This article explores how sophisticated geopolitical news and analysis capabilities enable institutional investors to convert political uncertainty into strategic advantage through AI-powered intelligence platforms. It is aimed at institutional investors, risk managers, portfolio strategists, and financial professionals seeking to enhance their geopolitical risk assessment and investment decision-making capabilities.

The landscape of institutional investing has fundamentally shifted, with geopolitical events now serving as primary drivers of market volatility across asset classes. Traditional approaches to political risk assessment – characterised by reactive analysis and limited data sources – are proving inadequate for navigating today’s interconnected global markets. The emergence of sophisticated geopolitical news and analysis of the kind that we offer through our own geopolitical data feeds enables investors to transform political uncertainty from a source of risk into a strategic opportunity through advanced intelligence capabilities.

Table of Contents

ToggleMarket sensitivity demands real-time intelligence

Modern financial markets are demonstrating unprecedented sensitivity to political developments, with events ranging from election outcomes to international trade disputes capable of triggering significant asset price movements within minutes. This heightened sensitivity demands a fundamental shift in how institutional investors approach geopolitical risk management. Rather than relying on traditional news sources and retrospective analysis, leading institutions are increasingly turning to AI-powered platforms that provide real-time geopolitical news and analysis, enabling proactive positioning ahead of market-moving events.

The power of predictive political signal decoding

The sophistication of contemporary geopolitical intelligence extends far beyond simple news aggregation. Our systems employ advanced natural language processing and machine learning algorithms to decode sentiment signals embedded within vast volumes of political discourse, policy documents, and international communications. By analysing these complex data streams, we provide institutions with predictive insights that traditional geopolitical news and analysis methods simply cannot provide. This capability proves particularly valuable when monitoring developments in key geopolitical hotspots, where early warning signals can provide significant competitive advantages.

Above: Crude oil multi-factor analysis dashboard from our Trading Co-Pilot intelligence suite showing the ranking of fundamental and geopolitical factors during the Iran crisis week. The heatmap visualisation reveals how geopolitical tensions (shown in red) dominated other market drivers like supply disruptions and demand patterns, with our sentiment algorithms providing clear early warning signals.

Protecting alpha in an age of information saturation

Our experience working with institutional clients across global markets has made it clear that traditional sources of alpha are eroding more rapidly in an environment defined by real-time information flow and geopolitical complexity. As political developments increasingly drive short-term market dislocations, the ability to respond with speed and precision has become essential to preserving performance margins.

Sophisticated geopolitical intelligence insights, such as those we provide, offer a timely antidote to alpha decay. By detecting early signals of, for example, political instability – often before they are reflected in mainstream media or market pricing – our systems enable investors and portfolio managers to act pre-emptively, not reactively. This reduces exposure to adverse price moves and strengthens the potential to generate relative outperformance over time.

And so, rather than relying on lagging indicators or retrospective analysis, those institutions equipped with real-time, AI-driven geopolitical insight are better positioned to maintain alpha in fast-moving conditions. In this context, real-time news intelligence is not simply a source of outperformance – it is a mechanism for preserving competitive edge in an increasingly crowded and volatile market landscape.

Above: The chart demonstrates our Trading Co-Pilot successfully identifying a strategic LNG entry point at €36.16/MWh on June 12th, preceding a sustained rally to €42/MWh driven by geopolitical tensions and bullish fundamentals. The system’s multi-layered sentiment analysis – spanning fundamental, macroeconomic, and geopolitical factors (shown in the bottom indicators) – provided early warning signals of market momentum shifts. Notable geopolitical catalysts included Iran tensions, LNG infrastructure developments, and supply chain disruptions, while the recent ceasefire agreement triggered the technical pullback. This exemplifies how sophisticated geopolitical intelligence transforms political uncertainty into actionable trading opportunities, with our Co-Pilot’s robust sentiment indicators enabling precise entry and exit timing ahead of market consensus.

From portfolio management to trading strategy

The practical applications of sophisticated geopolitical intelligence extend across multiple investment strategies and risk management frameworks. For example, portfolio managers can harness our real-time political sentiment analysis to adjust sector allocations ahead of policy announcements, whilst risk teams can employ our geopolitical tension indices to calibrate exposure limits during periods of heightened international instability. The benefits also extend to currency traders leveraging diplomatic relationship monitoring to anticipate central bank interventions, and energy investors track geopolitical developments in key producing regions to forecast supply disruptions and price volatility.

Historical patterns as predictive tools

Historical analysis reveals consistent patterns in how geopolitical events impact specific asset classes and market segments. Of course it goes without saying that energy markets demonstrate particular sensitivity to Middle Eastern political developments, whilst emerging market currencies respond predictably to shifts in US-China relations. Technology sectors show vulnerability to international trade policy changes, and defence contractors benefit from escalating international tensions. Understanding these historical relationships through comprehensive geopolitical news and analysis enables more sophisticated forecasting and strategic positioning, which is what our 10 year historical data facilitates.

Seamless integration with institutional investment systems

At Permutable, we’ve built our geopolitical intelligence to integrate effortlessly with institutional infrastructure. Through robust API connectivity, our real-time sentiment signals and geopolitical insights can be embedded directly into existing trading systems, portfolio construction tools, and risk management frameworks. This ensures that political developments are translated into actionable insights instantly – reducing the latency between event emergence and strategic decision-making, while preserving analytical rigour and auditability.

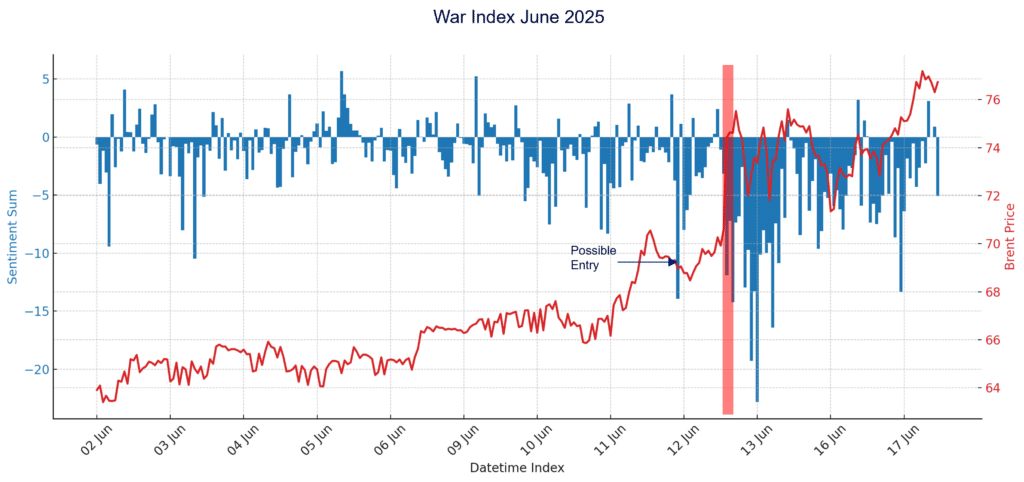

Above: Our War Index tracks real-time geopolitical tension levels through advanced sentiment analysis of global political discourse. The chart reveals a dramatic escalation in conflict risk during mid-June 2025, with sentiment indicators (blue bars) showing intense negative spikes coinciding with rising Brent crude prices (red line). The “Possible Entry” annotation highlights how our system identified optimal positioning opportunities as geopolitical tensions began building around June 11th, preceding the sharp price rally from $68 to over $76 per barrel. The sustained period of elevated tension (indicated by the red shaded area) demonstrates how our War Index provides early warning signals of geopolitical risk premiums entering energy markets, enabling institutional investors to anticipate and capitalise on volatility before it becomes widely recognised by market participants.

Turning political risk into strategic advantage

At Permutable, we equip our clients with the tools and data to move from reactive to proactive geopolitical risk management. By surfacing early sentiment shifts and identifying geopolitical fault lines in real time, we empower portfolio managers and risk teams to anticipate and respond to volatility before it’s widely recognised by the market. Institutions relying on legacy methods face mounting disadvantages — from increased transaction costs to eroded alpha — while those using Permutable’s platform gain a structural edge in positioning and timing.

Speak to our team to explore how Permutable’s geopolitical intelligence can help you stay ahead of market consensus and protect alpha. Discover how real-time signals can be seamlessly integrated into your investment strategy. Email our team at enquiries@permutable.ai to request a demo.