At Permutable AI, we’ve been at the forefront of R&D in AI trading investment for years, and have witnessed firsthand the rapid evolution of this sector. Ever since the introduction of machine learning algorithms in financial markets, the landscape has been changing at an unprecedented pace. All this means that investors and financial institutions must adapt quickly or risk being left behind.

Initially, AI in trading was primarily used for high-frequency trading and basic pattern recognition. Now, for many firms, it’s become an integral part of their entire investment strategy. What we’ve found is that AI isn’t just enhancing existing strategies; it’s creating entirely new approaches to market analysis and prediction.

The crisis in traditional investment strategies, exacerbated by global economic uncertainties, has accelerated the adoption of AI trading investment. Yet even now, we’re only scratching the surface of what’s possible. Let’s briefly look at some of the key trends we’re seeing in the industry.

Trends in AI trading investment

Advanced Natural Language Processing (NLP)

One of the most exciting developments is the use of NLP to analyse news, social media, and even company reports. It’s the same story on financial forums and in earnings calls transcripts. AI can now interpret sentiment and extract relevant information at a scale and speed impossible for human analysts.

Reinforcement learning

Increasingly, we’re seeing the application of reinforcement learning in trading algorithms. This method applies a reward-based system to teach AI how to make decisions in complex, dynamic environments like financial markets. Despite this being a relatively new approach, the results are promising.

Alternative data analysis

The keys to successful AI trading investment often lie in unexpected places. In the very near future, we can expect to see more AI systems incorporating alternative data sources such as satellite imagery and even weather patterns to gain a competitive edge.

Explainable AI

At Permutable, we know that explainability in our AI systems is crucial – especially for our clients who are increasingly relying on our trading tools to get ahead. As AI trading investment becomes more prevalent, there’s a growing demand for transparency. Explainable AI, which allows us to understand how AI models make decisions, is becoming crucial. The point here is that regulatory bodies and investors alike want to understand the logic behind AI-driven trades.

Federated learning

This approach allows multiple entities to train AI models without sharing sensitive data. It’s particularly relevant in the financial sector where data privacy is paramount. And this is why we believe federated learning will play a significant role in the future of AI trading investment.

Overarching AI trading investment trends

Almost everyone we speak to in the industry agrees that AI is transforming investment strategies. However, it’s not without its challenges. The trouble is, as AI systems become more complex, they also become more difficult to manage and understand. Of course, this has lead to a sense of foreboding among some traditional investors who fear being left behind by this technological revolution.

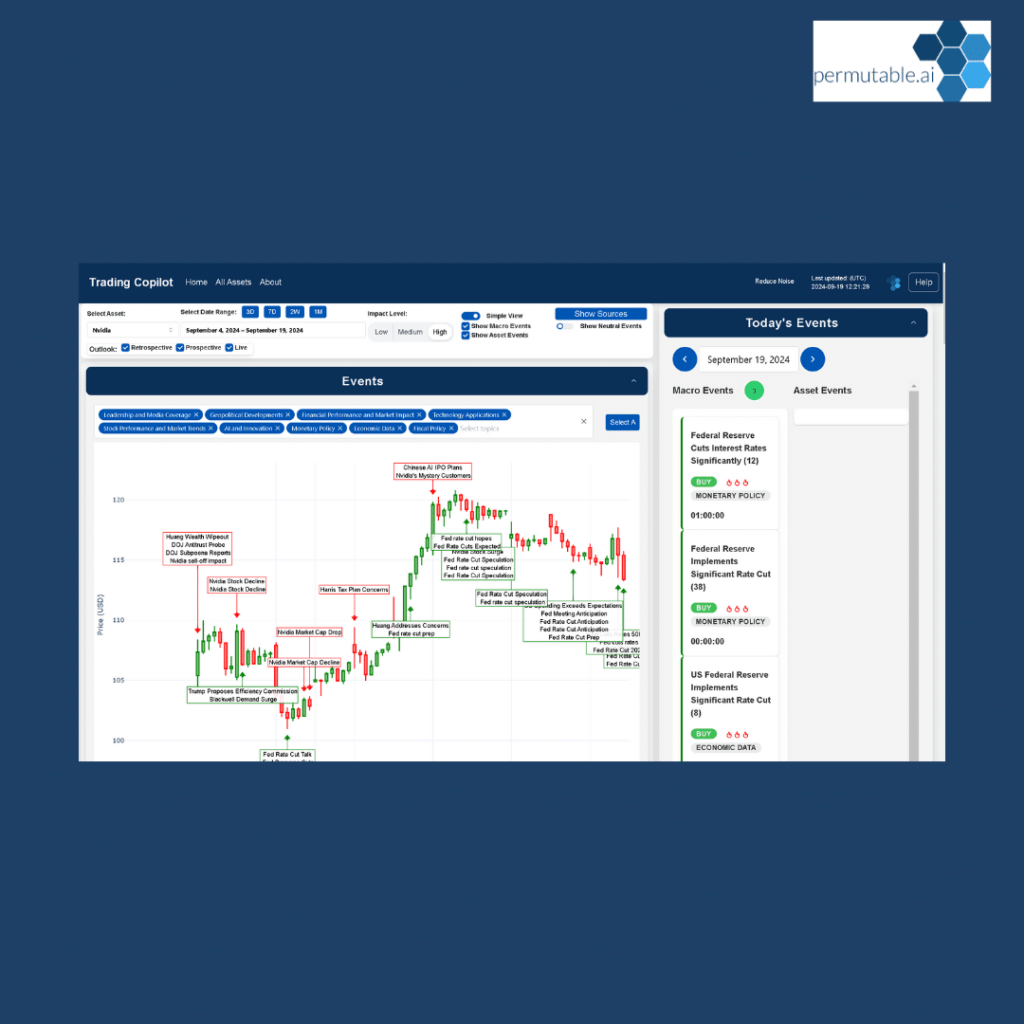

And the bad news is that all of this is likely to accelerate in the coming years. To address this, we at Permutable AI are focusing on developing AI systems that are not only powerful but also intuitive and user-friendly – as exemplified in our flagship product – our Trading Co-Pilot.

What actually is going on here? At its core, AI trading investment is about leveraging vast amounts of data and computational power to make more informed, timely, and profitable investment decisions. But it’s also about managing risk in an increasingly volatile global market.

This concern has three components:

- Data quality and quantity: AI models are only as good as the data they’re trained on. Ensuring access to high-quality, diverse data sets is crucial.

- Model interpretability: As mentioned earlier, there’s a growing need for explainable AI in finance.

- Regulatory compliance: As AI trading investment evolves, so too must the regulatory framework surrounding it.

So far, so predictable, you might think. And yet perhaps the most exciting aspect of AI trading investment is its potential to open up new markets and opportunities. For when you look again at emerging markets or previously overlooked asset classes, AI can provide insights that were previously impossible to obtain.

A new era in the financial markets

According to our sources in the industry, we’re on the cusp of a new era in finance, and we’re inclined to agree with this. It is claimed that AI will not just augment human decision-making, but in many cases, surpass it. And if it is the case that AI can consistently outperform human traders, what does this mean for the future of investment?

In this light, it’s clear that AI trading investment is not just a trend, but a fundamental shift in how we approach trading and investing. There’s plenty of evidence that firms embracing this technology are gaining a significant competitive advantage. Just as notably, those slow to adopt are finding themselves increasingly left behind.

The good news is that the barriers to entry for AI trading investment are lower than ever. With cloud computing and open-source AI tools, even smaller firms can leverage these powerful technologies. It also helps that there’s a growing ecosystem of AI-focused fintech companies providing specialised tools and services.

So there it is: AI trading investment is not just the future of trading and investing; it’s rapidly becoming its present. At Permutable AI, we’re excited to be part of this revolution, driving innovation and helping our clients navigate this new landscape with our Trading Co-Pilot which combines real-time news aggregation, asset and macro insights and actionable directional tips. The same applies to investors, traders, and financial institutions across the UK and beyond.

Your trading is about to take off

Schedule a free enterprise demo to see how our Trading Co-Pilot can help you make smarter trading decisions, faster.