It’s a question many of us have asked lately – why has ESG become a political issue? As ESG evolves and becomes more integrated into the political sphere, businesses must adapt to new regulations and requirements. By understanding the political landscape and prioritizing ESG issues, companies can capitalize on the opportunities and benefits that come with sustainable and ethical practices.

The Rising Importance Of ESG For Businesses

In recent years, there has been a growing consensus that businesses must incorporate ESG principles into their operations. This shift can be attributed to a variety of factors, including consumer demand, climate change, and the realization of the benefits that sustainable and ethical practices can bring.

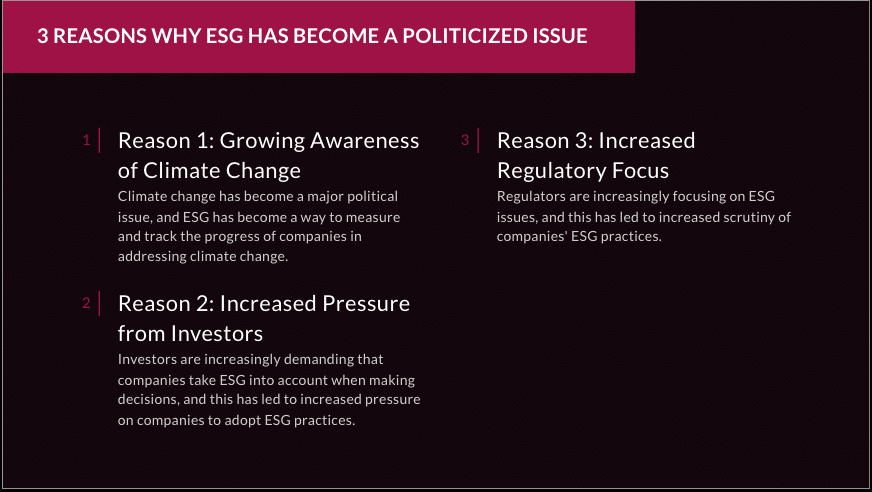

Why Has ESG Become a Political Issue?

Similarly, ESG has become a prevalent political issue in the US because of its growing popularity and impact on investment decisions. According to abcnews.go.com, ESG has been propelled by growing awareness about the negative effects of some corporate practices, in part due to the rise of social media. However, some Republicans have criticized ESG investing as “woke capitalism” and have blasted ESG financial practices. More than a dozen Republican state attorneys general have also criticized ESG financial practices. Republicans in Congress plan to increase their scrutiny of what they call “woke capitalism”.

According to cnbc.com, ESG has become a polarizing issue, leveraged by leading politicians to drive another wedge between Americans. In states including Texas and Florida, top state officials have inserted themselves into the ESG debate as part of the broader culture wars, with a particular markets’ twist.

Table of Contents

ToggleThe Transition to Sustainable and Ethical Business Practices

Consumer Demand for Sustainable and Ethical Goods and Services

Consumers are increasingly conscious of the environmental and social impact of the products and services they purchase. As a result, they are more likely to support businesses that demonstrate a commitment to ESG principles meaning companies that prioritize ESG issues are not only appealing to a growing market segment but also fostering brand loyalty among their customers.

Climate Change’s Influence on Business Operations

Climate change poses significant risks to businesses, including disruptions to supply chains, increased operational costs, and potential reputational damage. By adopting ESG principles, companies can mitigate these risks and improve their long-term resilience. Furthermore, businesses that take a proactive approach to addressing climate change can become industry leaders and gain a competitive edge in the market.

Benefits for Businesses Adopting Sustainable and Ethical Practices

Businesses that adopt ESG principles can enjoy numerous benefits, including improved risk management, increased operational efficiency, access to capital, and enhanced reputation. As more investors consider ESG performance when making investment decisions, companies with strong ESG credentials are likely to attract more capital and enjoy higher valuations.

The Role of Governments and Policymakers in ESG Adoption

Governments and policymakers play a crucial role in driving the adoption of ESG practices. They do this through the implementation of regulations and standards, as well as promoting transparency and disclosure on ESG performance.

Government Regulations and Standards

Many governments have introduced regulations and standards to promote sustainable and ethical business practices. These policies often require companies to disclose their ESG performance, adhere to specific environmental and social standards, and set targets for reducing their environmental footprint.

Political Campaigns and Activism

Political campaigns and activism have also played a significant role in raising awareness of ESG issues and driving change. Public pressure from activists, NGOs, and socially conscious investors has pushed governments to take action and implement policies that promote ESG practices.

Navigating the Political Landscape Around ESG

As the political landscape around ESG continues to evolve, businesses must stay informed and be prepared to adapt to new policies, regulations, and expectations from stakeholders. Here are some strategies companies can employ to navigate this shifting landscape. Active engagement with policymakers, regulators, and other stakeholders is essential for businesses to understand the expectations surrounding ESG practices. By participating in discussions and contributing to policy development, companies can help shape regulations that align with their values and are feasible to implement.

The Push for Transparency and Disclosure

Transparency and disclosure are crucial components of ESG reporting. Governments and regulators have increasingly called for companies to provide more detailed and accurate information about their ESG performance. This trend towards greater transparency enables investors, customers, and other stakeholders to make informed decisions and hold companies accountable for their ESG practices.

When it comes to ESG reporting, companies are increasingly adopting these practices to showcase their commitment to ethical and sustainable operations. Examples of ESG reporting include Apple’s ESG report, Microsoft’s ESG report, Amazon’s ESG report, Alphabet (Google)’s ESG report, and Facebook’s ESG report.

How Political Involvement Will Affect Businesses

As ESG becomes more prominent in the political sphere, businesses must be prepared to adapt to new policies and regulations. By understanding the political landscape and prioritizing ESG issues, companies can successfully navigate these changes and reap the benefits of sustainable and ethical practices.

Embracing Transparency and Reporting

Embracing transparency and comprehensive ESG reporting can help businesses demonstrate their commitment to sustainable and ethical practices. Companies should be proactive in disclosing their ESG performance, highlighting both their successes and areas for improvement. This transparency can foster trust among stakeholders and potentially lead to new opportunities for growth and investment.

Measuring and Monitoring ESG Performance

Measuring and monitoring ESG performance is essential for businesses to understand their progress, identify areas for improvement, and demonstrate their commitment to stakeholders. Companies should establish clear metrics and Key Performance Indicators (KPIs) to track their ESG performance over time. Regular reporting and communication of these results can help build trust with stakeholders and drive continuous improvement.

To learn more about ESG performance metrics and KPIs, visit the European Union’s comprehensive list of ESG KPIs that companies can follow to ensure their ESG reporting is consistent, comparable, and credible.

Seeking External Validation and Certification

Seeking external validation and certification for ESG performance can help businesses demonstrate their commitment to sustainable and ethical practices. Organizations such as the Global Reporting Initiative (GRI), the Sustainability Accounting Standards Board (SASB), and the Carbon Disclosure Project (CDP) provide frameworks and standards that companies can follow to ensure their ESG reporting is consistent, comparable, and credible.

To seek external validation and certification for ESG performance, you can visit greenbusinessbureau.com which provides a 3rd party verification system used to accurately show your company has completed key sustainability initiatives, and has become a sustainable business.

Investing in ESG Expertise

To successfully navigate the evolving political landscape around ESG, businesses should consider investing in in-house or external ESG expertise. This can help them stay informed about regulatory changes, develop effective ESG strategies, and ensure they are meeting stakeholder expectations.

Summing Up

In conclusion, the growing political interest in ESG reflects the increasing importance of sustainable and ethical business practices. Companies must be prepared to adapt to new policies and regulations, engage with stakeholders, and prioritize ESG issues in their decision-making processes. By doing so, businesses can capitalize on the opportunities and benefits that come with being a responsible corporate citizen, while also mitigating potential risks and challenges associated with ESG compliance.

The political landscape around ESG is constantly changing, and businesses must be prepared to adapt and evolve their ESG strategies accordingly. This may involve reassessing goals and targets, refining policies and procedures, and re-evaluating relationships with suppliers and partners to ensure alignment with evolving ESG expectations.

In summary, ESG has become a political matter due to its growing importance in society and the realization that businesses play a critical role in addressing environmental, social, and governance issues. Companies that successfully navigate the shifting political landscape around ESG and integrate these principles into their business model can enjoy numerous benefits, including improved risk management, increased operational efficiency, access to capital, and enhanced reputation. By prioritizing ESG issues and adopting a holistic, long-term approach, businesses can build a sustainable and resilient future for themselves and the communities they serve.