We’re pleased to share today that our AI-driven systematic trading strategies has been breaking new ground amid heightened market volatility in this news story from our startup’s HQ. Over the last few years we’ve been quietly transforming how markets are analysed and traded through our advanced systematic trading platform. Our artificial intelligence reads and processes market data reports without human analysts, enabling our London-based team to achieve a remarkable 26% annualised return while outperforming major commodity indices during recent market volatility.

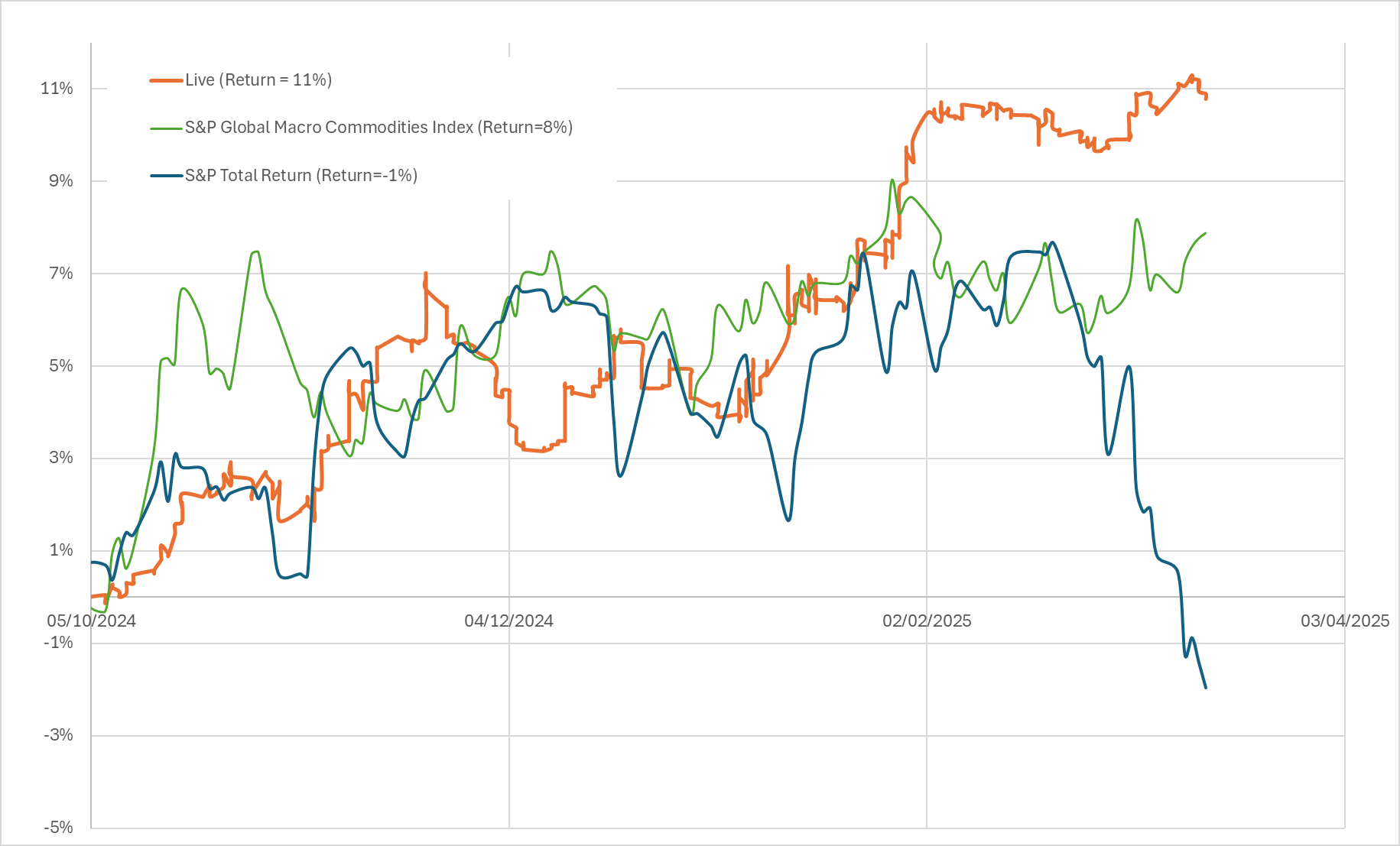

We can now announce that our end-to-end Large Language Model (LLM) based systematic trading platform, which has been implementing our innovative systematic trading strategies live since October 2024, has beaten the market across commodities over the last six months (see above chart).

Table of Contents

ToggleConsistent outperformance through market uncertainty

Our systematic trading strategies have outperformed all existing indices across energy, metals and agricultural commodities over the last six months – a period marked by unprecedented global market volatility. Most significantly, our LLM-driven systematic trading strategies have surpassed the S&P Global Macro Commodity Index, the primary CTA benchmark for the industry.

Unlike traditional investment vehicles, our systematic trading strategies have maintained a negative correlation with the S&P 500, delivering robust returns during recent market sell-offs when investors have increasingly turned to commodities as a haven. Our platform has achieved:

- 26% annualised return through our optimised systematic trading strategies

- Sub-10% annualised volatility

- Negative 20% correlation with the S&P 500 during the Trump Tariff period to date

Breaking away from industry underperformance

This robust performance of our systematic trading strategies comes at an important juncture for the industry. The CTA sector has experienced generally disappointing results in recent years, with many commodity hedge funds posting significant losses amid geopolitical uncertainty.

While the broader CTA industry has struggled to navigate recent market complexities in 2025, our systematic trading strategies have demonstrated remarkable resilience and performance,” says Wilson Chan, our CEO. “By harnessing the power of advanced language models to process and interpret vast datasets in real-time, we’ve created a trading infrastructure that not only adapts to market volatility but thrives within it.”

Industry recognition

We’re currently collaborating with several key institutions in the hedge fund industry, further validating the potential of our systematic trading strategies and approach to algorithmic trading.

Partner with us

Ready to leverage the power of our systematic trading strategies? We offer the following partnership opportunities:

- Data integration: Incorporate our market-beating data and insights into your existing trading systems

- Shared trading book: Run a joint trading book with us, benefiting from our proven systematic trading strategies

Contact us today at enquiries@permutable.ai to discuss how we can collaborate.