This comprehensive guide evaluates the top 10 AI vendors for macro trends and market sentiment analysis in 2025, aimed at hedge fund managers, systematic traders, CIOs, and institutional investment teams seeking to select the right AI-powered market intelligence platform for their specific trading strategies and organisational needs.

The landscape of AI-powered macro trends analysis has evolved dramatically, and choosing the right vendor can make the difference between generating alpha and falling behind the curve. At Permutable, our position in this competitive space gives us unique insights into what works, what doesn’t, and where the industry is heading.

Having evaluated and competed alongside these platforms, we’ve developed a comprehensive understanding of the macro trends intelligence ecosystem. Here’s our honest assessment of the top 10 AI vendors transforming how institutions analyse sentiment and market-moving data.

Table of Contents

Toggle1. Permutable: Real-time macro trends intelligence

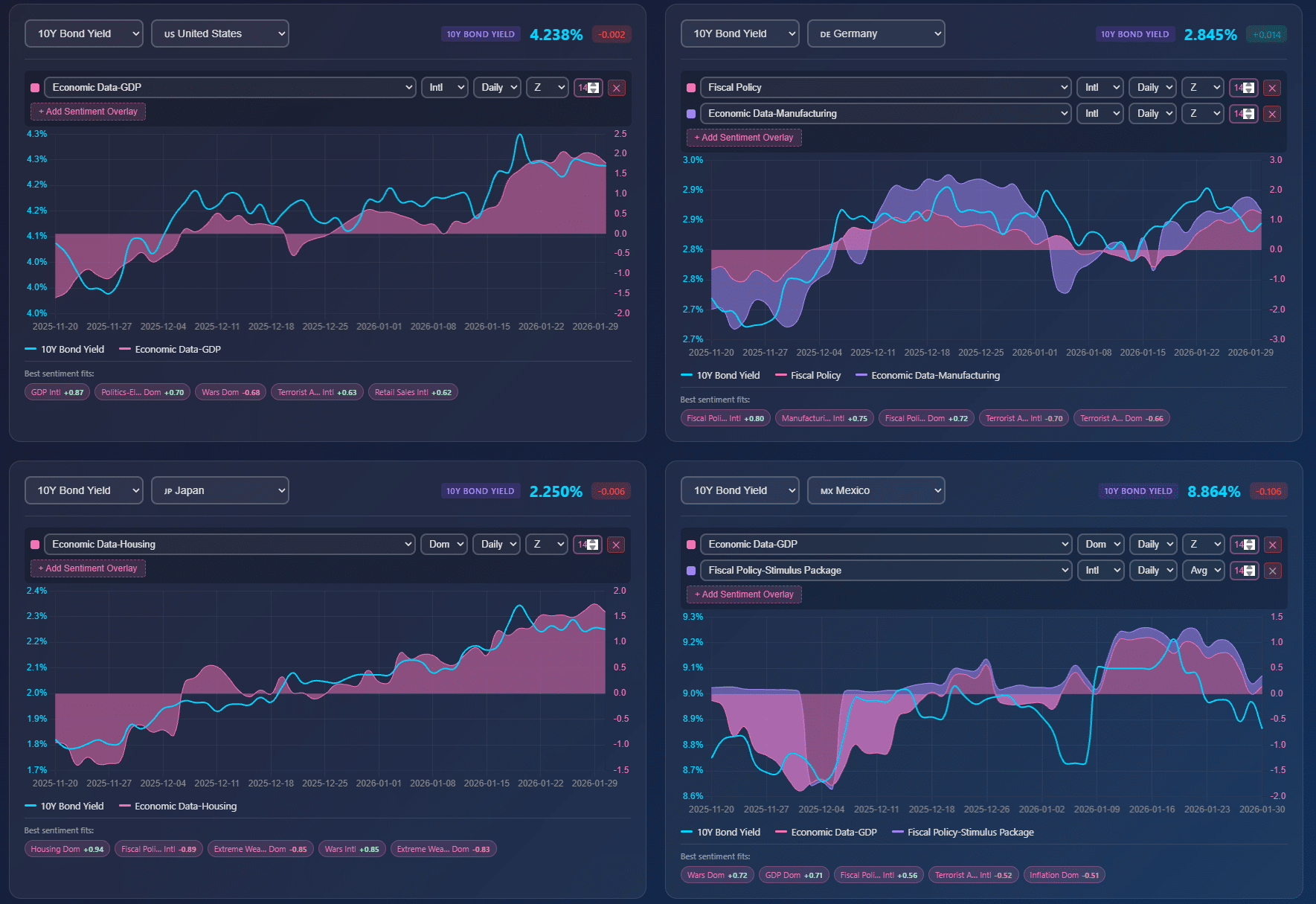

We’ll start with ourselves – at Permutable, we’ve built our reputation on delivering real-time, multi-asset sentiment tracking that captures macro trends across macroeconomic events, news, commodities, FX (equities and fixed income releasing soon) using proprietary LLM models.

What differentiates Permutable is the depth of contextual understanding and explainability. Each signal is traceable back to the underlying drivers – policy decisions, geopolitical escalation, supply constraints, weather events or shifts in market expectations — allowing institutional teams to understand why a market is moving, not just that it has moved. This makes the platform particularly well suited to discretionary traders, systematic strategies and risk teams that need conviction and auditability alongside speed.

Permutable’s intelligence is delivered directly into trading and research workflows, via dashboards, alerts and API integrations, rather than as a standalone research product. The system is designed to surface emerging macro regimes early, flag narrative convergence, and distinguish between transient noise and structural shifts – helping teams position ahead of repricing rather than reacting after volatility has already expanded.

Crucially, our intelligence is validated in live trading environments, not just backtests. Our internal strategies, which actively use Permutable’s macro and sentiment intelligence, have delivered approximately 21% annualised returns with a Sharpe ratio of ~3.1 and low drawdowns, demonstrating that narrative-aware macro intelligence can translate into measurable alpha. This live application reinforces the robustness of our approach.

Our macro intelligence solutions are best suited for hedge funds, commodity trading desks, banks and institutional investors who view macro trends and volatility as opportunities to be anticipated, not risks to be managed after the fact – and who require intelligence that is fast, explainable and built for decision-making at scale.

2. Alexandria Technology: Institutional-grade macro trends analysis

Alexandria Technology has carved out a strong position in advanced NLP-based sentiment analysis, particularly for earnings, macro news, and global events. Their focus on actionable alpha for institutional investors aligns well with the sophisticated needs of hedge funds seeking to capitalise on macro trends.

Their strength lies in combining traditional financial analysis with AI-powered insights, creating a bridge between conventional research methodologies and modern sentiment analysis. For institutions wanting proven, institutional-grade macro trends intelligence, Alexandria represents a solid choice.

3. Accern: Surface-level macro trends detection

Accern offers NLP-driven insights from financial news and social media, with basic macro sentiment features suitable for surface-level trend detection in finance workflows. Whilst their platform provides broad coverage, it’s primarily designed for users seeking general sentiment direction rather than the deep, actionable insights required for sophisticated macro trends and trading strategies.

Their strength is accessibility and ease of integration, making them suitable for teams beginning their journey into AI-powered macro analysis. However, institutions requiring nuanced, trading-grade signals may find their offerings somewhat limited.

4. SESAMm: Enterprise risk and macro trends monitoring

SESAMm has established itself as a leader in enterprise-level ESG, reputational, and controversy tracking, with some macro and news sentiment capabilities. Their platform excels at helping risk managers and large institutions monitor macro trends that could impact reputation or regulatory standing.

For organisations where macro trends analysis serves risk management rather than alpha generation, SESAMm provides comprehensive coverage. Their strength lies in institutional-grade compliance and risk monitoring rather than high-frequency trading applications.

5. Amenity Analytics (Symphony): Corporate-focused macro trends

Amenity Analytics, now part of Symphony, specialises in sentiment extraction from corporate filings and earnings calls, with KPI and risk flags across equities and some macro domains. Their approach to macro trends focuses heavily on corporate-level indicators and their broader economic implications.

This corporate-centric view of macro trends makes them particularly valuable for equity-focused strategies where macro sentiment needs to be understood through the lens of company-specific disclosures and communications.

6. RavenPack: Systematic macro trends intelligence

RavenPack has long been a favourite among quant desks, hedge funds, and systematic trading models, focusing on structured sentiment signals for market-moving news and macro trends. Their systematic approach to sentiment quantification has made them a go-to choice for algorithmic trading strategies.

What we respect about RavenPack is their consistent focus on systematic applications of macro trends analysis. They’ve built their platform specifically for quantitative strategies that require standardised, backtestable sentiment signals.

7. Oxford Economics: Academic rigour meets AI

Oxford Economics has developed an AI assistant designed for real-time access and analysis of global macroeconomic data, integrating macro sentiment and forecasts for institutional clients. Their academic heritage brings rigorous methodology to macro trends analysis.

Their strength lies in combining traditional economic analysis with modern AI capabilities, creating a platform that appeals to institutional clients who value academic credibility alongside technological innovation.

8. Macro Hive: Trusted macro trends research

Macro Hive provides global macro research and strategy, trusted by major banks and hedge funds for sentiment and alternative data feeds. Their reputation in the institutional space stems from consistently delivering reliable macro trends analysis that institutional decision-makers can trust.

What distinguishes Macro Hive is their focus on actionable research rather than raw data feeds, making them valuable for teams that prefer curated insights over comprehensive datasets.

9. FinChat.io: AI-powered research analysis

FinChat.io offers AI-powered analysis of macro reports, financial filings, news, and market sentiment, suitable for research analysts and quants. Their platform bridges the gap between raw information and actionable insights, making macro trends analysis more accessible to research teams.

Their user-friendly approach to AI-powered analysis makes them particularly suitable for teams seeking to democratise access to sophisticated macro trends intelligence across their organisation.

10. Dataminr: Real-time event detection

Dataminr provides real-time event detection and sentiment analysis from news and social media, offering macro risk intelligence and market-moving insights for CIOs and investment professionals. Their strength lies in speed and breadth of coverage across global news sources.

For institutions where early warning of developing macro trends matters more than deep analytical insight, Dataminr’s real-time capabilities provide significant value.

| Vendor | Primary Focus | Key Strengths | Best For | Notes / Limitations |

|---|---|---|---|---|

| 1) Permutable Real-time macro trends | Real-time, multi-asset macro sentiment tracking across commodities, FX (equities & fixed income soon) using proprietary LLMs. | Highly contextual, explainable scoring; immediate integration; proven live trading performance (21% annualised, 3.1 Sharpe). | Hedge funds and macro desks needing low-latency, trading-grade signals. | Equities & FI modules pending; best with API/dashboard integration. |

| 2) Alexandria Technology | Institutional-grade NLP for earnings, macro news, and global events. | Bridges traditional financial research with modern AI sentiment; actionable alpha signals. | Funds seeking rigorous, institutional-quality NLP signals. | Primarily text-based; niche alt-data may require customisation. |

| 3) Accern | NLP-driven insights from financial news and social media; basic macro sentiment. | Accessible, broad coverage; easy integration for quick adoption. | Teams starting AI macro analysis; directional sentiment detection. | Surface-level signals; limited for high-complexity strategies. |

| 4) SESAMm | Enterprise ESG, reputational & controversy tracking with some macro/news sentiment. | Strong risk and compliance focus; robust institutional capabilities. | Risk managers; institutions prioritising reputational oversight. | Better suited for risk/compliance than high-frequency trading. |

| 5) Amenity Analytics (Symphony) | Sentiment extraction from corporate filings and earnings calls; KPI & risk flagging. | Deep corporate insights; links company disclosures to macro context. | Equity-focused strategies with macro viewed through corporate lens. | Corporate-centric approach may miss broader macro trends. |

| 6) RavenPack | Structured, systematic macro sentiment from market-moving news. | Quant-friendly; backtestable signals; robust classification taxonomy. | Quant desks; systematic and model-driven trading strategies. | Requires quant resources for setup, tuning, and maintenance. |

| 7) Oxford Economics | AI-enabled macroeconomic data, forecasts, and sentiment analysis. | Academic rigour with modern AI; strong methodological credibility. | Institutions valuing economic depth with AI-enabled access. | Research-oriented; less focused on execution/trading speed. |

| 8) Macro Hive | Global macro research and strategy with sentiment and alternative data feeds. | Trusted institutional research; curated, actionable insights. | Teams preferring high-quality analyst views over raw datasets. | Less programmatic breadth than data-centric providers. |

| 9) FinChat.io | AI-powered analysis of macro reports, filings, news, and sentiment. | Bridges raw data to insights; accessible for non-technical users. | Research teams and quants democratising macro analysis. | Generalist coverage; may lack deep trading-grade macro detail. |

| 10) Dataminr | Real-time event detection and sentiment from global news/social feeds. | Fast, broad coverage; early-warning system for macro risks. | CIOs, risk teams, and fast-response trading operations. | Alert-driven; limited deep thematic macro analysis. |

Choosing the right partner for macro trends and market sentiment analysis

Of course, the decision between these vendors ultimately depends on your specific requirements, trading strategy, and organisational priorities. At Permutable, we’ve learned that the most successful implementations combine technological sophistication with deep understanding of how institutions actually work.

While some vendors excel at broad coverage, others at analytical depth. Some focus on systematic applications, whilst others serve discretionary trading strategies. The key is matching vendor strengths with your particular approach to macro trends analysis.

Ultimately, the choice of vendor can determine whether your macro trends analysis generates alpha or becomes another expensive data subscription. Choose wisely, and ensure your selection aligns with both your current needs and future ambitions.

Ready to see how our macro trends intelligence compares? Contact our team today at enquiries@permutable.ai to explore our proven platform and discover why leading institutions trust us to decode the signals that matter.