8 use cases for our AI-powered trading insights in energy markets

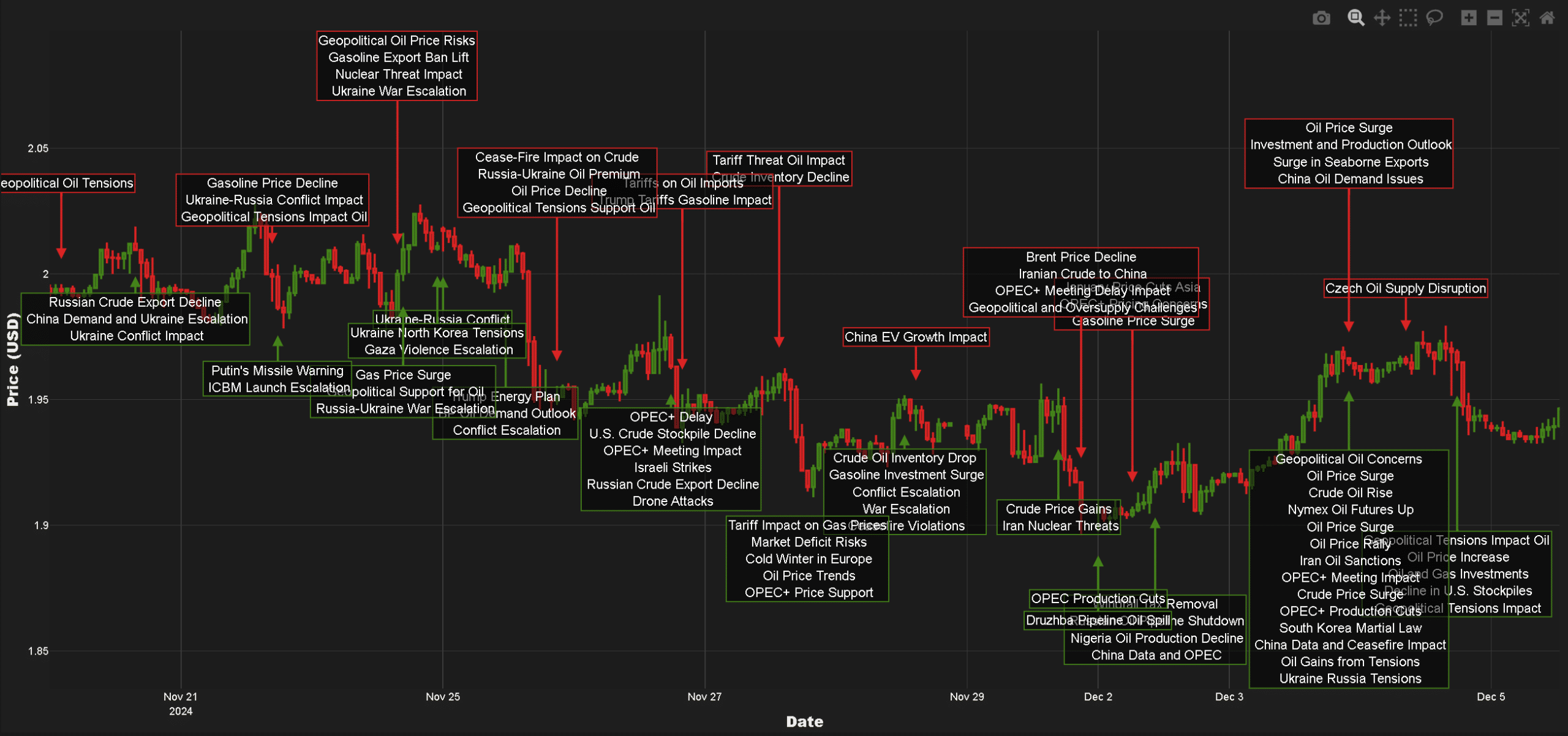

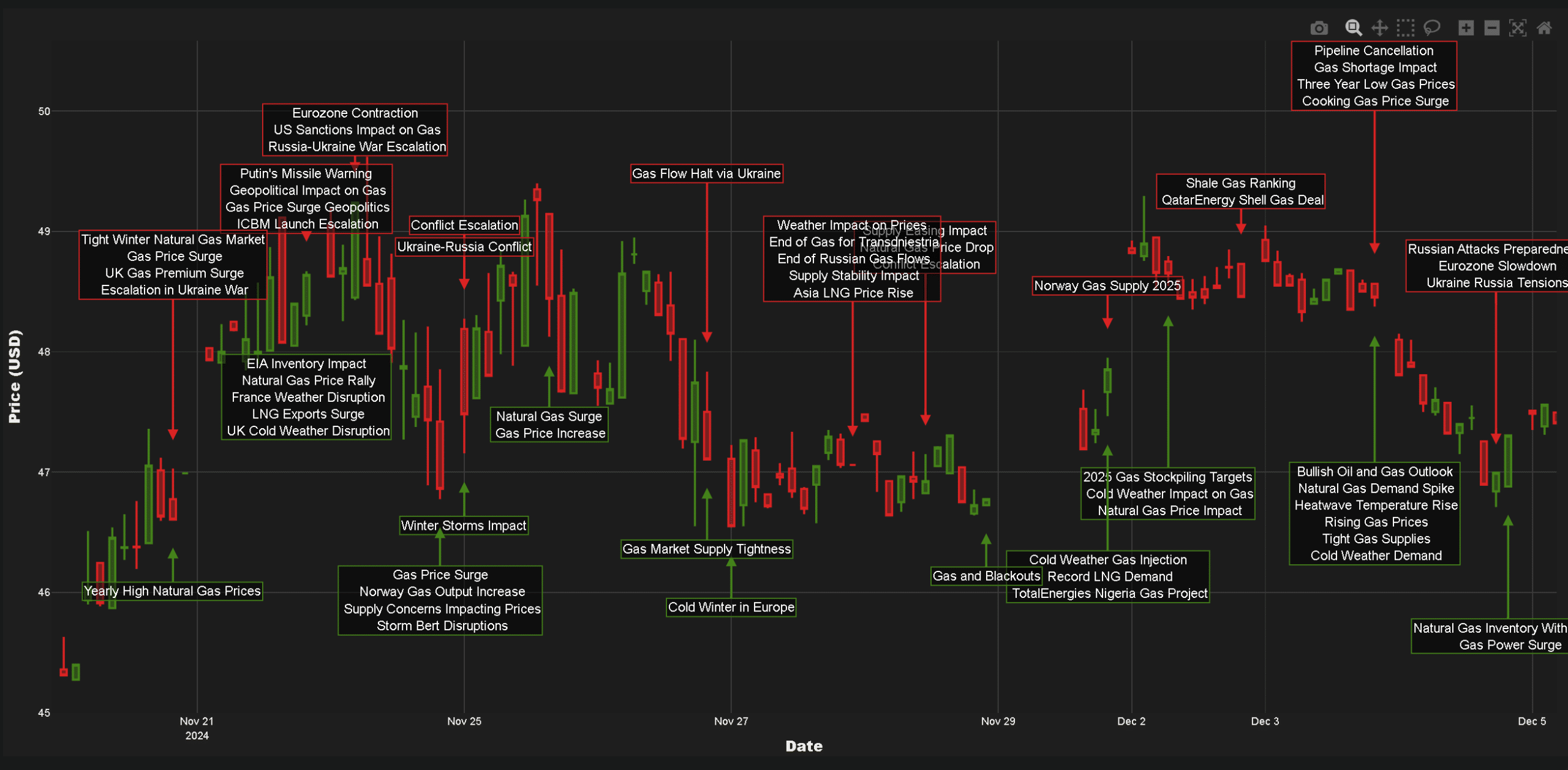

Energy markets are becoming increasingly complex to navigate and as they continue to evolve, those who are able to stay ahead of increasingly volatile market dynamics will be, in our opinion, those who embrace AI-powered trading insights for energy markets. While the AI race continues to develop at a unprecedented rate – within energy markets … Read more