Permutable AI introduces country-level macro signals that track domestic and international sentiment to reveal economic, policy, and growth shifts before markets react. The feeds help traders, analysts, and portfolio managers spot risk, mispricings, and opportunities across FX, rates, credit, and commodities, integrating directly into systematic and discretionary workflows for faster, better-informed decisions worldwide for institutional investment teams globally today everywhere.

We today announced the launch of our country-level macro signals data feeds, a major expansion of the Permutable AI intelligence platform that delivers structured economic, policy, and sentiment indicators at national level across more than 40 economies, with coverage continuing to scale globally.

At Permutable AI, our mission is to help market our clients understand what is changing before prices adjust. With this release, we extend that capability beyond asset-level signals into sovereign, policy and domestic economic dynamics – giving traders, analysts and portfolio managers earlier, more granular visibility into the forces shaping global markets.

These new feeds transform how institutions detect inflection points in sovereign risk, growth cycles, and policy shifts by converting unstructured global information into structured, actionable macro intelligence. Instead of waiting for lagging indicators or headline-driven reactions, our clients can now see change forming on the ground in real time.

Table of Contents

ToggleSeeing the cycle first

Traditional macroeconomic data arrives late. Inflation prints, GDP releases, and policy statements confirm what has already happened. By the time these indicators are published, markets have often moved.

Our country-level macro signals solve this gap.

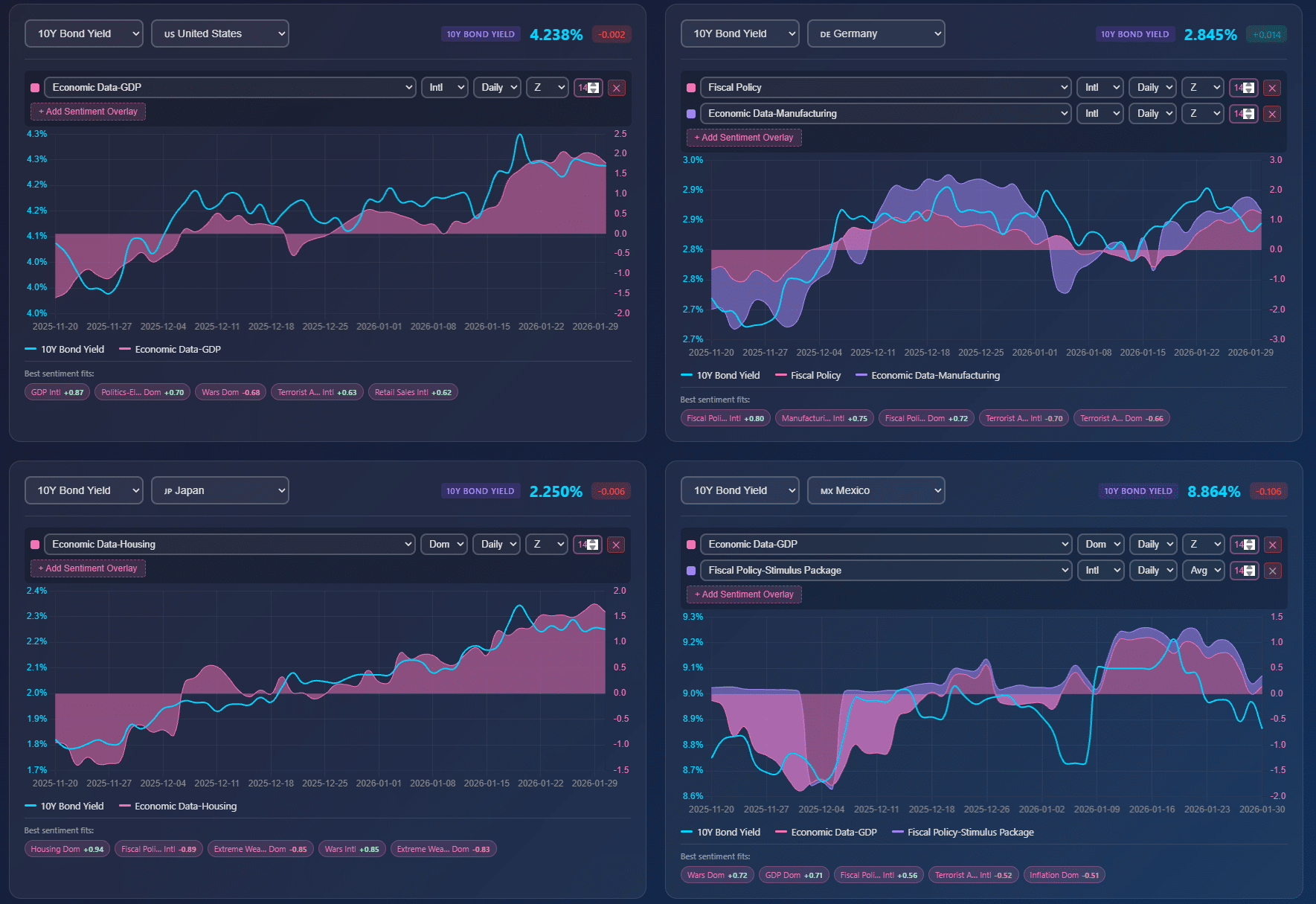

We analyse millions of domestic and international sources across local languages every minute, continuously measuring sentiment and narrative momentum around inflation, rates, growth, housing, consumer conditions and policy execution. These signals update dynamically – revealing shifts weeks or months before traditional metrics catch up.

Backtesting across major economies demonstrates consistent predictive value:

-

In the United States, inflation sentiment flagged the 2021–22 price surge months before core CPI accelerated

-

Rates sentiment turned ahead of moves in the 10-year Treasury during the Federal Reserve hiking cycle

-

In Japan, signals pointed to Bank of Japan normalisation risk and the unwind of ultra-loose policy before rate adjustments were announced

These early warnings offer a measurable edge for FX positioning, duration management, and cross-asset allocation.

As our Founder and CEO, Wilson Chan, explains:

“What we are now offering is the most comprehensive on-the-ground macro sentiment across every country which updates every minute. We still maintain that market sentiment moves markets. By analysing local-language sources alongside international coverage across 180+ countries, we’re giving traders the ability to see policy pressure, growth momentum and market risk as it builds – not after it has already moved prices. This is intelligence that supports better decisions in real time.”

Two lenses on every economy: Domestic and international

A defining feature of our platform is what we call the dual-lens approach.

Most macro analysis relies heavily on international media or institutional commentary. But markets often miss what is happening locally – where policy meets reality, and where execution risks emerge first.

Our system separates:

Domestic sentiment – local-language reporting that captures street-level issues, implementation friction, consumer stress, and political dynamics

International sentiment – global institutional narratives, geopolitical framing, and cross-border risk perception

This distinction matters because divergence creates opportunity.

When local conditions worsen but international coverage remains constructive, markets may be mispricing risk. Conversely, when global headlines exaggerate concerns not reflected domestically, assets may be oversold.

We consistently observe these disconnects across countries:

-

China’s domestic coverage focuses on stabilisation and policy support while international narratives emphasise structural risks

-

The UK’s domestic sentiment reflects lived inflation pressure, while international coverage centres on central bank messaging

-

Spain and Turkey show predominantly domestic-driven narratives, while China receives disproportionately international scrutiny

Understanding who is driving the narrative – and whether that narrative matches ground truth – can directly inform timing and positioning.

Michael Brisley, our Chief Commercial Officer, adds:

“The biggest alpha opportunities often emerge when domestic reality diverges from international perception. A portfolio manager looking at Brazil or Mexico needs to know if street-level sentiment is deteriorating while foreign headlines remain constructive, or vice versa. That gap is where mispricings live. Our country-level intelligence suite makes those disconnects visible and actionable.”

Built for real-world decisions

We designed these datasets for practical deployment inside trading and risk workflows.

Our clients use the feeds to directly support:

- Cycle & Risk Monitoring: Identify domestic stress before it reaches mainstream terminals. Flag countries where sentiment suggests FX repricing, curve steepening, or spread widening.

- Perception vs Fundamentals: Distinguish whether markets are trading headlines or underlying economic conditions, helping avoid false signals and crowded narratives.

- Policy & Implementation Risk: Capture signs of political strain, execution slippage, or social pushback early using local-language intelligence.

- Cross-Asset Allocation: Inform FX, rates, credit, commodities and sovereign risk positioning with forward-looking macro indicators.

- Systematic Strategies: Integrate structured signals directly into quantitative and algorithmic models via API.

Because our data is delivered in structured, machine-readable formats, it fits seamlessly into existing trading stacks and portfolio construction frameworks.

Expanded Coverage with Local Language Intelligence

Coverage includes major developed and emerging markets such as the United States, United Kingdom, Eurozone economies, Turkey, Japan, China, Brazil, Mexico and India, alongside additional countries.

Each market features multiple indices spanning:

-

Inflation

-

Interest rates

-

GDP and growth momentum

-

Consumer and household conditions

-

Housing

-

Policy and political dynamics

Every signal is powered by deep local-language analysis – a key differentiator that ensures our intelligence reflects real conditions rather than translated summaries or delayed commentary.

Availability

Our country-level macro signals are available immediately via API and integrate easily with existing market data infrastructure. Institutions can deploy the feeds across systematic trading, discretionary strategies, and enterprise risk management.

To request a walkthrough, institutional trial, or technical integration details, visit www.permutable.ai or contact enquiries@permutable.ai.