In this article we explore how our Trading Co-Pilot detected the EUR/USD and EUR/GBP shift ahead of the broader market, highlighting rising sentiment, improving Eurozone fundamentals, and dovish central bank cues before the price move unfolded. In FX, timing is critical. As macro divergence fuels FX volatility, real-time sentiment insight is key to outperformance and anticipating shifts in the euro forecast.

Table of Contents

ToggleA Turn in the Tide: Unpacking the Market Dynamics

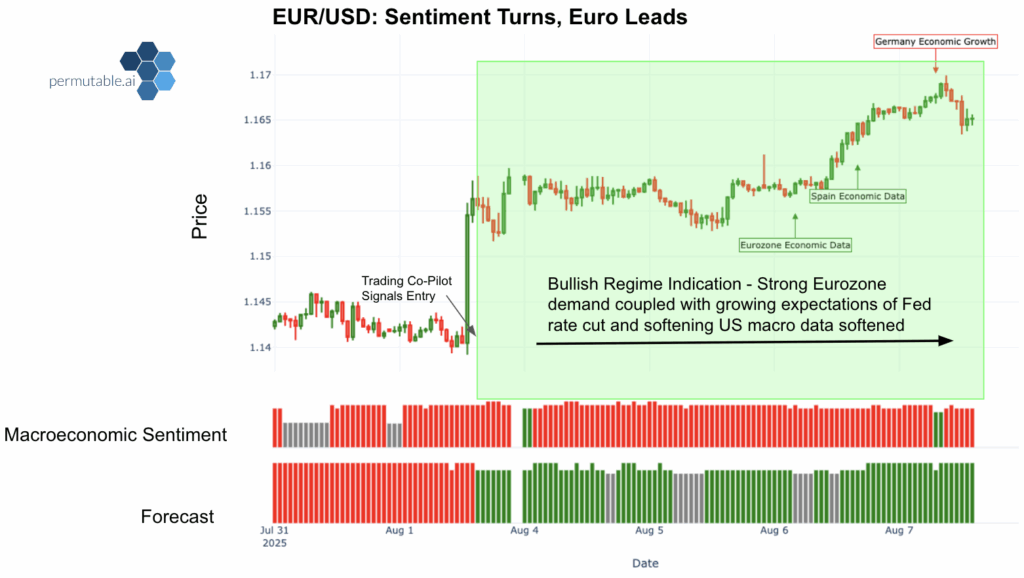

The tide has turned for the euro. EUR/USD rose from 1.14 to 1.17 over the past week, as global FX markets responded to a combination of U.S. dollar softness and stronger-than-expected Eurozone macroeconomic signals. Upbeat sentiment around the euro was lifted by a firm retail sales print, easing energy policy risks in Germany, and market expectations of few rate cuts coming from the Federal Reserve. Meanwhile, falling Treasury yields and a light U.S. data calendar left the dollar on the back foot, allowing the euro to consolidate gains without significant resistance.

But this wasn’t just a matter of playing catch-up to the data. The strength of the move was anticipated and confirmed in real time through our proprietary sentiment layers. Our Trading Co-Pilot had its finger on the pulse before headlines caught up.

Signal Intelligence: How our Trading Co-Pilot Spotted the Move Early

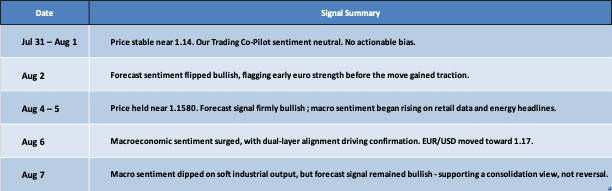

The first decisive signal came on 1 August, when our Trading Co-Pilot’s forecast flagged a bullish pivot, marking a structural turn in EUR/USD positioning. This was a forward looking call, surfacing before price or macro data confirmed the shift. This wasn’t just a subtle change in tone, but a clear shift in market direction, reinforced by high confidence signals.

That forecast call was reinforced on 5 and 6 August, as macroeconomic sentiment climbed, triggered by Eurozone retail sales strength and Germany’s cancellation of its gas levy. The result was a dual-layer alignment, with forecast and macro in sync, delivering a high-conviction, sentiment-driven long signal.

On 7 August, weaker German industrial output briefly weighed on macro sentiment. However, our Trading Co-Pilot’s forecast signal held steady, distinguishing a routine consolidation from a deeper reversal. This divergence allowed clients to hold exposure with confidence, avoiding unnecessary de-risking in response to transient macro noise.

Leading with Conviction

This was not a case of catching up with macro data. It was a well-signalled move, identified in advance. The bullish forecast pivot on 2 August, followed by macro reinforcement, gave clients a tactical lead well before the price peak, as signalled by pivot in euro forecast. When volatility resurfaced on 7 August, our Trading Co-Pilot remained unfazed by the noise, being able to distinguish temporary shifts from structural change.

EUR/GBP: Thematic Crosscurrents and Real-Time Sentiment Intelligence

Tracking the Macro Divergence

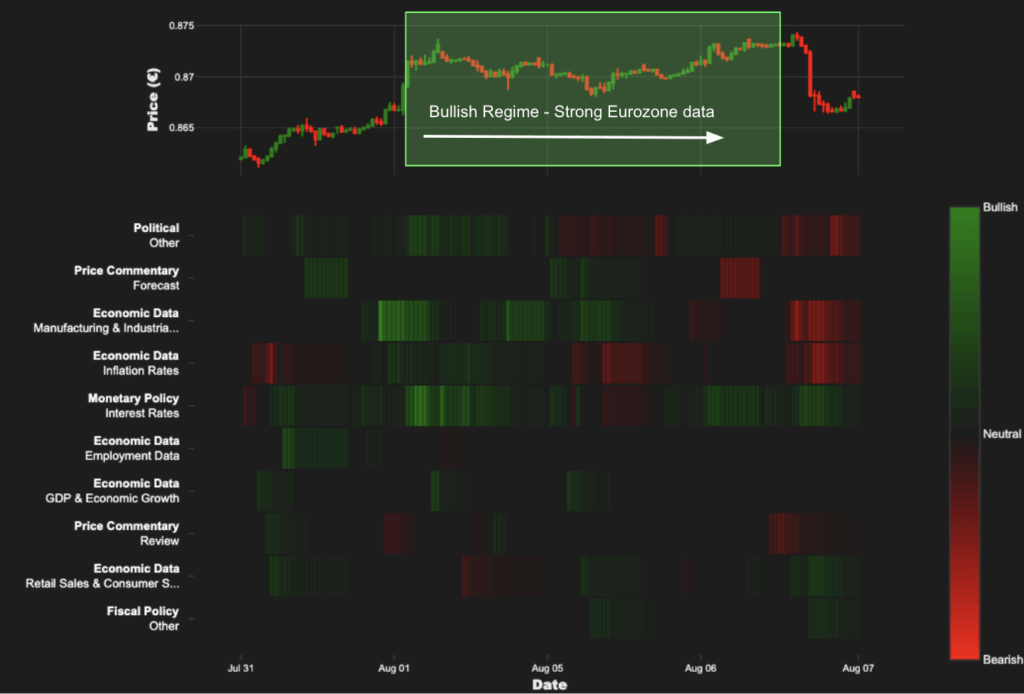

EUR/GBP advanced to 0.874 on 7 August before retreating to 0.8640 on 8 August after the BoE cut rates by 25bps to 4.00%, the lowest since March 2023. The narrow MPC 5-4 vote highlights the BoE’s delicate balancing act between inflation risks and slowing growth, leaving Governor Bailey’s guidance pivotal as markets still price in another cut by end-2025.

Sterling remains under pressure following weak UK retail sales and the steepest construction slowdown in five years. While the euro has faced headwinds from softening industrial output and France’s trade deficit widening by over €4.4 billion in H1 2025, reversing prior gains amid renewed U.S. tariff pressures. The euro finds support via stronger Eurozone retail data, and dollar softness driven by signs of U.S. macro and labour market fatigue.

Thematic Breakdown with our Trading Co-Pilot

Our Trading Co-Pilots thematic sentiment analysis was able to dissect real-time macro and political drivers behind EUR/GBP, offering clarity beyond headline noise.

- Macro themes tracked: Growing bearish sentiment manufacturing, inflation, and political risk across both EUR and GBP. A rise in Bullish sentiment came from monetary policy, consumer demand and fiscal policy.

- Colour-coded sentiment: Green signals bullish tone, red indicates bearish pressure

Dual-panel display: Overhead shows EUR/GBP price action; the heatmap tracks macro sentiment changes in real time.

Recent shifts:

- August 7–8: Sterling sentiment turned more negative following the BoE cut and soft UK data

- Eurozone sentiment held firmer, supported by retail sales

- August 7–8: Sterling sentiment turned more negative following the BoE cut and soft UK data

Strategic Advantage

Our thematic analyst breakdown delivers data-driven, time-sensitive signals that:

- Detect FX sentiment divergence

- Identifies dominant macro themes early

- Distinguish lasting trends from cut through the noise

Strategic Takeaway

Trading Co-Pilot led the move with clarity. Its layered sentiment intelligence provided an early, clean, and risk-aware bullish call on EUR/USD and EUR/GBP. This enabled clients to position with confidence and respond strategically in a dynamic FX environment.

Unlock the Edge

Contact enquiries@permutable.ai to access our real-time, sentiment-led FX intelligence and strengthen your trading strategy.