This Brent crude oil price forecast is a tactical analysis of immediate market conditions affecting Brent crude oil pricing over the next 24 hours, incorporating real-time insights from our Trading Co-Pilot Forecast Agents to provide institutional traders with actionable intelligence for tomorrow’s session. This analysis demonstrates the capabilities of our advanced AI-driven forecasting system, which we are continually enhancing with extended 6-month forecasting capabilities currently in development. It is aimed at energy traders and analysts, and institutional investors requiring immediate market positioning guidance for the next trading day.

The global energy markets are poised for another challenging session as Brent crude oil faces mounting pressure heading into tomorrow’s trading. This analysis represents a demonstration of our cutting-edge Trading Co-Pilot Forecast Agents‘ capabilities, delivering the precision and analytical depth without pages of reports that institutional traders demand for immediate market positioning. Drawing upon our real-time market intelligence, this Brent crude oil price forecast presents key insights for the next 24-hour period, highlighting immediate catalysts that are likely to drive price action.

Our Trading Co-Pilot technology continues to evolve, with development currently underway on extended 6-month forecasting capabilities that will provide unprecedented long-term market visibility. But back to the now. Recent overnight developments have intensified the bearish sentiment surrounding crude oil markets, with key indicators suggesting continued downward pressure through tomorrow’s session. Consequently, our analysis reveals an increasingly negative short-term outlook that demands immediate attention from active market participants.

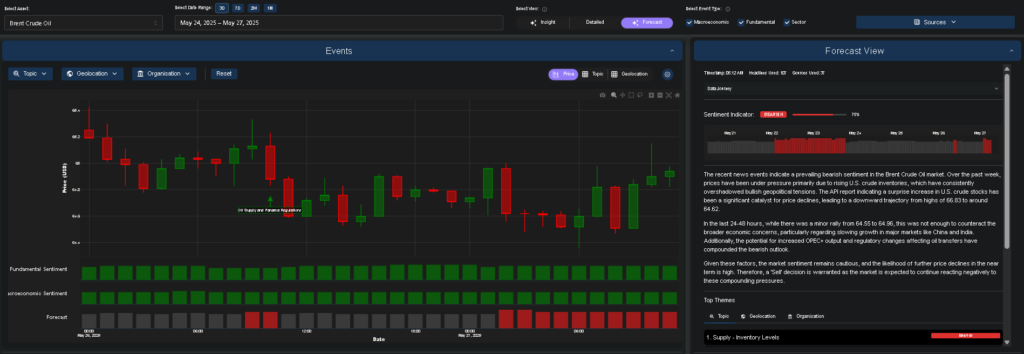

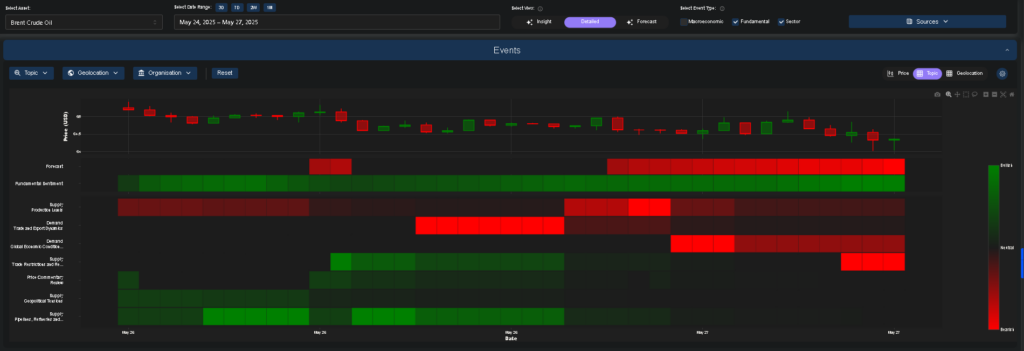

Above: Trading Co-Pilot Brent crude oil forecast view visualisation using forecast agents

Table of Contents

ToggleImmediate price catalysts for tomorrow’s session

The prevailing sentiment surrounding Brent crude oil has turned decisively bearish heading into tomorrow’s trading, with prices positioned for potential further declines from current levels around \$64.62 per barrel. More importantly, overnight inventory data and reports continue to weigh heavily on market sentiment, setting the stage for what could be a challenging 24-hour period.

Furthermore, the American Petroleum Institute’s latest inventory revelation has established a bearish foundation that is likely to persist through tomorrow’s session. These inventory builds are expected to dominate trading sentiment over the next 24 hours, particularly as traders digest implications for brent crude oil price forecast and positioning strategies.

Additionally, whilst yesterday’s modest recovery attempt from $64.55 to $64.96 provided temporary relief, overnight price action suggests this bounce lacks conviction. Early Asian trading indicators point towards renewed selling pressure, with technical levels suggesting limited upside potential over the next trading day. These developments significantly influence our immediate brent crude oil price forecast for tomorrow’s session.

Key supply and demand dynamics

Overnight developments in global oil supply dynamics have created immediate headwinds for tomorrow’s Brent crude trading. Nigeria’s recent emergence as the continent’s leading producer continues to influence supply calculations, whilst mounting speculation regarding imminent OPEC+ announcements threatens to destabilise price action over the next 24 hours.

Moreover, fresh reports suggesting that OPEC+ members may announce accelerated output increases as early as tomorrow have created significant downside risk for crude prices. Markets are positioning defensively ahead of potential policy announcements, with our brent crude oil price forecast reflecting heightened probability of negative price gaps at tomorrow’s opening.

Concurrently, regulatory developments affecting oil transfer operations are expected to influence trading sentiment throughout tomorrow’s session. Recent enforcement actions and shipping restrictions continue to create uncertainty, though their immediate impact on tomorrow’s price action remains secondary to broader supply concerns.

The implications of these overnight supply-side developments suggest that tomorrow’s trading session could see accelerated selling pressure, particularly if OPEC+ signals shift towards more aggressive production policies. Early futures positioning data indicates that institutional players are already adjusting exposure ahead of potential volatility.

Economic and currency pressures

The U.S. dollar has created immediate headwinds for commodity prices, with Brent crude oil particularly vulnerable to currency-driven selling pressure expected to continue through tomorrow’s session and anticipated to persist through the next 24 hours, creating a challenging environment reflected in this brent crude oil price forecast.

Subsequently, concerns regarding immediate demand destruction in key consuming regions have intensified overnight, with fresh economic data from China and India suggesting potential weakness that could influence tomorrow’s trading sentiment. These markets, crucial for global oil demand, are showing signs of immediate softening that have necessitated a more cautious stance in our analytical framework.

Furthermore, overnight developments regarding trade policy and potential tariff adjustments have introduced fresh uncertainty into tomorrow’s energy market dynamics. These policy considerations are creating immediate volatility that extends beyond typical overnight price movements, influencing opening positions and strategic decisions for tomorrow’s session.

Above: Our real-time sentiment analysis dashboard for Brent Crude Oil (May 24-27, 2025) displays a pronounced shift towards bearish territory, with dominant red indicators across forecast sentiment and critical supply-demand metrics signalling significant downward pressure for tomorrow’s trading session. The visualisation clearly demonstrates how rising U.S. crude inventories, potential OPEC+ output increases, and weakening demand fundamentals have overwhelmed previously supportive factors, creating the 75% bearish sentiment environment identified by our Trading Co-Pilot Forecast Agents. Whilst some pipeline and refinery dynamics maintain limited green support, the overwhelming red sentiment across trade and export dynamics, alongside supply technology factors, reinforces our tactical recommendation for defensive positioning in crude oil markets over the next 24 hours.

Geopolitical developments and risk assessment

Despite recent diplomatic developments that might typically support crude oil prices, overnight market response suggests that supply fundamentals will dominate tomorrow’s trading session. Most significantly, fresh developments regarding potential ceasefire negotiations have actually contributed to reduced geopolitical risk premiums, creating additional downside pressure expected to persist through the next 24 hours.

The market’s immediate reaction to these overnight geopolitical shifts highlights the current prioritisation of supply-demand fundamentals over traditional risk premium considerations, with geopolitical risk premiums likely to remain compressed whilst immediate supply pressures persist. Additionally, sanctions-related developments and their enforcement mechanisms continue to influence immediate oil trade flows, though their impact on tomorrow’s price action is expected to remain secondary to broader inventory and supply concerns.

Tomorrow’s trading strategy, today

This analysis demonstrates our AI-driven capabilities for immediate market intelligence, with advanced 6-month forecasting technology currently in development. Contact our team now for a demo on how our Trading Co-Pilot forecasting agents can help you navigate the next 24 hours of volatile energy markets. Simply email enquiries@permutable.ai or fill in the form below.