At Permutable, we’re redefining how investors navigate market volatility. As shocks from global tariffs and geopolitical headlines increasingly drive near-instant market reactions, traditional economic indicators arrive too late to inform timely decisions. Built for this new era, Permutable’s Trade Sentiment Index (TSI) quantifies the tone, direction, and momentum of trade-related news in real time, across thousands of global sources.

Rather than reacting to backward-looking data, the TSI empowers investors to anticipate cross-asset moves in equities, commodities, FX, and rates, capturing shifts in market sentiment as they happen. In this study, we examine how the TSI provides a forward-looking lens on trade-driven volatility, enabling faster, more informed decisions in today’s headline-sensitive markets.

Table of Contents

ToggleKey Insights

- TSI leads major asset price shifts.

- S&P 500 shows strongest correlations to trade sentiment.

- Tariff rhetoric in the news shows impactful market reaction, evidence of sentiment based use cases.

- Trade-related news has become the dominant volatility driver in 2025.

Trade Sentiment Takes Centre Stage

Trade sentiment has clearly emerged as the dominant force in market pricing, often displacing traditional economic data as the key input into asset valuation. All eyes are currently fixed on 1 August, the date on which Trump’s temporary tariff reprieve expires, potentially leaving over 100 countries facing the prospect of fresh levies.

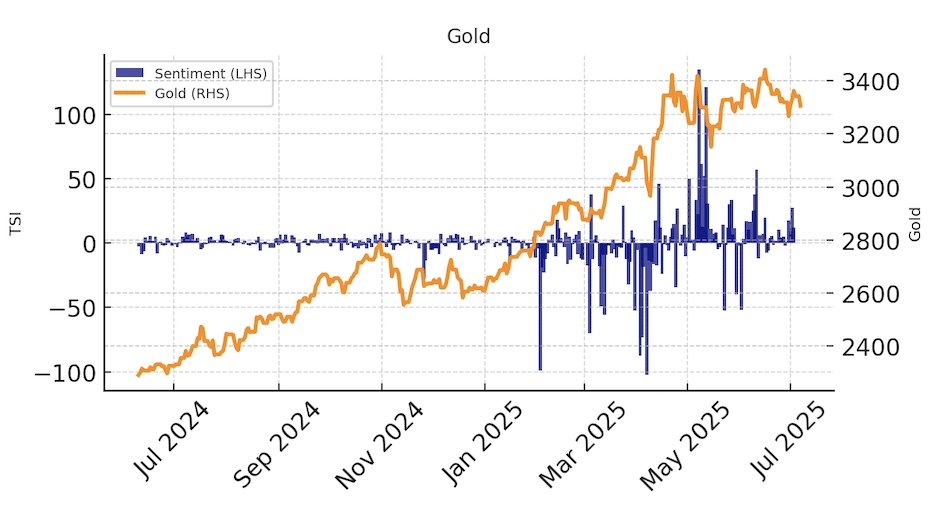

This marks a fundamental transition in how markets interpret macroeconomic risk, driven less by data prints and more by evolving geopolitical narratives. Each new tariff threat, or, conversely, a pronouncement from the BRICS bloc, such as their recent statement of “grave concern” over unilateral trade measures, alongside renewed calls for de-dollarisation, sends a jolt through currencies, bonds and commodities. Only last week, an initial 10% tariff warning aimed at BRICS nations, specifically those deemed to instigate “anti-American policies”, propelled the dollar above 97.00. Meanwhile, gold, typically a refuge in times of volatility, retraced from $3,339 to $3,311 on mere murmurs of trade progress, demonstrating the market’s heightened sensitivity to geopolitical developments.

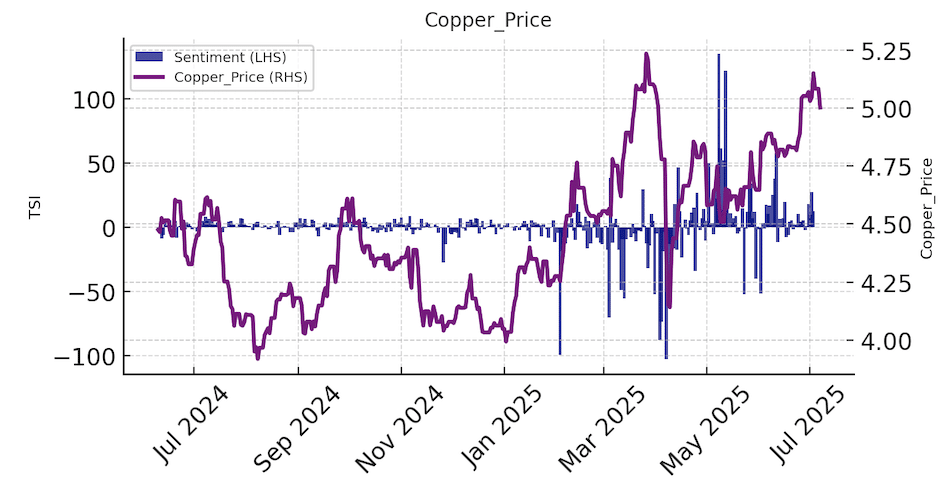

Copper, too, has become a geopolitical barometer. The July announcement of a 50% tariff on copper imports led to an unprecedented 17% surge in COMEX copper futures, the largest single-day move on record. While some of this spike reflects front-running behaviour ahead of the tariff’s implementation, it also signalled the market’s repricing of supply chain disruption and longer-term demand risk.

Renewed Tariff Risk

Simultaneously, the US administration’s expansion of its tariff campaign, with new 25 – 40% levies targeting Malaysia, Kazakhstan, South Africa, Laos, Myanmar, and trans-shipped goods via Vietnam. Vietnam brokered a more favourable two-part deal, a 20% tariff on domestically produced goods and 40% on trans-shipped imports, aimed at curbing indirect Chinese flows. These measures followed closely on the heels of a 25% tariff on imports from Japan and South Korea, two of America’s largest trading partners. Trump warned of additional 25% tariffs on any retaliatory measures. Japan’s Finance Minister labelled the move regrettable, while Prime Minister Ishiba firmly rejected the notion of capitulation.

Then, the European Union and Mexico were next to come in the firing line. With both recently receiving letters from the US confirming a blanket 30% tariff, a stark reversal after speculation just a day earlier of an imminent US-EU trade agreement. Trump’s long-standing hard-line rhetoric on the EU set the stage, and the letters make clear that August 1 is now the inflection point. The EU has delayed its retaliation until that date, opting to retain leverage while recalibrating strategy.

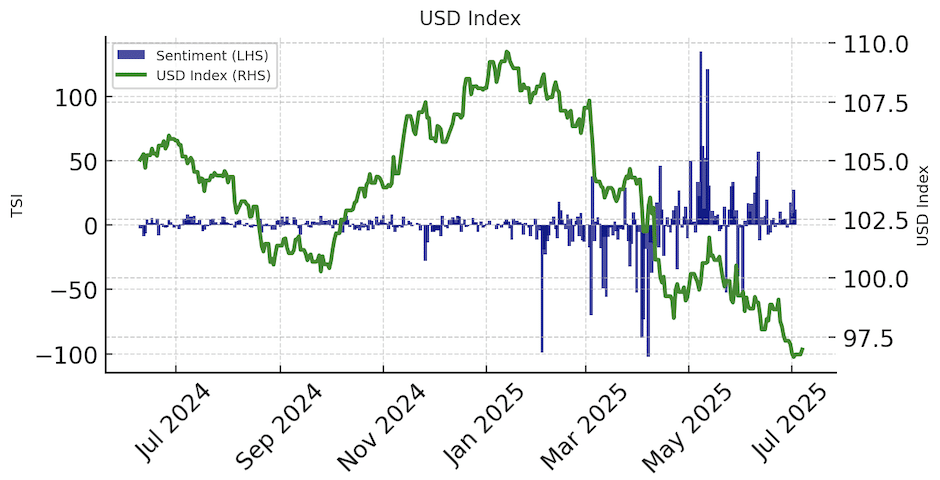

In this context, traditional safe havens have grown fragmented. The dollar continues to rally on negative sentiment shocks but quickly reverses on hints of dovish Fed policy pivot. While gold has maintained some safe-haven characteristics, it often retreats on signs of trade progress. Treasuries, meanwhile, have exhibited violent swings, reacting as much to fiscal risks as to pure sentiment.

This reveals that trade and tariff risk is not just a geopolitical flashpoint, but a fundamental shift in how markets price risk and manage strategies.

Introducing the Trade Sentiment Index (TSI)

Permutable’s TSI is designed to quantify these narrative shifts in real time. Using natural language processing, the index ingests trade-related headlines from global sources, scoring them on tone, polarity, volume, and topic intensity. The result is a real-time signal that offers:

- Lead-time advantage: TSI often anticipates and leads asset moves.

- Multi-asset relevance: Equities, commodities, rates, and FX all respond.

- Cross-market consistency: Strongest signals observed in S&P 500 and Copper.

Clients can access the TSI via API, using it to monitor regime shifts, manage risk, and spot trading opportunities in volatile macro conditions.

Asset Performance in a Sentiment-Led Regime

S&P 500: The Sentiment-Aligned Proxy

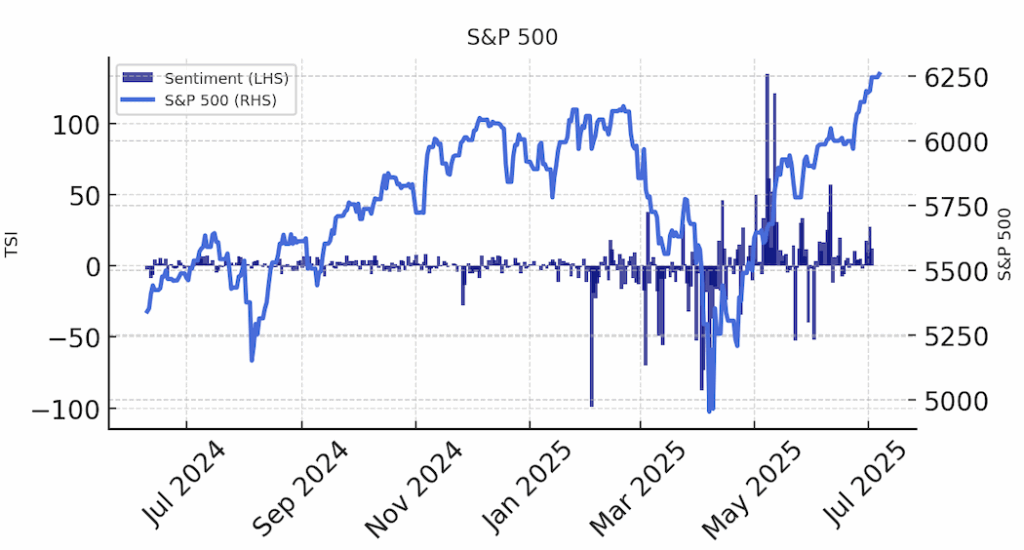

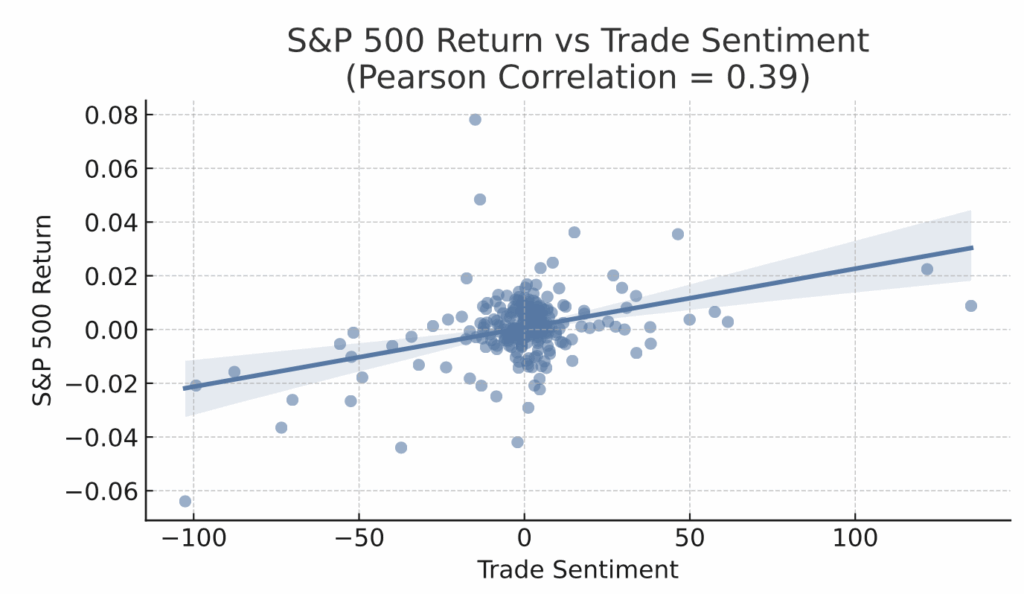

Among all asset classes, the S&P 500 demonstrates the strongest correlation with the TSI. March – April 2025 saw pronounced drops in TSI coincide with a steep decline in the index, followed by recovery in Q2 as sentiment improved.

- Correlation coefficient: +0.39

- Interpretation: Equity markets price sentiment shocks quickly, often ahead of fundamentals.

Implication: TSI provides early/on the day signals of equity rotation and drawdown risk

Copper: Industrial Confidence in Real Time

Copper, traditionally a proxy for industrial demand, has shown increasing sensitivity to trade sentiment. The recent tariff on copper imports announced in July 2025 triggered a record one-day price surge, highlighting copper’s role as a geopolitical barometer.

Correlation coefficient: +0.10

Implication: The TSI helps identify front-running behaviour ahead of supply chain disruption or demand rebounds

Fragmented Safe Havens: USD, Gold, Treasuries

US Dollar

US Dollar dropped sharply on negative sentiment (e.g., during Feb, Apr, July tariff rounds). Domestic trade policy weakened USD appeal spurring capital flight. Investors are increasingly viewing US-linked tariffs, fiscal risks, and lower yield support as dollar-negative. Even modest recoveries in sentiment failed to revive the greenback. The Trade Sentiment Index is best used here to detect macro shifts in how the dollar is perceived.

Gold

Gold surged to nearly $3,500/oz during mounting tariff escalation, reaffirming its role as a crisis hedge. It then plateaued, held back by rising real yields and brief dollar resilience. By late June, gold rebounded as sentiment worsened and the dollar declined. This shows gold remains effective as a hedge when falling sentiment aligns with loose liquidity. The Trade Sentiment Index is especially valuable for gold during acute stress events.

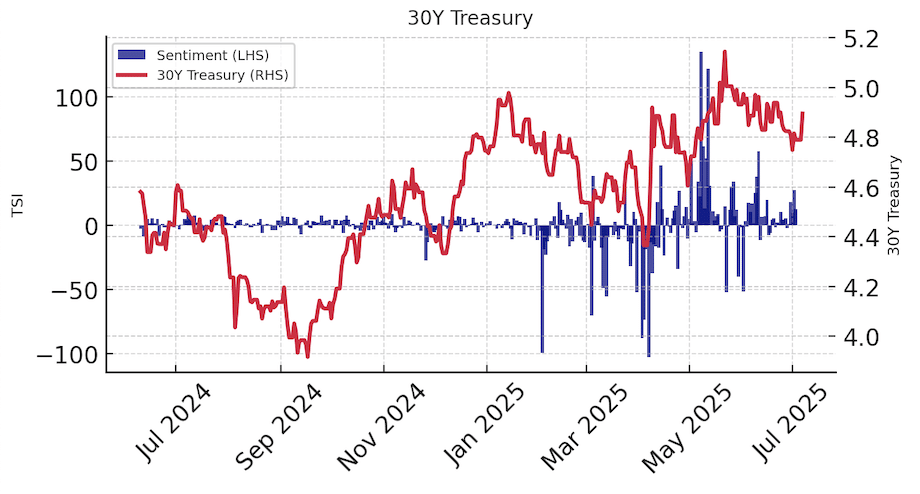

30Y Treasuries

30-year treasury yields rose over ahead of April’s shock in trade sentiment, being reactive to protectionist shocks and US domestic strength. Yields have moved closely with sentiment momentum, as markets price in the inflationary and fiscal risks from escalating tariffs. Treasuries now reflect not just fear, but market judgement on policy credibility.

Trade Sentiment vs Asset Returns: A Comparative View

Recent regression analysis of our Trade Sentiment Index scores versus daily asset returns highlights a clear divergence in sensitivity across asset classes:

S&P 500

S&P 500 exhibits a moderate positive correlation (r = +0.39) with trade sentiment. As TSI scores rise, signalling an improving trade narrative – the index tends to rally, particularly in sectors with significant international exposure. This reinforces TSI’s value as a forward indicator for equity risk-on phases and investor confidence in global earnings stability.

Gold

Gold, by contrast, shows no meaningful correlation (r = 0.00) to TSI. While often considered a geopolitical hedge, gold’s price behaviour in 2025 has become increasingly selective, responding less to general trade noise and more to systemic stress signals such as instability, inflation or central bank actions. This suggests gold is a consistent hedge for geopolitical risk and ought to be pivoted into more tactically in diversified portfolios.

Copper and 30Y Treasuries

Copper and 30Y Treasuries exhibit low but positive correlations, respectively, indicating lagged or secondary reactions to sentiment shifts, consistent with copper’s role in industrial cyclicality and Treasuries’ sensitivity to broader risk conditions.

USD Index

USD Index also shows a modest positive correlation, reinforcing the idea that the dollar strengthens modestly during sentiment recoveries but more sharply on crisis headlines.

The strength of the S&P 500’s alignment with our TSI suggests that trade sentiment has evolved into a reliable leading signal for equity allocation, while gold’s decoupling cautions against assuming traditional safe havens will always respond to geopolitical stress.

Timeline: Turning Points in 2025 Trade Sentiment

The timeline outlines the pivotal moments in 2024–25 when trade disruption reshaped market sentiment, drove asset repricing, and triggered regional volatility across equities, FX, metals, and bonds.

Date | Event/Trigger | Regions | Market Reaction Snapshot |

2024-09-13 | US hikes China tariffs | US, China | USD up, China stocks down, metals rally |

2025-01-20 | Trump inauguration, tariff rhetoric | US | Mild USD uptick, cautious equities |

2025-02-04 | US 10% tariff on China | US, China | Dollar up, gold soft, S&P drops |

2025-03-04 | US +10% tariff; China retaliates | US, China | Gold/treasuries up, equities fall |

2025-03-12 | US steel/aluminum tariffs | US, BRIC, EU | Metals spike, global stocks dip |

2025-04-02 | US 34% China tariff + 10% global baseline | US, China, EU | Risk-off: USD/gold up, S&P/EM FX down |

2025-04-04 | China 34% retaliation, WTO complaint | US, China | Gold up, US exporters hit |

2025-04-07 | US 50% tariff on China | US, China | Treasuries up, equities drop |

2025-04-09 | US 125% China tariff, delays for others | US, China, EU | Equities rebound, gold/bonds retrace |

2025-04-10 | US/China escalate to 145%/125% tariffs | US, China | Global stocks down, gold/treasuries up |

2025-04-21 | US retailers warn on tariff price hikes | US, China, EU | Retail/consumer stocks lag |

2025-04-24 | Trump hints at tariff reductions | US, China, EU | Equities stabilise, risk appetite returns |

2025-05-03 | US auto part tariffs | US, BRIC, EU | Autos down, USD steady |

2025-05-12 | US-China 10% tariff truce (90 days) | US, China | Relief rally: S&P, EM FX up, gold down |

2025-06-09 | US-China trade talks in London | US, China | Markets optimistic, S&P/EM FX climb |

2025-06-16 | US 50% steel-appliance tariff | Global | Metals/equities volatile |

2025-06-25 | EU announces new trade strategy & CBAM | EU | EUR weak, EU stocks mixed |

2025-06-27 | US-China trade truce framework | US, China | Commodities stabilize, equities firm |

2025-07-07 | US delays reciprocal tariffs | US, BRIC, EU | Temporary relief, risk assets bounce |

2025-07-08 | US plans 49% tariffs for non-deal countries | US, BRIC, EU | USD up, metals rally |

2025-07-09 | US 50% copper tariff | US, Brazil, RU | Copper up, EM FX pressured |

2025-07-10 | US 50% tariff on Brazil | US, Brazil | BRL weak, Brazil stocks down |

2025-07-11 | US 35% tariff on Canada | US, Canada | CAD down, Canadian stocks fall |

2025-07-12 | US 30% tariffs on EU & Mexico | US, EU, Mex | EUR/MXN weak, EU/Mex stocks down |

2025-07-13 | EU delays response to US tariffs | EU | EU markets cautious |

Strategic Use Cases for Our Trade Sentiment Index

The Trade Sentiment Index transforms real-time narrative signals into strategic intelligence. Whether managing downside risk, capturing tactical opportunities, or enhancing existing models, the TSI provides a robust framework for navigating sentiment-driven markets.

Risk Management

- Hedge exposures during sharp TSI declines

- Anticipate volatility in rates and FX

Tactical Allocation

- Go long copper or S&P on positive sentiment reversals

- Reduce duration/risk when TSI drops sharply

Portfolio Overlay

- Integrate TSI into existing macro models

- Use TSI thresholds as quantitative triggers

Strategic Asset Allocation

In a sentiment-driven regime, long-term asset allocation strategies must account for both narrative volatility and its cascading impact across asset classes. Our TSI offers a powerful overlay for:

- Rebalancing decisions: Adjust strategic exposures based on sustained shifts in sentiment.

- Capital allocation: Tilt allocation towards cyclicals, EMs, or safe havens based on sentiment trends.

- Style rotation: Incorporate sentiment directionality into factor-based models (e.g., overweight quality or momentum when sentiment is negative).

- Thematic positioning: Align long-term allocations to benefit from sentiment-linked macro trends such as reshoring, trade blocs, or deglobalisation.

Our TSI adds a forward-looking, data-driven lens to macro allocation, helping investors avoid the lag embedded in traditional economic forecasting models.

Client Value: Why This Matters Now

In a market environment defined by speed and noise, clarity and timing have become competitive advantages. As geopolitical risks and trade policy shifts increasingly drive asset prices, investors need tools that cut through the narrative and deliver insight before traditional data reacts. The value is immediate, earlier positioning, clearer strategy, and better-informed risk decisions across portfolios.

- Real-time edge: Avoid lag from traditional macro data.

- Actionable intelligence: Move early on headline risk.

- Institutional clarity: Clear inputs, stable methodology.

- Multi-asset utility: One signal, many markets.

For Global Macro Hedge Funds: Position early around geopolitical regime shifts and volatility shocks

The TSI detects real-time breakdowns in trade sentiment that often precede macro dislocations. For example, in early July 2025, sentiment around U.S.–BRICS trade deteriorated sharply ahead of new tariff measures. Renewed uncertainty around metals and EM currencies reacted sharply in the days following, but the TSI flagged this escalation beforehand. For macro funds managing cross-asset exposure, this lead time enables early risk reallocation and alpha generation around policy-driven volatility.

For Tactical Allocators: Capture short-term market rotation with a sentiment aware lens

The TSI helps identify when risk appetite pivots, before it becomes consensus. In late April 2025, sentiment began to recover following weeks of protectionist escalation. The S&P 500 rebounded shortly after, as risk assets priced in easing trade tensions. TSI’s inflection provided a forward-looking signal for timely re-entering equities or increasing cyclical tilts, allowing allocators to act ahead of broader market positioning.

For Portfolio Strategists: Enhance long-term allocation and style tilts with forward narrative signals

Sustained fall in TSI, such as those observed through March and early April 2025, can act as early warnings of structural macro stress. During this period, equity markets declined and uncertainty around global supply chains intensified. Strategists monitoring sentiment would have had the insight to shift exposures towards defensive assets sooner, reducing risk-weighted allocations, before fundamentals deteriorated. TSI supports a more adaptive, geopolitically aware allocation strategy.

Market behaviour is increasingly shaped by the tone of trade policy, not just its implementation. The Trade Sentiment Index offers a structured, real-time view of global trade narratives, allowing clients to respond with greater speed, precision, and alignment to the evolving macro regime.

Conclusion: Sentiment is the New Macro

The message is clear: trade sentiment is no longer a peripheral consideration – it has become a central force driving cross-asset price action. Against the backdrop of fragmented trade alliances, perpetual tariff threats, and politicised supply chains, traditional macroeconomic indicators alone no longer provide a complete picture. Investors must now account for the mood of the market, the tone of geopolitical dialogue, and the shifting narratives that shape risk and opportunity.

This marks a fundamental regime shift. Trade alliances are increasingly transient, tariff threats are ever-present, and global economic stability is deeply entangled with political perception. Market movements are no longer driven solely by data or policy; they are increasingly shaped in real time by sentiment, information flow, and geopolitical narrative shifts.

Permutable’s Trade Sentiment Index is designed specifically for this new reality. Unlike traditional tools that lag behind events, our TSI captures and quantifies emerging narratives as they unfold. It allows investors, asset managers, and strategists to track sentiment divergences between trading partners, detect geopolitical tone shifts, and anticipate volatility before it is reflected in prices. By bringing structure and intelligence to the noise, our TSI offers a unique advantage in understanding and navigating geopolitically driven markets.

In an era where perception moves faster than policy, sentiment is no longer noise – it’s signal. It is, in every sense, the new macro.

Access the Trade Sentiment Index

Anticipate market-moving events with real-time sentiment intelligence. Seamlessly integrate the Trade Sentiment Index via API and set tailored alerts by asset, region, or topic to stay ahead of the next volatility shock.

To schedule a demo or request access simply email enquiries@permutable.ai