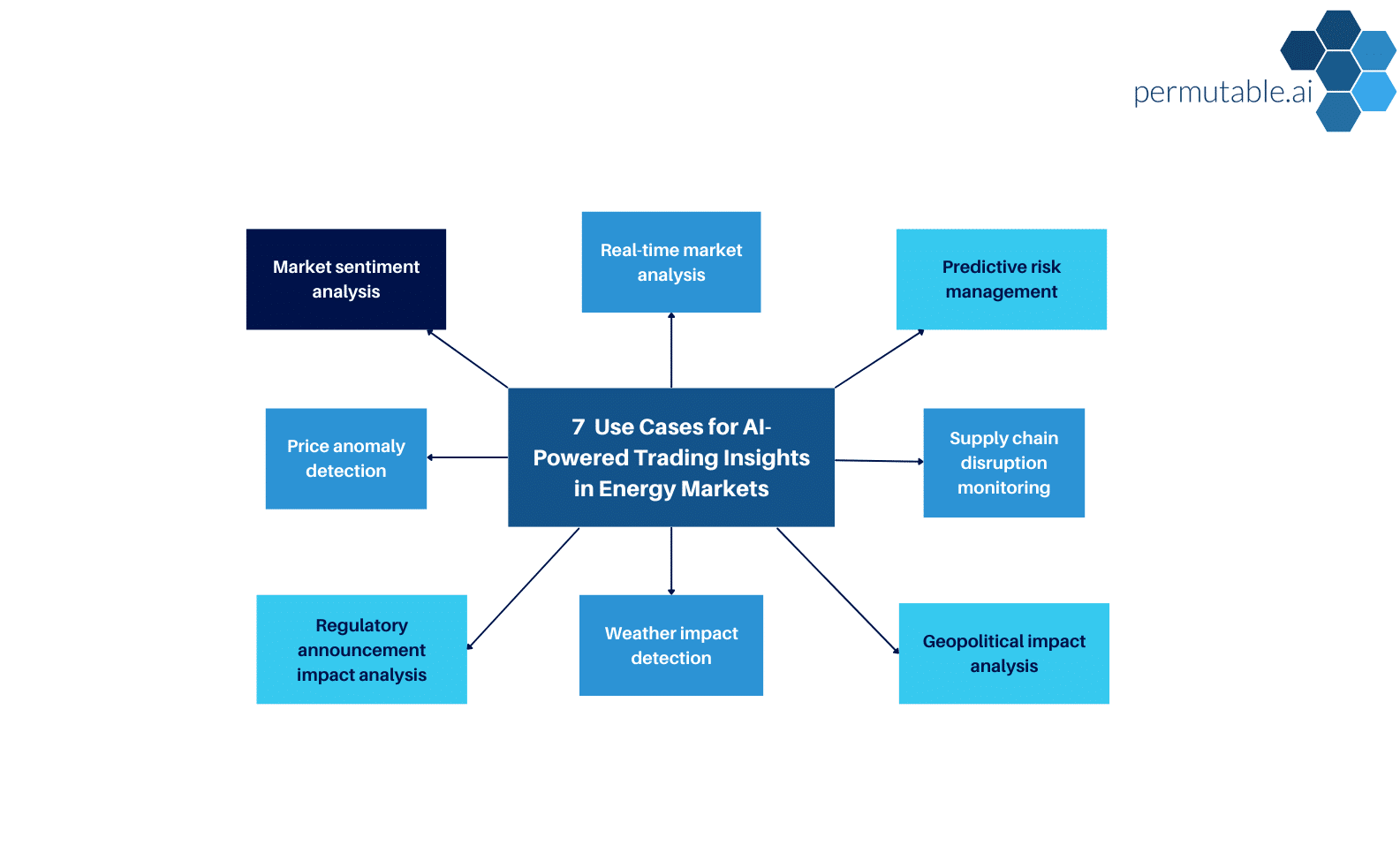

7 reasons to watch market sentiment indicators in today’s volatile investment landscape

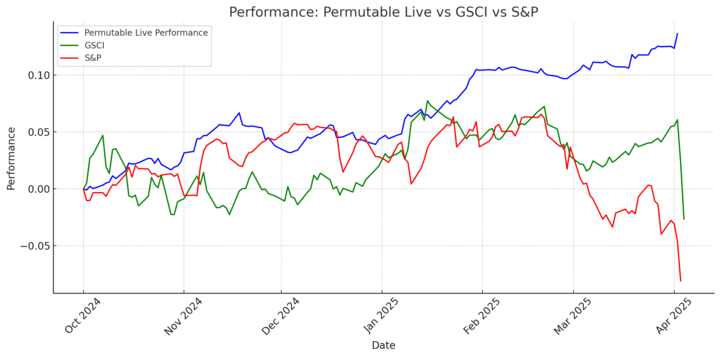

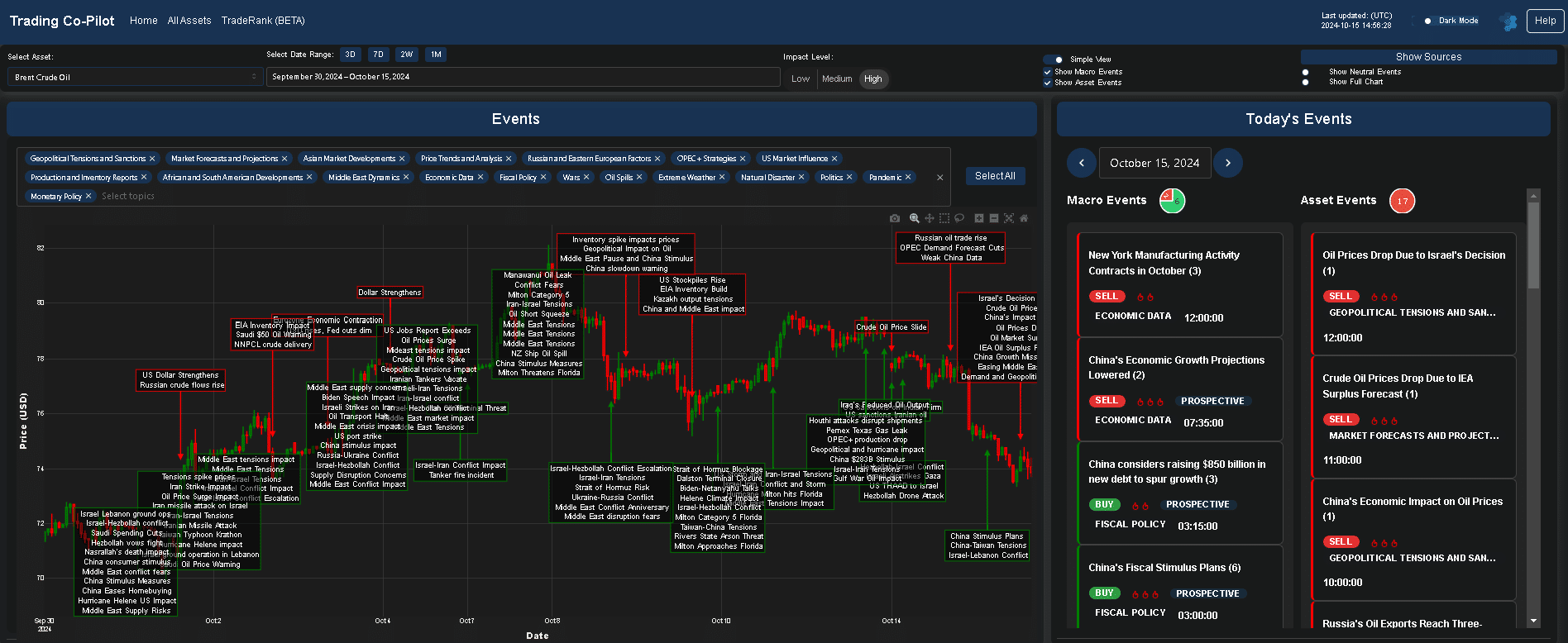

In this new world order of financial markets, we have been seeing first hand both through our own activities and those of our clients how powerful market sentiment indicators can be for navigating market volatility. The hard truth found in the blur of the last few weeks in global markets is that traditional indicators often … Read more