One thing that is absolutely crystal clear this year is that companies with a commitment to responsible management of their business and operations are going to have to step up their game if they want to stay in business. So where does ESG due diligence fit in the picture?

At Permutable, we believe that 2023 is the year that ESG due diligence will come into its own as businesses come under increasing pressure from increased regulation and the need for greater transparency. The new era of data-driven analysis and the growing importance of environmental, social, governance factors as a way for companies to evaluate any potential risks or advantages of doing business in different areas or countries means that businesses need to get serious about ESG.

It’s imperative that companies realize the true cost associated with operating their businesses, understand the potential risks and benefits involved in operating specific activities and make decisions based on facts rather than hearsay. By incorporating an ESG due diligence framework within your company, you will be not only protecting your company’s brand but also ensuring its financial integrity.

What is ESG due diligence?

Due diligence is the process of investigating a business’s financial operations, management and practices to ensure they are in line with the company’s strategic goals and objectives. This process generally includes an in-depth review of a business’s financial records, management, products and services to ensure their strategic importance to the company’s profitability and growth. ESG due diligence is the process of investigating the operational activities, risks and benefits of a company’s business operations in order to understand their potential impact on the environment, stakeholders and bottom line.

Why is ESG due diligence important?

With a growing focus on corporate responsibility, investors are more likely to scrutinize the activities and practices of companies that they believe could impact the environment. Additionally, growing consumer awareness of the impact of activities such as pollution, carbon emissions and waste is likely to make investors more critical of the environmental performance of companies they have invested in.

To remain competitive and relevant, companies with a commitment to responsible management of their business and operations are going to have to step up their game if they want to stay in business. The new era of data-driven analysis and the growing importance of environmental, social, governance factors as a way for companies to evaluate any potential risks or advantages of doing business in different areas or countries.

How to conduct an ESG due diligence

The key to conducting an effective ESG due diligence is an in-depth understanding of the basic principles behind each sector. With this understanding in hand, you can dig deeper into specific areas to understand the potential implications.

As with any other type of due diligence, the first step is to conduct an initial scan of a company’s operations. Through a review of the company’s organizational structure, products and services you can get a basic understanding of where the company operates and what areas of the company are most important to its operation. Next, it is important to understand how each sector is influenced by the ESG factors. An effective ESG due diligence is dependent on understanding the basic principles behind each sector. With this understanding in hand, you can dig deeper into specific areas to understand the potential implications.

ESG due diligence and the supply chain

There is growing legal and regulatory pressure on companies to address ESG factors within their supply chain. Although some companies have previously adopted voluntary international due diligence reporting and standards, it is highly likely that in 2023 and beyond, companies will take on increasing amounts of legal responsibility concerning their supply chains.

Last year the European Commission proposed its new Corporate Sustainability Due Diligence Directive (CSDDD) that would introduce significant and widespread corporate due diligence obligations with respect to human rights and international environmental standards across supply chains. It is therefore imperative that companies address ESG supply chain risks and conduct stringent ESG due diligence concerning human rights and environment-related risks in their supply chains.

At Permutable, we use real time machine learning-driven analysis of global news flows to provide an

ongoing view of ESG risks across your supply chain. This data is made available with a rich taxonomy allowing ingest to existing ERP and supply chain management software.

Evolving ESG legislation requires firms to show ongoing due diligence of supply chains. It is no longer acceptable to review once at point of onboard and then allow self reporting. As mentioned previously, legislation in many jurisdictions puts the onus on the corporate to prove that such ongoing analysis is in place.

Case study

As part of our work analysing companies for ESG risks we were asked by one client if it was passible to analyse a supply chain in real or near real time to help them stay on top of their ESG due diligence. The concern was that ESG issues were appearing and growing much more quickly than traditional ratings and reporting procedures could cope with.

Timeline and entity

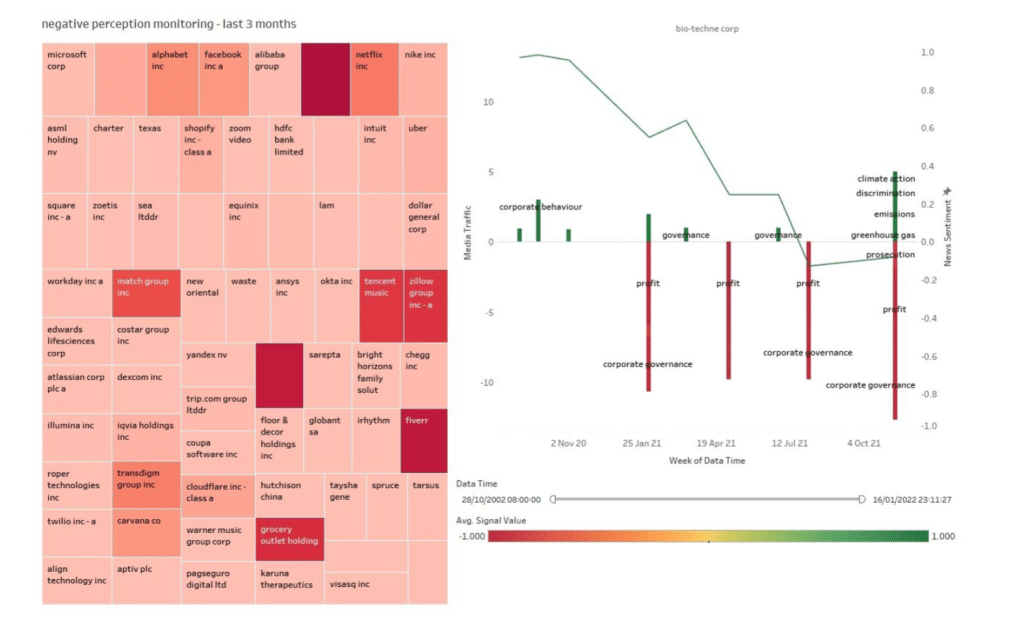

Using our AI technology for a job that in the past had taken a team of analysts and days to complete. Above is the time line of ESG related events for one example firm. In this case Philips. This is the reporting of issues that Philips faces as seen by the EM1 sentiment engine. Sentiment is positive when the line is above 0 and negative when its is below 0. The measure is rolling hence the large negative counts that begin in August bring the average down

The length of the bars is the source count. Source count indicates how widespread the issue is not

how serious it is from a sentiment impact. opics are depicted in the colours. These can be selected and added/removed as required for analysis.

Sentiment turned strongly negative around Aug 2021 as an environmental issue was first reported in

local papers and to local authorities and then more widely before calming again. This kind of analysis can be performed on every entity in the supply chain in close to real time.

Ranking

High level ranking of all entities in the supply chain is provided automatically and updated continuously. The chart on the left is an example of this data can be represented.

Heat map and warning

Heat maps are a powerful tool for helping people to quickly understand where there is change in

data and where that change is an outlier. This is coupled with automated warning monitors against areas of specific concern. Below are examples of these representations.

Weighting & benchmarking

All headlines that drive the sentiment analysis are made available for review. By changing the

weighting of the sentiment engine users are able to shape how the system understands what is positive and negative for the group. If there are issues that are particularly pressing for the group these can be given a higher weighting.

Benchmarking can be against any group of firms. A typical example is the direct peer group as shown in the above diagram. This shows both the volume of data available on the x axis and the sentiment score on the y. In this example we have set THG against major UK consumer groups.

Where the positioning is negative compared to peer groups one would look to a breakdown of the

elements that are driving this negative sentiment. This would allow issues to be addressed be they in the group or the supply chain.

Summing up

ESG due diligence is important because it’s a way for companies to protect their businesses by ensuring that they are doing their best to operate responsibly and achieve their stated business objectives in the process. When companies incorporate ESG due diligence into their operations, they are able to make more informed decisions about what types of business activities to pursue, what risks are higher and whether or not it makes sense to continue a given business activity. This is also important because it can help a company better position itself for future success as well as reduce the potential financial or reputational impact of potential negative outcomes.

When companies fail to integrate ESG related due diligence into their operations, they are ultimately failing in their quest to protect their businesses from potential negative outcomes. By incorporating an ESG due diligence framework within your company, you will be not only protecting your company’s brand but also ensuring its financial integrity.

If you are interested in developing your business to be more sustainable, you should incorporate an ESG due diligence framework within your operations as a first step and take a close look across the entirity of your supply chain. It is no longer sufficient to say that your business is being sustainable or behaving responsibly. You need to demonstrate how it is doing so, and how it hopes to improve in future too.