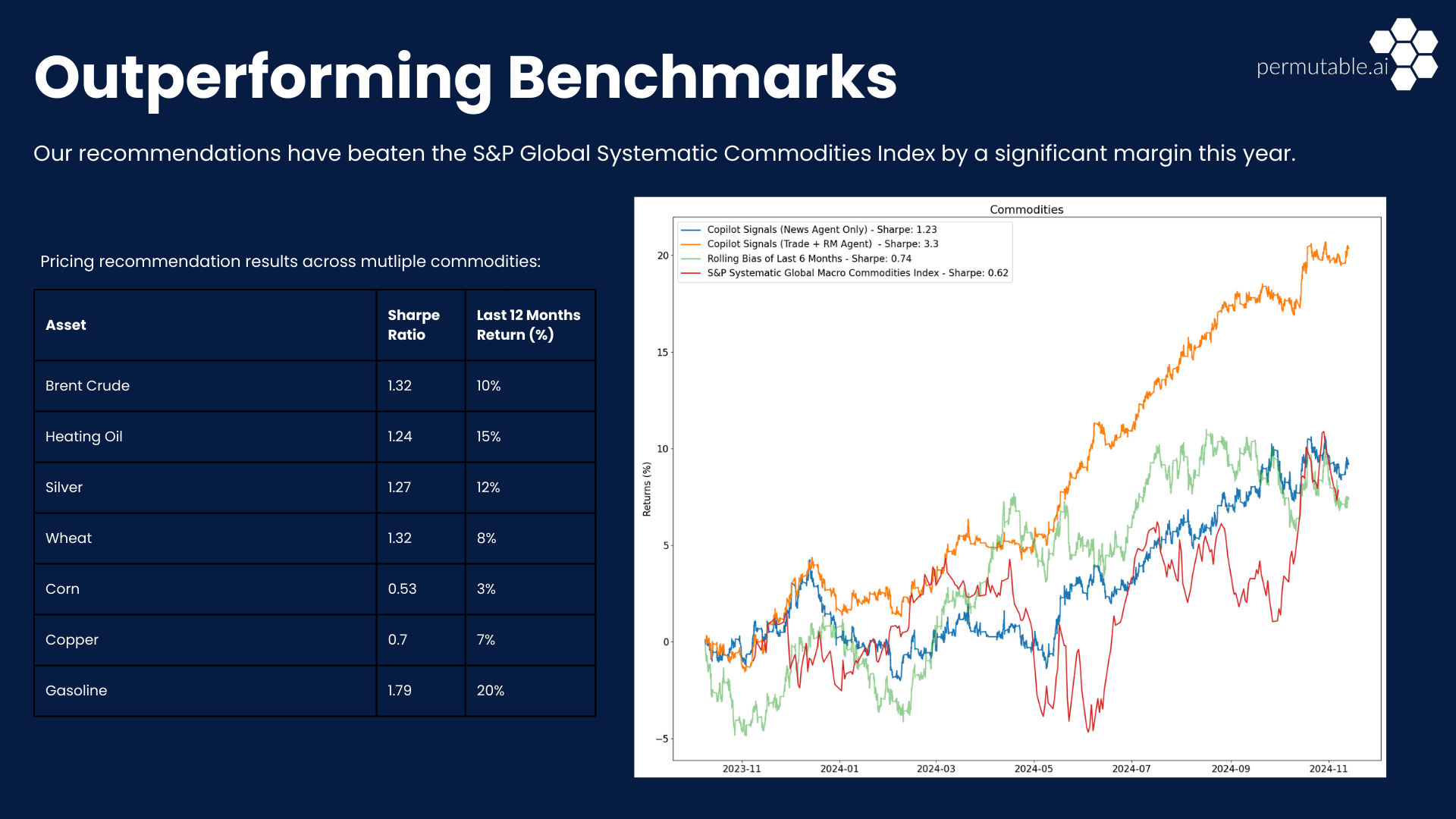

How energy traders can develop a smarter lens on breaking geopolitical tensions 2025

This comprehensive analysis explores how energy traders are adapting to navigate breaking geopolitical tensions 2025 through advanced market intelligence and AI-powered insights. Written for commodity traders, energy analysts, portfolio managers, and institutional trading desks seeking sophisticated tools to decode complex market dynamics and geopolitical risks. It’s fair to say that energy markets have entered an … Read more