Trading Co-Pilot Case Study:

Oil Commodity Price Analysis

Delivering turnkey trading intelligence through seamless Trading Co-Pilot API integration and AI-powered oil price analysis for energy trading desk operations

PROBLEM

Energy trading desks face mounting pressure to enhance their oil commodity price intelligence capabilities whilst managing complex technical integration challenges and resource constraints. Traditional approaches require significant IT overhead, lengthy implementation cycles, and substantial analyst headcount to deliver comprehensive Brent crude signals and oil price analysis across volatile energy markets. This creates a fundamental tension between the need for sophisticated oil commodity price forecasting and the practical realities of trading infrastructure and budget limitations.

What’s the operational impact of these intelligence gaps on your energy trading performance? If your trading desk lacks seamless oil price analysis integration or sufficient analyst coverage for Brent crude regime changes, you’re not just missing profitable trade opportunities – you’re experiencing the compounding effect of delayed oil commodity price insights and missed entry/exit points that prevent you from delivering competitive energy trading performance.

SOLUTION: COMPREHENSIVE TRADING CO-PILOT FOR ENERGY MARKETS

Our institutional energy trading desk client faced exactly this challenge. Their energy trading operations required sophisticated oil commodity price intelligence capabilities, particularly for Brent crude forecasting and oil price analysis. They needed a turnkey trading solution that could integrate seamlessly with existing trading infrastructure whilst providing enterprise-grade oil commodity price signal generation capabilities.

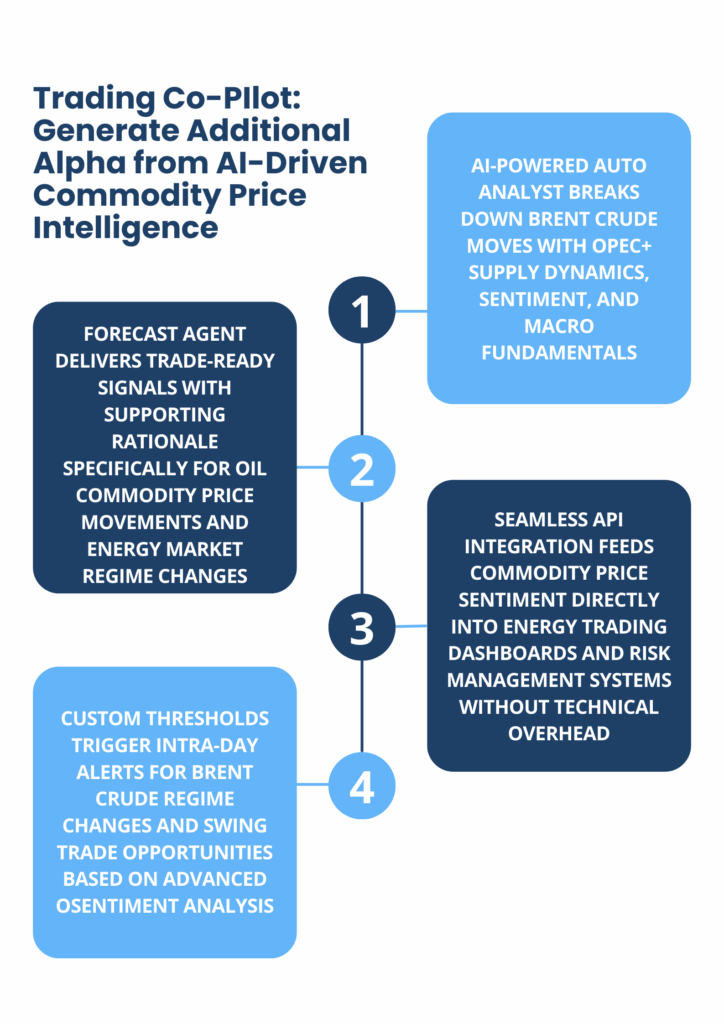

OUR TRADING CO-PILOT

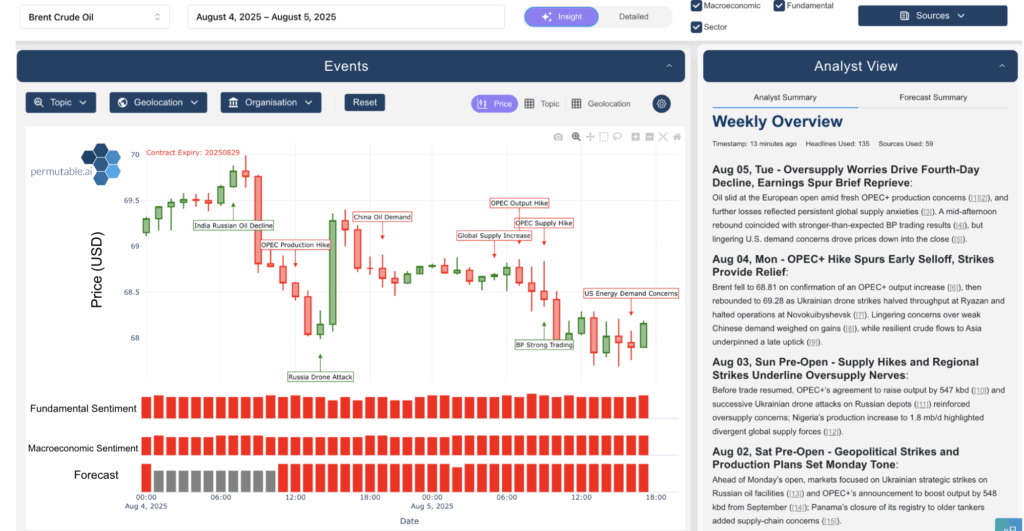

- Chart Above: Captured early Brents bearish regime change in early August 2025 after sentiment turned. Brent dipped to a one-week low as markets digested OPEC+ supply-hike signals. A well positioned and timely short opportunity.

- Auto Analyst: Provides concise breakdowns of recent Brent crude moves with key drivers using sentiment, macro fundamentals, and OPEC+ supply dynamics for comprehensive oil price analysis

- Forecast Agent: Delivers hourly BUY/SELL signals with supporting rationale and topic-level sentiment specifically for oil commodity price movements and energy market shifts

WORKFLOW INTEGRATION

- Plug-and-Play API Integration: Real-time oil commodity price sentiment feeds and Brent crude trading signals that integrate directly with existing energy trading dashboards and risk management systems without technical overhead

- Automated Alerts: Custom threshold alerts for intra-day Brent crude and swing trade setups based on oil price analysis

- Cross-Asset Overlays: Used to refine entry/exit points and energy sector rotation logic

“Permutable’s Trading Co-Pilot integrates seamlessly with our energy trading infrastructure. We now have real-time sentiment and oil commodity price signals feeding directly into our risk management systems without any technical overhead. The automated oil price analysis and alerts for Brent crude regime changes have enhanced our intra-day energy trading capabilities. – Head of Innovation, Energy Trading Desk

SEE HOW OUR TRADING CO-PILOT WORKS

Discover how our Trading Co-Pilot can enhance your energy trading operations without technical complexity. Request a demo at enquiries@permutable.ai.