In the ever-evolving landscape of the banking industry, ESG factors have gained paramount importance in driving a transition towards a more sustainable finance system. Bank of America emerges as a frontrunner in this transformative journey, with an outstanding ESG rating that showcases its steadfast commitment to sustainability and responsible business practices. In this article, we will delve into the Bank of America ESG rating, exploring how the institution actively reduces its carbon footprint, fosters diversity and inclusion, and upholds ethical governance. By examining Bank of America’s sustainability endeavours, we gain valuable insights on how businesses can navigate today’s challenges while making a positive impact on the planet and society at large, contributing to the transition to a more sustainable finance system. Join us as we dive into the world of ESG and witness Bank of America’s role in setting an exemplary standard for the industry.

The importance of ESG ratings for businesses

Despite recent backlash, ESG ratings have become a crucial tool for investors and stakeholders to assess a company’s sustainability performance. These ratings evaluate a company’s environmental impact, social responsibility, and governance practices, providing a comprehensive view of their overall sustainability efforts. For businesses, a high ESG rating not only enhances their reputation but also attracts socially conscious investors and customers. It demonstrates a company’s commitment to responsible business practices and can lead to long-term profitability and success. Bank of America, with its impressive ESG rating, has recognized the importance of these factors and has made significant strides in incorporating them into their operations.

Overview of Bank of America’s ESG rating

Bank of America has consistently been recognized for its strong ESG performance. According to our data on Bank of America, the financial institution has a strong commitment to sustainability and responsible business practices across various dimensions, including environmental impact (scoring 94), social responsibility (scoring 86) , though in terms of their governance their score is somewhat less (49). That said, by excelling in the areas of environmental impacts and social responsibility, Bank of America has positioned itself as a leader in sustainable finance within the banking industry.

Bank of America’s commitment to sustainability

Bank of America’s commitment to sustainability is evident in its comprehensive approach to ESG. The bank has set ambitious goals to reduce its own environmental footprint, support renewable energy, promote diversity and inclusion, and ensure ethical governance. By integrating sustainability into its core business strategy, Bank of America aims to create long-term value for its stakeholders while also addressing pressing global challenges such as climate change and social inequality.

Environmental initiatives and accomplishments

Bank of America has implemented a range of environmental initiatives to minimize its carbon footprint and promote sustainable practices. The bank has committed to carbon neutrality and has set a target to reduce greenhouse gas emissions from its operations and supply chain. Bank of America has also invested in renewable energy projects and has provided substantial financing for clean energy initiatives. Additionally, the bank has developed innovative financial products and services to support clients in their transition to a low-carbon economy. These efforts have not only contributed to mitigating climate change but have also positioned Bank of America as a leader in sustainable finance.

Social initiatives and community involvement

Bank of America recognizes the importance of social responsibility and has undertaken numerous initiatives to support communities and promote social inclusion. The bank has committed billions of dollars to address economic and racial inequalities, investing in affordable housing, education, and job creation programs. Bank of America also actively supports small businesses, particularly those owned by underrepresented groups, through various lending and mentorship programs. By prioritizing social impact, Bank of America demonstrates its commitment to creating a more equitable society.

Governance practices and transparency

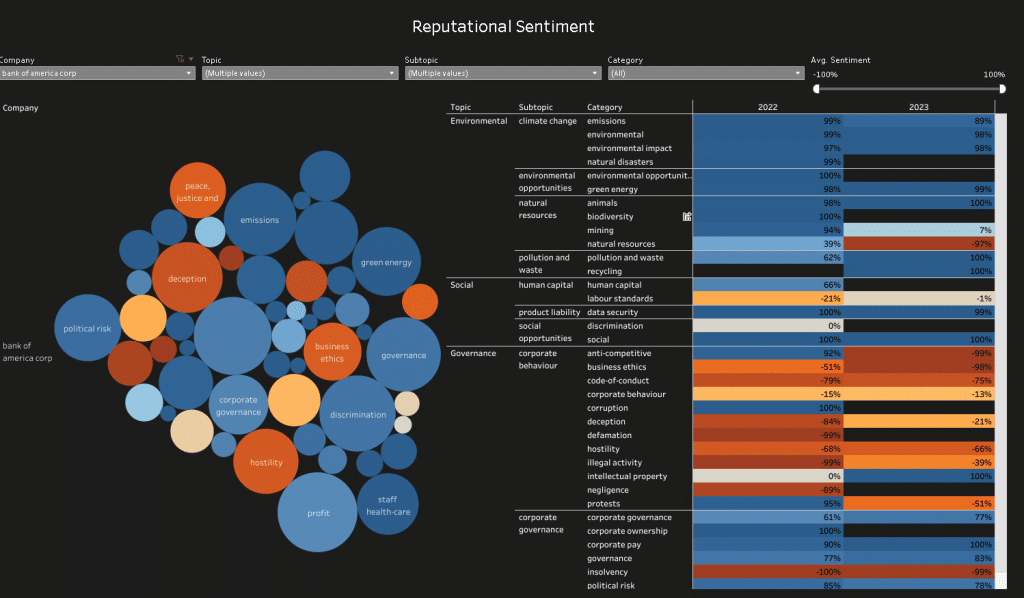

Although Bank of America places a strong emphasis on ethical governance and transparency, their score of 49 in this area shows there is still work to be done in the area particularly with regards to business ethics, code of conduct, negligence and overall hostility. While the bank has implemented robust governance practices and policies to ensure integrity and accountability throughout its operations fortified by a board of directors consists of experienced professionals with diverse backgrounds, enabling effective oversight and strategic decision-making, the score of 49 suggests that there may be areas where Bank of America can further enhance its governance practices to align with industry best practices.

Bank of America’s impact on the UN Sustainable Development Goals

Bank of America’s commitment to sustainability aligns with the United Nations Sustainable Development Goals (SDGs). The bank actively meets 12 out of 17 of the SDGs, including affordable and clean energy, gender equality, decent work, and economic growth. Through its lending and investment activities, Bank of America channels capital towards projects and initiatives that contribute to the achievement of these goals. By leveraging its resources and expertise, Bank of America plays a vital role in advancing the global sustainability agenda.

Comparison with other banks’ ESG ratings

Bank of America’s impressive ESG rating places it ahead of many other banks in terms of sustainability performance. While several banks have made strides in integrating ESG factors into their operations, Bank of America stands out for its comprehensive approach and ambitious goals. The bank’s commitment to reducing its carbon footprint, promoting diversity and inclusion, and ensuring ethical governance sets it apart in the industry. As investors and stakeholders increasingly prioritize sustainability, Bank of America’s strong ESG rating positions it as an attractive choice for those seeking to align their investments with their values. Take a look at their competitor ESG ratings below:

- JPMorgan Chase ESG rating

- Citigroup ESG rating

- Wells Fargo ESG rating

- Goldman Sachs ESG rating

- Morgan Stanley ESG rating

- U.S. Bancorp ESG rating

- Barclays ESG rating

- HSBC ESG rating

- Deutsche Bank ESG rating

- PNC Financial Services Group ESG rating

Conclusion: Bank of America’s impressive ESG rating and future sustainability goals

Bank of America has established itself as a leader in sustainability within the banking industry. With an impressive ESG rating and a comprehensive approach to environmental, social, and (relative to their peers) governance factors, the bank has demonstrated its commitment to responsible business practices. Through its environmental initiatives, social programs, and ethical governance practices, Bank of America is setting an example for businesses worldwide. By prioritizing sustainability and integrating ESG factors into their operations, companies can not only create a positive impact on the planet and society but also drive long-term profitability and success. Bank of America’s dedication to sustainability serves as an inspiration for others to follow, and its future sustainability goals will undoubtedly pave the way for a more sustainable and inclusive future.

Find out more

Find out more about Bank of America’s sustainability initiatives and their role in driving positive change in the industry. By requesting more comprehensive ESG data, you can delve deeper into the bank’s commitment to sustainable finance, environmental stewardship, social responsibility, and ethical governance. Discover how Bank of America is making strides towards a more sustainable future and contributing to global sustainability goals and where improvements can still be made. Get in touch with us to find out more.