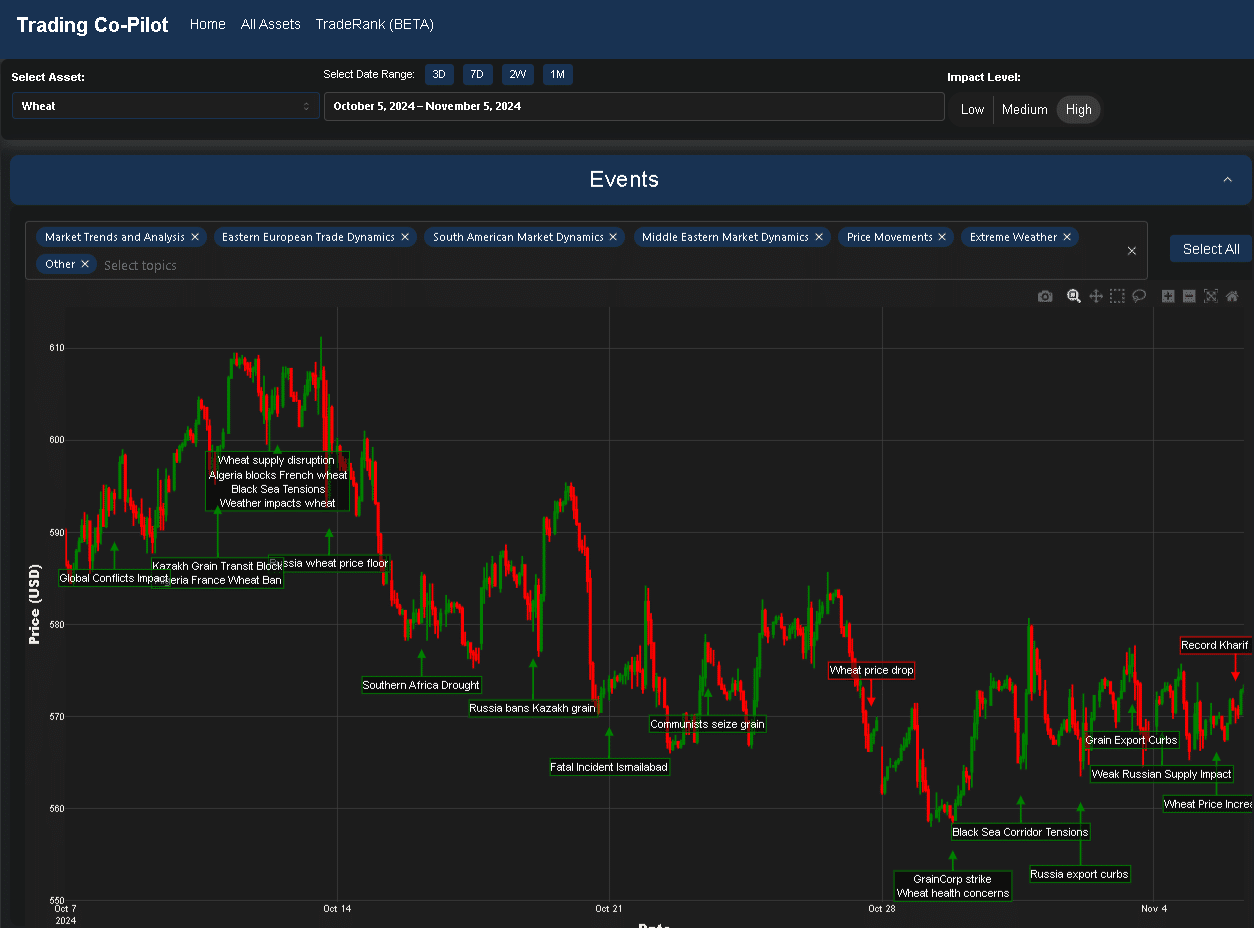

In this article, let’s compare the various factors currently shaping wheat markets to understand their profound impact on global prices. The approach to analysing the price of wheat has transformed dramatically of late particularly as we witness the tidal wave of technological change that’s about to hit commodity trading through AI-powered analytics provided by tools like our Trading Co-Pilot. Suffice to say that the traditional methods of market analysis are being transformed by real-time data processing and pattern recognition capabilities that were unimaginable just a few years ago. With many asking “why is the price of wheat so volatile” of late, here we’ll use insights taken from our Trading Co-Pilot to help you understand the current state of play.

Until recently, traders relied on fragmented information sources, often missing crucial market signals and opportunities. This has previously meant that a wheat or commodity trader may have struggled to connect seemingly unrelated events that could impact wheat prices significantly. But what happens when you use our Trading Co-Pilot instead? Through the use of this latest technology, several key patterns emerging from recent market data will have emerged, providing traders at the helm with unprecedented market visibility and actionable insights.

4 key factors contributing to volatility in the price of wheat

1. Geopolitical tensions reshaping supply chains and impact on price of wheat

First, let’s turn our attention to Eastern European trade dynamics, where it has emerged that Russian grain export policies have become increasingly complex. Our platform not only highlighted this as a contributing factor (see image above), but also the introduction of price floors at $250/tonne. Then there was the blocking of Kazakh grain transit and escalating Black Sea corridor tensions have added layers of complexity to global wheat movements.

2. Influence of weather events and production uncertainty on price of wheat

Take a look above at the obvious correlation between weather events and price movements in recent markets. Much of the world takes for granted the stability of wheat production but the initiated among us will know that there are important developments that can change everything – as highlighted in the image above from our Trading Co-Pilot. The severe drought crisis in Southern Africa, combined with poor US winter wheat health conditions and global weather-related production concerns, has created a perfect storm of supply uncertainty.

3. Price of wheat and diplomatic relations altering trade flows

To see this point at work, look at the recent Algeria-France situation, where diplomatic tensions taking root from Algeria blocking French wheat entry are perhaps reshaping established trade relationships. You may say, “So what?” But the link with broader market dynamics is crucial, as these diplomatic shifts can create sudden changes in supply and demand patterns. This is true in the context of global trade flows, where our Trading Co-Pilot frequently tracks how diplomatic tensions rapidly reshape established patterns and create new market opportunities.

4. Market structure evolution and price of wheat formation

The picture we are seeking to paint here is one of interconnected market forces, where changes in one region can have unexpected consequences globally. It’s a remarkable time with nail-biting developments in how price discovery occurs, particularly as technology enables faster and more sophisticated market analysis. Of course, you may be a skeptic and continue to watch traditional indicators, but a cynic might observe that these often lag behind real-time events, making them less valuable for active traders. And it is precisely this kind of feedback we have been receiving from early users of our Trading Co-Pilot – and among them are traders at some of the biggest companies involved in trading commodities.

Leveraging our Trading Co-Pilot’s market intelligence

As an example of our platform’s capabilities, consider how our Trading Co-Pilot processes thousands of market events daily scanning 20,000 articles every hour across 50,000 news sources , identifying critical price drivers and correlating seemingly unrelated events to provide actionable trading signals. This is the result of sophisticated algorithms combined with deep market understanding, enabling traders to detect emerging market trends before they become obvious to the broader market.

Key market indicators we track include but are not limited to:

- Real-time price movements

- Supply chain disruptions

- Weather pattern impacts

- Geopolitical developments

- Diplomatic relations

- Regional trade flows

- Market structure changes

Request a free trial of our Trading Co-Pilot

Only five early access positions remaining for our Trading Co-Pilot. Join leading energy trading houses in shaping the future of commodities trading intelligence. Our early access partners receive priority platform customisation, a dedicated account strategist, advanced feature releases, and direct development team support. Get ahead with tech-enabled competitive advantage with our 30-day unrestricted platform access. Simply fill in the form below to get in touch or to schedule your private demo and discuss your specific trading requirements. Don’t miss this opportunity to transform your commodities trading strategy with institutional-grade market intelligence.