We’re excited to share a significant milestone in our journey at Permutable AI. Our Trading Co-Pilot has achieved strong performance metrics that validate our vision for the future of commodity trading. These results demonstrate how our approach to using artificial intelligence is delivering real value in today’s complex commodity markets.

Strong performance benchmarks in commodity markets

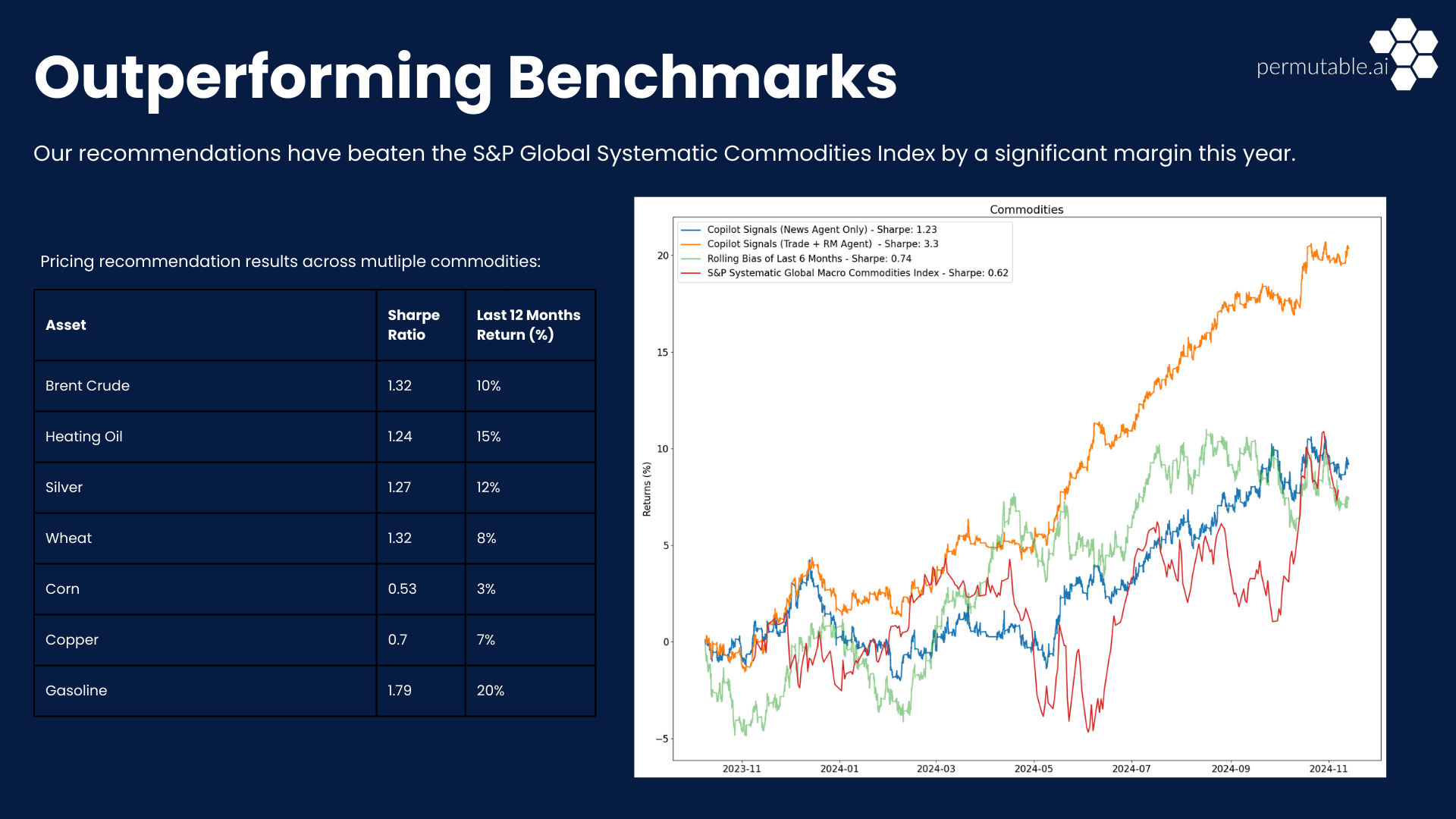

We’re particularly proud of our Trading Co-Pilot‘s achievement of a 3.3 Sharpe ratio when combining trade and risk management signals. This substantially outperforms the S&P Systematic Global Macro Commodities Index’s 0.62 Sharpe ratio. For us, this strong risk-adjusted return validates our fundamental belief: that the future of trading lies in the seamless integration of cutting-edge AI with human trading expertise.

Our performance across individual commodities has been equally encouraging. Our gasoline trading signals have achieved a 20% return with a 1.79 Sharpe ratio, while our heating oil recommendations have delivered 15% returns. We’ve also seen strong performance in precious metals, with our silver trading maintaining 12% gains, and our Brent Crude signals achieving solid returns of 10% with a robust 1.32 Sharpe ratio.

What this means for the future of trading commodity markets

While we’re proud of these numbers, what excites us most is what they represent for the future of trading. Over the past year, our Trading Co-Pilot has generated 150 precise recommendation points, each backed by comprehensive data analysis and delivered through our intuitive interface. This bridges the gap between sophisticated AI and practical trading applications – something we’ve been working towards since our inception.

“These results demonstrate the transformative potential of our approach to AI in commodity trading,” explains our Founder and CEO Wilson Chan. “It represents a fundamental shift in how trading decisions can be enhanced through artificial intelligence.”

Our human-AI partnership vision for trading commodity markets

From the beginning, we’ve built our system on the conviction that successful trading requires both technological sophistication and human expertise. We’ve designed our Trading Co-Pilot specifically to augment rather than replace human decision-making, providing traders with actionable insights backed by comprehensive data analysis.

“What sets our approach apart is how we combine advanced AI analysis with practical trading intelligence,” Chan highlights. “Ultimately, our goal is to create tools that enhance human trading capabilities in meaningful ways.”

Meeting the challenges of today’s commodity markets

We’re launching these results at a crucial time, as commodity markets face increasing complexity and volatility. We understand that today’s traders face an unprecedented challenge in processing and acting upon vast amounts of market data in real-time. Our Trading Co-Pilot’s performance demonstrates how we’re helping address this challenge, providing traders with clear, actionable insights derived from complex market analysis.

Looking ahead

For us, these results represent so much more than just performance metrics – they validate our vision for the future of trading. We see a future where AI tools become essential partners in the trading process, not as replacements for human traders, but as sophisticated allies in decision-making. And our achievements with the Trading Co-Pilot to date show that we’re already making this future a reality.

We know full well that as commodity markets continue to evolve and become more complex, the ability to process and act upon vast amounts of data in real-time becomes increasingly crucial. And so, our Trading Co-Pilot’s performance demonstrates that our approach – combining advanced AI technology with human expertise – offers a powerful solution to this challenge.

As we continue to onboard early-stage users onto our Trading Co-Pilot and Commodities API these results demonstrate the practical realisation of our vision for AI in financial markets. By combining our sophisticated technology with the expertise and domain knowledge of the traders we’re working in partnership with, we believe we’re helping to define the future of commodity trading. And it’s one where human traders are supported and empowered by the capabilities provided by artificial intelligence to make better, more informed decisions in increasingly complex markets.

What’s even more exciting is that we’re committed to continuing this journey of innovation and improvement, as we continue to work closely with our users in partnerships to enhance and refine our capabilities in tandem with their own domain knowledge. With new assets just launched across TTF Natural Gas, gasoline and heating oil with more assets being rolled out in early 2025, we’re excited about the possibilities that lie ahead and the opportunities to further transform how trading decisions are made in the modern market environment.

Experience our Trading Co-Pilot’s performance

We know some may be skeptical of these results, so if you’d like to discuss how our Trading Co-Pilot achieves a 3.3 Sharpe ratio and delivers consistent returns across multiple commodities with the team then we’re inviting selected trading professionals to join us for an exclusive walkthrough of our performance results and trading capabilities.

Our personalised demonstration will take you through our proven track record across various commodities, and we’ll show you firsthand how our sophisticated AI technology is delivering real value in today’s complex trading environment. To book a demo and explore how Trading Co-Pilot can enhance your trading decisions with AI-powered market intelligence, email us at enquiries@permutable.ai or complete the form below to schedule your session.

Get in touch