The relationship between news sentiment and GDP gross domestic product performance has long been a topic of interest for economists and policymakers. Understanding how news sentiment impacts the economy can provide valuable insights into economic forecasting, business decision-making, and policymaking. In this article, we will explore the concept of news sentiment analysis and its connection to GDP performance.

Table of Contents

ToggleUnderstanding news sentiment analysis

News sentiment analysis is the process of determining the sentiment or tone of news articles, social media posts, and other textual data. It involves using natural language processing algorithms to classify text as positive, negative, or neutral. By analyzing the sentiment of news, economists and analysts can gain a better understanding of public perception and its potential impact on economic variables such as GDP.

News sentiment analysis relies on advanced machine learning techniques that can accurately identify sentiment from large volumes of text data. These techniques use algorithms to analyze the words, phrases, and context of the text to determine sentiment. By classifying news articles into positive, negative, or neutral categories, analysts can quantify the overall sentiment of the news and its potential influence on the economy.

The impact of positive news sentiment on GDP gross domestic product performance

Positive news sentiment has been shown to have a positive impact on GDP gross domestic product performance. When the news is filled with positive stories and optimistic forecasts, it can boost consumer and investor confidence. This increased confidence often leads to higher spending, investment, and overall economic growth.

For example, during periods of positive news sentiment, consumers may feel more optimistic about their financial situation and be more willing to make purchases. This increase in consumer spending can stimulate economic activity and contribute to GDP gross domestic product growth. Similarly, positive news sentiment can also encourage businesses to invest in expansion, hiring, and research and development, further driving economic growth.

The influence of negative news sentiment on GDP gross domestic product performance

On the other hand, negative news sentiment can have a detrimental effect on GDP performance. When the news is dominated by negative stories, such as economic downturns, political instability, or natural disasters, it can create a sense of uncertainty and fear among consumers and investors. This increased uncertainty often leads to reduced spending, investment, and economic activity.

During periods of negative news sentiment, consumers may become more cautious about their spending, fearing potential economic hardships. This decrease in consumer spending can have a cascading effect on businesses, leading to reduced sales, layoffs, and a contraction in economic activity. Negative news sentiment can also deter investors from making new investments or expanding existing ones, further impacting economic growth.

Case studies: Examining the relationship between news sentiment and GDP in different countries

To better understand the relationship between news sentiment and GDP gross domestic product performance, let’s examine two different case studies.

Nowcasting Euro Area GDP with news sentiment

This study by the European Central Bank (ECB) examined the use of news sentiment analysis for “nowcasting” GDP growth in the Eurozone. Nowcasting refers to predicting economic activity in the very near future, typically within a quarter.

The ECB compared news sentiment metrics derived from newspaper articles to traditional economic indicators like the Purchasing Managers’ Index (PMI). They found that news sentiment offered valuable insights, particularly in the first half of a quarter when other data might be unavailable.

Interestingly, the study also highlighted the importance of considering the specific economic climate. News sentiment analysis proved especially effective during crisis periods like the Great Recession and the COVID-19 lockdowns.

Using news sentiment for economic forecasting: A Malaysian case study

This study by the Bank for International Settlements (BIS) looked at the relationship between news sentiment and economic activity in Malaysia [2]. The researchers used news sentiment analysis to forecast various economic indicators, including private investment growth and GDP growth.

Their findings suggested that news sentiment was a reliable predictor of private investment growth, particularly within a 2-3 quarter timeframe. However, the link between news sentiment and broader measures of GDP growth was less clear.

This case study highlights the potential limitations of news sentiment analysis. While it can provide valuable insights into specific economic sectors, it might not always capture the full picture of a nation’s GDP.

These two case studies demonstrate that news sentiment can be a useful tool for understanding and potentially predicting economic activity. However, it’s important to consider the specific context and limitations of this approach.

Factors affecting the correlation between news sentiment and GDP gross domestic product performance

Several factors can influence the correlation between news sentiment and GDP gross domestic product performance. Firstly, the credibility and reliability of news sources can impact how individuals perceive and react to news sentiment. If news sources are viewed as biased or unreliable, their impact on sentiment and subsequent economic behaviour may be diminished.

Additionally, the timing and intensity of news sentiment can also affect its impact on GDP performance. For example, a short-lived positive news sentiment may not have a significant and lasting effect on economic variables. Conversely, a prolonged period of negative news sentiment can have a more profound and enduring impact on economic behaviour.

Furthermore, the specific economic conditions and structural factors of a country can influence the relationship between news sentiment and GDP performance. For instance, a country with a robust and diversified economy may be less susceptible to the impact of negative news sentiment compared to a country heavily reliant on a specific industry.

Leveraging Permutable AI’s GDP gross domestic product data intelligence

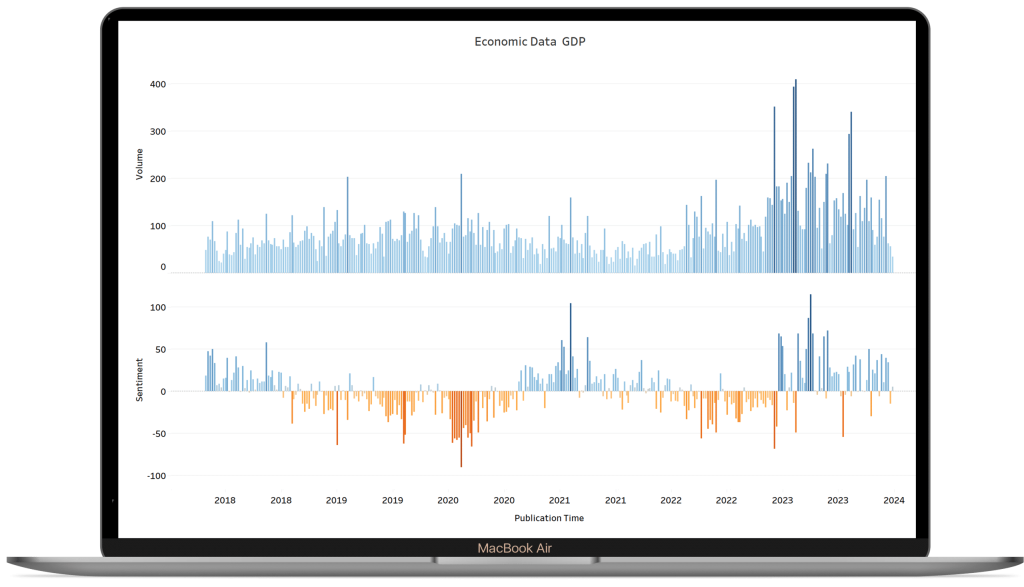

At Permutable AI, we have harnessed the power of cutting-edge natural language processing technologies to develop a robust platform that systematically evaluates the sentiment of global news sources towards GDP gross domestic product performance. We used state-of-the-art machine learning models to scan, categorize, and analyze large volumes of news data. This process not only identifies the general sentiment of articles—whether they are positive, negative, or neutral—but also captures the nuances and context that could influence economic indicators.

Our technology performs real-time tracking of news sentiment related to GDP trends. This data intelligence allows users to observe how shifts in media tone correlate with economic activity, offering insights into potential GDP movements before traditional economic data is available. Our data feeds offer insights based on sentiment trends. For policymakers, this could assist with adjusting economic policies in anticipation of changes signaled by news sentiment. For businesses, it can provide a basis for strategic planning and risk management, particularly in volatile markets.

Above: Our economic data GDP gross domestic product data intelligence

Using news sentiment analysis for economic forecasting

News sentiment analysis has gained popularity as a valuable tool for economic forecasting. By incorporating news sentiment data into forecasting models, economists and analysts can improve the accuracy of their predictions. News sentiment data provides real-time insights into public perception, which can be used to anticipate changes in consumer behaviour, investment trends, and overall economic performance.

For example, if news sentiment analysis indicates a rising positive sentiment, economists may forecast an increase in consumer spending and subsequent economic growth. Conversely, if news sentiment analysis reveals a declining negative sentiment, economists may forecast a decrease in consumer spending and a potential economic downturn.

By leveraging news sentiment analysis for economic forecasting, policymakers and businesses can make more informed decisions and develop strategies to mitigate potential risks or capitalize on emerging opportunities.

Implications for businesses and policymakers

The link between news sentiment and GDP gross domestic product performance has significant implications for businesses and policymakers. Businesses can benefit from monitoring news sentiment to gauge consumer and investor confidence, identify emerging trends, and adjust their strategies accordingly. By understanding how news sentiment affects consumer behavior and economic activity, businesses can make informed decisions about product development, marketing campaigns, and investment opportunities.

Policymakers can also utilize news sentiment analysis to inform their economic policies and decision-making. By monitoring news sentiment, policymakers can gain valuable insights into public perception and adjust their policies to promote economic growth and stability. For example, during periods of negative news sentiment, policymakers may implement measures to boost consumer and investor confidence, such as tax incentives or stimulus packages.

Leveraging news sentiment analysis for economic growth

The connection between news sentiment and GDP gross domestic product performance provides a fascinating area of study for economists and analysts. By understanding the impact of news sentiment on economic variables, businesses, and policymakers can make better-informed decisions and develop strategies to promote economic growth.

News sentiment analysis offers a powerful tool for analyzing public perception and its influence on economic behaviour. By leveraging advanced techniques and tools, economists and analysts can extract valuable insights from large volumes of textual data. Incorporating news sentiment analysis into economic forecasting models can improve the accuracy of predictions and enable businesses and policymakers to stay ahead of economic trends.

Find out more

Ready to harness the power of Permutable’s data intelligence on GDP gross domestic product? To find out more about our data intelligence feeds and how it can benefit your organisation visit our dedicated data intelligence hub or request a free trial below.