Commodity news analysis January 2025: 4 key developments reshaping global trade

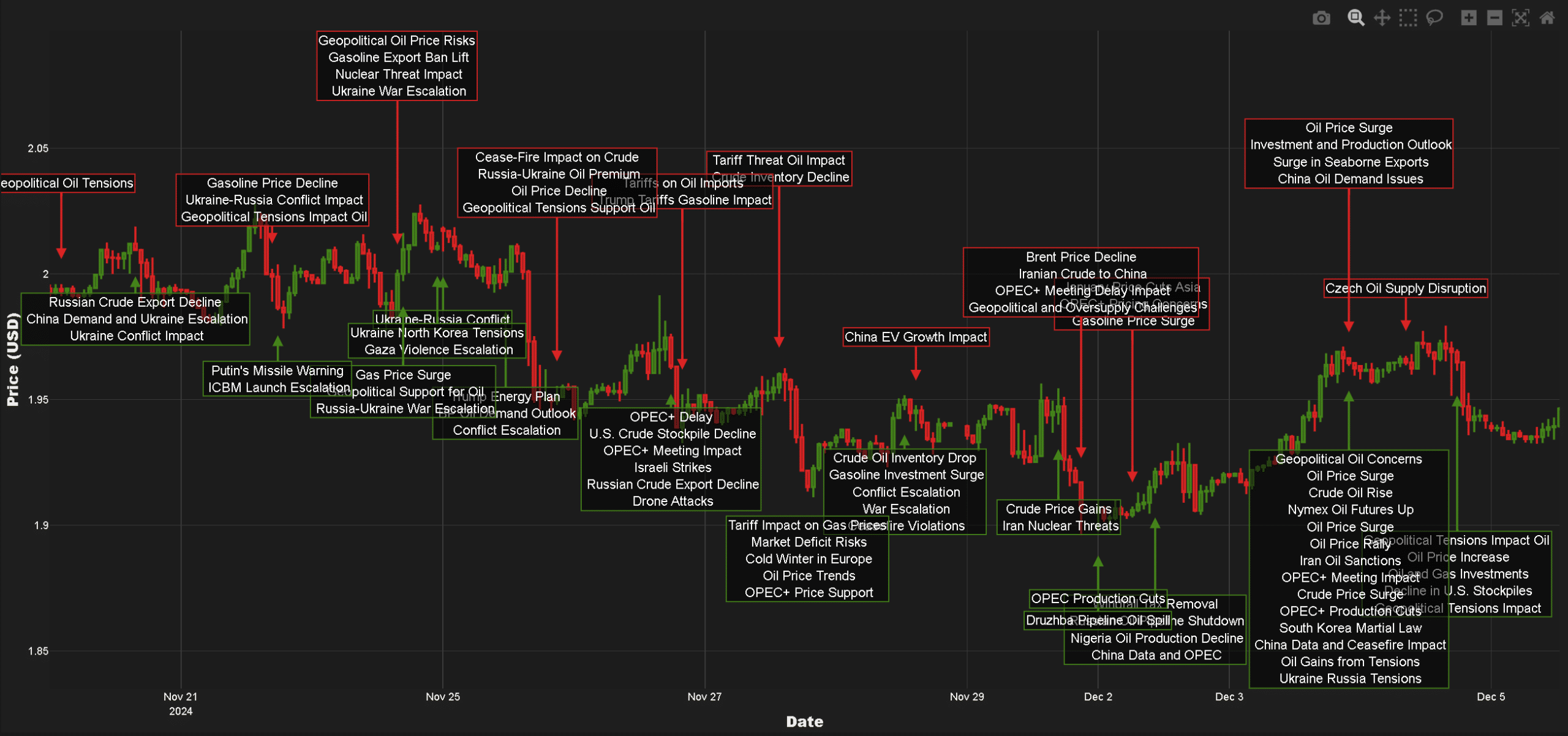

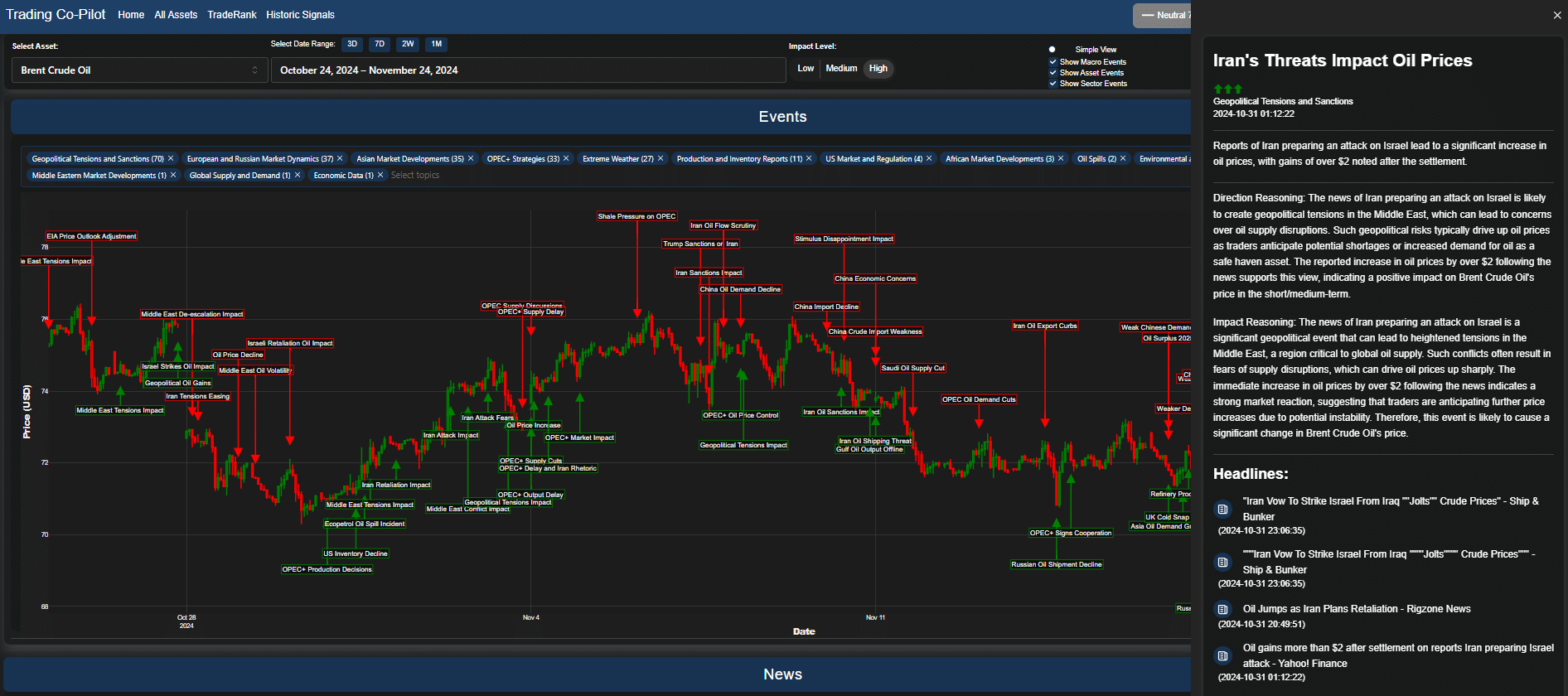

It is indeed a volatile market as global commodities continue to see unprecedented challenges into early 2025. According to our Trading Co-Pilot’s Analyst View prices are predicted by the unpredictable and ever-moving forces, creating a landscape where commodities traders must remain increasingly vigilant. In this article, we outline the key commodity news stories shaping the … Read more