Current forex market sentiment 27 Feb 25: A week of global uncertainties

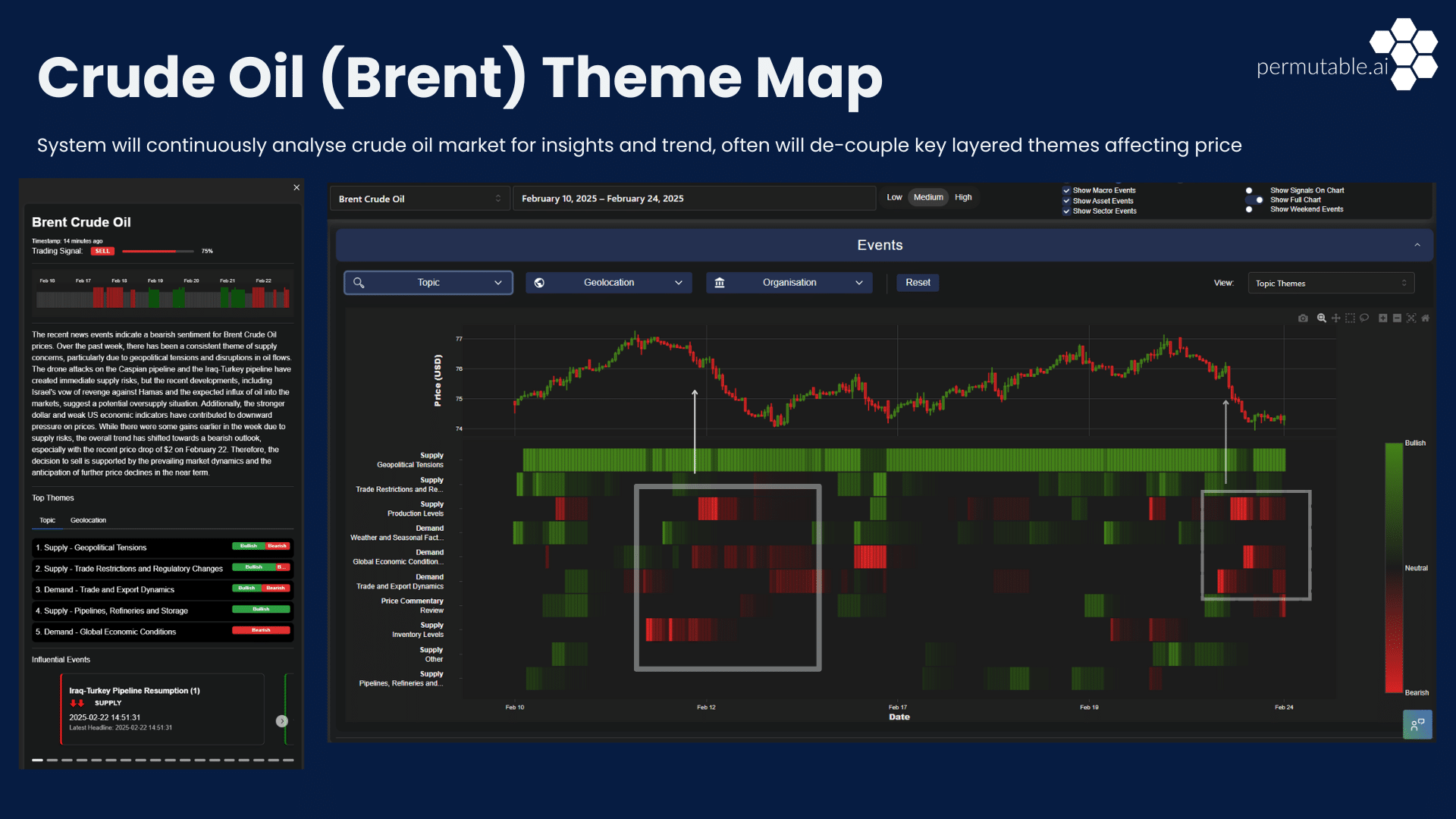

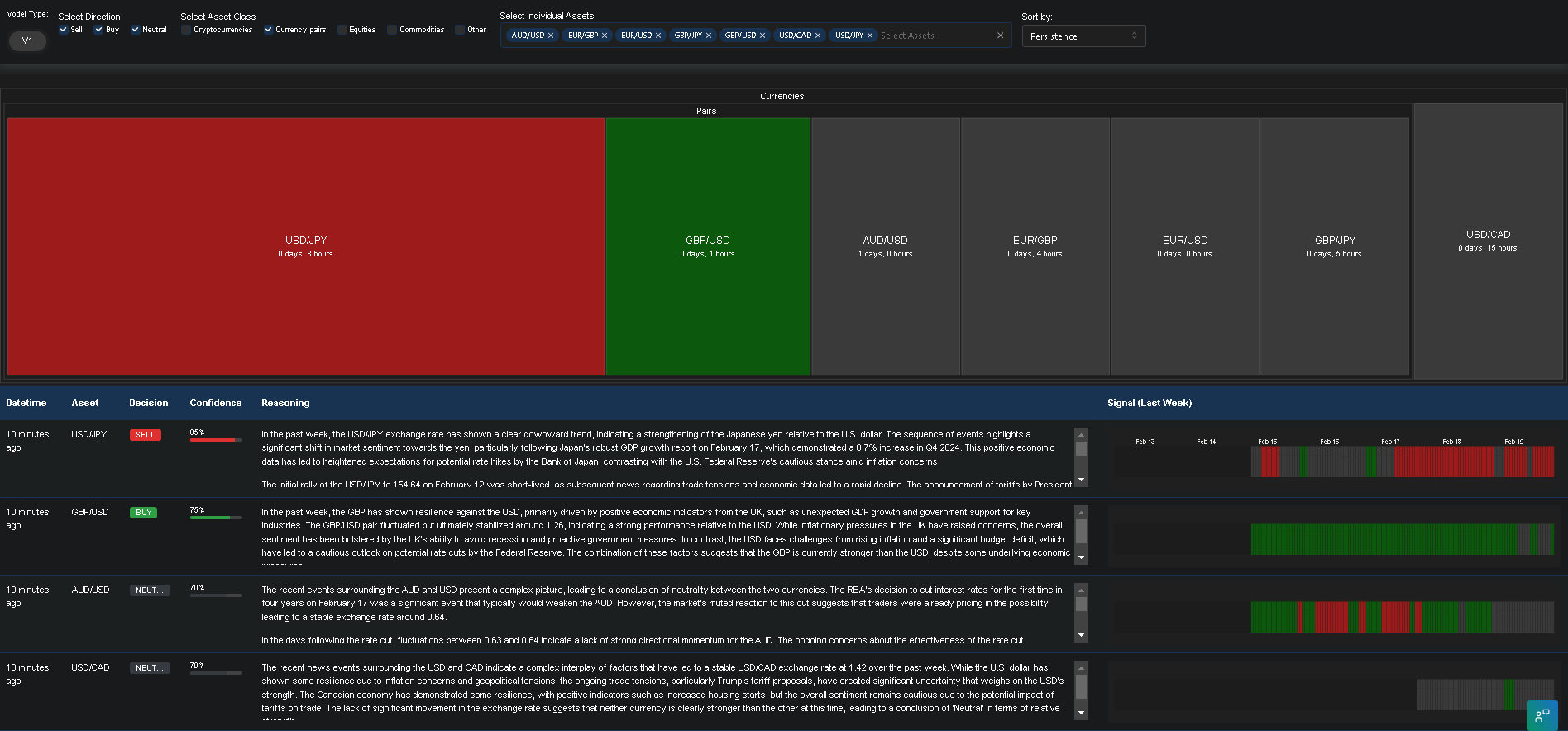

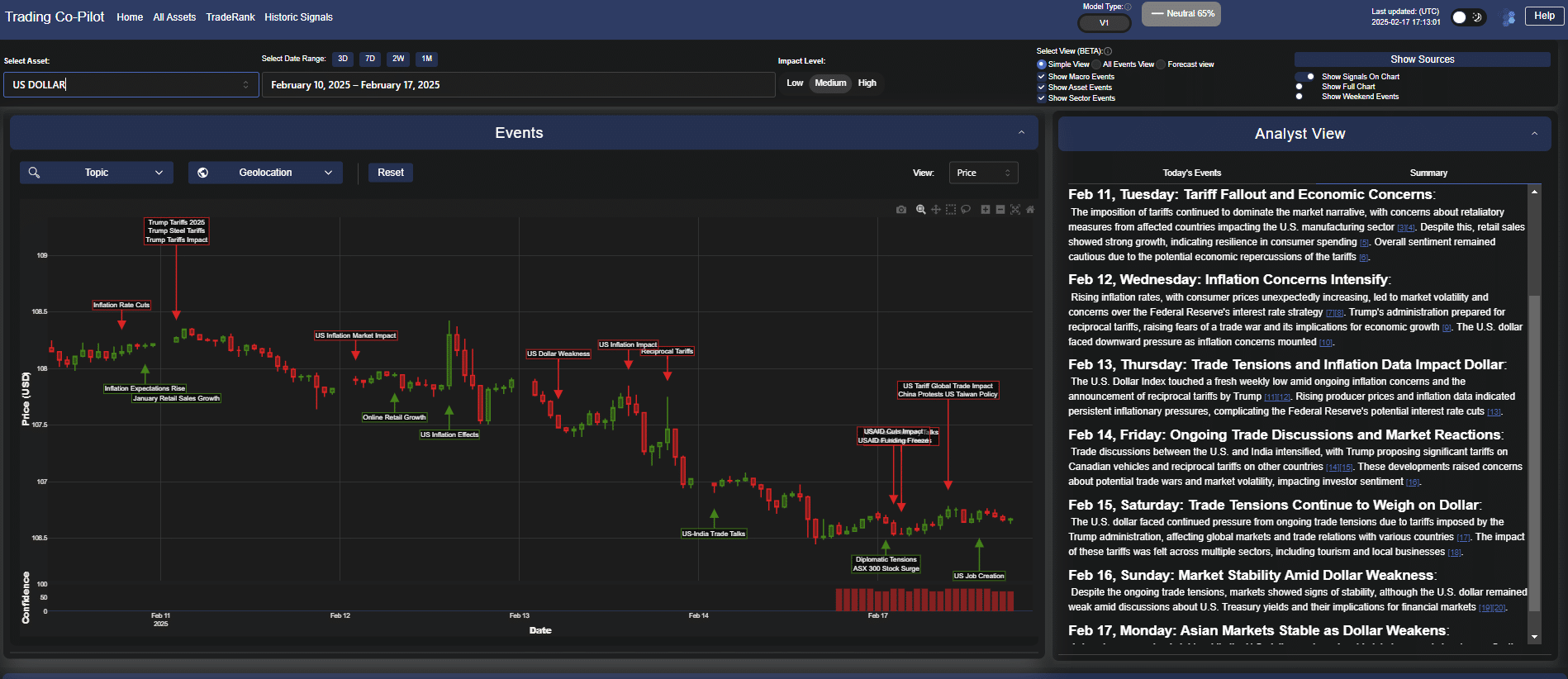

Current forex market sentiment this week presents a complex picture of shifting power dynamics across major currency pairs. Amid the furor of tariff announcements and economic data releases, traders have been navigating a particularly challenging environment. Here, thankfully, our Market 360 analysis from our Trading Co-Pilot provides clear insights into the state of current forex … Read more