This article is aimed at institutional forex traders, systematic desks, and macro strategists who want to understand how forex sentiment indices, daily sentiment analysis, and FX market signals can enhance trading strategies and risk management.

In the institutional trading world, speed and foresight determine success. The foreign exchange market, with its trillions in daily volume, reflects not just economic fundamentals but also the shifting narratives and expectations of investors worldwide.

At Permutable, we have seen first-hand how forex sentiment often moves ahead of traditional data. Central bank language, geopolitical tensions, or sudden policy shifts can reframe market direction long before hard numbers confirm the change. That is why our sentiment analysis API includes both single currency indices and currency pair indices designed specifically to measure forex market sentiment in real time.

By translating news flow and macro narratives into structured, explainable indices, we give institutional traders a forward-looking perspective on FX sentiment that enhances both strategy and risk management.

Table of Contents

ToggleWhy forex sentiment matters

Currencies are macro assets by nature. Their value reflects growth, inflation, monetary policy, and political risk. Yet what drives positioning is rarely the data alone. It is how the market interprets that data.

For instance, when US inflation comes in soft, traders don’t just see weaker prices; they anticipate how the Federal Reserve may adjust policy. A single headline about trade tensions can spark safe-haven flows into the yen or Swiss franc before fundamentals shift.

This is why forex sentiment is so powerful. Unlike backward-looking statistics, it captures live changes in how currencies are being discussed. Our daily sentiment index updates in near real time, showing how narratives around each currency are evolving. For institutional traders, this provides clarity at the very moments when uncertainty is highest.

Single currency indices: a measure of confidence

Our single currency indices quantify how the pound, dollar, euro, sterling, yen and other G7 majors are perceived across global news and commentary.

Use cases include:

Tracking safe-haven demand, such as yen sentiment during geopolitical flare-ups.

Monitoring policy expectations, for example shifts in dollar sentiment ahead of FOMC meetings.

Detecting political risk, such as changes in sterling sentiment during elections.

For FX desks, these indices act as a daily sentiment tool, helping to flag when markets are about to price in volatility before it appears in spot or futures prices.

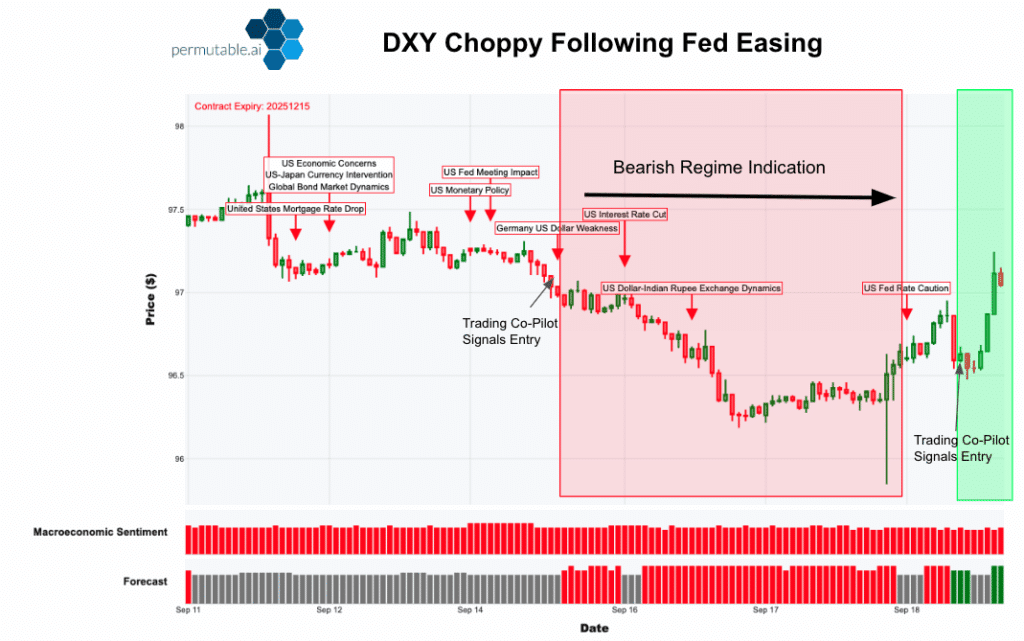

Above: DXY sentiment analysis reveals choppy dollar performance following Fed policy easing signals. Permutable’s Trading Co-Pilot identified key bearish regime indicators through macroeconomic sentiment tracking, with red sentiment bars highlighting negative dollar narratives during the bearish phase (highlighted in pink), followed by green bullish signals as Fed rate caution emerged. The integration of real-time sentiment data with price action demonstrates how narrative shifts precede traditional technical breakouts

Currency pair indices: mapping divergences

While single currencies matter, forex is ultimately traded in pairs. Our pair indices track relative sentiment between currencies, making it possible to spot when one side of the trade is strengthening against the other.

Institutional applications include:

Identifying when forex market sentiment supports a breakout in EUR/USD or GBP/USD.

Filtering out short-lived spikes to focus only on durable shifts in FX sentiment.

Providing systematic traders with backtestable inputs for quantitative models.

For example, if euro sentiment strengthens while dollar sentiment weakens, our daily sentiment index for EUR/USD highlights this divergence before price action confirms the move.

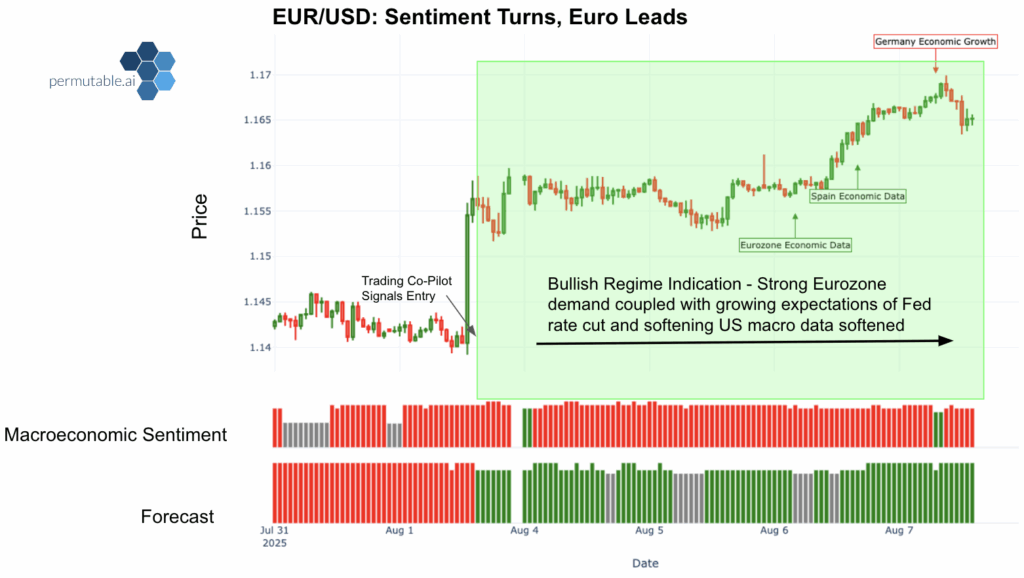

Above: EUR/USD sentiment divergence captures euro strength as narratives shift in favour of eurozone fundamentals. The Trading Co-Pilot’s sentiment analysis (shown in bottom panels) transitioned from bearish red to sustained bullish green signals, anticipating the EUR/USD rally highlighted in the green zone. Key fundamental drivers including Spain and Eurozone economic data, coupled with Germany economic growth expectations, supported the bullish regime indication as Fed rate cut expectations and softening US macro data strengthened the euro’s relative positioning.

Institutional use cases across FX desks

From our work with clients, several clear applications for forex sentiment are to be highlighted here:

1. Macro event anticipation

Our FX sentiment tools enable desks to track narrative build-up in real time ahead of key macro events such as central bank meetings, elections, or trade disputes. Instead of relying solely on consensus forecasts or lagging analyst commentary, traders can observe how market mood is shifting in the days and hours before announcements. This allows for proactive positioning around volatility catalysts and greater confidence in managing exposure during periods of heightened uncertainty.

2. Short-term trading filters

Intraday and short-term traders are often challenged by distinguishing between random noise and genuine trend formation. By applying daily forex sentiment signals, our intelligence provides a filter that helps separate fleeting spikes driven by headlines or rumours from sustained momentum backed by broader narrative shifts. This clarity allows traders to avoid false signals and time entries with greater precision.

3. Risk monitoring

Institutional desks can integrate Permutable’s forex sentiment indices directly into their risk dashboards to monitor vulnerabilities in their portfolios. By flagging sudden increases in negative sentiment towards specific currencies, the system offers an early warning of potential stress points. This gives risk managers a forward-looking lens to complement traditional VaR models and volatility measures, improving resilience during turbulent market phases.

4. Cross-asset strategy alignment

Currency flows rarely move in isolation. Our sentiment indices allow FX desks to compare market mood across asset classes – from commodities to equities – and identify where correlations may strengthen or break down. For example, a bullish skew in oil-linked currencies can be cross-checked against real-time commodity sentiment to validate trades or adjust exposures, ensuring strategies are aligned with broader market narratives.

5. Systematic strategy enrichment

For quants and systematic desks, Permutable’s forex sentiment offers a robust, quantifiable alpha factor that can be incorporated into existing models. Unlike traditional price or volume-based inputs, sentiment captures the qualitative narrative embedded in global media and policy discussions. When embedded into algorithmic frameworks, it enriches predictive power, reduces model blind spots, and provides an additional dimension of diversification within trading signals.

Why our forex sentiment analysis API stands out

Of course, there are many forex sentiment tools on the market, so why should institutional clients choose our forex market sentiment solutions?

-

Explainability: Each sentiment index is tied to identifiable narrative clusters, ensuring compliance and research teams understand the source.

-

Speed: Our daily sentiment index updates in near real time, allowing traders to react quickly to breaking stories.

-

Integration: Delivered via API, the data slots seamlessly into existing trading platforms, quant dashboards, or risk systems.

This combination of transparency, timeliness and usability makes our forex sentiment solution far more than a simple data feed.

Case example: Policy divergence

When the ECB turned dovish while the Fed remained cautious, eurozone fundamentals pointed one way but forex market sentiment revealed another. Our indices showed euro sentiment rising as narratives around fiscal stability outweighed inflation concerns. Traders monitoring this signal were able to anticipate EUR/USD resilience before it became visible in price action.

This illustrates the value of measuring FX sentiment at the narrative level rather than relying solely on lagging economic prints.

Above: Fed policy sentiment analysis demonstrates how dovish and hawkish narrative volumes anticipate Federal Reserve rate decisions across multiple cycles. Permutable’s sentiment tracking shows hawkish commentary (red bars) dominated during the 2018-2019 tightening cycle and again through 2022-2023 as inflation concerns peaked, while dovish sentiment (blue bars) surged during the 2019-2020 easing period and has recently intensified in 2024-2025 as rate cut expectations build. The sentiment volume shifts consistently precede actual Fed funds rate changes (black line), highlighting how institutional traders can leverage narrative analysis to position ahead of monetary policy pivots rather than react to them.

From signal to strategy

For institutional forex traders, the challenge is not information scarcity but information overload. News, data and commentary flood in constantly. What matters is distinguishing true market-moving signals from noise.

By offering structured indices for both single currencies and currency pairs, our forex sentiment analysis API gives traders that capability. The daily sentiment index shows when narratives are gaining momentum. Meanwhile, our single currency indices reveal how each currency is perceived globally. Pair indices map divergences that can spark the next move.

Together, these tools give FX desks the foresight needed to:

Position ahead of macro events.

Detect divergences before they show in price.

Manage currency risk with confidence.

Enhance quantitative and discretionary strategies.

At Permutable, our mission is to transform complex market narratives into actionable insight. For institutional forex traders, this means turning forex sentiment into a measurable, tradeable advantage.

To explore how our platform can support your strategy, contact us at enquiries@permutable.ai