US Federal Reserve Chairman Jerome Powell’s announcement about upcoming interest rate cuts signals a key shift in the world’s economic scene. The Fed now aims to boost economic growth by lowering borrowing costs, after years of sharp rate increases to control inflation. This change comes as inflation in the United States seems to be moving towards the central bank’s 2% goal. Yet, this choice affects more than just the US. Countries worldwide are keeping a close eye on these changes and the United States inflation rate.

The Fed’s decision around the United States inflation rate

Jerome Powell’s speech at the Jackson Hole meeting points to a big shift in US monetary policy. The Fed, which had been hiking interest rates fast to fight the worst inflation in years now plans to cut these rates. US inflation hit 9.1% in June 2022 but fell to 2.9% in July 2024, so the central bank thinks it has a handle on price growth and can start to loosen its money stance. Powell also noted “downside risks” to jobs, with unemployment up a bit. This shows the Fed worries about the economy slowing down if tight money rules stay too long.

People expect the Fed to cut rates to keep the US economy from falling into a recession. When the Fed lowers interest rates, it tries to make borrowing cheaper for companies and consumers, which should boost economic activity. This is part of a bigger plan to achieve a “soft landing,” where inflation returns to normal without causing a major economic slump. But when and how fast these cuts happen will be key and will depend on ongoing economic numbers and risks.

How the world sees and responds to United States inflation rate and interest rates

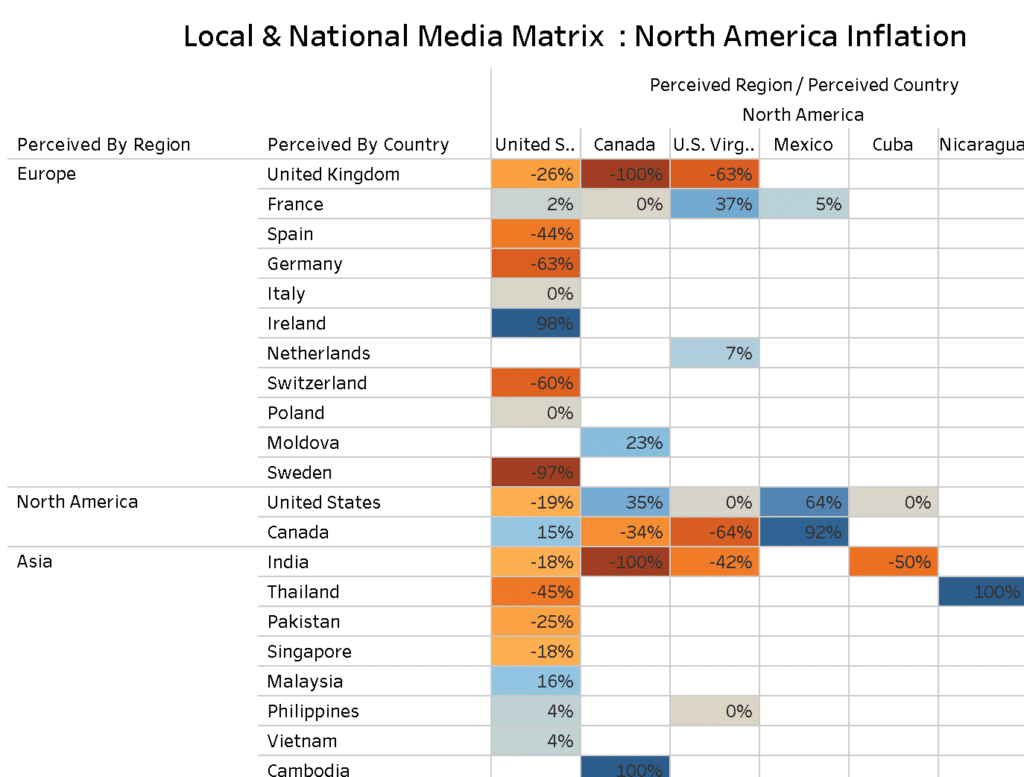

The US, as the world’s biggest economy, has a big influence on global financial markets. When it changes its monetary policy, like adjusting interest rates, this has widespread effects. The way different parts of the world see the United States inflation rate, based on our news sentiment analysis data taken from our Country Bias Matrix, part of our Geopolitical Dataset, gives us a good feel of how various regions view the situation.

How Europe perceives the United States inflation rate

In Europe, perceptions of US inflation vary significantly. Big economies like Germany and Spain mostly view the United States inflation rate negatively . They worry about how US economic policies might affect their own economies. Take Germany, for example. It relies heavily on international trade. It might be afraid that US inflation and high interest rates could make fewer people buy its goods. Spain has a similarly negative perception, suggesting it’s concerned about keeping its economy stable and how US inflation might impact the Eurozone.

Still, nations like Ireland stand out with a positive outlook maybe showing a more upbeat view of economic bounce-back and gains from trade across the Atlantic. This split in views within Europe highlights the ins and outs of the region’s economic scene where different countries feel the effects of US money policies in different ways and to different degrees.

How Asia views the United States inflation rate

Asian countries have different views on United States inflation rate. India and Thailand have a negative outlook because they worry about how the United States inflation rate and interest rates might affect money flows and exchange rates in their economies. A stronger US dollar backed by high interest rates, can cause money to leave emerging markets. This makes their currencies weaker and increases the cost of imports key products like oil.

Vietnam however, sees US inflation in a positive light. This suggests they feel good about their economic ties with the US and might see chances for trade and investment. These different views across Asia show how various economies think about and get ready for the effects of US policies. Their unique economic links and dependencies shape these outlooks.

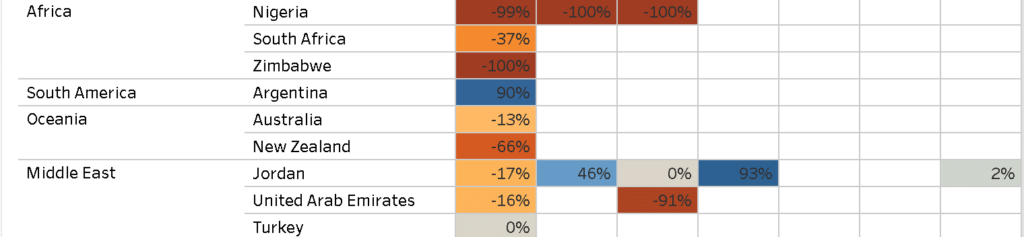

Africa and Oceania’s concerns

In Africa, people see US inflation as bad news in countries like Nigeria and Zimbabwe. These countries already face significant money problems. They think the US inflation and the interest rates that come with it make their economic troubles worse, making it harder for them to handle debt and get new investments.

Oceania, including Australia and New Zealand also has a negative view. These countries depend a lot on global trade. They worry that US economic choices will affect global demand and the prices of raw materials. This matters a lot to their economies, which rely on selling goods to other countries.

How does North America perceive itself?

North America shows a split in views. The US has a mixed outlook, with both good and bad sentiments about inflation. This divide shows the wider argument in the US about how inflation and Fed policies affect different parts of the economy.

Canada also has a mix of bad and good views. This is likely because it’s so tied to the US economy. Changes in US inflation and interest rates shape Canadian economic factors, from trade balance to how strong the currency is.

The wider effects of the Fed’s rate cut

The US Federal Reserve’s choice to reduce interest rates is set to have a big impact on world money markets. Countries that don’t see US inflation in a good light, like those in Africa and some parts of Europe and Asia, might worry about ups and downs in money flows, currency rates, and economic steadiness. These countries may need to take steps to protect their economies from possible shocks.

On the flip side, countries with a brighter view such as Ireland and Vietnam, might see the Fed’s moves as a chance to build stronger economic bonds with the US. They could take advantage of cheaper loans and the better economic outlook in the world’s biggest economy.

Addressing global economic sentiment: Final thoughts

As the US Federal Reserve prepares to lower interest rates, the world economy keeps a close eye feeling both excited and worried. The different views shown by our Country Bias Matrix show how complex and linked today’s global economy is. For leaders and companies around the world, it’s key to understand these views to handle the ups and downs that will come as the Fed starts this new phase in how it manages money. Ultimately, the US’s chance to pull off a “soft landing” will not test its own economy but also signal how stable the world economy might be in the coming years.

Find out more

If you’re interested in understanding more about how global perceptions of inflation or other market factors can influence geopolitical dynamics, or if you want to explore our comprehensive geopolitical intelligence offerings, reach out to us. To discover how our cutting-edge data insights can help your business stay ahead of global trends and make informed decisions in an ever-changing economic landscape simply email us at enquiries@permutable.ai or fill out the form below.