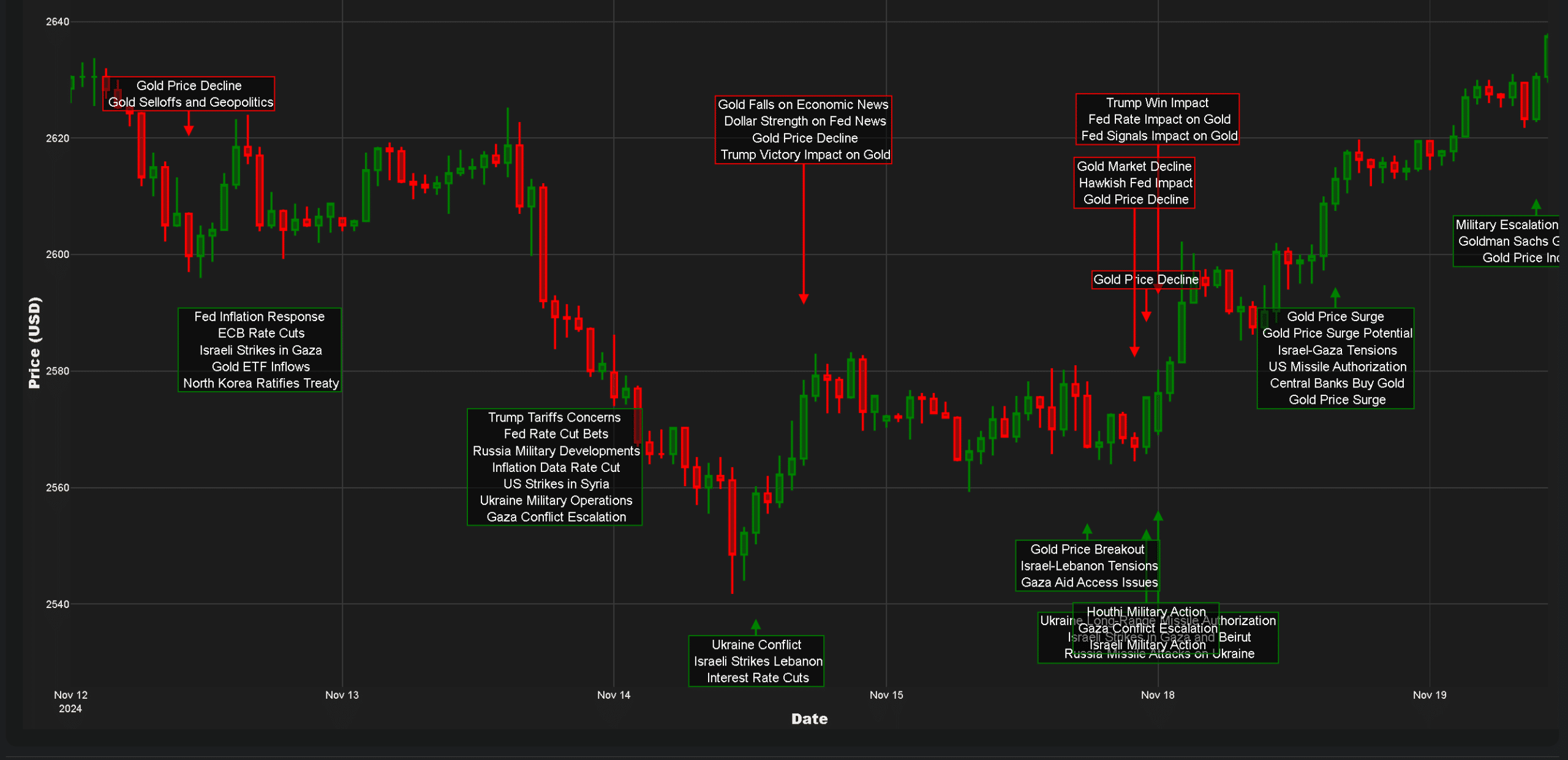

Transforming financial market predictions with AI-powered sentiment analysis

In today’s volatile financial landscape, the ability to detect market sentiment shifts before they manifest in price movements represents the new frontier for institutional investors seeking accurate market predictions. Traditional analysis often relies on lagging indicators that struggle to capture the nuanced emotional drivers behind market movements. However, as markets become increasingly influenced by sentiment … Read more