Alternative data has been changing the landscape of institutional investment strategies, transforming how hedge funds, asset managers, and systematic traders identify alpha opportunities in increasingly competitive markets. As traditional data sources become commoditised, sophisticated investors are turning to alternative data streams to gain decisive informational advantages.

This comprehensive guide addresses some of the most common questions that are posed to us about our alternative data solutions, drawing from our extensive experience serving institutional clients across global markets. Whether you’re a quantitative hedge fund seeking systematic signals or an algorithmic trader building next-generation strategies, understanding how our structured macro intelligence can enhance your competitive edge is essential.

Table of Contents

ToggleWhat does Permutable’s alternative data encompass and why does it present value for institutional investors?

Our alternative data encompasses structured macro intelligence that transforms unstructured news and global signals into decision-ready formats for systematic trading. Unlike standard market data or fundamental company information, we capture real-world activities, sentiment patterns, and macro-economic signals that traditional datasets often miss or deliver with significant lag.

For institutional investors, our alternative data offers unprecedented granularity and timeliness. We structure thousands of verified media sources into systematic trading signals with hourly refresh rates, providing measurable alpha generation opportunities particularly in markets where traditional fundamental analysis has become increasingly crowded.

The sophistication of our alternative data lies in its backtest-ready format and systematic applicability. Rather than raw news feeds or unprocessed data streams, we deliver professional-grade structured intelligence that integrates immediately into quantitative models and systematic trading frameworks through our robust API infrastructure.

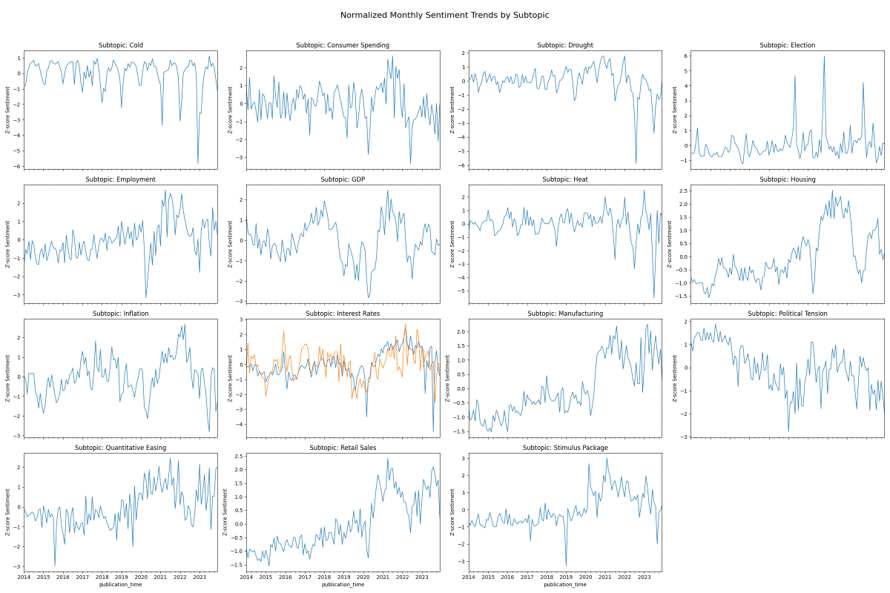

Above: Permutable’s structured macro intelligence capabilities, tracking normalised sentiment trends across 16 key economic and political subtopics from 2013 to 2025 illustrating how our alternative data transforms unstructured news flows into backtest-ready formats for institutional investors.

How does our alternative data differ from traditional market data sources?

Traditional market data typically includes price movements, trading volumes, and company financials reported on standardised schedules. Alternative data, conversely, captures real-time activities and sentiment shifts that often precede market movements. This temporal advantage creates significant opportunities for systematic strategies.

Our geopolitical intelligence feeds, for instance, structure thousands of verified media sources into decision-ready formats with hourly refresh rates. This contrasts sharply with traditional economic releases that arrive monthly or quarterly. The frequency and granularity enable intraday and high-frequency trading applications that traditional data cannot support.

Alternative data also provides cross-asset correlation insights that traditional sources miss. Political tension indices, for example, demonstrate predictive relationships with commodity prices, foreign exchange movements, and equity sector rotations. These multi-dimensional relationships offer systematic traders sophisticated signal diversification opportunities.

Which types of alternative data are most valuable for systematic trading strategies?

Our geopolitical intelligence represents perhaps the most powerful alternative data category for systematic strategies. Using our multi-entity sentiment code, we can analyse how multiple countries, companies, or public figures are simultaneously influencing market sentiment – providing deeper macro context for signal generation. Here, political events, international conflicts, and policy shifts create measurable market impacts that traditional economic indicators cannot capture. For example, our Political Tension Index, built from structured news analysis, provides quantifiable metrics for political risk assessment.

Economic sentiment analysis delivers another crucial data stream. By processing thousands of economic reports, policy statements, and market commentary, sentiment analysis identifies regime changes before they appear in traditional economic releases. This forward-looking perspective enables systematic strategies to position ahead of market consensus.

Meanwhile, credit risk monitoring through alternative data sources provides real-time sovereign and corporate risk assessment. Traditional credit ratings often lag actual risk developments by months. Alternative data captures risk signals from news flows, policy changes, and market sentiment shifts in real-time, enabling more responsive risk management.

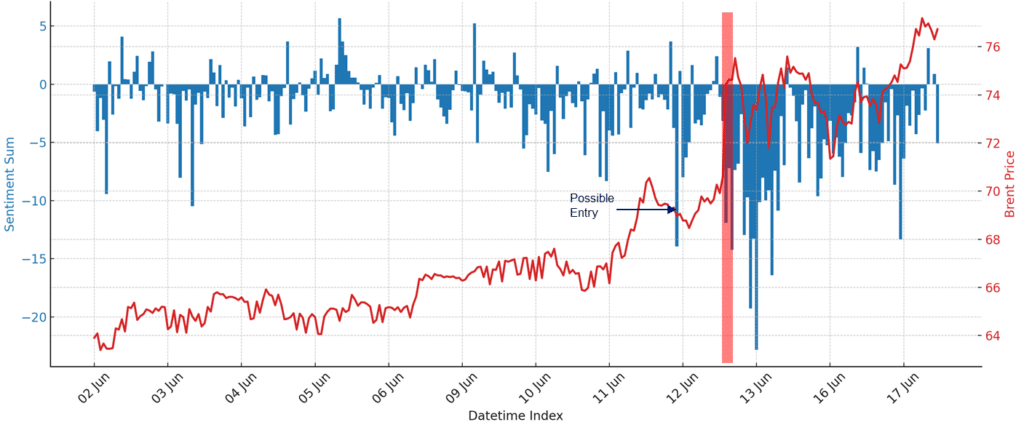

Real-time sentiment signal (blue) overlaid with Brent crude oil price (red) highlights a potential long entry triggered by extreme negative sentiment divergence on 12 June. Our sentiment intelligence enables traders to identify uncrowded, time-sensitive opportunities – often long before price moves are fully realised – helping avoid alpha decay and signal saturation.

How do we help investors avoid alpha decay?

One of the greatest challenges facing institutional investors today is alpha decay – the gradual erosion of signal strength as market participants increasingly adopt the same data sources and trading strategies. Many alternative data providers offer datasets that, while initially novel, become quickly commoditised and crowded as adoption scales. At Permutable, our core focus is on delivering signals that remain differentiated and effective over time.

We achieve this in several key ways:

Non-crowded, underutilised signal space. Our intelligence is built on a unique blend of geopolitical, economic, and sentiment-based data that is not widely available in the institutional market. This means our signals aren’t overexploited, preserving their ability to generate alpha even as strategies scale.

Proprietary sentiment modelling. Our multi-entity sentiment code allows us to uncover subtle, context-specific sentiment divergences across geographies, sectors, and actors—insights that are difficult to replicate or dilute through mass usage.

High-frequency updates and backtested validation. Our signals are refreshed hourly, enabling you to act on emerging risks and opportunities before they are priced in. Combined with over a decade of historical coverage, we offer robust backtesting to ensure that signals show durability – not just novelty.

Internal signal deployment and continuous refinement: We use our own sentiment data in live trading strategies. This real-world application gives us constant feedback on signal drift, market saturation, and noise allowing us to recalibrate and innovate faster than traditional data vendors.

By focusing on data that is structurally distinct, continuously updated, and validated through real-world application, Permutable empowers systematic traders to sidestep the pitfalls of crowded trades and alpha erosion – ensuring your strategy remains ahead of the curve.

How can institutional investors integrate our alternative data into existing systematic frameworks?

Our API delivers millisecond response times with enterprise-grade uptime guarantees, ensuring seamless integration with existing systematic trading platforms with full documentation and client libraries for Python, R, and Java facilitate rapid implementation.

Our backtest-ready formats enable immediate historical analysis without extensive data processing. Additionally, our 10+ years of historical coverage supports comprehensive strategy development and validation. This historical depth allows systematic traders to understand how alternative data signals performed across different market regimes and economic cycles.

The key to successful integration lies in treating our alternative data as complementary signals rather than standalone indicators. Combining geopolitical intelligence with traditional macro signals and other inputs for instance, creates more robust systematic strategies than either data source alone. This layered approach improves signal reliability and reduces false positives.

Above: Our Political Tension Index (Z-score, red) plotted against the 30-Year U.S. Treasury Yield (black). This visual highlights how rising political sentiment stress often precedes or coincides with yield inflections – offering a unique, forward-looking macro signal. Institutional investors use this signal to anticipate shifts in rate expectations and manage duration risk, gaining an edge unavailable through traditional data alone.

What are some key considerations?

We are well aware that signal quality can vary significantly across alternative data providers. Poorly structured or unvalidated data can generate noise rather than alpha. At Permutable, we mitigate this risk through sophisticated natural language processing, rigorous source verification, and consistent structural formatting – ensuring that our data delivers real, systematic trading value.

Latency is another critical factor. While alternative data often offers a temporal edge, the time it takes to transform raw inputs into structured signals can impact usefulness. Our feeds refresh hourly, striking the right balance between low latency and high signal quality for live and backtesting environments.

Coverage limitations can also affect some data sources, especially across diverse regions and languages. What sets us apart is how we work in partnership with you during the testing phase – adapting, refining, and aligning our data to your strategy needs. This collaborative approach ensures the best possible fit and performance for your specific investment mandates and geographic focus.

How we do differentiate ourselves against other alternative data providers?

At Permutable, we’re not just another alternative data provider. We’re a next‐gen market insights company that goes beyond basic articles and sentiment coverage to deliver actionable intelligence designed for the top trading desks. Our offering includes:

Comprehensive news coverage and automated insights

We deliver deep news intelligence that captures the time of story break-out, summarisation, sentiment analysis, and even the impact on asset prices. Our automated market insights provide detailed round-ups, price causation analysis, and even 24‑hour forecasting to give you a holistic view of market events

Systematic trading support

We back our data with robust systematic trading support – enabling institutional clients to backtest strategies on historical data spanning over 10 years, with hourly updates and even tick-level granularity in some feeds. This isn’t raw data; it’s refined and structured for immediate integration.

Extensive source coverage and rich tagging

With access to over 20,000 sources and dedicated, rich tagging for rich macro and asset taxonomy our insights include detailed asset and macro drivers tailored by region.

Advanced technology and AI expertise

We are advanced practitioners of transformers and large language models. Using our proprietary advanced machine-learning framework – and the best reasoning models from OpenAI, Anthropic, Microsoft, and Google. We continuously test, improve, and deploy our models to generate the market’s most sophisticated insights.

Partnership-driven customisation

We pride ourselves on working in true partnership. While we deploy our data in our own systematic strategies, we work closely with clients – like our weekly collaborations with key desks – to tailor our offerings for optimum alignment, coverage, and delivery. This collaborative approach ensures that our insights fit your unique needs and drive tangible value.

More importantly, we are a tech provider, not a trading house. We are dedicated to equipping our clients with the tools and intelligence they need to succeed, while continuously refining our platform through rigorous internal use and real-world testing.

Looking to test our enterprise-grade alternative data for your systematic trading strategies? Contact our institutional team at enquiries@permutable.ai for a personalised demonstration of how our structured macro intelligence can enhance your quantitative models and systematic trading performance.