Navigating market dynamics: 7 essential ways to use our Trading Co-Pilot

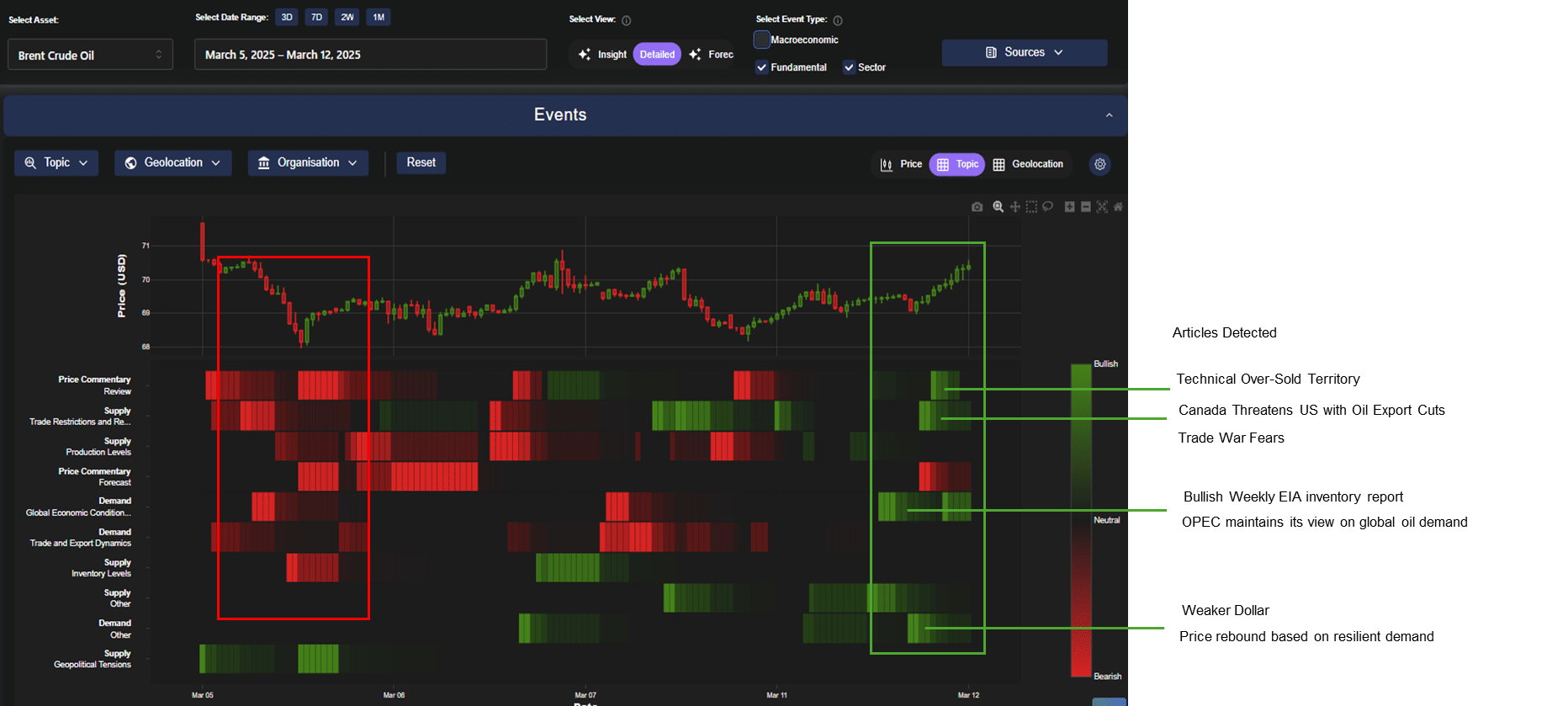

*This article is aimed primarily at professional traders, portfolio managers, commodity traders, and institutional investors and explain how our AI-powered market intelligence platform can help traders and portfolio managers understand complex market dynamics using seven specific use cases. Market volatility has reached new heights in recent month, creating unprecedented challenges for those navigating market dynamics … Read more