This article examines use cases for Permutable’s G7 macroeconomic sentiment data and predictive intelligence on global inflation rates for institutional investment strategies and real-time market narrative analysis aimed at institutional investors, hedge fund managers, asset managers, quantitative researchers, risk officers, and central bank officials seeking cutting-edge sentiment analytics to enhance their inflation-related investment strategies and portfolio risk management across G7 markets.

As central banks worldwide grapple with persistent inflationary pressures and investors seek alpha in an increasingly challenging environment, the ability to decode market sentiment around global inflation rates has become a critical competitive advantage. At Permutable, our G7 macroeconomic sentiment data presents value in how institutional investors approach this challenge, offering real-time insight into the narrative forces that drive market movements before they materialise in traditional metrics.

Drawing from our deep experience in quantitative finance and natural language processing, we have developed a comprehensive macro sentiment intelligence platform that transforms the cacophony of market discourse into actionable investment signals. The platform’s proprietary large language models systematically process unstructured news across all G7 advanced economies – United States, Canada, United Kingdom, Germany, France, Italy, and Japan – providing institutional investors with a powerful lens through which to interpret and anticipate shifts in global inflation rates across multiple asset classes and geographies.

The foundation of this approach lies in recognising that markets are narrative-driven ecosystems. Traditional economic data offers only a rearview mirror on inflation, while sentiment analysis provides a forward-looking view of how participants are processing and positioning for future developments. Our structured quantitative analytics capture monetary policy sentiment from the Federal Reserve, ECB, Bank of England, and Bank of Japan with five-minute refresh rates, alongside real-time reactions to key economic indicators such as employment, GDP, and inflation releases. With ten years of hourly structured intelligence for robust backtesting and a Co-Pilot API delivering millisecond-latency sentiment scores, event classifications, and risk metrics, investors gain an unparalleled information edge in navigating complex inflation dynamics.

Table of Contents

ToggleHedge funds: Macro timing and cross-asset precision

Hedge funds employing macro, multi-strategy, and long-short equity approaches could significantly enhance their ability to detect inflection points in inflation narratives ahead of official data releases through our sentiment data. This capability would prove particularly valuable when positioning for trades where understanding the trajectory of central bank policy through sentiment analysis could mean the difference between capturing significant alpha or suffering whipsaw losses. Our platform’s ability to map sentiment momentum to specific trades could be used as an essential tool for managers seeking to monetise their macro views with greater precision.

Asset managers: Strategic allocation and regime awareness

Asset managers operating multi-asset strategies can use our global inflation rates sentiment to tilt exposures based on sentiment-driven regime changes, enhancing risk-adjusted returns whilst maintaining appropriate diversification. Additionally, those asset managers responsible for long-term policy portfolios could integrate our sentiment regime scores into their strategic allocation frameworks, using rolling sentiment analysis to inform tactical bands around core equity and bond positions. This approach would prove particularly valuable for pension funds and insurance companies, where liability-aware hedging strategies could benefit enormously from early warning systems around potential correlation regime changes between equities and bonds during periods of heightened inflation concern.

Systematic and quantitative funds: Feature engineering

For systematic and quantitative funds, our daily and intraday sentiment feeds provide rich feature sets for machine learning models focused on macro forecasting and cross-asset strategies. Our platform’s ability to capture sentiment momentum, breadth, and dispersion across G7 economies offers CTA and statistical arbitrage strategies novel alpha sources that complement traditional price-based signals. Our experience of integrating these sentiment features into our own systematic models in live testing has consistently demonstrated improved Sharpe ratios and reduced drawdown periods, particularly during volatile inflation regimes when traditional correlations break down.

Fixed Income and rates: Precision timing for inflation products

For fixed income and rates desks, our sentiment data will prove particularly valuable for breakeven and inflation-linked securities trading. Our platform’s ability to detect subtle shifts in inflation narratives before they appear in market pricing enables traders to position more effectively in TIPS, inflation swaps, and cross-currency basis trades. The sophisticated timing capabilities offered by our real-time sentiment feeds will become especially valuable during central bank communication periods, where understanding the market’s interpretation of policy signals can drive significant performance differences.

Foreign exchange and commodities: Global macro baskets

In terms of foreign exchange and commodities applications of G7 sentiment analysis extend the platform’s utility across a broader range of investment strategies. Currency managers can leverage our sentiment analysis to construct pro-inflation currency baskets. Similarly, commodity-focused strategies have found significant value in using sentiment momentum to time entries and exits in energy, agricultural, and metals markets, where inflation expectations often drive substantial price movements.

Risk management and Portfolio Construction: Regime detection

Risk management applications represent a key dimension of our value proposition. Here, CIOs and risk managers could find that incorporating our sentiment regime analysis into their frameworks would provide early warning systems for periods when traditional portfolio construction assumptions may break down. The platform’s ability to flag potential correlation spikes between asset classes during sentiment-driven inflation scares could help institutional investors avoid significant drawdowns during market stress periods.

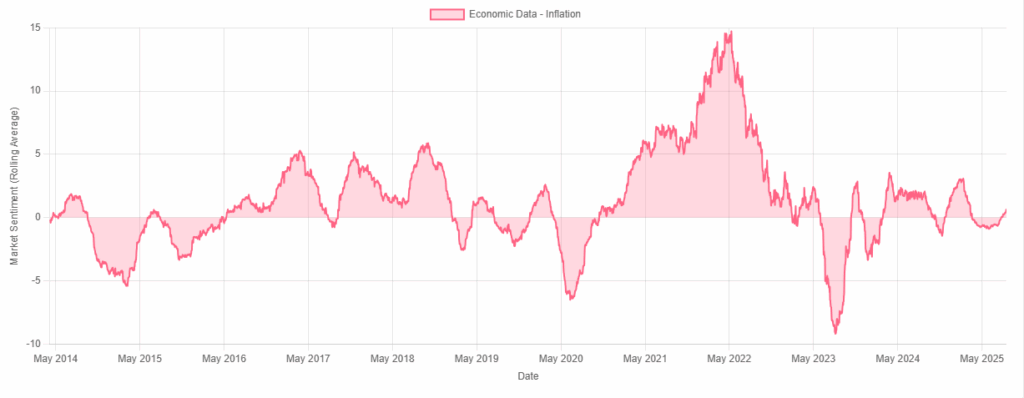

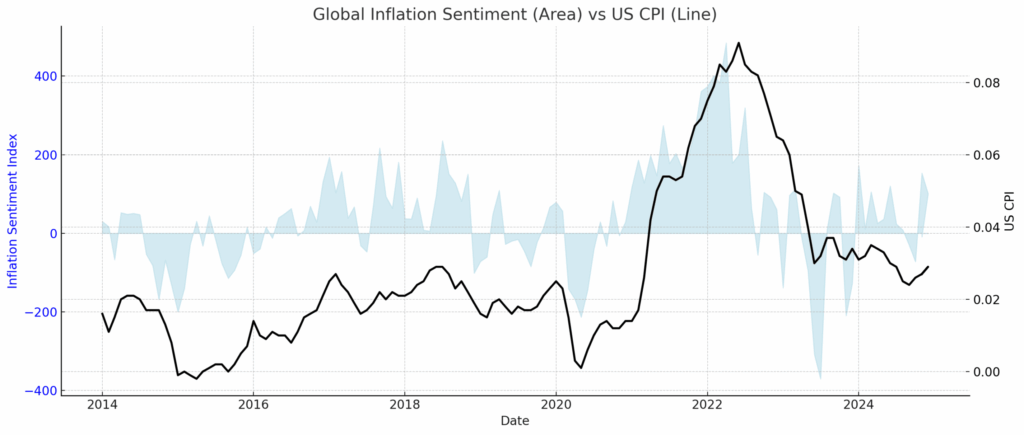

Empirical applications: Learning from historical performance

The charts below illustrate the compelling empirical foundation for sentiment-driven inflation analysis across G7 markets. The relationship between global inflation sentiment and US CPI demonstrates how narrative momentum often precedes actual inflation realisations, with sentiment spikes in 2021-2022 anticipating the substantial CPI increases that followed. This predictive capability would enable investors to position portfolios ahead of regime shifts rather than reactively adjusting after inflation data surprises markets.

The Japan-specific analysis reveals even more nuanced applications, where inflation sentiment demonstrated remarkable prescience in anticipating the country’s emergence from decades of deflationary conditions. The sentiment data captured the narrative shift around Japan’s inflation dynamics well before external inflation measures reflected this change, providing sophisticated investors with months of advance positioning opportunity. This type of country-specific sentiment intelligence would prove invaluable for currency managers constructing carry trades or equity investors positioning for the structural shifts accompanying Japan’s return to positive inflation expectations.

These empirical patterns suggest that systematic strategies incorporating sentiment timing could significantly enhance returns around major inflation regime transitions. The ability to detect when sentiment momentum begins diverging from actual inflation data creates opportunities for contrarian positioning, whilst periods of sentiment-data convergence would signal trend continuation phases suitable for momentum strategies. Cross-asset applications become particularly compelling when sentiment analysis enables investors to anticipate how inflation narrative shifts translate into sector rotation, currency movements, and commodity price adjustments across different G7 economies simultaneously.

Looking ahead, the integration of our advanced sentiment intelligence into institutional investment processes represents more than just an enhancement to existing capabilities but a fundamental shift in how sophisticated investors approach global inflation rates and their market implications. Our next gen G7 sentiment data provides a robust analytical foundation for this evolution, offering institutional investors the precision, timing, and cross-asset perspective necessary to navigate an increasingly complex global macro environment.

Request an enterprise demo today by contacting enquiries@permutable.ai to discover how our G7 macroeconomic sentiment intelligence can enhance your portfolio performance and risk management capabilities across multiple asset classes and time horizons. See our latest monthly publication for the most recent updates on global inflation sentiment trends and market insights.