This guide to commodities market analytics is designed for institutional energy traders, commodity fund managers, and market analysts seeking to leverage advanced AI-driven commodities market intelligence to gain competitive advantages in volatile energy markets through proven sentiment analysis techniques and real-time data processing capabilities.

Navigating the volatile world of energy and commodity trading requires more than instinct; it demands data-backed precision and the right tools to act swiftly. As energy market dynamics shift due to geopolitical events, supply chain disruptions, or seasonal demand cycles, traders who leverage cutting-edge commodities market intelligence are gaining a decisive edge. This commodities market analytics cheatsheet distils institutional-grade insights into the tools and practices that separate winning commodity trading desks from the pack.

Table of Contents

ToggleCore tools for institutional-grade commodity and energy analytics

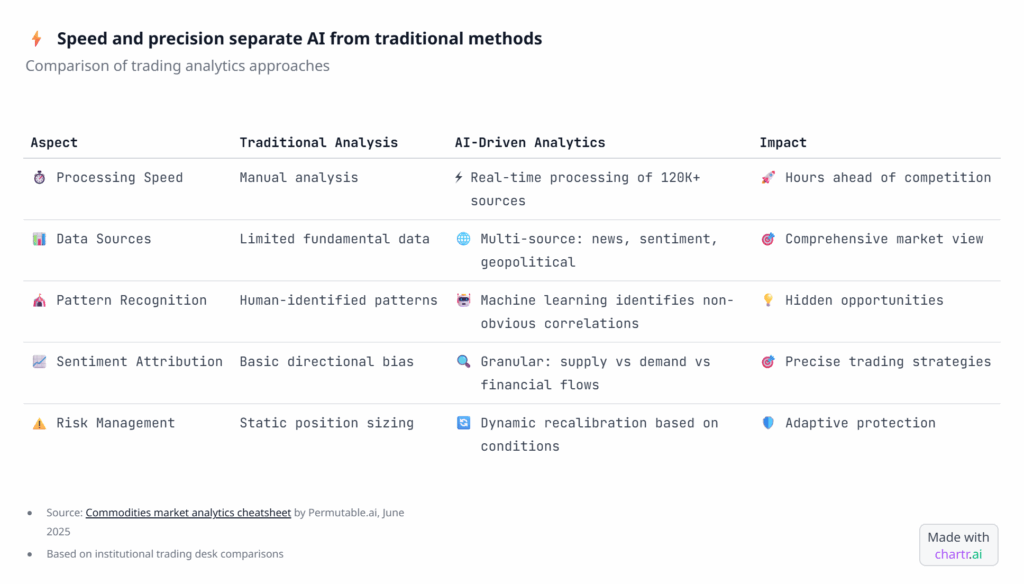

The most successful energy and commodity trading desks are combining multiple analytical layers to build comprehensive commodities market intelligence. In fact, here are the essential tools that top-tier institutional traders are increasingly relying on to maintain their competitive advantage:

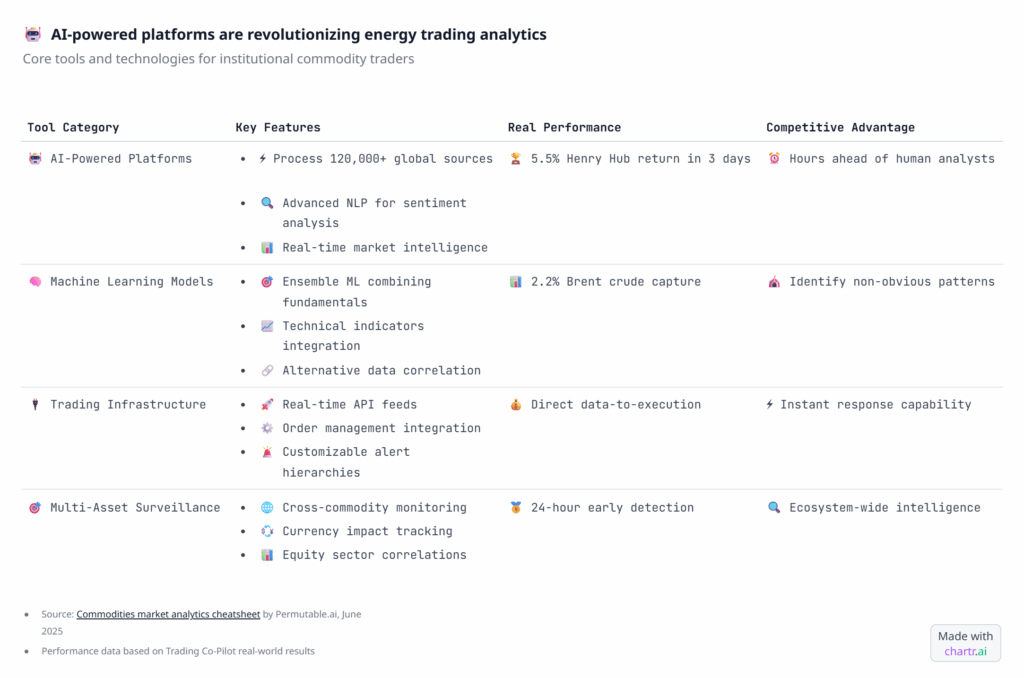

AI-powered commodity and energy trading analytics platforms

Modern trading requires processing vast information streams at machine speed. Platforms like our Trading Co-Pilot analyse over 120,000 global sources in real-time, using advanced NLP to extract actionable news intelligence from market noise. Consequently, when OPEC+ announces production cuts or geopolitical tensions escalate, these systems immediately quantify sentiment shifts and their potential price impacts – often hours before human analysts catch up.

Real world example

Our Trading Co-Pilot recently detected a significant shift in gold market sentiment following Moody’s US downgrade, with sentiment indicators turning positive and subsequently driving gold prices above $3,300 per ounce. Additionally, when Chinese gold imports surged to an 11-month high, our system immediately flagged this as a major demand catalyst before broader markets recognised its significance.

Predictive analytics and machine learning models

Meanwhile, top energy and commodity traders are now deploying ensemble ML models which are the bedrock of our energy trading analytics, that combine fundamental analysis with technical indicators and alternative data sources. Additionally, these systems excel at identifying non-obvious patterns, such as correlation breakdowns during transport bottlenecks, or early demand signals from inventory data analysis – creating sophisticated commodities market intelligence that traditional methods miss.

Proven performance

Our Trading Co-Pilot delivered a 5.5% return on Henry Hub natural gas in just three days by detecting sentiment shifts around inventory data and the BP-Woodside supply agreement. Furthermore, the system – powered by our proprietary energy trading analytics – successfully predicted Brent crude movements, capturing a 2.2% return following US sanctions on Chinese refiners over Iranian oil dealings.

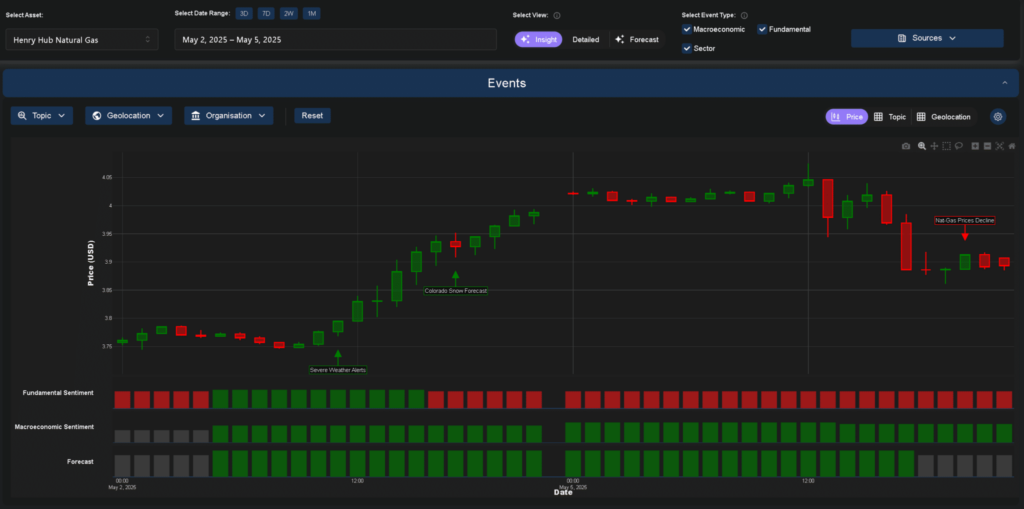

Above: Our energy trading analytics in action. This Henry Hub natural gas chart shows exactly how our Trading Co-Pilot identified the perfect entry point – notice the sentiment shift from red to green coinciding with the ‘Colorado Snow Forecast’ and ‘Severe Weather Alerts’ on May 2nd. Our ML models detected these fundamental catalysts before the market fully reacted, capturing that 5.5% move in just three days. The sentiment bands at the bottom tell the story: when fundamental sentiment (red) meets supportive macroeconomic conditions (green).

Integrated trading infrastructure

Needless to say, institutional energy and commodity trading requires seamless data-to-execution workflows. Here, advanced platforms provide real-time API feeds that integrate market intelligence directly into order management systems, enabling more optimal positioning in response to early indications of market sentiment shifts.

Pro tip

Look for systems that offer customisable alert hierarchies – not every market move requires immediate action, however, emerging narratives being surfaced with strong confidence should trigger instant notifications.

Advanced features to look out for

Real-time multi-asset surveillance

Energy and commodity markets are interconnected ecosystems. Look out for professional platforms that can deliver deep value by monitoring cross-commodity relationships, currency impacts, and equity sector correlations simultaneously. So for example, when natural gas storage reports miss expectations, this breed of sophisticated systems can immediately flag potential impacts on crude oil, heating oil, and LNG markets.

Case study

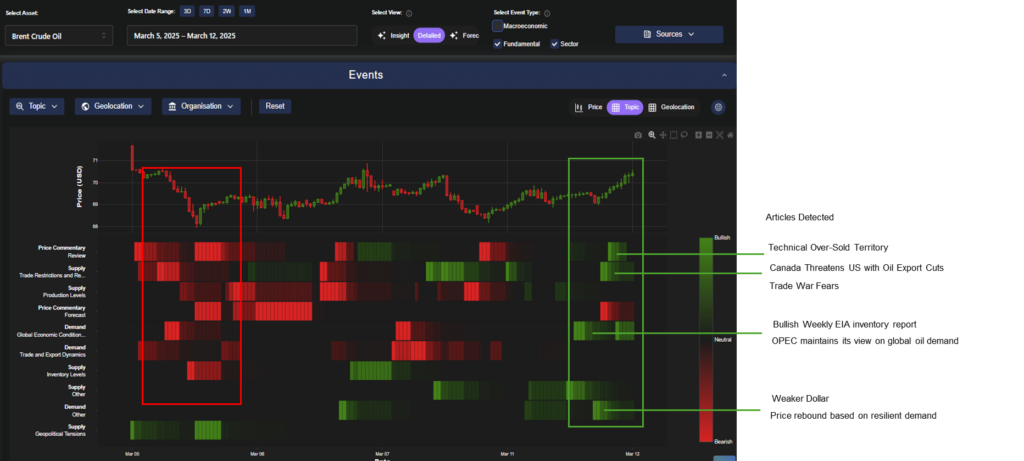

Recently, our Trading Co-Pilot’s oil market analysis successfully identified coordinated sentiment shifts across fundamentals, technicals, and geopolitical factors before Brent crude and gasoline rebounded to the upper boundary of their trading range. The system detected these changes 24 hours before price action materialised.

Above: Our energy trading analytics in action. This Brent crude heatmap shows exactly how our Trading Co-Pilot identified the perfect storm before it hit. Notice the red box (March 5-6) – massive bearish sentiment across fundamentals, technicals, and geopolitics. But here’s the alpha: our ML models detected the coordinated shift starting March 11th (green box) – from ‘Trade War Fears’ and ‘Technical Over-Sold Territory’ to ‘Weaker Dollar’ and ‘Price rebound based on resilient demand.’ The system flagged this multi-factor alignment 24 hours before Brent broke higher.

Sentiment granularity and attribution

Basic sentiment analysis provides directional bias; however, professional tools offer granular attribution that transforms raw data into actionable commodities market intelligence. Instead of simply “bullish oil sentiment,” advanced platforms specify whether optimism stems from supply concerns, demand growth, or financial flows – each requiring different trading approaches.

Real world example

During silver’s safe haven demand breakout in March 2025, our Trading Co-Pilot distinguished between industrial demand factors and investment sentiment, providing traders with precise attribution for the metal’s resilience near $33.00 despite market volatility.

Institutional best practices for maximum analytics impact

1. Layer multiple intelligence sources

Never rely on single-source signals. Instead, combine fundamental analysis, technical indicators, sentiment tracking, and alternative data sources to create robust commodities market intelligence. Subsequently, the strongest trading signals emerge when multiple analytical layers converge.

2. Implement dynamic risk overlay

Use real-time analytics to continuously recalibrate position sizing based on evolving market conditions particularly when volatility spikes or correlations break down.

3. Exploit temporal sentiment sequencing

Advanced analytics identify the critical timing of sentiment shifts. Our Trading Co-Pilot’s oil market analysis revealed how initial dollar weakness sentiment preceded and catalysed subsequent bullish EIA inventory responses – demonstrating path dependency in sentiment factors.

4. Monitor geopolitical catalysts in real-time

Of course, energy and commodity markets are heavily influenced by geopolitical developments. Consequently, professional platforms track political developments across major energy regions, military activities, and policy changes that impact supply routes and demand patterns—integrating this into comprehensive commodities market intelligence frameworks.

Gaining a competitive edge

The most successful energy and commodity traders don’t just use advanced tools – they are integrating our commodity and energy trading analytics into comprehensive trading workflows that combine speed, accuracy, and risk management. Our real-world case studies demonstrate that commodities market intelligence provides measurable advantages in volatile market conditions. Whilst traditional analysis struggles with rapidly changing market dynamics, AI-driven sentiment detection offers consistent early warning signals across multiple energy commodities.

Our Trading Co-Pilot is already delivering measurable results for leading energy trading desks and institutional clients worldwide – from predicting gold surges and capturing natural gas rebounds to identifying oil market reversals before they materialise. Ready to join them by integrating our commodity and energy trading analytics? Contact us at enquiries@permutable.ai to discover how our platform can transform your trading strategies with real-time intelligence and predictive insights.

Q&A: Commodities and energy market analytics

Q1: How can commodities market analytics help predict price movements?

Advanced commodities market analytics platforms, like our Trading Co-Pilot, analyse thousands of data sources in real time. By combining sentiment detection with fundamental and technical indicators, these systems identify emerging narratives before they influence markets, giving traders early signals on likely price movements across oil, gas, and metals.

Q2: What makes AI-driven trading analytics more effective than traditional methods?

Traditional analysis often lags behind real-time events. In contrast, AI-driven trading analytics use machine learning and natural language processing to process huge volumes of market news, social sentiment, and geopolitical developments instantly. This speed allows traders to act on actionable insights before the broader market reacts.

Q3: How do actionable insights from market sentiment data support energy traders?

By attributing whether sentiment shifts stem from supply disruptions, demand changes, or financial flows, our models transform raw data into actionable insights. This helps institutional traders decide whether to hedge, scale positions, or pursue arbitrage – optimising both risk management and profitability.

Q4: Can can our commodities and energy market analytics identify arbitrage opportunities?

Yes. Cross-commodity and cross-asset correlation monitoring often highlights mispriced relationships. For example, a sudden natural gas storage draw may create ripple effects in heating oil or LNG markets. Advanced platforms flag these dislocations, allowing traders to exploit arbitrage opportunities before they close.

Q5: Who benefits most from integrating AI-based market intelligence into trading workflows?

Institutional energy desks, commodity hedge funds, and asset managers gain the most value. They require speed, accuracy, and depth – qualities delivered by AI systems that generate trading analytics and sentiment-driven forecasts with precision. This provides the confidence needed to capture alpha in highly volatile markets.