At first glance, attempting an Amazon stock price prediction 2030 might seem like a Herculean task, fraught with uncertainties and variables. Dip beneath the surface though, and you’ll find a fascinating landscape of data, trends, and expert insights that paint a compelling picture of the e-commerce giant’s future. At Permutable, we always approach stock predictions with a blend of confidence and humility, leveraging cutting-edge technology while acknowledging the inherent uncertainties of the market. With that in mind, this article will take a look at what you can expect in terms of an Amazon stock price prediction 2030, and key factors to consider.

Table of Contents

ToggleUnderstanding Amazon’s market position and growth potential

Amazon’s journey from an online bookstore to a global tech behemoth mirrors the broader shift in consumer behaviour and the digital transformation of commerce. Yet the reality is that Amazon’s continued dominance is not guaranteed. A skeptic might say that the company’s rapid growth is unsustainable. That’s a difficult thing to admit for many Amazon bulls, but it’s a consideration that can’t be ignored.

No business operates in a vacuum, and Amazon is no exception. The company’s stock price is influenced by a myriad of factors, creating a complex web of influences that shape its market value. This is unlikely to change any time soon.

Factors influencing Amazon stock price prediction 2030

E-commerce growth and market saturation

Amazon’s core business remains e-commerce, and its growth in this sector will significantly impact its stock price in 2030. While e-commerce penetration continues to increase globally, the pace of growth in mature markets like the United States may slow. However, emerging markets present significant opportunities for expansion. The picture varies between different regions, with some markets approaching saturation while others are just beginning to embrace online shopping at scale.

AWS performance and cloud computing dominance

Amazon Web Services (AWS) has been a major driver of the company’s profitability and stock price growth. By 2030, the cloud computing landscape may look quite different, with increased competition from Microsoft Azure, Google Cloud, and other players. However, AWS’s first-mover advantage and continuous innovation could help maintain its leadership position. The bigger picture, though, is that the overall cloud market is expected to grow substantially, potentially offsetting any market share losses.

Regulatory pressures and antitrust concerns

A frisson of fear runs through some investors when considering the regulatory challenges Amazon faces. These are not idle concerns. The world is taking notice of Amazon’s market power, and regulatory scrutiny is intensifying. Addressing this, though, would not be enough to derail Amazon’s growth trajectory entirely. The company’s diversified business model and global presence provide some insulation against regional regulatory actions.

Global economic conditions and consumer spending

The macroeconomic environment will play a crucial role in Amazon’s performance leading up to 2030. Factors such as inflation, interest rates, and overall economic growth will impact consumer spending patterns and, consequently, Amazon’s revenues. Coming out of a brutal period marked by the global pandemic, supply chain disruptions, and economic uncertainty, Amazon has shown remarkable resilience. However, the potential for economic downturns or shifts in consumer behavior remains a consideration in long-term stock price predictions.

Technological innovations and new market entries

Central to that revolution is Amazon’s continued investment in cutting-edge technology. From AI and machine learning to robotics and drone delivery, Amazon is at the forefront of innovation. Much of that is still from the research and development stage, but the potential impact on Amazon’s future value is significant. By 2030, we may see Amazon making significant inroads into new markets such as healthcare, financial services, or even space technology.

Expert predictions for Amazon stock price 2030

By most accounts, Amazon’s stock price is poised for growth by 2030. According to forecasts, Amazon’s stock could reach $838.29 by 2030, representing a potential 349.17% increase from its current price. This argument holds water when considering Amazon’s historical performance and future growth prospects. Meanwhile, anecdotal evidence of Amazon’s continued relevance in consumers’ lives abounds. From e-commerce to cloud computing, streaming services to smart home devices, Amazon’s reach extends far and wide. This ubiquity in daily life supports the bullish case for Amazon’s long-term stock performance.

Challenges and uncertainties in Amazon stock price prediction 2030

While the outlook for Amazon appears generally positive, several challenges and uncertainties could impact its stock price by 2030:

- Increased competition: As the e-commerce and cloud computing markets mature, Amazon faces intensifying competition from both established players and innovative startups.

- Regulatory actions: Potential antitrust measures or increased regulation could limit Amazon’s growth or force the company to divest certain business units.

- Technological disruption: Emerging technologies could disrupt Amazon’s core businesses or erode its competitive advantages.

- Global economic uncertainties: Economic downturns, trade tensions, or geopolitical events could impact consumer spending and cloud adoption rates.

- Leadership transitions: Changes in leadership or corporate strategy could affect investor confidence and the company’s long-term direction.

Again, these are not idle concerns, and their potential impact should be carefully considered when making long-term investment decisions.

The road to 2030

So, why does Amazon continue to captivate investors and analysts alike? The answer lies in the company’s ability to innovate, adapt, and expand into new markets. If you want to break things down to one simple theme, it’s that no one understands this unique combination of change and stability quite like Amazon.

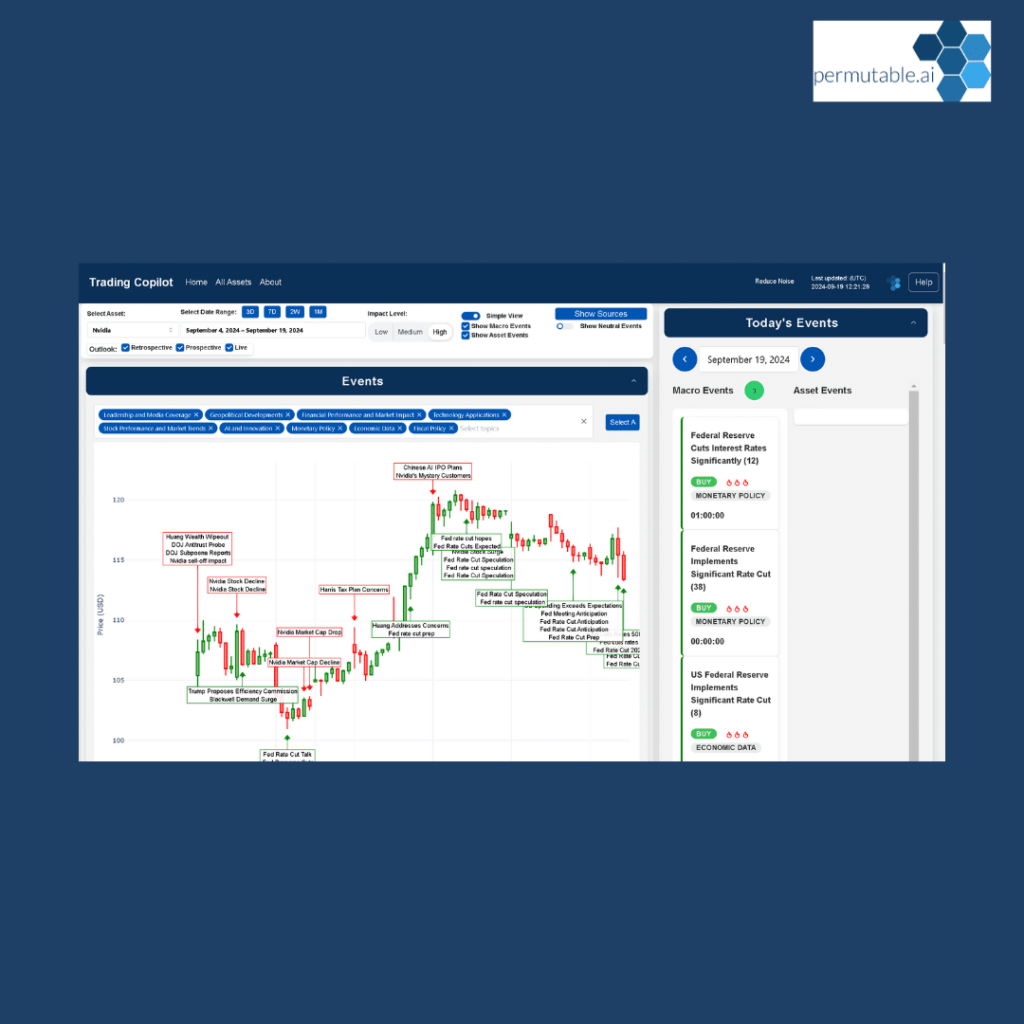

All of which leads to perhaps the most important question: What should investors do with this information? Fortunately, Permutable AI’s Trading Co-Pilot, currently in BETA, will soon be launching to help provide a safe pair of hands for stock trading. Our philosophy has always been to provide data-driven insights while acknowledging the inherent uncertainties in long-term stock predictions, but for the short term, our Co-Pilot will provide you with the real-time information you need to fine tune your investment strategies (more on that below).

Amazon stock price prediction 2030: Final thoughts

When all is said and done, predicting Amazon’s stock price for 2030 is an exercise in informed speculation. In the wake of recent market volatility and economic uncertainty, it’s more important than ever to approach such predictions with a balance of optimism and caution.

So, rather than fixating on a specific price target, investors would be wise to focus on Amazon’s fundamentals, its competitive position, and its ability to innovate. The second hit is to keep a close eye on regulatory developments and global economic trends that could impact the company’s growth trajectory.

While this may paint a complex picture for potential investors, the bigger picture, though, is that Amazon has consistently demonstrated its ability to adapt and thrive in changing market conditions. From its humble beginnings as an online bookstore to its current status as a global tech giant, Amazon has repeatedly defied expectations and reshaped entire industries.

While the exact stock price of Amazon in 2030 remains uncertain, the company’s potential for continued growth and innovation is clear. As always, Permutable AI remains committed to providing insightful, data-driven analysis to help investors navigate the complex world of stock market predictions. By staying informed, adapting to market changes, and maintaining a long-term perspective, investors can position themselves to potentially benefit from Amazon’s future growth while managing the inherent risks of stock market investing.

Register interest for our Trading Co-Pilot

Are you ready to embrace the future of trading? Permutable AI’s Trading Co-Pilot, powered by advanced machine learning, provides real-time insights and context-aware strategies. Harness AI to analyse global sentiment and market events, giving your firm the edge with more precise, risk-aware trading decisions. Contact us at enquiries@permutable.ai or via the form below to explore how our Trading Co-Pilot can transform your trading approach.

Your trading is about to take off

Get in touch to register your interest to see how our Trading Co-Pilot can help you make smarter trading decisions, faster.

Disclaimer: The information provided by Permutable AI is for informational purposes only and does not constitute financial advice, investment advice, or a recommendation to buy, sell, or hold any securities. While we strive to provide accurate and up-to-date information, we do not guarantee the completeness, accuracy, or reliability of the data. All investments involve risks, including the loss of principal. Past performance is not indicative of future results. Users are advised to conduct their own independent research and consult with a licensed financial advisor before making any investment decisions. Permutable AI, its affiliates, or its employees shall not be held liable for any losses or damages resulting from reliance on the information provided.

Further reading

Looking for more stock price predictions? See below for:

Intel stock price prediction 2025

Nio stock price prediction 2025

Palantir stock price prediction 2030

Microsoft stock price prediction 2025

DJT stock price prediction 2025