LNG price ascent stirred by geopolitical volatility: Our Trading Co-Pilot’s guide through turbulent energy markets

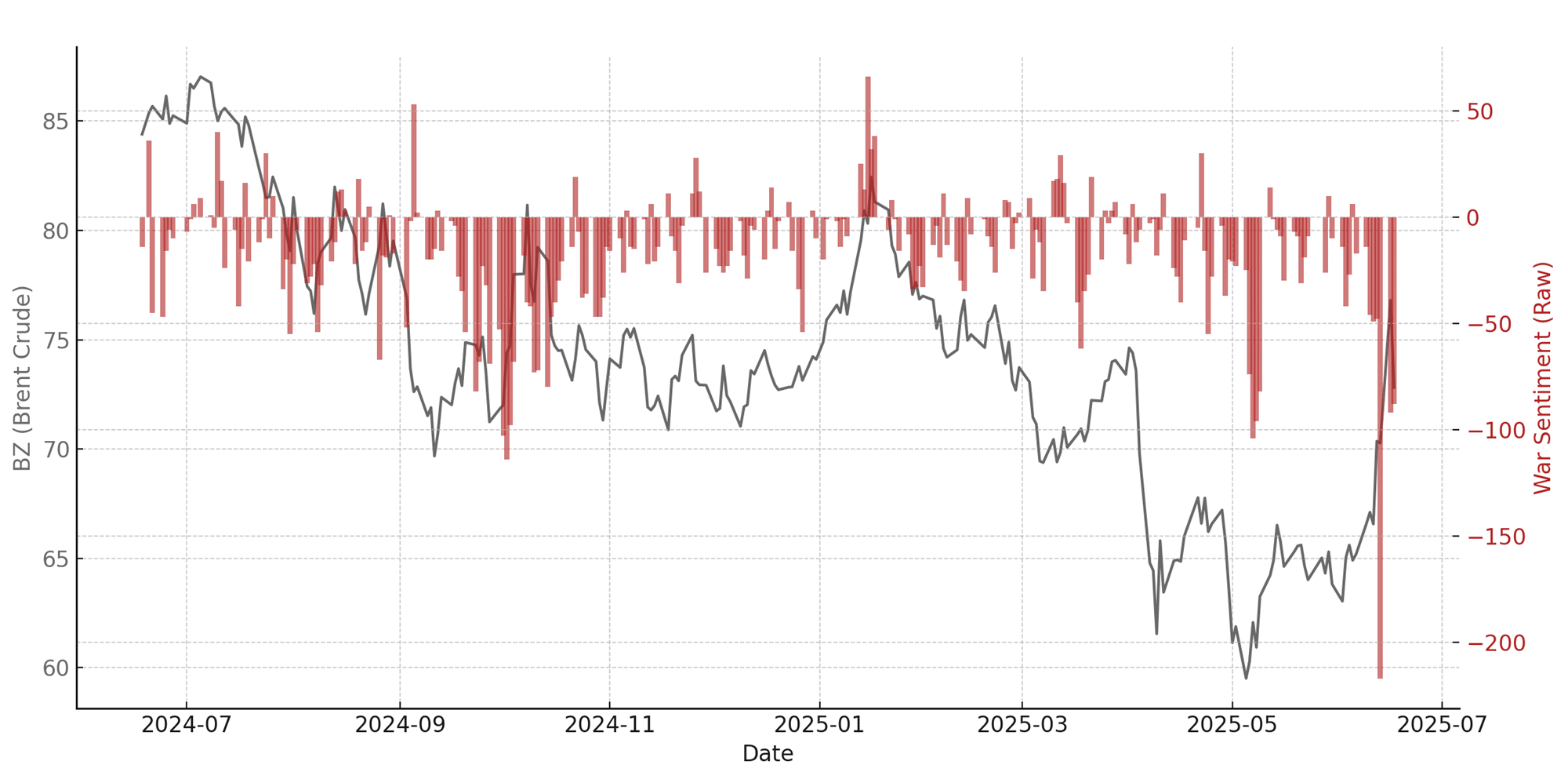

This article looks at the significant movements in the Liquefied Natural Gas (LNG) market over the past fortnight, driven by a combination of geopolitical volatility and strong demand-side fundamentals. Our proprietary Trading Co-Pilot, leveraging advanced Artificial Intelligence and Large Language Model (LLM) sentiment analysis, precisely detected this volatile energy market landscape, identifying optimal positions and … Read more