This announcement introduces Permutable AI’s new LNG data feed, expanding our data-as-a-service portfolio to help energy traders, portfolio managers, and financial institutions gain real-time insights into liquefied natural gas markets with zero integration requirements – enabling faster, more informed trading decisions during periods of market volatility and geopolitical uncertainty.

We are delighted to announce that we have expanded our data-as-a-service offering with the addition of a comprehensive LNG data feed to our Trading Co-Pilot suite. This expansion represents a significant enhancement to our market coverage, providing energy traders and financial institutions with immediate, actionable data and insights into one of the world’s most dynamic commodity markets.

The new LNG data feed reinforces our commitment to delivering specialist data services that require minimal integration effort whilst providing maximum analytical advantage. By leveraging our proprietary LLM technology to process and analyse thousands of global news sources in real-time, we transform raw information into structured, actionable data that identifies critical market-moving events and provides contextualised interpretation of their potential impact on prices and trading conditions.

As with all our data-as-a-service products, our LNG market intelligence feed requires zero technical integration, delivering immediate value from day one through our plug-and-play data feeds.

Recent LNG market insights revealed

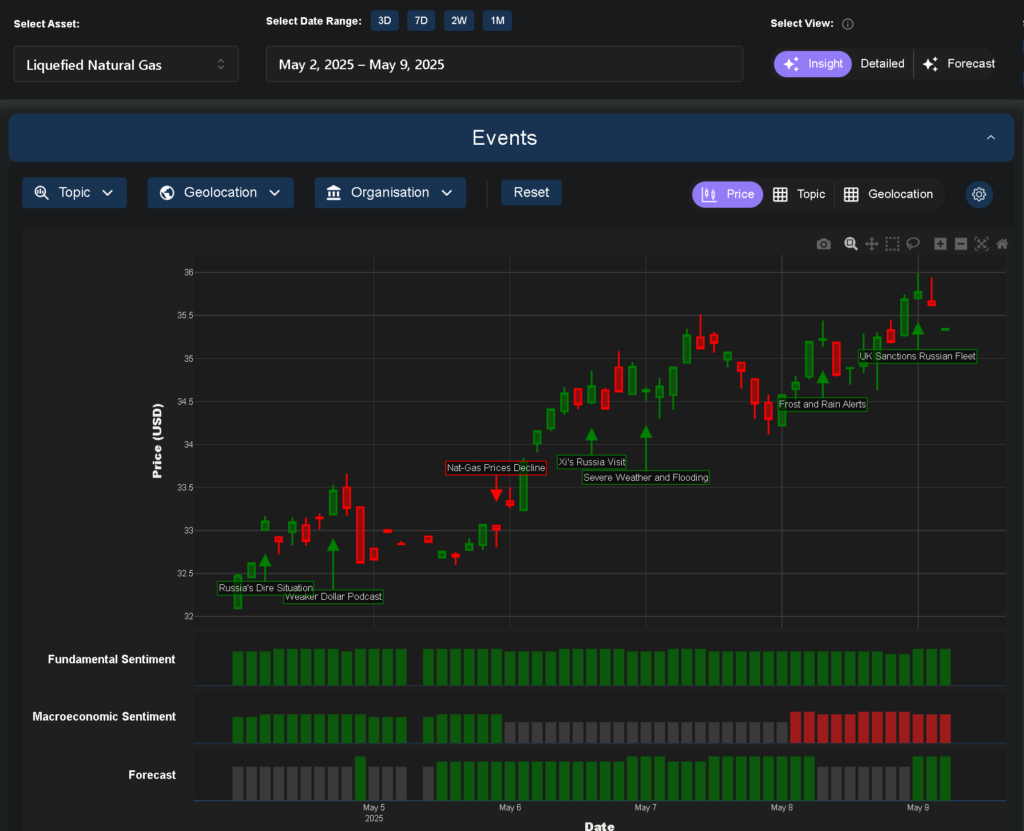

Our LNG data feed has already captured several key market sentiment developments that illustrate its effectiveness in identifying tradable signals. During the past week alone, our data service detected significant price movements driven by a complex interplay of weather concerns, geopolitical tensions, and shifting supply-demand dynamics.

For example, Thursday’s market activity (8 May) revealed growing concerns about weather impacts on energy demand, with our system identifying specific regional factors including hurricane preparations in Florida and reduced precipitation in New Mexico. These localised developments contributed to price movement from $34.58 to $34.96, demonstrating how our data-as-a-service offering can connect seemingly disparate events to identify their collective market impact.

On Wednesday (7 May), our LNG data feed capture important demand signals from Southeast Asia, where surging power requirements amid unsettled weather patterns are prompting a prioritisation of gas in the regional energy mix. This intelligence provided valuable context for the day’s price movement from $34.63 to $34.29, highlighting how profit-taking and market corrections can temporarily overshadow positive demand fundamentals.

Perhaps most significantly, Tuesday’s substantial price rally from $33.29 to $34.90 coincided with our system’s identification of Chinese President Xi Jinping’s upcoming visit to Russia, with energy cooperation featuring prominently on the agenda. This geopolitical development, captured early by our data service, provided traders with crucial advance intelligence on potential shifts in global LNG supply dynamics.

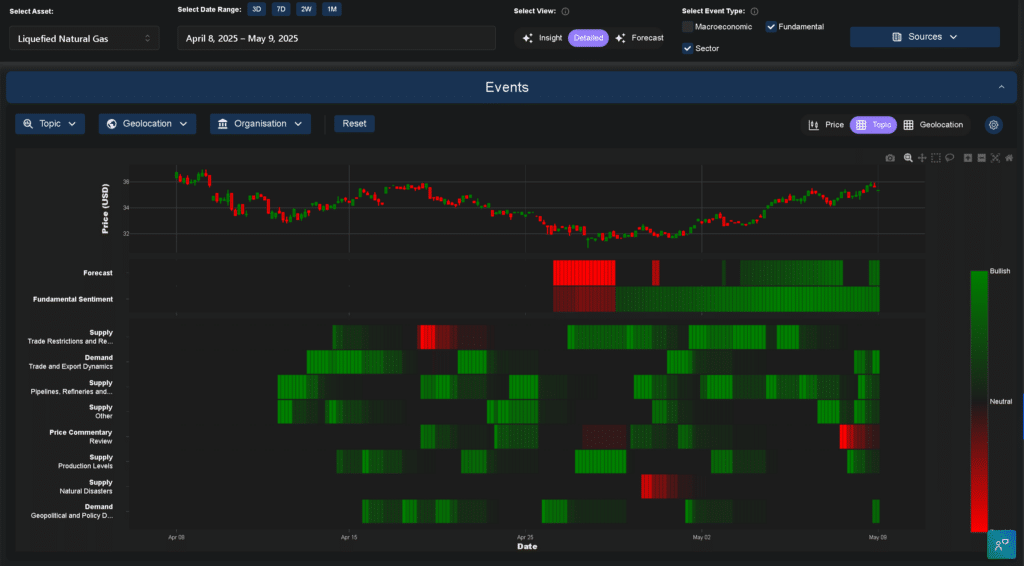

Figure 1: Visualisation of LNG data feeds and price movements (April 8 – May 9, 2025), showing our comprehensive sentiment analysis across multiple market dimensions

Comprehensive LNG data

What truly distinguishes our LNG data feed is its ability to contextualise price movements within broader market narratives. Rather than simply tracking fluctuations, our data-as-a-service offering identifies the underlying catalysts and potential implications for future market direction.

For instance, our system detected significant supply-side developments including the United States matching its monthly export record, whilst simultaneously capturing demand-side signals such as QatarEnergy’s negotiations with Japan for long-term supply arrangements. This comprehensive data perspective enables traders to develop more nuanced strategies that account for the full spectrum of market influences.

The feed also demonstrates our data service’s ability to monitor corporate developments with potential market implications, such as TotalEnergies’ deprioritisation of Argentine LNG investments and BP’s credit outlook adjustment for Woodside. These corporate signals, when combined with geopolitical and weather-related intelligence, provide an unparalleled view of market dynamics.

Figure 2: Visualisation of LNG data feeds showing key market-moving events identified by our specialist LLM technology

Specialist LLM technology driving superior data services

Our LNG data feed is powered by the same specialist LLM technology that has established Permutable AI as a leader in data-as-a-service for financial markets. By combining advanced natural language processing with deep domain expertise in energy markets, we’ve created a solution that goes beyond conventional news aggregation to deliver genuinely actionable trading data.

“The expansion into LNG represents a natural evolution of our data-as-a-service capabilities,” explains Wilson Chan, our founder. “Energy markets are increasingly influenced by complex, interconnected factors ranging from weather patterns to geopolitical developments. Our specialist LLM tools transform this complexity into structured, accessible data that traders can immediately incorporate into their decision-making processes.”

What sets our data service apart is our unwavering focus on practical implementation. Unlike traditional market data providers that require extensive integration work, our LNG feed delivers immediate value through our plug-and-play architecture, allowing traders to incorporate these insights into their workflows without disruption.

Comprehensive data coverage across energy markets

The addition of LNG complements our existing energy market data services, providing clients with a comprehensive view across interconnected commodities. This holistic data perspective is particularly valuable given the increasing correlation between LNG and other energy markets, including natural gas, crude oil, and even renewable energy sources.

Our data feed has already identified several instances where developments in one energy sector created ripple effects across others. This cross-commodity perspective is further enhanced by our service’s ability to identify second-order effects that might escape conventional analysis. When Southeast Asian countries prioritise gas for power generation, this has implications not only for LNG prices but also for coal, renewables, and even carbon markets – connections that our data-as-a-service platform is designed to identify and explain.

Immediate availability for existing and new clients

The LNG data feed is available immediately to both existing clients and new users of our Trading Co-Pilot. For current clients, the data service is accessible through the same intuitive interface they already use, requiring no additional setup or integration work. New clients can begin receiving LNG data insights within hours of engagement, experiencing the same frictionless implementation that defines all our data-as-a-service offerings.

“We’re committed to continuously enhancing our data services based on client needs,” adds Chan. “The addition of LNG reflects our ongoing dialogue with energy traders seeking more sophisticated data tools to navigate increasingly complex market conditions.”

Experience our LNG data

Our early results demonstrate that the LNG feed delivers the same advantages that have made our existing data services indispensable to commodity traders – immediate implementation, actionable insights, and a genuine competitive edge in rapidly changing markets.

As geopolitical tensions, weather concerns, and energy transition dynamics continue to drive volatility in LNG markets, access to sophisticated, real-time data has never been more valuable. Our data-as-a-service offering provides exactly that, enabling traders to identify opportunities and manage risks with unprecedented clarity and confidence.

Access our LNG data feed

To experience the transformative impact of our LNG data feed and broader Trading Co-Pilot capabilities, we invite energy traders and financial institutions to request a personalised demonstration. See firsthand how our data feeds can enhance your trading strategies and decision-making processes with immediate, actionable intelligence. Request a demonstration b emailing enquiries@permuable.ai or simply fill in the form below and find out how our data services can give your trading operation a decisive advantage in today’s complex energy markets.

Permutable AI – Specialist data-as-a-service solutions delivering instant market intelligence with zero integration headaches.