Permutable AI expands market intelligence capabilities with new LNG data feed

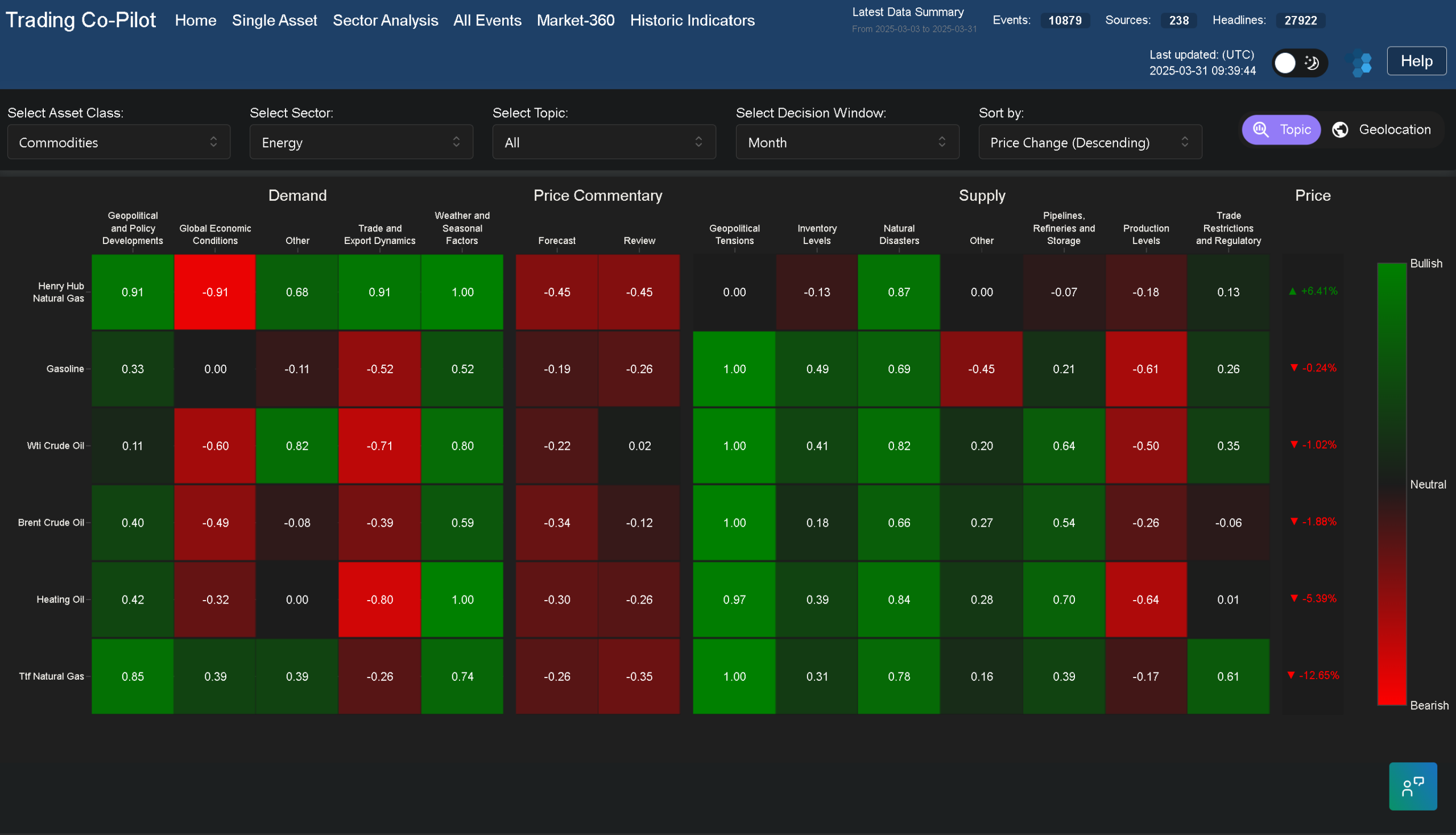

This announcement introduces Permutable AI’s new LNG data feed, expanding our data-as-a-service portfolio to help energy traders, portfolio managers, and financial institutions gain real-time insights into liquefied natural gas markets with zero integration requirements – enabling faster, more informed trading decisions during periods of market volatility and geopolitical uncertainty. We are delighted to announce that … Read more