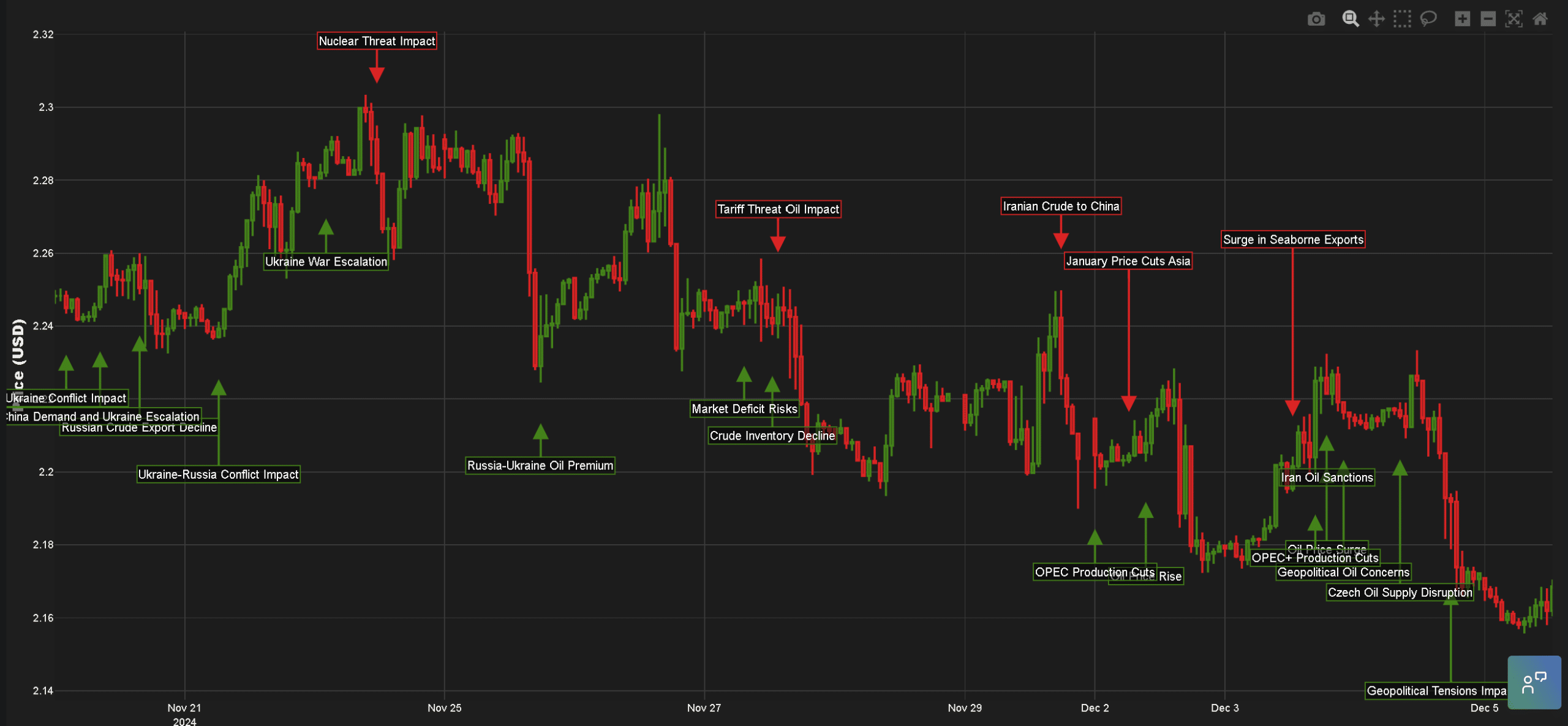

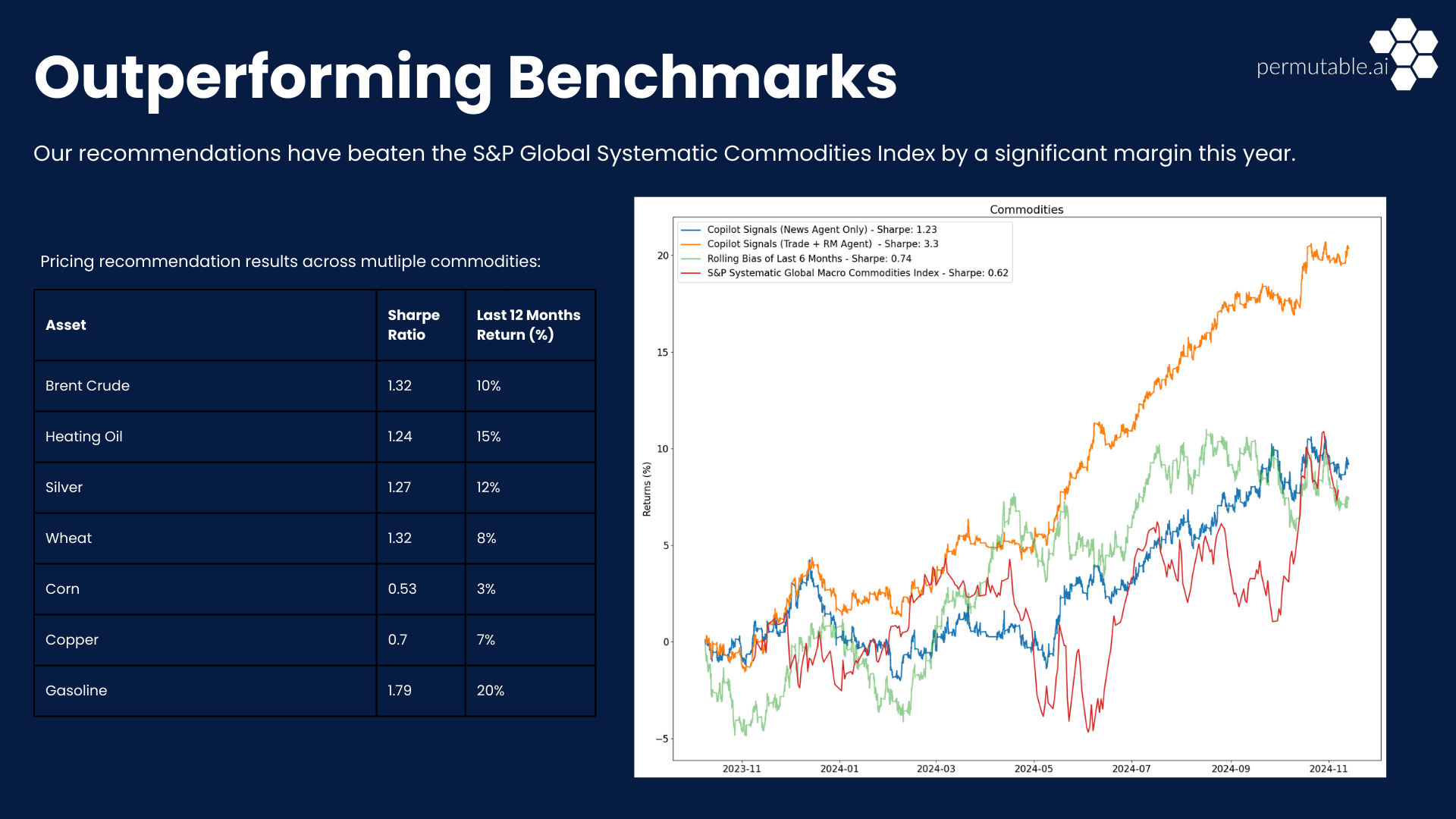

7 ways to navigate energy markets volatility in 2025

There was a time when energy trading relied purely on instinct and experience, with traders poring over data and news feeds to make split-second decisions. Today, as we face unprecedented energy markets volatility, the landscape has transformed dramatically. It’s plain for all to see that the confluence of geopolitical tensions, rapid technological advancement, and the … Read more