In this article we will provide a detailed guide to scope 1 2 3 emissions reporting. Environmental, Social, and Governance (ESG) reporting has become increasingly important in recent years, as companies are expected to be transparent about their impact on the environment and society. The Task Force on Climate-related Financial Disclosures (TCFD) was established in 2015 to provide guidance for companies on how to disclose information about the risks and opportunities related to climate change. Today, TCFD-aligned disclosures are considered a best practice, and many companies are required to report on their ESG activities and emissions.

Understanding Scope 1 2 3 Emissions

In order to accurately measure and report on a company’s emissions, it is important to understand the different scopes of emissions, the methods used to calculate emissions, and the different approaches to reporting emissions.

Scope 1 emissions are those produced directly by a company’s operations, scope 2 emissions are generated indirectly by a company’s consumption of electricity, heat, or steam, and scope 3 emissions are all indirect emissions that are not included in scope 2.

Companies may use a control or equity share approach to calculate their emissions, and the Greenhouse Gas Protocol provides 15 categories of scope 3 emissions to help companies better understand and categorise their indirect emissions. Understanding these concepts is key to producing accurate, transparent ESG reports and ensuring that companies are held accountable for their impact on the environment and society.

Scope 1 2 3 Emissions Reporting

Corporate emissions reporting involves quantifying and disclosing a company’s greenhouse gas (GHG) emissions. These emissions are typically divided into three scopes: scope 1, scope 2, and scope 3. Companies are required to set organisational boundaries which will determine the allocation of the emissions to the different scopes, and these organisational boundaries should be standardised throughout a company’s supply chain emissions to ensure accurate accounting and reporting.

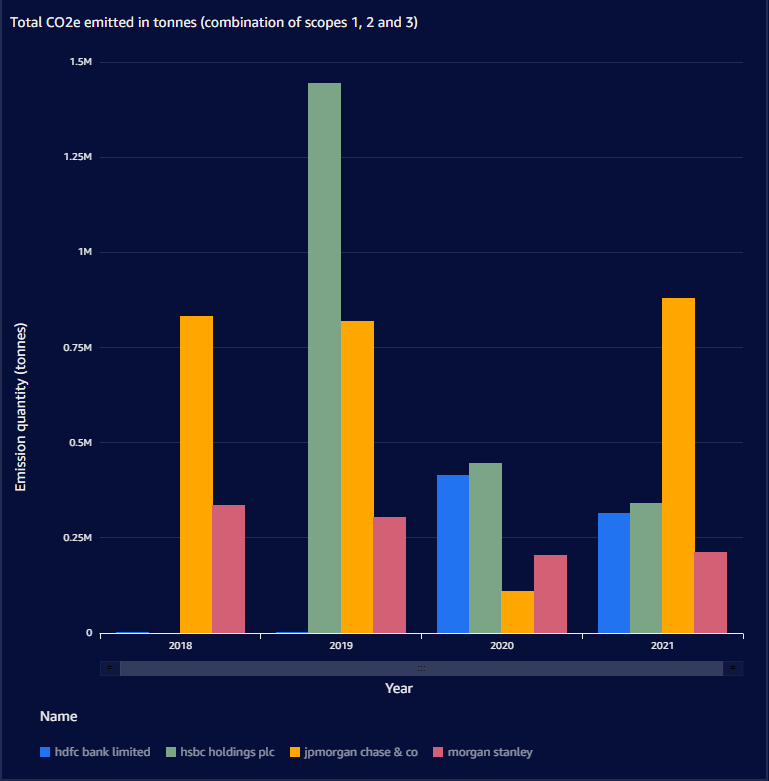

Above: Permutable’s Corporate Emissions Analytics Dashboard. Combination of Scope 1 2 3 emissions of the banking sector.

Scope 1 Emissions:

Scope 1 emissions are produced directly by a company’s operations, such as emissions from on-site combustion of fossil fuels, mobile equipment, and company-owned vehicles.

Scope 2 Emissions:

Scope 2 emissions are generated indirectly by a company’s operations, specifically emissions from the production of electricity, heat, or steam that the company purchases from a utility or supplier. Companies can measure these emissions using two methods: location-based and market-based.

Location-based method

The location-based method entails that an organisation’s Scope 2 emissions are based on the amount of energy consumed at the location where the energy is used. This approach takes into account the energy mix of the specific grid where the energy is consumed and the emissions that are generated from that energy mix. This approach is useful for organisations that have a direct energy connection to the grid and consume a significant amount of energy.

MarkeT-based method

The market-based approach in turn calculates an organisation’s Scope 2 emissions based on the emissions that are generated from the energy mix of a specific region or country. This approach uses a standardised emissions factor to represent the emissions intensity of the energy mix in the relevant region or country. This approach is useful for organisations that purchase energy from a utility company and don’t have direct access to the grid.

The market-based approach tends to result in lower emissions than the location-based approach because the emissions factor used is typically lower than the average emissions intensity of the local grid.

Scope 3 Emissions:

Scope 3 emissions are all indirect emissions that are not included in scope 2. These emissions are generated by activities that are outside of a company’s direct control but are a result of a company’s operations, such as emissions from the production of purchased goods, services, and transportation. The Greenhouse Gas Protocol defines 15 categories of scope 3 emissions, including:

|

Category |

Description |

|

Purchased goods and services |

Extraction, production, and transportation of goods and services purchased or acquired by the reporting company in the reporting year, not otherwise included in Categories 2 – 8. |

|

Capital goods |

Extraction, production, and transportation of capital goods purchased or acquired by the reporting company in the reporting year |

|

Fuel- and energy related activities (not included in scope 1 or scope 2) |

Extraction, production, and transportation of fuels and energy purchased or acquired by the reporting company in the reporting year, not already accounted for in scope 1 or scope 2, including: a. Upstream emissions of purchased fuels (extraction, production, and transportation of fuels consumed by the reporting company) b. Upstream emissions of purchased electricity (extraction, production, and transportation of fuels consumed in the generation of electricity, steam, heating, and cooling consumed by the reporting company) c. Transmission and distribution (T&D) losses (generation of electricity, steam, heating and cooling that is consumed (i.e., lost) in a T&D system) – reported by end user d. Generation of purchased electricity that is sold to end users (generation of electricity, steam, heating, and cooling that is purchased by the reporting company and sold to end users) – reported by utility company or energy retailer only |

|

Upstream transportation and distribution |

Transportation and distribution of products purchased by the reporting company in the reporting year between a company’s tier 1 suppliers and its own operations (in vehicles and facilities not owned or controlled by the reporting company) Transportation and distribution services purchased by the reporting company in the reporting year, including inbound logistics, outbound logistics (e.g., of sold products), and transportation and distribution between a company’s own facilities (in vehicles and facilities not owned or controlled by the reporting company) |

|

Waste generated in operations |

Disposal and treatment of waste generated in the reporting company’s operations in the reporting year (in facilities not owned or controlled by the reporting company) |

|

Business travel |

Transportation of employees for business-related activities during the reporting year (in vehicles not owned or operated by the reporting company) |

|

Employee commuting |

Transportation of employees between their homes and their worksites during the reporting year (in vehicles not owned or operated by the reporting company) |

|

Upstream leased assets |

Operation of assets leased by the reporting company (lessee) in the reporting year and not included in scope 1 and 2 – reported by lessee |

|

Downstream transportation and distribution |

Transportation and distribution of products sold by the reporting company in the reporting year between the reporting company’s operations and the end consumer (if not paid for by the reporting company), including retail and storage (in vehicles and facilities not owned or controlled by the reporting company) |

|

Processing of sold products |

Processing of intermediate products sold in the reporting year by downstream companies (e.g., manufacturers) |

|

Use of sold products |

End use of goods and services sold by the reporting company in the reporting year |

|

End-of-life treatment of sold products |

Waste disposal and treatment of products sold by the reporting company (in the reporting year) at the end of their life |

|

Downstream leased assets |

Operation of assets owned by the reporting company (lessor) and leased to other entities in the reporting year, not included in scope 1 and 2 – reported by lessor |

|

Franchises |

Operation of franchises in the reporting year, not included in scope 1 and 2 – reported by franchisor |

|

Investments |

Operation of investments (including equity and debt investments and project finance) in the reporting year, not included in scope 1 or 2 |

Different Approaches for Calculating Emissions

Defining the organisational boundary is a key step in corporate GHG accounting. This step determines which operations are included in the company’s organisational boundary and how emissions from each operation are consolidated by the reporting company. As detailed in the GHG Protocol Corporate Standard, a company has three options for defining its organisational boundaries. Companies should use a consistent consolidation approach across the scope 1, scope 2, and scope 3 inventories. The selection of an approach affects which activities in the company’s value chain are categorised as scope 1, 2 or, 3 emissions. When calculating emissions, companies can use three different approaches: operational control, financial control, or equity share.

Operational Control Approach

The operational control approach allocates emissions based on the company’s operational control over a facility or asset. For example, if a company has operational control over a coal-fired power plant, it would allocate all of the emissions from the plant to its own scope 1 emissions inventory, even if it does not own the plant.

Financial Control Approach

The financial control allocates emissions based on the company’s financial control over a facility or asset. A company accounts for 100% of the emissions over which it has financial control. It does not account for GHG emissions from operations in which it owns an interest but does not have financial control.

Equity Share Approach

The equity share approach allocates emissions based on the company’s ownership share of a facility or asset. For example, if a company owns 50% of a coal-fired power plant, it would allocate 50% of the emissions from the plant to its own scope 1 emissions inventory.

If a company selects the equity share approach, emissions from any asset the company partially or wholly owns are included in its scope 1 emissions, but emissions from any asset the company controls but does not partially or wholly own (e.g., a leased asset) are excluded from its direct emissions and should be included in its scope 3.

Emissions Exclusions

When reporting GHG emissions, many of the standards such as the GHG Protocol allow for justified exclusions when disclosing emissions. This is most frequently seen during scope 3 emission reporting. Some of these examples of disclosing & justifying exclusions can be considered controversial and have been contested by scientists.

One of these exclusions that have been subject to intense scrutiny is the GHG Protocol: Corporate Standard that requires that direct CO₂ emissions from the combustion of biomass be included in the public report, but reported separately from the scopes, rather than included in scope 1. The separate reporting requirement also applies to scope 3.

This exclusion can thus encourage companies to move to biomass combustion practices which can add pressure on the earth’s forests and force the world into a “carbon debt”. A carbon debt refers to how long it will take to sequester the GHG emitted from the burning of biomass (e.g. trees). The regrowing of trees used for biomass takes time to sequester the CO₂ emissions and this is time the world does not have to solve climate change. Numerous studies have also shown that this burning of wood will increase warming for decades to centuries.

Challenges of Scope 1 2 3 Emissions Reporting

The reporting of scope 1 2 3 emissions have increased dramatically in the past 5 years, but it is still subject to several pitfalls that can be exploited by companies in the form of greenwashing and do more environmental harm than it appears.

Exclusions

As mentioned above, biomass combustion emissions are excluded from scope 1 emissions reporting because they are considered to be carbon neutral, as the carbon released from burning biomass is assumed to have come from recently absorbed atmospheric carbon through photosynthesis. However, this does not negate the fact that the combustion of biomass still produces as much or even more carbon emissions than the combustion of fossil fuels.

Lack of standardisation

There are currently several different reporting standards and methodologies used for reporting emissions, which makes it difficult to compare emissions between companies. The lack of consistent reporting standards can further make it challenging for stakeholders to understand and interpret the data being reported.

Lack of verification

There is further a lack of verification of companies’ emissions reporting. The absence of independent verification and assurance can limit the credibility and reliability of the data being reported. Regulation has increased and the TCFD has made it mandatory for more than 1,300 of the UK’s top companies to report their scope 1 and 2 emissions. Scope 3 emissions reporting is however only encouraged and not enforced. The failure to include scope 3 emissions means that companies can set their boundaries for reporting emissions reporting in such a way that it minimises their scope 1 and 2 emissions.

Voluntary disclosure

As the reporting of scope 3 emissions is not mandatory it also faces less scrutiny and companies can portray a greener image by only reporting some 1 or 2 of their scope 3 emissions categories. When stakeholders then assess the company’s emissions reporting it would seem that their scope 3 emissions are quite low. When implementing tricks like these, companies can make false claims about their emission reductions and route to net zero.

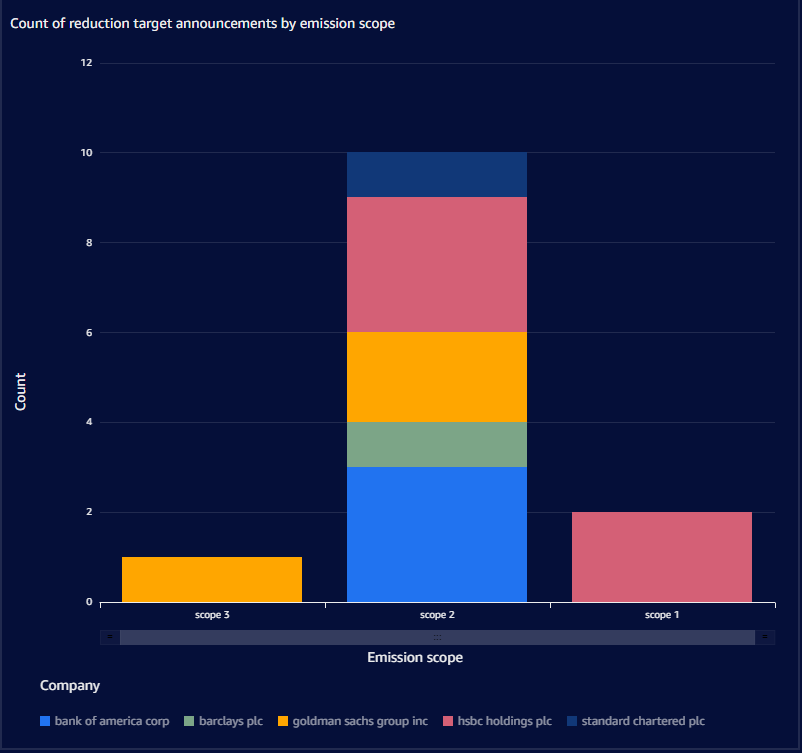

Permutable’s Corporate Emissions Analytics Dashboard. Count of reduction target announcements of the banking sector by scope 1 2 3 emissions.

Conclusion

ESG reporting and corporate transparency on environmental issues are critical to ensuring that companies are held accountable for their impact on the environment and society. The TCFD provides guidance on how to disclose information about climate-related risks and opportunities, and companies are expected to measure and report their emissions using the most appropriate methods and approaches.

Understanding the different scopes of emissions, including scope 1 2 3 emissions as well as the control, and equity share approaches to calculating emissions, is essential to producing accurate and transparent ESG reports. The Greenhouse Gas Protocol provides a framework for companies to categorise their indirect emissions, helping to ensure that all emissions are accounted for and reported in a consistent and meaningful way. Through transparent ESG reporting, companies can demonstrate their commitment to sustainability and their responsibility to the environment and society.

As ESG reporting however increases and becomes more normalised, the regulations and standards should adapt to prevent any misuse of reporting by companies to mislead stakeholders. Looking for more information on emissions reporting? Don’t forget to read our guide to understanding scope 4 emissions here.