This article explores how the 2-year T-note became the focal point of a short-duration rally and subsequent reversal, and how our Trading Co-Pilot tracked both in real time. From detecting the initial bullish pivot in mid-July to flagging the slowdown as macro headwinds emerged, our Trading Co-Pilot continues to provide institutional investors with a distinct tactical edge.

In today’s volatile fixed income landscape, turning points in US Treasuries are increasingly driven by subtle shifts in sentiment rather than traditional data releases alone. This is where our Trading Co-Pilot proves invaluable, capturing the earliest signals across monetary policy, trade flows, and geopolitical risk.

Table of Contents

ToggleReal-Time Detection: The Early Bullish Signal

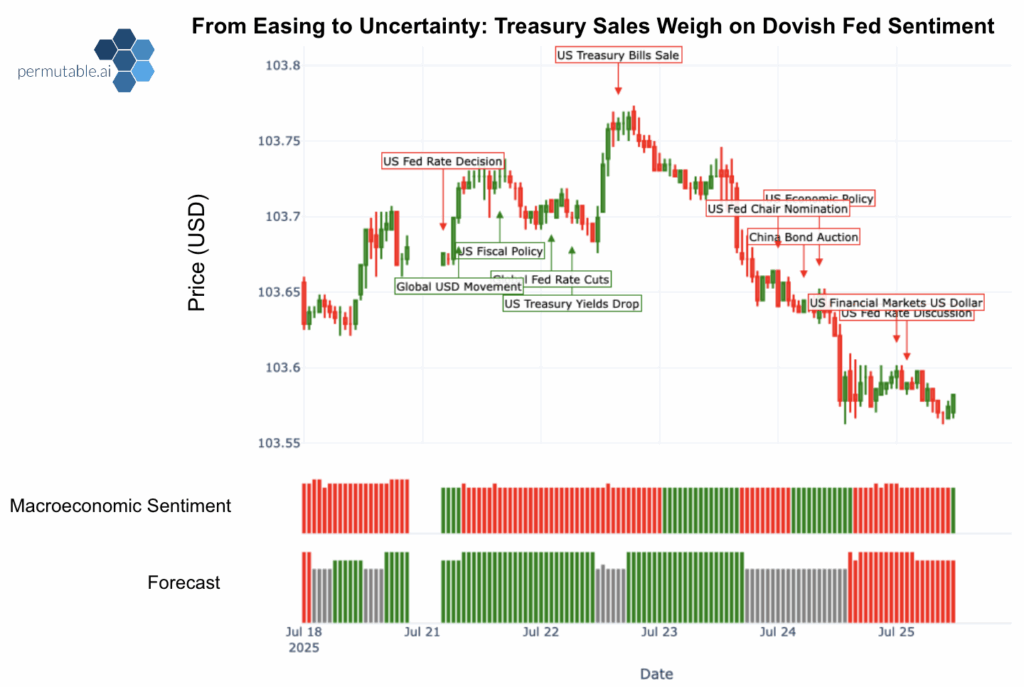

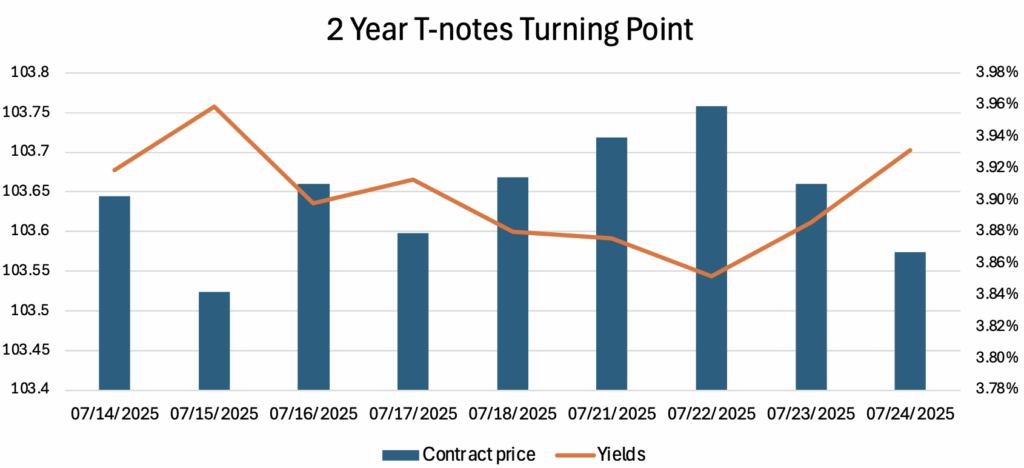

Between 18 and 23 July, our Trading Co-Pilot flagged a steady build-up in bullish sentiment surrounding the 2-year T-note as yields declined to around 3.85%, while the contract price rose from $103.60 to $103.75. This signal was driven by a combination of:

- Dovish messaging from Federal Reserve officials.

- Strengthening US-Japan trade ties.

- Heightened geopolitical tensions supporting safe-haven flows.

- A more disciplined fiscal tone from US policymakers.

The signal came early, giving investors time to rotate before the broader market responded.

What Moved the Needle

Renewed Trade Optimism

The recently signed US-Japan trade agreement, valued at over $550 bn, acted as a macro catalyst. Key provisions included Japanese investment in critical US sectors such as semiconductors and pharmaceuticals, alongside a reduction in US tariffs on Japanese cars from 27.5% to 15%.

The easing of trade tension sparked a rally in Japanese equities and led to a weaker greenback against the yen, improving the relative value of US Treasuries to foreign buyers. Our Trading Co-Pilot picked up on this rotation early, flagging sentiment gains tied to trade and FX dynamics.

Fiscal Restraint and the Supply Picture

The US Congress’s approval of a $9bn spending cut, targeted at foreign aid and public broadcasting, added another layer of support. Though modest in scale, it signalled a willingness to rein in public spending buoying investor confidence in fiscal restraint. The US Treasury’s preference for longer-dated issuance further supported demand at the short end.

Dovish Signals

Additional support came from Fed Governor Christopher Waller, whose dovish tone reinforced expectations for rate cuts to come. Although June CPI rose slightly to 2.7% from May’s print, inflation remained within the Fed’s acceptable range despite the trickle of tariff based inflation pressure creeping in. Our Trading Co-Pilot integrated these developments into a rising sentiment score well ahead of the rally in 2-year T-note prices.

Inflection Detected: From Momentum to Market Caution

However, from 24 July our Trading Co-Pilot detected a turn in sentiment as yields creeped back up and contract prices fell. This preceded the broader pause in Treasury gains and was driven by a convergence of factors:

- A significant upcoming $70 bn 5-year treasuries auction raised concerns over short-end supply.

- Renewed political tensions, as President Trump clashed publicly with Fed Chair Powell over fiscal priorities, with the chair signalling no intention to resign.

- A strengthening US dollar reduced the appeal of Treasuries for foreign investors.

- Economic data surprised markets, particularly a drop in initial jobless claims and robust consumer sentiment.

Stronger labour market figures published on Thursday shifted the narrative of a slowing US growth. While markets still expect rate cuts in 2025, they have pulled back from pricing in two full cuts this year. A hold in July remains fully priced in, though expectations for a September move have weakened modestly.

Our Trading Co-Pilot incorporated these dynamics in real time. The forecast sentiment turned bearish on 24 July as yields rose and contract prices fell, reflecting an erosion in conviction around monetary easing. This foresight offered a vital edge as institutional positions recalibrated.

The Bigger Picture

The 2-year T-note remains the most direct expression of market rate expectations. With its low duration and deep liquidity, it responds swiftly to shifts in policy tone and macro narrative. The combined effects of policy recalibration, geopolitical strain, trade stabilisation, and fiscal prudence have created a mixed environment for the 2-year T-note. Our Trading Co-Pilot translates these developments into forward-looking sentiment scores, ahead of both price action and consensus forecasts.

Safe Haven Rotation: Flight to Yield Amid Volatility

Even as gold retreated amid easing trade tensions, demand for 2-year T-notes still holds firm over concerns of increased market volatility. Our Trading Co-Pilot identified this divergence in real time, flagging a rotation towards yield-linked defensives as investors sought both safety and return.

Meanwhile, ongoing geo-political uncertainty in Japan, regional instability in the Middle East, and the prolonged war in Ukraine continued to support short-duration US Treasuries. Our Trading Co-Pilot tracked this constructive sentiment across geopolitical developments.

Turn Market Complexity into Trading Edge

In a week marked by rapid shifts, our Trading Co-Pilot demonstrated its value as a real-time lens on the T-notes market. It identified the early bullish pivot, tracked the influence of trade diplomacy and macro policy, and detected the reversal.

In a market shaped by policy transition, trade realignment, and ongoing geopolitical risk, the 2-year T-note anchors institutional positioning.

Our Trading Co-Pilot intelligence suite delivers early, forward-looking insight across these moving parts, helping investors anticipate change and act before it becomes consensus.

For enquiries or trial access to our API or dashboard, contact us at: enquiries@permutable.ai