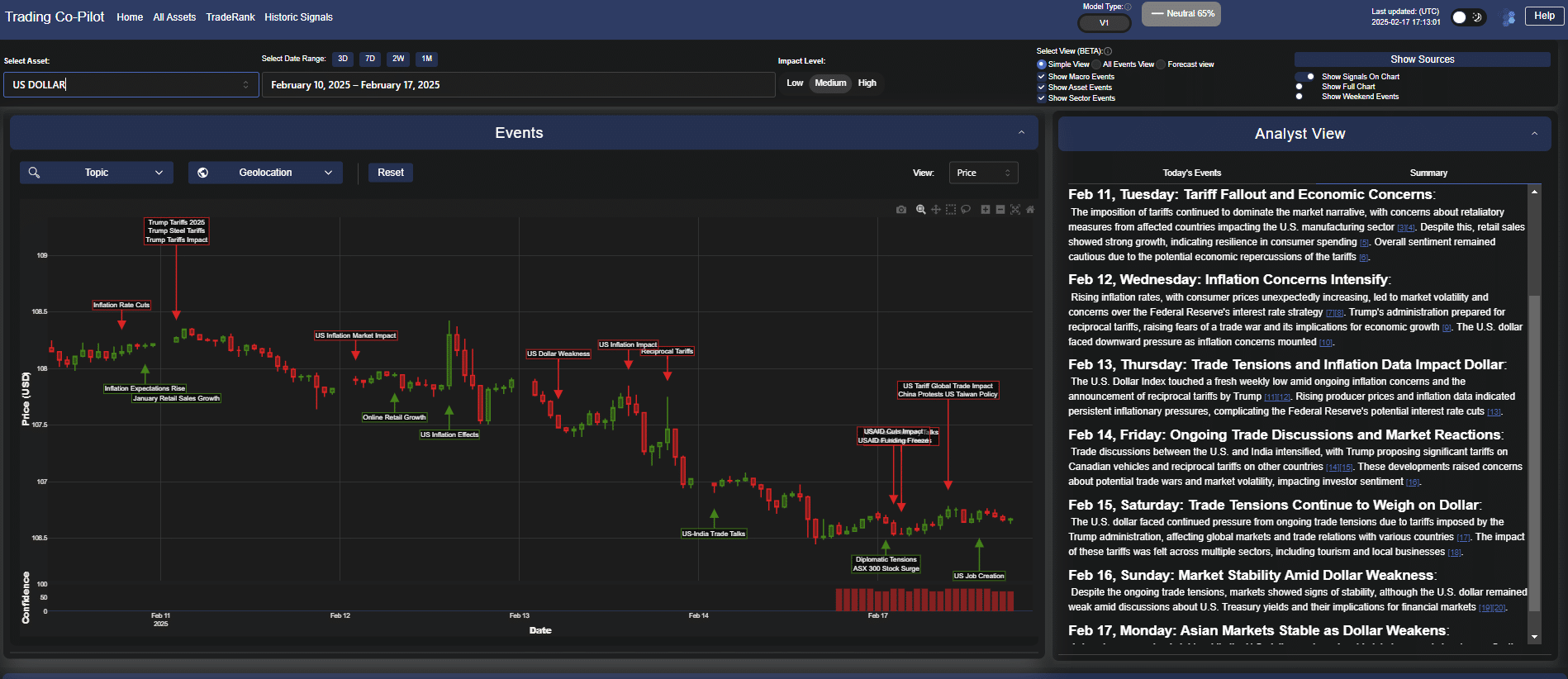

US Dollar market sentiment: How this perfectly explains current global economic turbulence March 2025

Global trust has been left in tatters in recent days with markets grappling with the implications. Tracing the rapidly shifting US dollar market sentiment through our Trading Co-Pilot’s analysis reveals a clear and troubling convergence of factors driving what may become the dollar’s worst performance since the 2008 financial crisis. In the blur of the … Read more