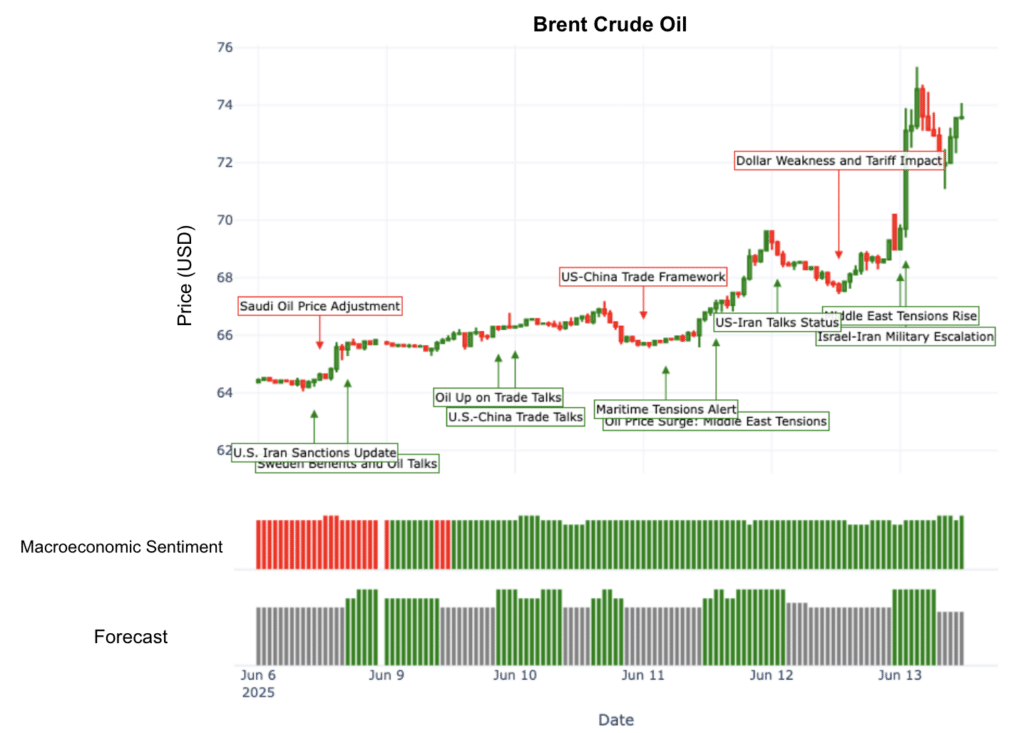

Over the past week, oil prices have demonstrated a significant upwards trajectory owing to the mounting geopolitical tensions between Israel and Iran. Brent Crude prices surged between June 6 and June 13, reaching one of the highest points in months, nearing the $75 per barrel mark. This sharp change in price momentum reflects trader responses to the intensifying military conflict. Notably, our Trading Co-Pilot sentiment analysis tools detected this oil prices rally early, signaling a strong bullish forecast to our clients ahead of the market surge.

Geopolitical uncertainty driving oil prices rally

Both Brent Crude and WTI’s latest price ascendance is primarily driven by heightened concerns over a potential broader spillover in the region. Recent Israeli strikes on Iranian nuclear and missile facilities, met with drone attacks from Iran, have fundamentally altered market risk perceptions within the oil sector. While there have been no direct disruptions to oil supply infrastructure or strategic trade routes so far, the persistent threat to the Strait of Hormuz has fueled this oil prices rally through speculative trading and bullish sentiment.

The critical choke point for global oil shipping has investors incorporating a higher risk premium into oil prices due to the potential for future disruptions in this strategically vital region. This geopolitical premium has been a key driver of the current oil prices rally, with market participants closely monitoring developments.

Table of Contents

ToggleSentiment indicators: Early detection of market movements

Our proprietary Trading Co-Pilot’s sentiment indicators aligned closely with the oil prices rally, confirming a strong bullish signal ahead of the price action. The sentiment gauge tools, which assess the economic and fundamental implications of the escalation, showed a steep rise in bullish sentiment between June 11 and June 13, perfectly capturing the market outlook that would drive the subsequent oil prices rally.

This provided a clear early indication that investors anticipated supply side risks and a flight to safe-haven assets would drive Brent Crude and WTI prices higher, positioning our clients ahead of the oil prices rally that followed.

Beyond the immediate geopolitical concerns, the surge in both Brent Crude and WTI has also been supported by a broader investor shift towards safe-haven assets, including gold and stable currencies, amidst rising global uncertainty. However, there are emerging signs that this strong oil prices rally momentum may be moderating.

Our platform’s sentiment forecast has cooled since to a neutral stance, suggesting that the market might be becoming overextended following the recent oil prices rally. This could indicate a period of profit-taking, as investors await further developments concerning the regional tensions and evaluate whether the current price levels accurately reflect the risk premium.

Above: Brent Crude Oil price chart (June 6-13, 2025) showing the dramatic oil prices rally from \$64 to \$75 per barrel driven by escalating Israel-Iran military tensions. The integrated sentiment analysis indicators (green bars) correctly predicted the bullish breakout, while key geopolitical events including “Middle East Tensions Rise” and “Israel-Iran Military Escalation” are clearly marked at inflection points. The macroeconomic sentiment shifted from bearish (red) to strongly bullish (green) as dollar weakness and tariff impacts amplified the rally. This visualisation demonstrates how advanced sentiment analysis tools like our Trading Co-Pilot can provide early warning signals for major commodity price movements in volatile geopolitical environments.

Don’t miss the next market move

Our advanced sentiment analysis tools identified this rally days before it happened, giving our clients a crucial edge in volatile energy markets. Join the professional traders who rely on our proprietary Co-Pilot indicators to spot profitable opportunities before the crowd. Get exclusive access to real-time sentiment analysis, early warning signals, and expert market insights that could transform your trading results.

Email enquiries@permutable.ai to request a demo and discover why leading institutional investors trust our platform to navigate complex commodity markets with confidence.