May 2021. The fundamentals surrounding the metal point to a combination of a perfect storm of supply constraints, geopolitical risk, and investor positioning driving the sustained rally. The move began on 5 June, when platinum broke through resistance at $1,089.50.

During early Asian trading, our Trading Co-Pilot system issued a “strong bullish” sentiment alert, hours before prices surged to $1,127.20, and then accelerated to $1,222.50. This early signal gave a critical edge ahead of a sharp breakout fuelled by renewed momentum and technical positioning. By 10 June, the market paused, taking a natural pullback.

Our Co-Pilot concurrently flagged this indicating a shift to neutral sentiment, capturing the cooling tone as profit-taking and consolidation took place. However, on 11 June, the rally reignited. Platinum opened sharply higher at $1,268.90, propelled by renewed safe-haven buying after an intensified Russian drone offensive on Kyiv spurred geopolitical risk aversion during the Asian session. Our Trading Co-Pilot once again tracked the real-time shift, signalling a bullish turn in sentiment and helping traders stay ahead of the curve.

Above: Our Trading Co-Pilot sentiment indicators caught the platinum rally early – while traditional analysts focused on supply fundamentals, our AI detected shifting institutional sentiment patterns across news sources before the breakout. The sentiment heat map showed bullish momentum building in precious metals discourse, with platinum-specific mentions spiking as traders rotated from gold. This is exactly how intelligent sentiment analysis transforms market timing.

The macro outlook: Why platinum has rallied

Several structural and macroeconomic drivers are underpinning platinum’s price strength:

Tight supply: Major producers in South Africa and Russia have curbed output amid a prolonged low price environment owing to covid and the rise of EV’s, worsening an already deepening deficit. The World Platinum Investment Council (WPIC), most recent report forecasts a 966,000oz shortfall for 2025, the third consecutive annual deficit.

Investor safe-haven flows: With elevated lease rates and geopolitical instability, platinum has regained traction as a store of value, attracting capital inflows on the margins.

China demand shift: In retail markets, platinum is gaining prominence in the Chinese jewellery market as a lower-cost alternative to gold, which has fueled additional demand.

Tariff hedging: Earlier in 2025, large volumes were diverted to the United States as investors braced for a potential return to Trump-era tariffs, signalling how political risk is being priced into physical flows.

Above: Breakout signals – our intelligence-driven trading alerts identified platinum’s two-stage rally before price action confirmed the moves. Permutable AI sentiment indicators captured demand surge narratives in May and squeeze dynamics in June, delivering actionable positioning opportunities ahead of the 15% price appreciation.

Why it matters: Signals and substance

This rally exemplifies the importance of combining real-time sentiment systems like our Trading Co-Pilot with robust macro, sectoral, and fundamental analysis. In a volatile, undersupplied market like platinum, timing is everything. In this case, our Trading Co-Pilot not only captured the rally, it anticipated key inflection points in sentiment, giving users the ability to position ahead of price moves. With platinum markets now driven by both tight fundamentals and headline risk, tools that identify sentiment shifts early are critical in capturing the market early. Co-Pilot delivers that edge.

How many critical market moves are you missing without real-time sentiment intelligence?

Every day, commodity markets experience inflection points that separate profitable positions from missed opportunities. Without real-time sentiment detection, how much alpha is your trading operation leaving on the table? Traders relying on traditional technical analysis entered platinum positions hours after our Co-Pilot users had already capitalised on the initial momentum, and in volatile, headline-driven markets, this timing differential compounds across every major move.

Your competitors are already gaining systematic advantages through our advanced sentiment intelligence, and as markets become increasingly driven by geopolitical headlines and macro sentiment shifts, the question isn’t whether you need real-time sentiment analysis – it’s whether you can afford to operate without it whilst your competition gains positioning advantages on every market inflection.

Contact our trading intelligence team at enquiries@permutable.ai to discover how our Trading Co-Pilot intelligence suite and systematic data feeds deliver systematic positioning advantages for your commodity and precious metals strategies.