According to a recent article in the ft.com, the UK’s commercial real estate market is recovering faster than the rest of Europe. In H1 2024 UK deal volumes were up 7% to €26bn (£22bn) and values were up 1.4%. France and Germany were flat and prices were barely moving. But to really understand what’s going on you need to dig into how the UK is being perceived across Europe, as per Permutable AI’s news sentiment analysis.

Table of Contents

ToggleUK property market recovery: How are we perceived across Europe?

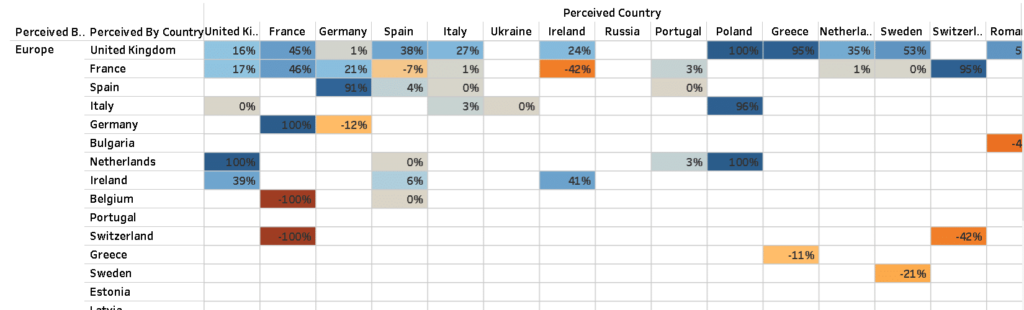

Our news sentiment analysis gives a more detailed view of how the UK property market is perceived across different European countries. The overall sentiment is positive but varies by country.

UK property market recovery: Strong positive sentiment from key players

-

France (45%) and Ireland (24%) have a strong positive view of the UK housing market. This could be due to the UK’s stable post-Brexit political environment and strong economic prospects. For France it’s the close economic ties with the UK and for Ireland historical and economic connections.

-

Poland (100%) and Greece (95%) are also very positive. Poland sees the UK as a major economic partner and Greece the UK as a stable and attractive market given their own economic difficulties.

Neutral to slightly positive from Germany and Spain

-

Germany (1%) and Spain (38%) are more neutral to slightly positive towards the UK housing market. Germany’s neutrality might be due to the competitive nature of the two biggest European economies. Spain’s slightly positive sentiment could be due to the economic ties with the UK, especially in tourism and real estate.

Negative perception from Russia

-

Unsurprisingly, Russia (-42%) has a strong negative view of the UK housing market. This is likely due to the broader geopolitical tensions and economic sanctions which have strained relations between the two countries. The negative bias could also be due to Russia’s strategic and economic divergence from Western Europe including the UK.

What this sentiment analysis means for UK property market recovery

Our sentiment analysis helps you to understand what’s driving the UK’s real estate recovery. Positive sentiment from key European countries means the UK is seen as a stable and attractive market. This will likely drive foreign investment and overall resilience of the market. Key points to note here are:

Investor confidence

The positive sentiment from France, Ireland, Poland and Greece highlights the importance of political stability in driving investor confidence. Post the general election the UK is seen as a more stable environment which is essential for long term real estate investment. This stability is attractive to investors looking for safe havens in the midst of economic uncertainty elsewhere in Europe.

Economic prospects and market dynamics

The UK’s stronger economic prospects as seen by its European neighbours is driving the positive sentiment and therefore the recovery. The perception that the UK’s market is more attractive than the rest of Europe is driving investment and supporting the upturn in values and volumes. This is particularly relevant given the rise in UK rents which is seen as a sign of demand and a healthy market.

Sector by sector recovery

The uneven recovery across different sectors of the UK’s property market, highlighted by the sentiment analysis, reflects broader economic trends that extend beyond the property market. Sectors such as warehouses, residential properties, and hotels are leading the recovery, likely due to structural shifts in the economy, such as the growth of e-commerce and the persistent demand for housing.

This strong performance in specific real estate sectors not only signals their own robust recovery but also suggests positive ripple effects in related industries. For instance, the thriving warehouse sector could indicate a broader rebound in retail and logistics, while the strong demand for residential properties might signal improving consumer confidence and economic stability. As these real estate sectors recover, they will in all likelihood drive recovery in other areas of the economy, creating a more comprehensive and sustained economic revival.

Investor insights from our news sentiment analysis on the UK property market recovery

Our sentiment analysis on the UK property market recovery offers several strategic insights for investors in the UK property market. First, investors should concentrate on high-performing sectors such as logistics, residential properties, and hotels, which are currently benefiting from positive sentiment and strong market fundamentals. These sectors are likely to continue performing well, driven by structural economic changes and sustained demand. However, a cautious approach should still be taken when it comes to office spaces, in light of the ongoing challenges in this sector, which signal that investors should approach office investments carefully. There may be opportunities to repurpose or reimagine office spaces to meet new market demands, but these will require thoughtful planning and strategic execution.

Additionally, the positive perception of the UK’s political stability following the recent election is a significant driver of market confidence. Investors can leverage this by pursuing long-term investments that benefit from a stable and supportive policy environment. However, it is also important to remain aware of geopolitical risks. The negative sentiment from Russia serves as a reminder to consider how broader political dynamics might impact the UK real estate market and influence investment outcomes. By keeping these insights in mind, investors can navigate the UK commercial real estate market more effectively, capitalizing on opportunities while managing potential risks.

Summary: Final thoughts on UK property market recovery and our news sentiment analysis

It’s good news about the UK property market recovery, with the UK commercial real estate market is recovering faster than the rest of Europe driven by political stability, stronger economic prospects and strategic investment. Permutable AI’s news sentiment analysis shows a positive view of the UK market across Europe with key countries like France, Ireland and Poland being very confident in the UK’s prospects. But the recovery is sector by sector and geopolitical factors are still influencing sentiment and investment decisions. For investors understanding these sentiment dynamics is key to navigating the market and making informed decisions to play the UK’s strengths and mitigate the risks.

Find out more

The insights in this analysis are drawn from the Country Bias Matrix, part of our geopolitical dataset and geopolitical risk intelligence platform. If you’re interested in exploring how these insights can help guide your investment strategies, get in touch with us today for a free trial. Discover how our data-driven approach can provide you with the edge you need in navigating complex markets by emailing enquiries@permutable.ai or filling out the form below.