10 applications of sector specific LLM market intelligence for financial decision-making

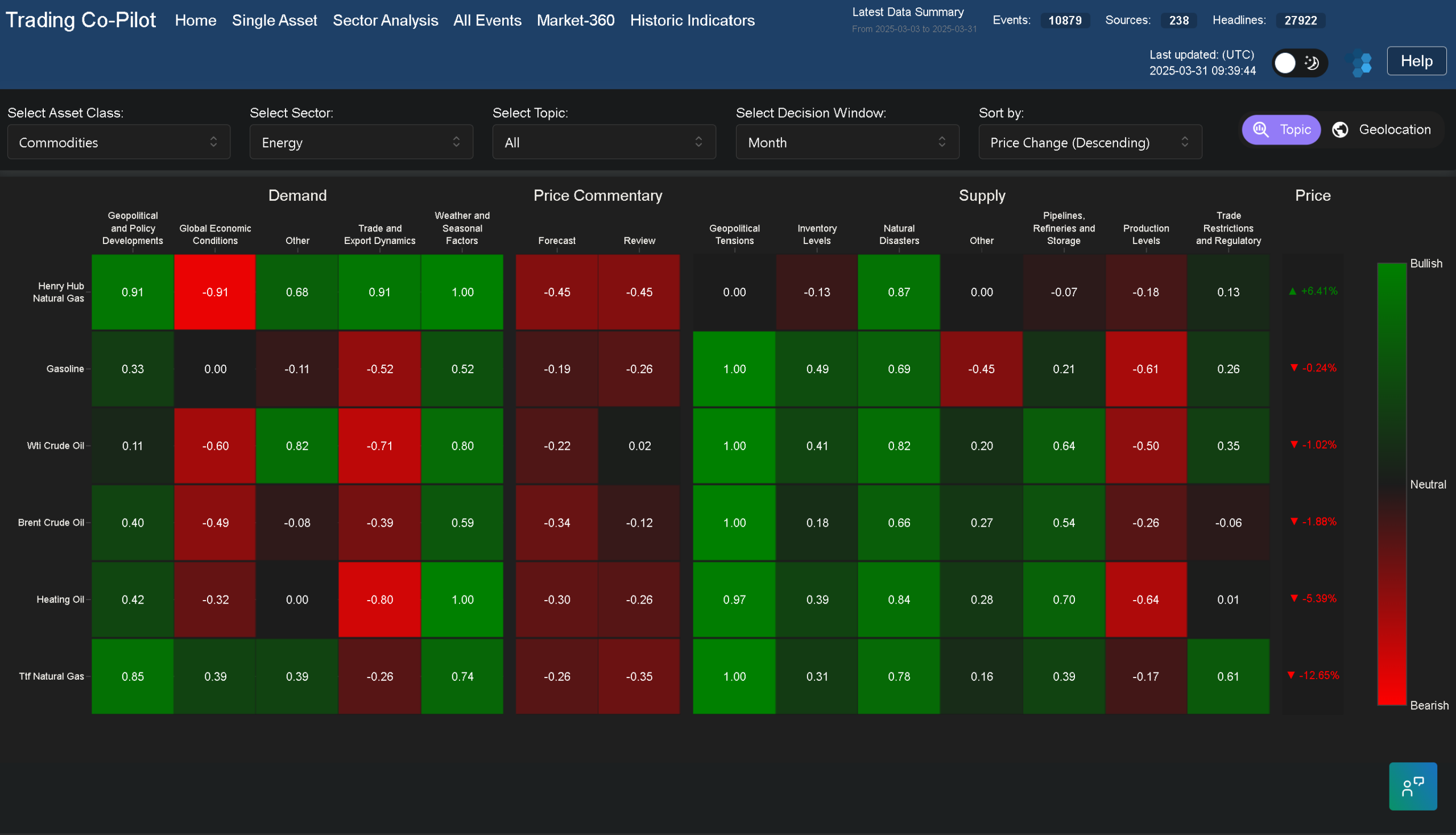

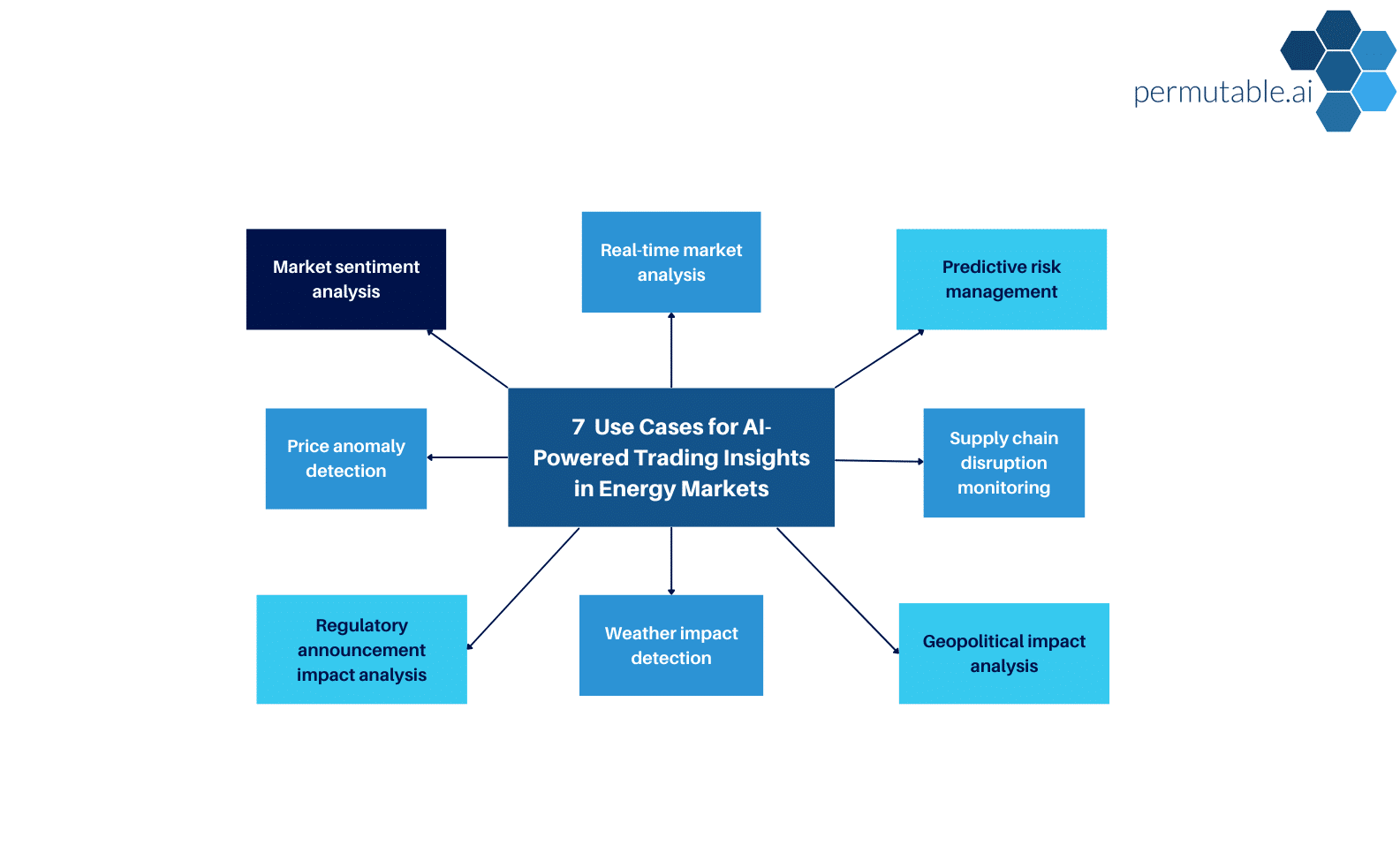

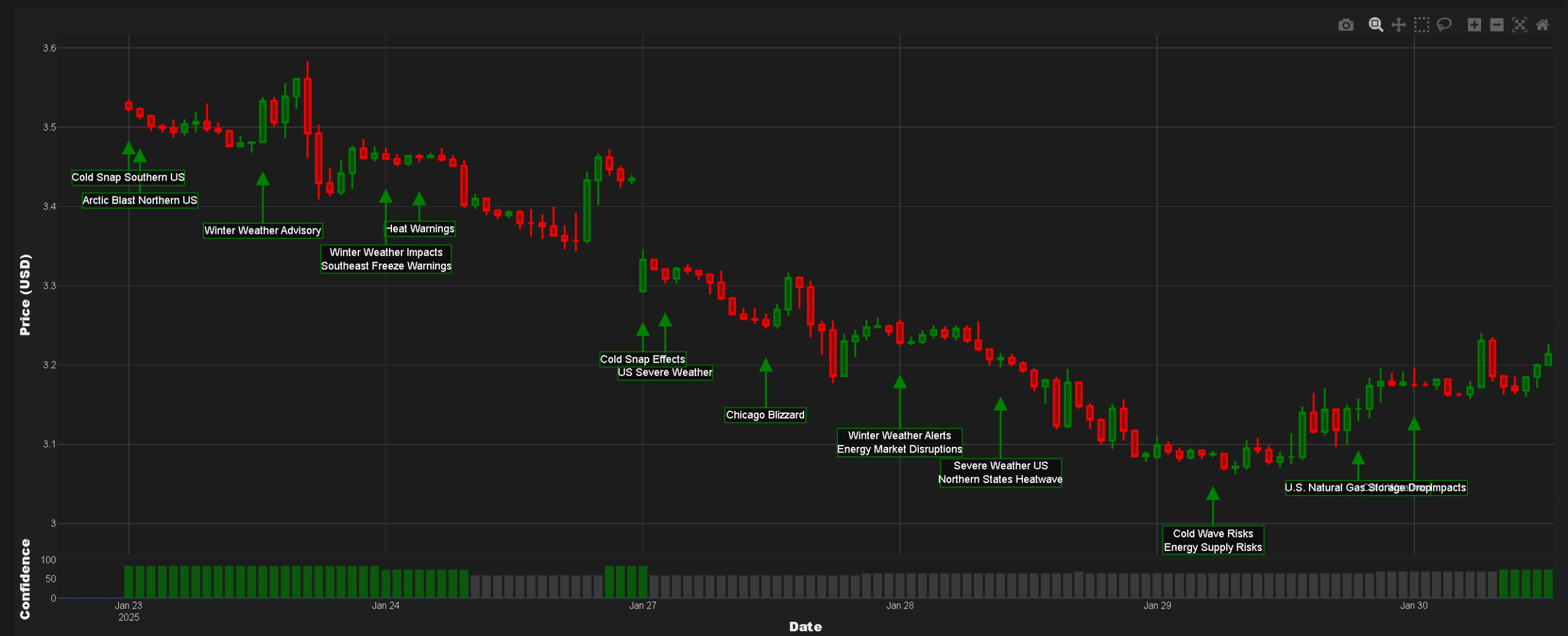

This article explores the practical applications of our LLM market intelligence Sector Analysis feature on our Trading Co-Pilot for financial services. It is specifically aimed for portfolio managers, institutional traders, and investment strategists seeking concrete ways to enhance their decision-making processes using advanced AI technology. In today’s data-saturated financial markets, gaining actionable intelligence is more … Read more