This article examines the drivers behind the current S&P 500 rally, the role of sentiment as a leading market indicator, and how Permutable’s political tension index and macro sentiment indices capture tariff-driven nerves, policy expectations, and safe-haven flows. It is aimed at institutional investors, traders, and macro analysts seeking deeper insight into market-narrative dynamics.

The S&P 500 rally in 2025 has left many investors questioning whether equity markets are still tethered to economic reality. While economic indicators such as job growth, consumer sentiment, and inflation data show signs of strain, the index has powered to fresh record highs.

At first glance, the disconnect looks puzzling. The Bureau of Labor Statistics recently halved its job growth estimates in a historic downward revision, while inflation remains above the Federal Reserve’s 2% target. Yet equity markets, and particularly the S&P 500, appear unmoved. Instead, the S&P 500 rally has been supported by narratives that transcend the current data cycle: expectations of imminent rate cuts, a weaker dollar boosting exporter earnings, and resilience in corporate strategies to absorb tariffs.

This paradox underscores a deeper truth. Markets are forward-looking machines, and sentiment – not lagging data – often dictates direction.

Table of Contents

ToggleWhy sentiment leads markets

Economic data tells us what has already happened. It is backward-looking by nature. Markets, however, price in expectations. They are stories in motion.

When job growth data comes in weak, traders do not simply see deterioration in the labour market. They see a potential Fed response – looser policy, cheaper credit, and a supportive environment for risk assets. This is why the S&P 500 rally has continued even as the underlying economy shows fragility.

Market sentiment translates these expectations into real-time signals. It is not the weak data that moves markets directly, but the narrative around what the weakness implies. Investors ask: will the Fed cut rates? Will AI productivity gains offset labour market pressures? Will exporters benefit from a weaker dollar? These interpretations drive positioning long before hard data confirms or denies them.

This is why sentiment is a leading indicator. It captures confidence, anxiety, and shifting narratives that shape future investment flows.

Safe-haven flows and tariff-driven nerves

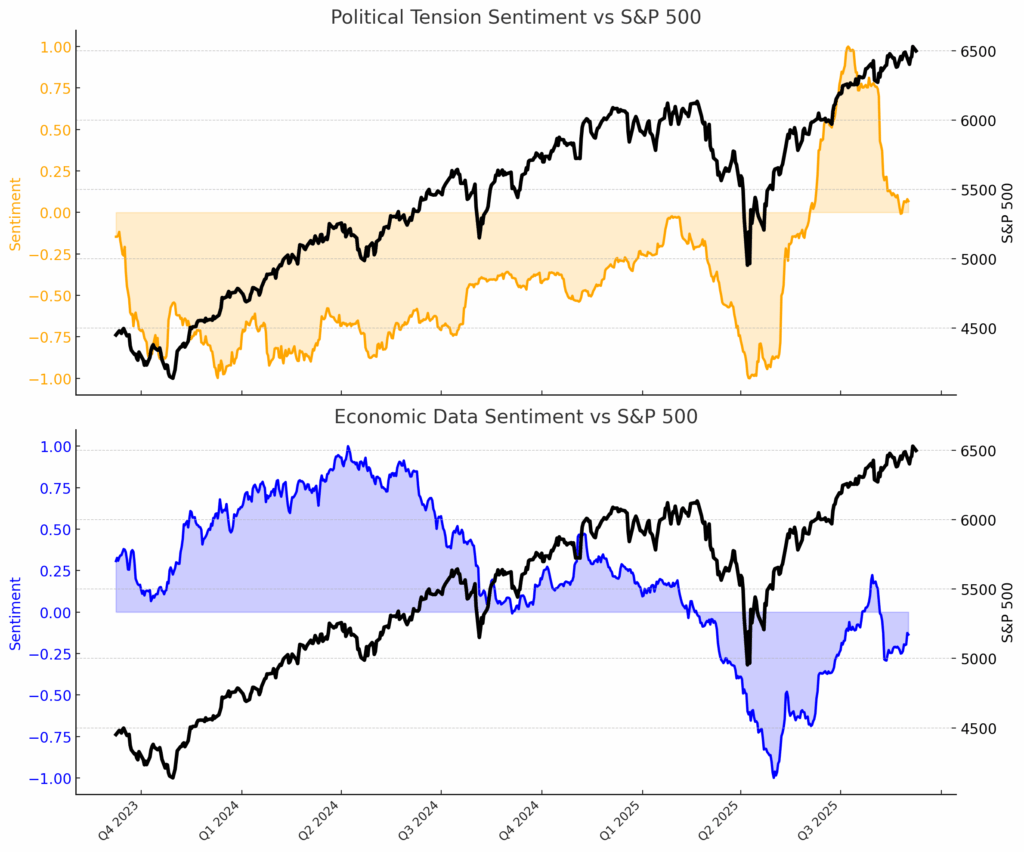

At Permutable, our Political Tension Index has been particularly active in recent months, capturing the anxiety stemming from President Trump’s new tariff measures. Interestingly, our indices show that while corporate earnings calls initially bristled with the language of “uncertainty” around tariffs, this narrative has faded. Firms have moved on to adaptation strategies – renegotiating supply chains, passing costs to consumers, and finding efficiencies. This resilience helps explain why the S&P 500 rally has persisted in the face of tariff-related risks.

But all the while, our Political Tension Index continues to flash red, highlighting the persistent undercurrent of unease. And so. these flows into US equities may be less about confidence in economic strength and more about the relative weakness of alternatives. That distinction matters when assessing sustainability.

Above: Sentiment leads markets – the S&P 500 rallies despite weak economic data hinting at bubble risk, while political tension captured tariff-driven nerves and safe-have flows.

Our macro indices: Translating narratives into signals

At Permutable, we believe that narratives shape markets. Our suite of macro indices translates global news flows into forward-looking signals on global macro events relating to GDP, inflation, monetary policy, and geopolitics.

GDP Narrative Index captures shifts in expectations around growth, from optimistic expansion stories to recession fears.

Inflation Sentiment Index monitors how pricing pressures are being discussed — whether central banks are seen as hawkish or behind the curve.

Policy Rate Index tracks narratives around central bank decisions such as those from the Fed, ECB, Bank of England, and Bank of Japan.

Geopolitical Sentiment quantifies combined tensions from elections, conflicts, and trade disputes, showing how political developments are priced into assets.

These indices provide a forward-looking complement to economic data. Where the official GDP print is released quarterly and revised months later, our narrative signals update in near real time, offering analysts an early read on shifts in sentiment that may foreshadow market movements.

This is the practical application of sentiment as a leading indicator: it allows investors to see where narratives are heading, not where the data has already been.

The bubble risk question

There is, of course, a risk. When markets rise on sentiment while economic fundamentals weaken, the danger of a bubble grows. The current S&P 500 rally shows hallmarks of such divergence: equities are surging while the dollar weakens, inflation proves sticky, and job growth falters.

In the short term, optimism can sustain rallies. But if the expectations driving sentiment – such as aggressive Fed cuts or AI-driven productivity gains – fail to materialise, the unwind could be sharp.

Our indices are designed precisely to monitor these divergences. By comparing sentiment-driven optimism with lagging macroeconomic data, investors can identify when markets may be running ahead of fundamentals. This does not guarantee a correction, but it highlights the growing probability of misalignment.

Reading the future – not the past, with market sentiment

The S&P 500 rally in the face of weak economic data is not a paradox – it is a demonstration of how markets function. Sentiment, not lagging data, drives price action. Narratives about monetary policy, tariffs, AI adoption, and global trade flows explain the rally far more than statistics about last quarter’s job growth.

Yet investors must tread carefully. While sentiment leads markets, it can also overextend them. At Permutable, we specialise in providing data intelligence solutions that provide clarity in this fog – offering structured, forward-looking signals that capture the narratives shaping tomorrow’s markets today.

The S&P 500 rally may yet continue, but understanding the sentiment behind it – and the risks it conceals – is critical for those navigating increasingly complex global markets.

See our intelligence in action

If you’d like to see how our intelligence suite translates market narratives into forward-looking signals — from political tension to macroeconomic sentiment – we’d be delighted to show you more.

Get in touch with us today at enquiries@permutable.ai to request a demo and explore how our data can give your team the edge.