Commodity prices: Cross-asset analysis – mid-February 2025 outlook

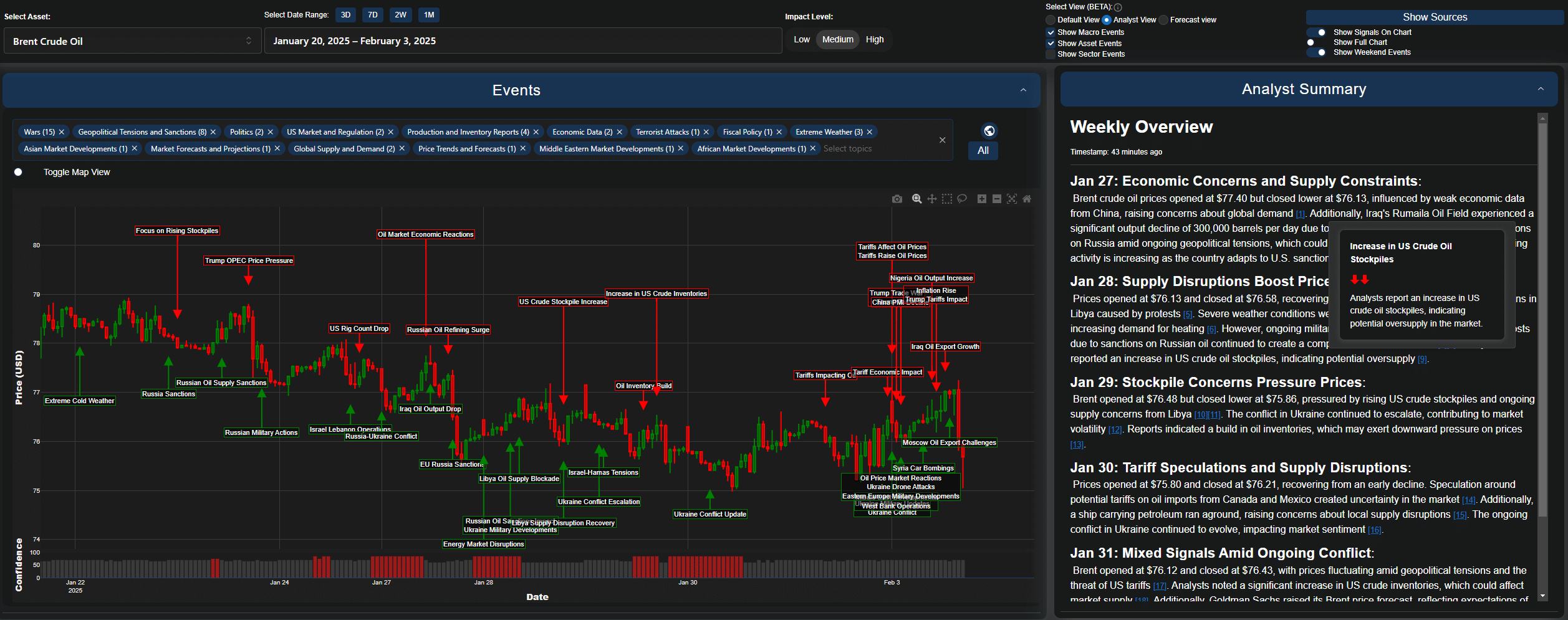

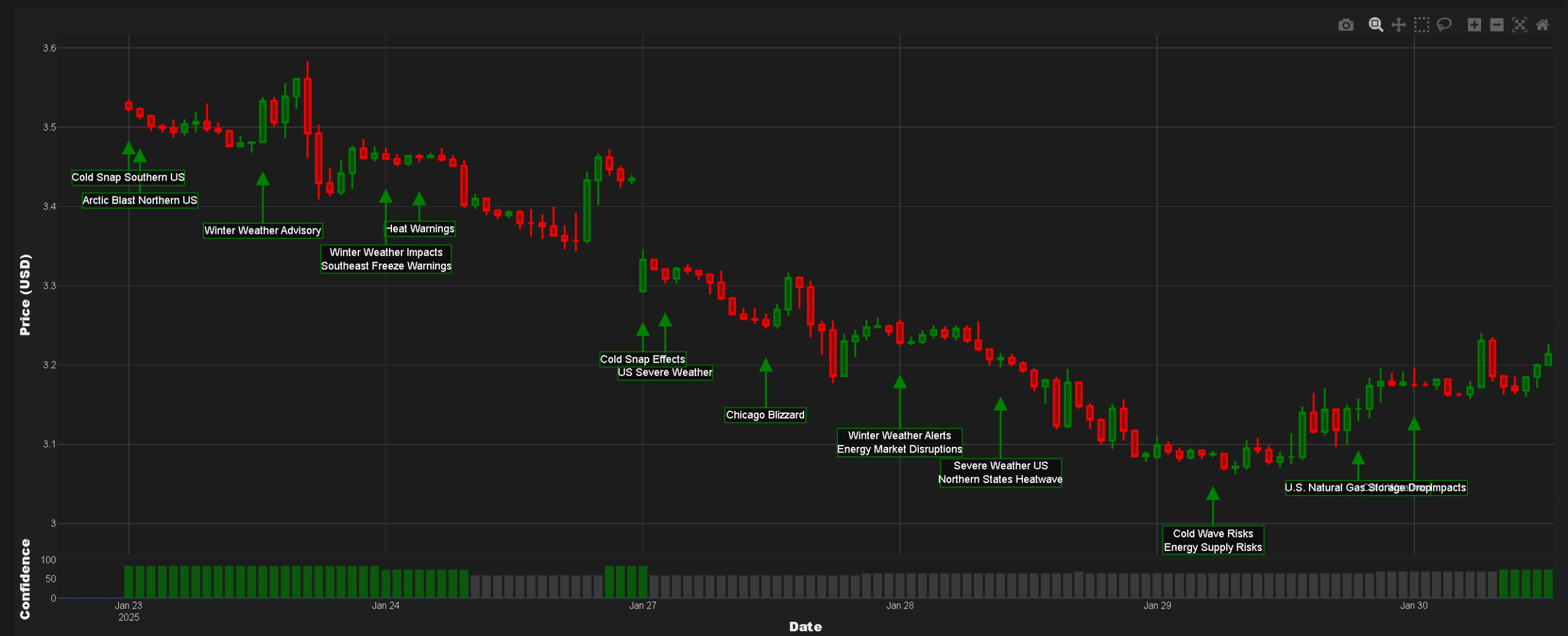

As we move into mid February, the obvious pattern emerging across commodity markets is that of an intensifying impact of trade tensions and extreme weather events. There is no doubting that each commodity class is responding uniquely to these catalysts, creating a complex trading environment that demands sophisticated analysis. In this article, we take a … Read more