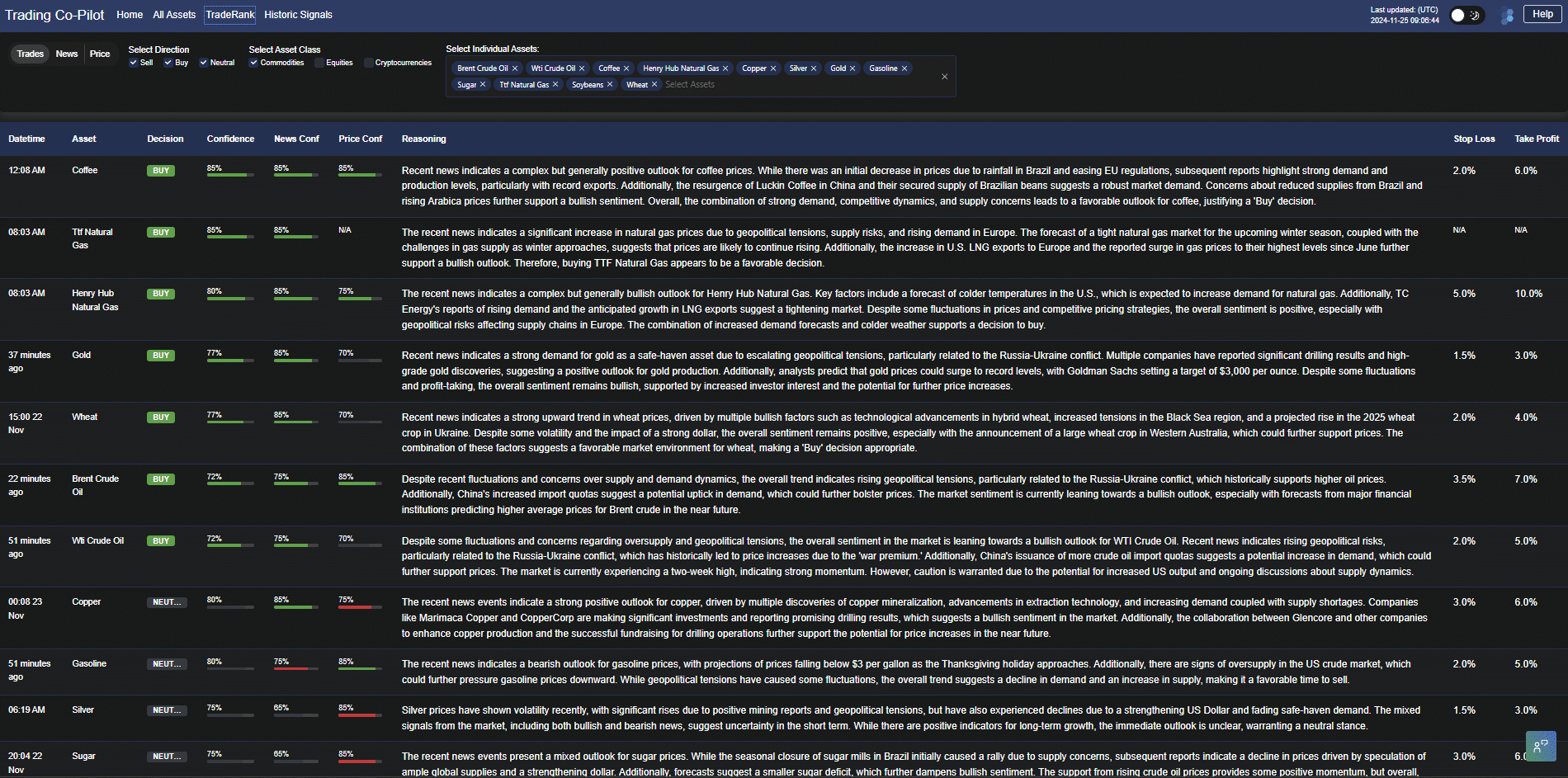

This week, what we’re seeing is a convergence of bullish signals across multiple commodity markets. This isn’t new, but there is a certain flavour of intensity around alignment of these signals deserve closer attention. Let us not forget that commodity trades often reflect broader economic and geopolitical dynamics. Here’s our top commodity trades for this week across coffee, natural gas, gold, wheat and crude oil.

Top commodity trades: #1 Coffee

There is a case for strong optimism in coffee markets, with our AI analysis indicating an 85% confidence buy signal. The realisation that supply constraints from Brazil alongside rising Arabica prices. Then there’s the rising demand in Chinese markets exemplified Luckin Coffee’s expansion.

Top commodity trades: #2 & 3 Natural gas (TTF and Henry Hub)

This, we suspect, is where the most interesting commodity trades are developing. Both TTF Natural Gas and Henry Hub Natural Gas markets show strong buy signals. Day by day, the real world consequences of geopolitical tensions in Europe become more apparent. By unhappy coincidence, these market pressures coincide with forecasts of colder U.S. temperatures. Then, consider the additional pressure from record-breaking U.S. LNG exports to Europe. What this situation requires is an appreciation of the complexity and context of global gas markets. These spikes happen whenever there is a perfect storm of supply constraints and demand surges.

Top commodity trades: #4 Gold

History has shown time and again that gold strengthens during periods of geopolitical uncertainty. Or rather – because of its safe-haven status – gold often presents compelling commodity trades during such times of geopolitical unrest, particularly in relation to the Russian-Ukraine conflict. Additionally, with significant investments in gold mining and Goldman Sachs targeting $3,000/oz, the bullish sentiment appears well-supported.

Top commodity trades: #5 Copper

Last but not least, the copper market is showing bullish momentum with 77% confidence based on multiple supply-demand drivers. Recent discoveries of copper mineralisation and successful drilling campaigns signal strong supply prospects against the backdrop of increasing demand. Meanwhile, industrial demand continues to grow, particularly from green energy and EV sectors. Supply chain bottlenecks and historically low inventories provide additional price support. Increased mining investment and successful resource expansion indicate potential price appreciation ahead.

The future of intelligent commodity trading

In this complex market environment the role of granular analysis and real-time intelligence can not be understated. Day by day, the real world consequences of supply constraints, geopolitical tensions, and evolving demand patterns create both challenges and opportunities for commodity traders.

Our Trading Co-Pilot‘s proven track record in identifying these key market movements enables trading desks to act with greater confidence and precision. For commodity houses, energy trading firms, hedge funds, and CTAs looking to enhance their trading decisions with AI-driven intelligence, we would love you to experience our technology firsthand.

Our Trading Co-Pilot delivers institutional-grade analysis and real-time trading signals across multiple asset classes, now available via enterprise API integration. Leading energy trading houses and hedge funds are already leveraging our technology to enhance their trading decisions. Experience how our AI-driven signals, multi-asset analysis, and risk-adjusted positioning can transform your trading strategy with a corporate trial. Simply email us at enquiries@permutable.ai or fill in the form below to request your personalised demo and free trial.