Enhancing oil price forecast accuracy with real-time sentiment analysis

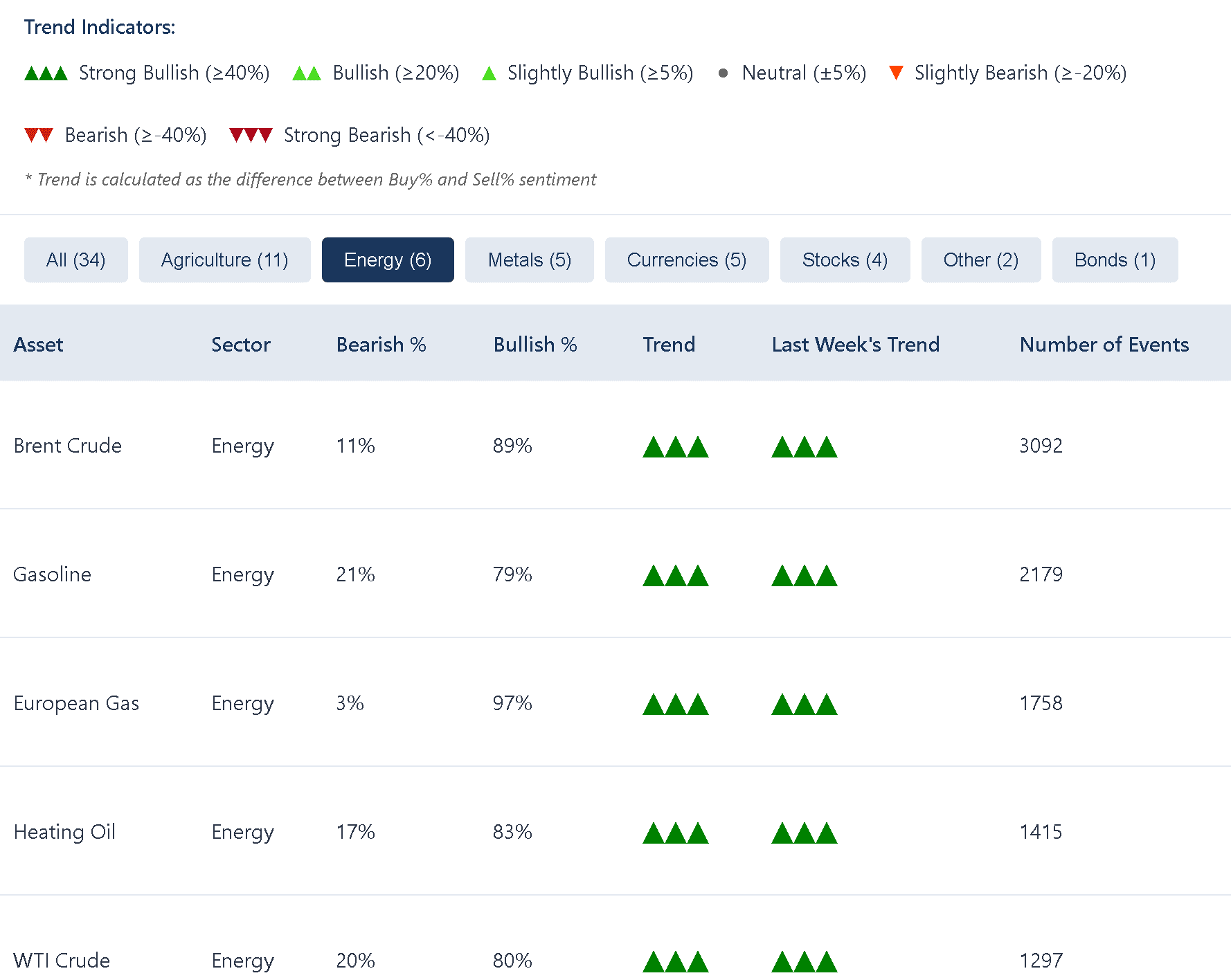

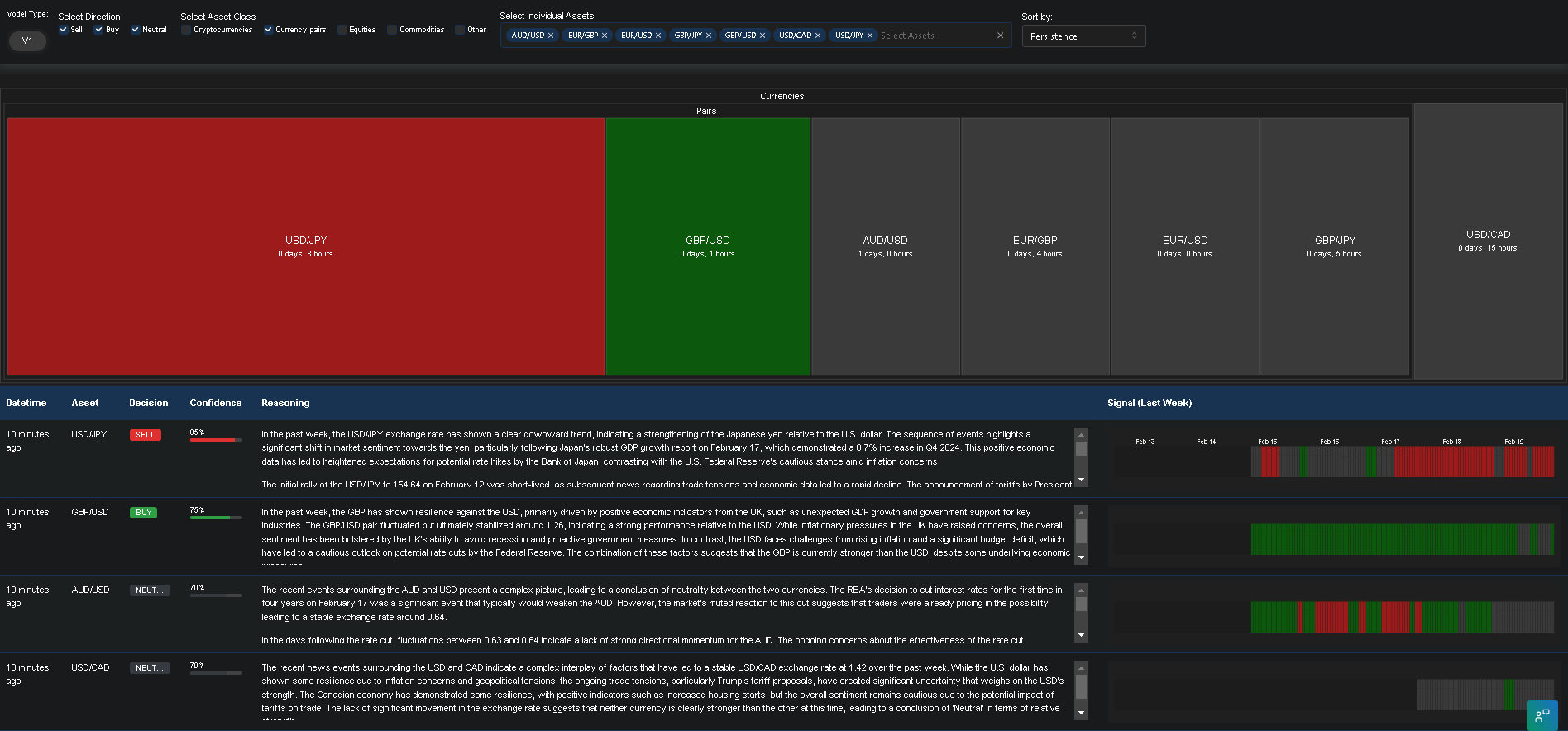

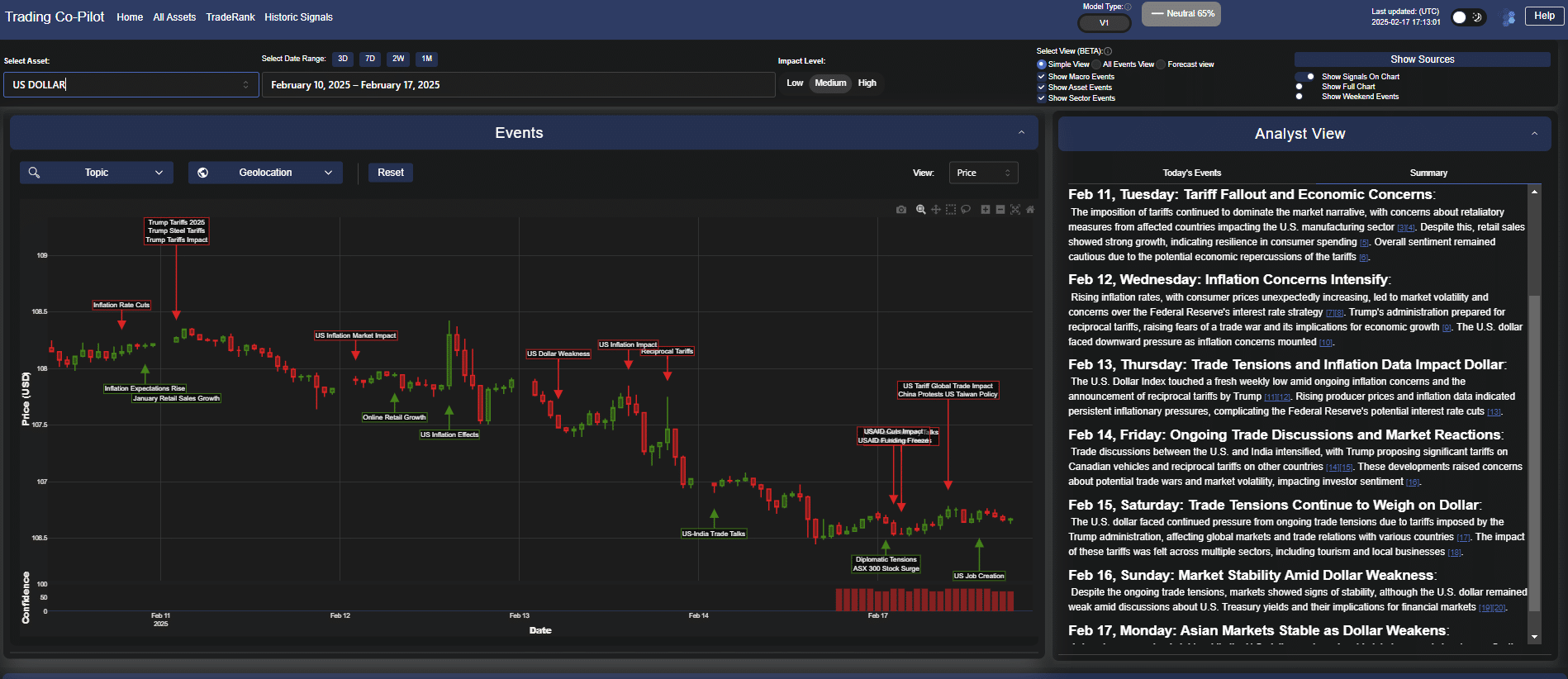

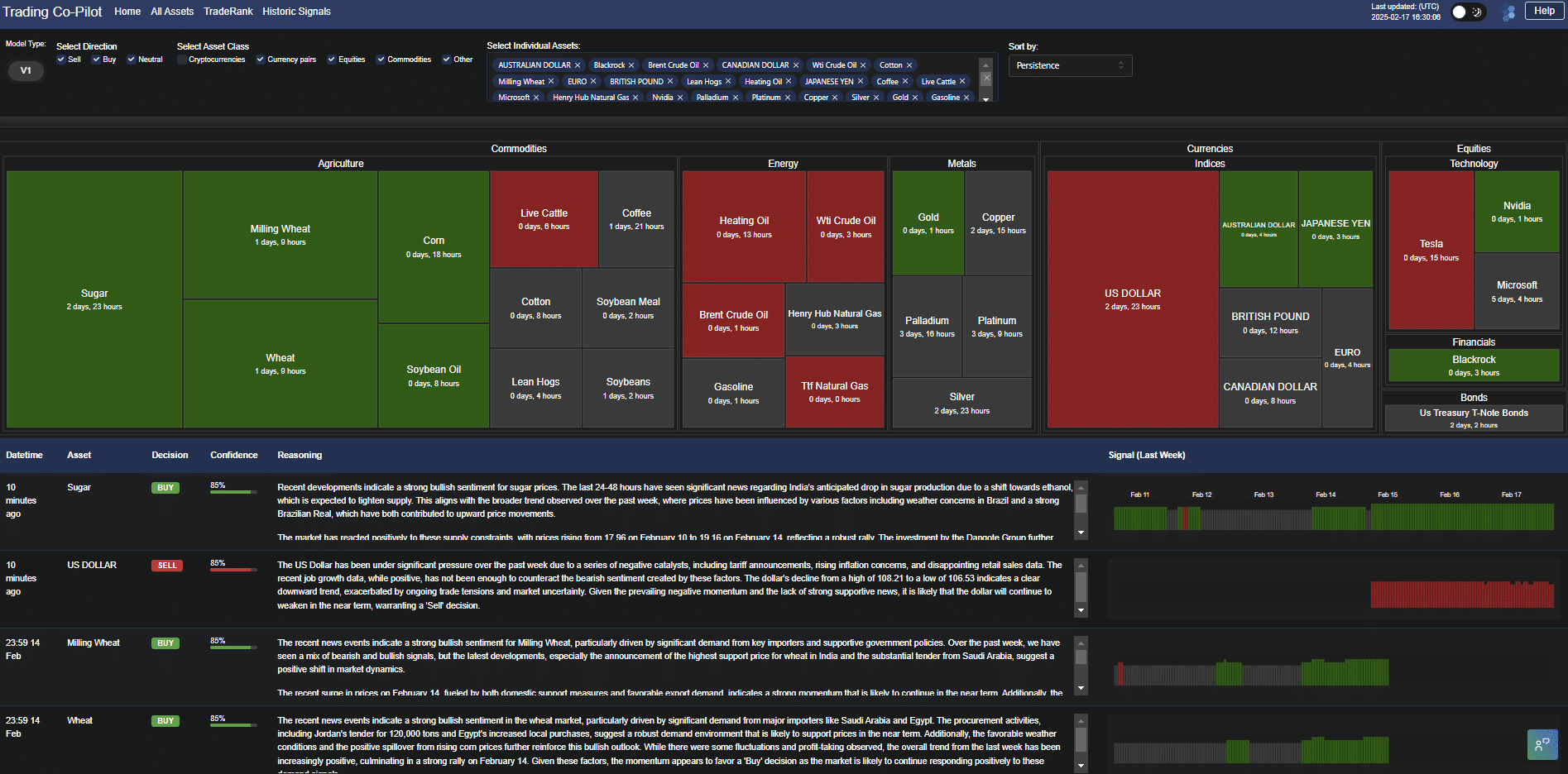

This article explores how advanced AI-driven sentiment analysis is transforming oil price forecasting by processing thousands of news sources hourly to identify narrative drivers that precede market movements. It is written for energy traders, commodity analysts, quantitative researchers, risk managers, and institutional investors seeking enhanced oil market intelligence. The crude oil market represents one of … Read more